The S&P 500 recently tested the 4,200 area after rallying from the lows observed in late 2022. With the Federal Reserve likely to deliver its last rate hike in May and the US economy avoiding a recession, investors face a crucial question: Are we witnessing a new bull market, or is this merely an extended bear market rally?

In this article, Peccatiello will:

- Discuss the prospects for earnings growth and valuations;

- Assess the current stage of risk premia for equity markets worldwide;

- Present historical parallels and conclude with our assessment of the stock market for 2023.

According to Alfonso Peccatiello, Macro Strategist at The Macro Compass, investors should focus on the stream of future cash flows (earnings) a company will deliver and the price (valuation) they find reasonable to pay for them. As Earnings Whispers reports, companies worth over $10 trillion are expected to report earnings this week. Approximately 25% of S&P 500 companies have already reported earnings, with 68% beating consensus.

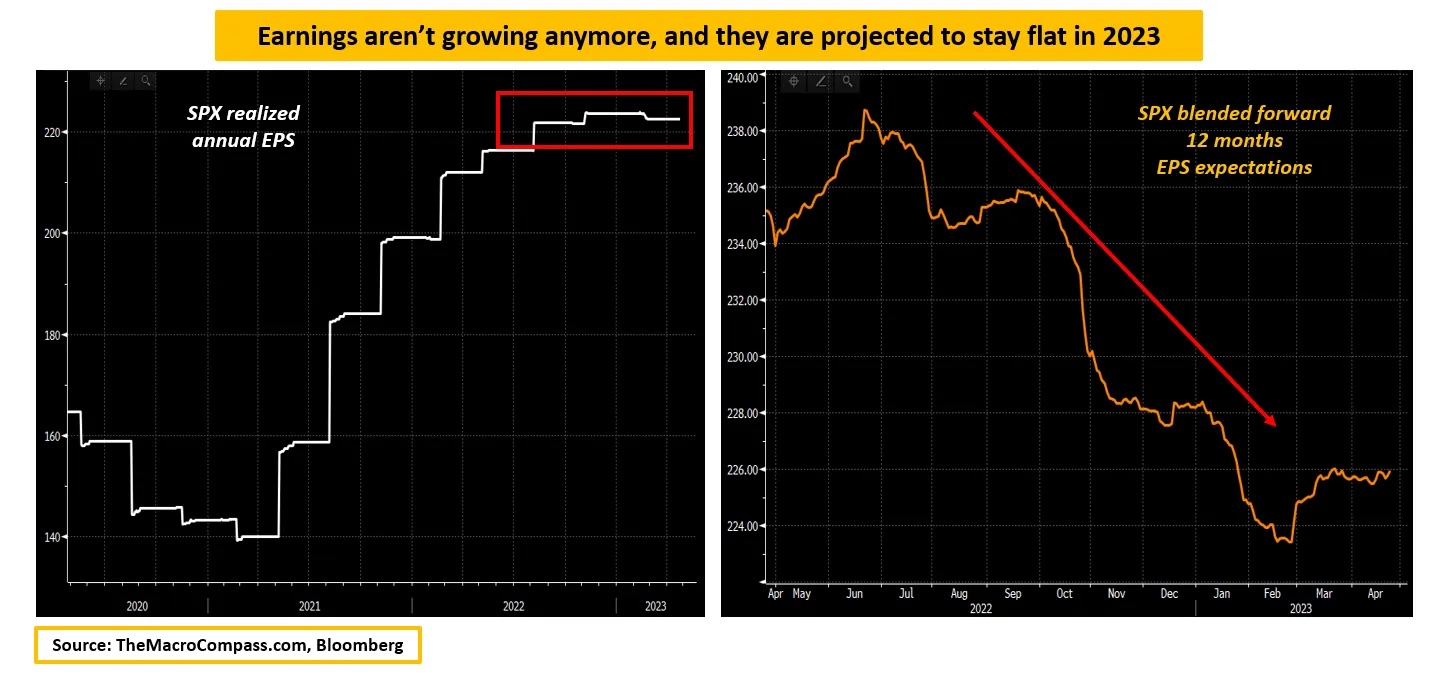

Peccatiello argues that equities have been a negative carry trade since summer 2022 and will likely continue as such. The momentum of earnings growth has stalled around the $220 area, with expectations for future 12-month EPS growth dropping from the $240 to the $225 area. Investors who bought equities since mid-2022 were "promised" an 8-10% EPS growth over a 12-month period, only to see these expectations slashed back to almost 0%. Additionally, they experienced no actual earnings per share growth in nearly a year.

When deploying capital, stock investors expect a future stream of above-consensus growing earnings. However, the inverse scenario has unfolded since last year, with weak realized earnings and slashed future EPS growth expectations. With risk-free rates now in the 5% area, equities are a negative carry trade. Despite this, negative carry trades can still be profitable through valuations expansion or people willing to pay more to be in the trade.

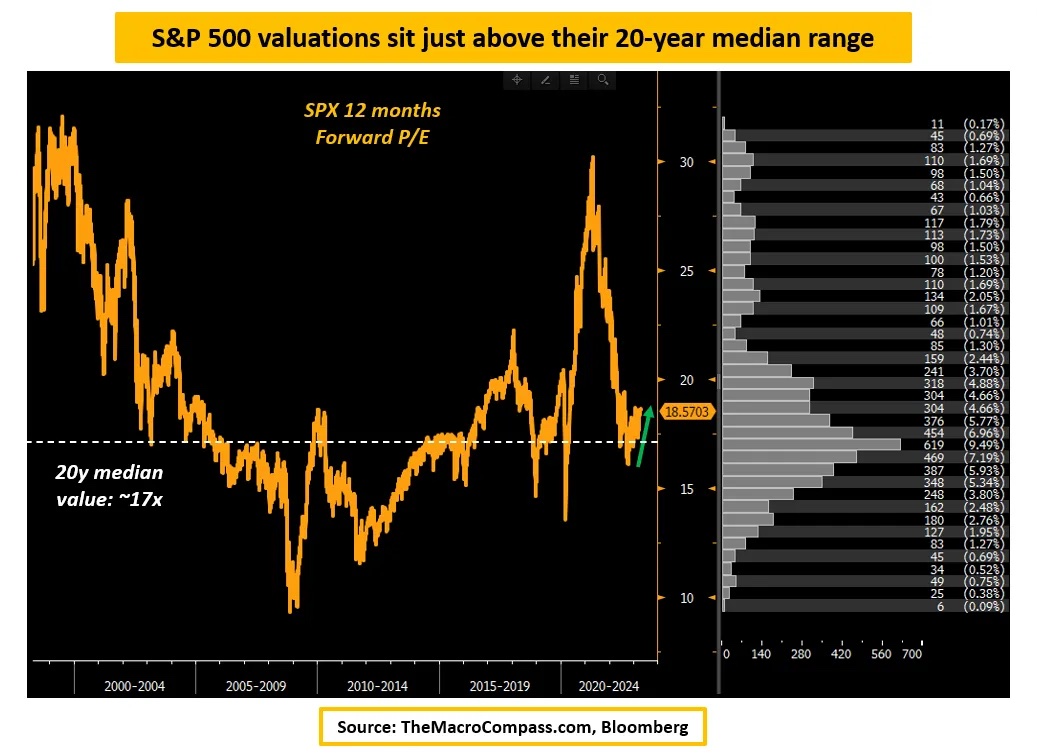

The S&P 500 rally from late 2022 lows has been almost entirely driven by multiples expansion. The 12-month forward P/E rapidly moved from 16x to 18.5x as the disinflationary trend began and the Fed removed some uncertainty from markets.

The key question now is the future of earnings, valuations, and risk premia. Peccatiello states, "As a macro investor, buying stocks means taking a view on the stream of future cash flows (earnings) the company will deliver and the price (valuation) you find reasonable to pay for them."

This leads to the central question: Is this a new bull market or just another bear market rally?

In conclusion, investors must assess the prospects for earnings growth and valuations, evaluate the current stage of risk premia for equity markets worldwide, and consider historical parallels to determine whether this is a new bull market or an extended bear market rally. The answer will be crucial for making informed investment decisions in 2023 and beyond.

For the full scope:

Footnotes:

1 Adapted from source: (Alf), Alfonso Peccatiello. "New Bull Market or Bear Market Rally?" The Macro Compass, 25 Apr. 2023, themacrocompass.substack.com/p/new-bull-market-or-bear-market-rally.