Pre-opening Comments for Wednesday April 26th

U.S. equity index futures were higher this morning. S&P 500 futures were up 7 points at 8:35 AM EDT.

Index futures were virtually unchanged following release of the March Durable Goods Orders report at 8:30 AM EDT. Consensus was an increase of 0.5% versus a decline of 1.0% in February. Actual was an increase of 3.2% thanks mainly to a surge in aircraft deliveries by Boeing.

Microsoft gained $20.78 to $296.20 after reporting higher than consensus first quarter earnings.

Chipotle advanced $98.00 to $1,878.00 after reporting higher than consensus first quarter revenues and earnings. The company also raised second quarter guidance.

Alphabet slipped $0.61 to $103.36 despite reporting higher than consensus first quarter earnings. The company also announced a $70 billion share buyback program.

Visa jumped $4.76 to $234.35 after reporting higher than consensus first quarter earnings.

EquityClock’s Daily Comment

Headline reads “The move below the rising wedge pattern on the chart of the S&P 500 Index continues, leading to a short-term oversold reading according to RSI.”

http://www.equityclock.com/2023/04/25/stock-market-outlook-for-april-26-2023/

Technical Notes

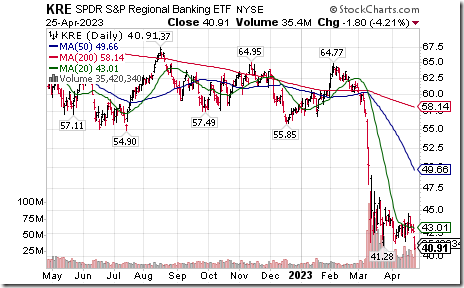

Regional Banking SPDRs $KRE moved below $41.28 extending an intermediate downtrend.

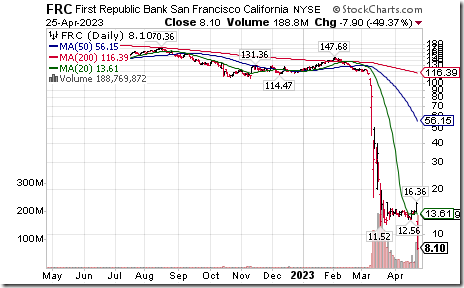

Weakness in $KRE was triggered by additional weakness in First Republic Bank $FRC on a drop below $11.52

US Bancorp $USB an S&P 100 stock moved below $32.29 extending an intermediate downtrend.

Several NASDAQ 100 stocks broke support extending an intermediate downtrend including Trip.com, Splunk, KLA Tencor and Okta.

AbbVie $ABBV an S&P 100 stock moved above $165.01 extending an intermediate uptrend.

Fiserv $FISV a NASDAQ 100 stock moved above $119.48 extending an intermediate uptrend.

Starbucks $SBUX a Dow Jones Industrial Average stock moved above $110.28 extending an intermediate uptrend.

Trader’s Corner

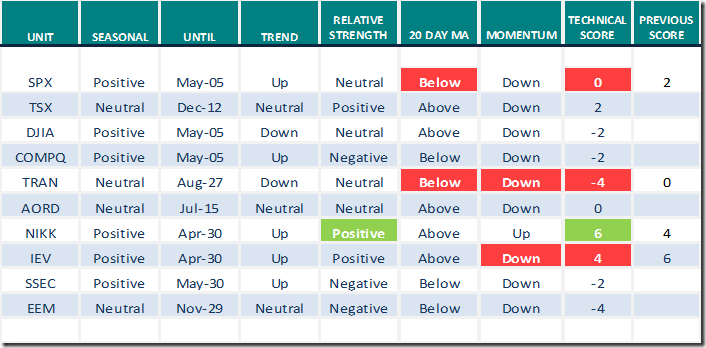

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 25th 2023

Green: Increase from previous day

Red: Decrease from previous day

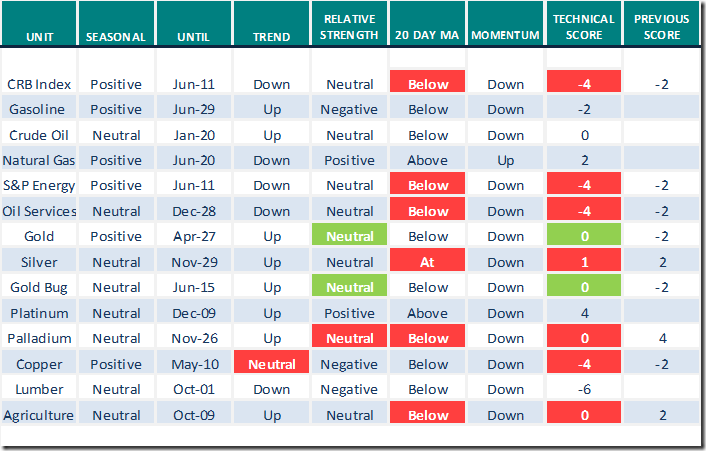

Commodities

Daily Seasonal/Technical Commodities Trends for April 25st 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for April 25th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

Go Away in May: Pack Now? | Tom Bowley | The Final Bar (04.24.23)

Go Away in May: Pack Now? | Tom Bowley | The Final Bar (04.24.23) – YouTube

Long-Term View of the Dollar | Carl Swenlin & Erin Swenlin | DecisionPoint Trading Room (04.24.23)

Technical Chart of the Day

Technical score for Regional Banking SPDRs dropped from -2+0-1+1= -2 to -2-2-1-1= -6 when relative strength changed from neutral to negative and the three daily momentum indicators (Stochastice, RSI, MACD) turned from up to down.

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 13.40 to 47.00. It remains Neutral. Daily trend has turned down.

The long term Barometer dropped 6.20 to 53.40. It remains Neutral. Daily trend has turned down.

TSX Momentum Barometers

The intermediate term Barometer plunged 7.76 to 58.62. It changed from Overbought to Neutral on a drop below 60.00. Daily trend has turned down.

The long term Barometer dropped 2.59 to 61.21. It remains Overbought. Daily trend has turned down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed