by Stephen Vanelli, CFA, Knowledge Leaders Capital

Leading into the weekend, where the debt ceiling had not been settled, markets were exhibiting very interesting positioning. To start, US Treasuries across the maturity spectrum were hugely out of favor. Net speculator positioning in options and futures were as short as they have every been. The charts below show the 2-year, 5-year and 10-year US Treasury.

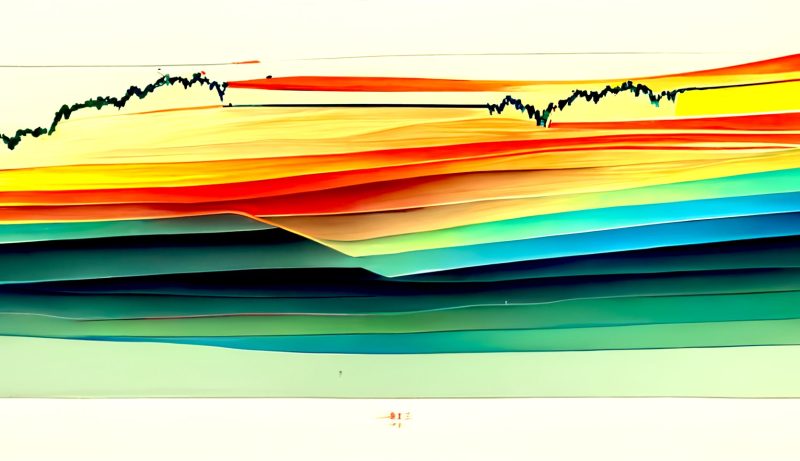

At the same time, investors were very short stocks. The next couple charts show speculator net positioning in the S&P 500 and the MSCI EAFE Index (a proxy for the developed world ex-US).

Hopefully, a successful debt ceiling deal brings some risk-taking back into the markets. At present, all money flows are going into money market funds, which is good news and bad news. The bad news of course is that these are money flows not going into risky assets. The good news is that, should the inflation fever break convincingly and US Treasury rates roll over, there is a tremendous amount of money that will be looking for higher returns.

While early indications seem to suggest that spending will be curbed in the next few years relative to the baseline by about $50 billion, while at the same time the US Treasury may issue a flood of US Treasury bills to rebuild its coffers, perhaps the more attractive play right now is the medium-to-longer dated US Treasuries.

As of 3/31/23, the iShares MSCI EAFE ETF was not held in the Knowledge Leaders Strategy.