by NBI Investments Team

For years, a tendency towards large cap or growth-oriented companies has been at the forefront of equity investing. The attractiveness of growth from many large or mega cap companies have overshadowed the potential for opportunities within the small-cap equity space, especially from a global scale.

Many companies in this space are often overlooked by both institutional and individual investors during bull markets. This has translated into potentially missed opportunities when maximizing returns. Below, we will break down a few concepts that can help make the case for global small-cap equities within a portfolio.

Often overlooked

Quite often these companies fly under the radar given the mass exposure blue-chip names get in the business world. Analysts and investors alike will scrutinize every figure in the latest earnings report from larger cap stocks, yet smaller names are less likely to be covered in the same extent. Consequently, some of these names may potentially be inaccurately priced. For savvy investors, this offers an opportunity as they may potentially exhibit better performance because of their higher risk/reward profile.

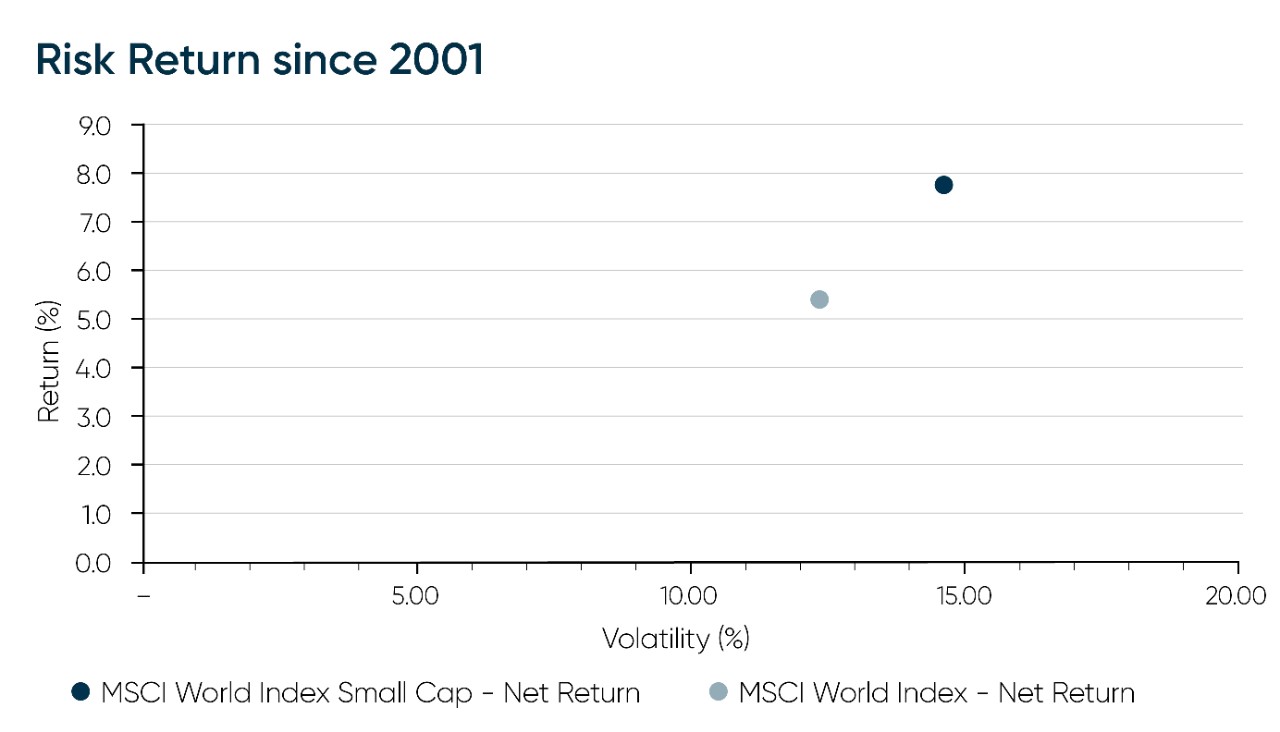

Below shows a risk/return graph of both a global index and it’s small-cap counterpart with data dating back to January 2001. Over a long-term horizon, the small-cap index offers a greater risk/return opportunity for investors looking to enhance their existing portfolio. The potential for stronger returns over the long term is characterized by the extra room these companies have to grow.

Indeed, by tracing back to the last three major bear markets, small-cap equities have had the largest rebounds compared to large-cap equities.

Indeed, by tracing back to the last three major bear markets, small-cap equities have had the largest rebounds compared to large-cap equities.

Quality and quantity

Smaller companies are usually more nimble and agile, allowing them to respond quicker to secular trends and changing markets. This allows them to grow and tap into markets that can significantly enhance their growth potential. A perfect example of this was during the pandemic; when the once small video communications company Zoom grew from an initial $3 million seed startup to now, a household name with over $4 billion in revenue.

When it comes to global small-cap equities, investors also tend to have many options to choose from in several different sectors. The MSCI World Small Cap index offers over 4,300 constituents compared to just 1,500 or so, held in the MSCI World Index. The larger number of options in smaller companies allows for the likelihood of finding attractive opportunities of companies that have proper revenue growth and steady profits with an attractive valuation.

Enter the active manager

Investing in smaller cap names may require more active management with an investment professional that can regularly monitor small-cap equities. A professional portfolio management team with a sound fundamental investment process will help mitigate the risk surrounding this overlooked asset class and potently boost returns.

Many equity-based portfolios are often already heavily invested in large cap stocks. Allocating a portion of global small-cap equities can help enhance the diversification from a sectoral and geographical point of view with the potential to generate higher expected returns. In turn, the investor has compelling benefits that can add potentially robust growth potential to their portfolio, especially during market rebounds or after bear-market bottoms.

*****

https://nicolawealth.com/insights/understanding-opportunities-in-global-small-cap-equities. Dot.com October 2002; Global Financial Crisis March 2009; Covid-19 March 2020

https://investors.zoom.us/. As of January 31, 2023

The information and the data supplied in the present document, including those supplied by third parties, are considered accurate at the time of their printing and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

The data presented in the graph is based on past performance. The graph is provided for information only, and only serve to illustrate the performance difference between small-cap and large-cap indexes. The actual returns of your investments may not correspond to the presented hypothesis, namely according to the nature of the securities in which you will have invested and the timing of your investment(s). The data presented does not create any legal or contractual obligations for National Bank of Canada or any of its subsidiaries.

NBI Funds (the “Funds”) are offered by National Bank Investments Inc., a wholly owned subsidiary of National Bank of Canada. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Funds before investing. The Funds’ securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Funds are not guaranteed, their values change frequently and past performance may not be repeated.

This index provider is included in this document: MSCI. This index provider is licensing its indices “as is”, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness and/or completeness of its indices or any data included in, related to or derived therefrom, assumes no liability in connection with its use and does not sponsor, endorse or recommend National Bank Investments Inc. or any of its products and services. The above index provider does not guarantee the accuracy of any index or blended benchmark model created by National Bank Investments Inc. using this index. No responsibility or liability shall attach to any member of the index provides or its respective directors, officers, employees, partners or licensors for any errors or losses arising from the use of this publication or any information or data contained herein. In no event shall the above index provider be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, legal or other expenses, or losses (including, without limitation, lost revenues or profits and opportunity costs) arising out of or in connection with the use of the content, even if advised of the possibility of such damages. MSCI indices are trademarks of MSCI Inc.

© 2023 National Bank Investments Inc. All rights reserved. Any reproduction, in whole or in part, is strictly prohibited without the prior written consent of National Bank Investments Inc.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.