by Larry Adam, CIO, Raymond James

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economy likely to start cruising at a lower altitude

- Gravity is setting in on equity valuations

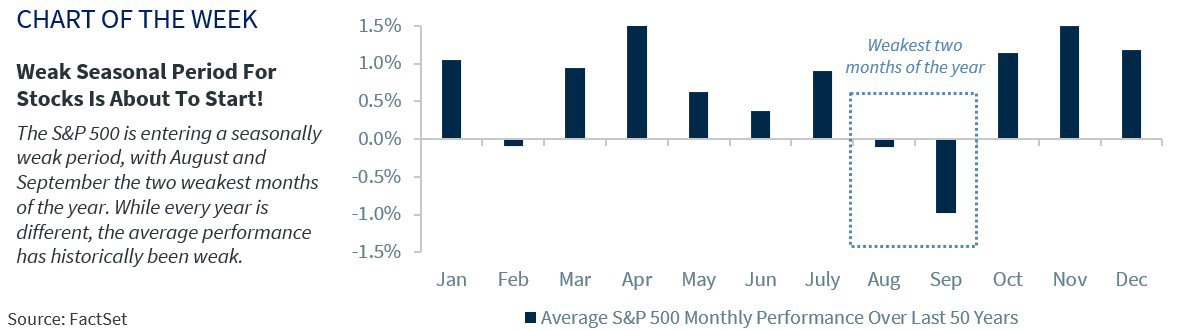

- Soaring stocks entering a weak seasonal period

Happy August! As sky gazers and astronomy enthusiasts know, August is the best time for stargazing! And this month is sure to bring excitement as the sky lights up with two Supermoons – the Sturgeon Moon (which took place on Tuesday) and the Super Blue Moon (August 30) – as well as the Perseid meteor showers (August 12). In fact, blue moons are so rare that sky gazers have waited 14 years to get a glimpse of one and will need to wait another nine years for the next one! If you haven’t had a chance to see these magnificent sites, put these dates on your radar! Speaking of radar, ‘dotting’ our radar these days are positive macro surprises, sharp increases in investor sentiment and the rise in U.S. equity prices that has lifted the S&P 500 beyond our year-end 2023 target (4,400) and near our 12-month target (4,600). While we have a favorable long-term outlook on equities, below are four dynamics that make us cautious in the near term.

- Economy likely to start cruising at a lower ‘altitude’ | Coming into the year, over 60% of economists expected the economy to enter a recession in 2023. But the economy’s resilience, particularly in the wake of aggressive rate hikes, has surprised the market and supported better than expected earnings growth and the equity rally year-to-date. However, consensus calls for a soft, non-recessionary landing are building. We are not ready to go there yet and still believe we are headed for a mild recession – a dynamic that does not support current valuations. Our expectation is that economic data is likely to begin to disappoint after an extended period of outperforming expectations, especially given the lagged effects of Federal Reserve (Fed) tightening. The Citigroup Economic Surprise Index (which measures economic data releases relative to expectations) rose to a 29-month high of 81.9 – up from a -24.7 at the beginning of the year which means that we were in a period of the market underestimating the strength of the economy. But the Index historically peaks after it reaches these lofty levels, setting the market up for a period of downside surprises to economic data. Disappointing data and a return of recessionary concerns could sour sentiment modestly from current levels.

- Bullish sentiment ‘eclipses’ long-standing bears | The beginning of the year was filled with uber pessimism, with Wall Street analysts in aggregate forecasting the first decline in equity prices since at least 2000. Investor sentiment was similarly at highly pessimistic (i.e., bearish) levels. As we have mentioned in our numerous publications, that extreme level of pessimism was a contrarian reason why we came into the year more optimistic than many of our Wall Street counterparts. However, that pessimism has reversed to more optimistic levels. In fact, many Wall Street analysts have upgraded their S&P 500 year-end targets over the last two months and bullish sentiment, as measured by the AAII Investor survey, peaked at 51.4% in recent weeks, a level that has historically provided a reliable contrarian signal. This optimism after such a powerful rally may be misplaced and the market may have to dial back some of its lofty expectations as high valuations leave it vulnerable to pullbacks.

- ‘Gravity’ is setting in on equity valuations | With the S&P 500 trading at 19x forward earnings (and 21x trailing), a significant amount of good news has been built into the market. Keep in mind, the forward P/E multiple coming into this year was 16x. Two factors that drive P/E multiples are inflation and interest rates. But with inflation falling from 9.1% to 3% already, there is not much room for further multiple expansion as it will be a struggle for inflation to reach the 2% level in the near term. There is the potential that the twelve-month streak of decelerating YoY inflation could be temporarily interrupted by the recent rise in commodity prices and less favorable base effects. This means that earnings will need to have a healthy rise to propel the stock market higher – which is unlikely given our call for a mild recession. And with 10-year Treasury interest rates above 4% (and corporate yields even higher), bonds have become much stiffer competition for the equity market. Therefore, a pause in the equity rally is more likely.

- ‘Soaring’ market entering a weak seasonal period | The S&P 500 is off to its best start to a year (+18%) since 1997 and has been positive for each of the last five months. While investors have had plenty to cheer, it is worth mentioning that we are heading into a seasonally weak period of the calendar year. In fact, August and September have historically been two of the weakest months, with S&P 500 returns averaging -0.1% and -1.0% respectively over the last 50 years. Throw in the fact that the S&P 500 typically has three to four 5% pullbacks in any given year and this year, there has only been one (during the March regional bank turmoil), highlights how vulnerable the market is at current levels. And with once bearish investors now chasing the market’s recent momentum and potentially ignoring risks on the horizon, the market could be setting up for some potential weakness in the months ahead.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.