Pre-opening Comments for Thursday March 23rd

U.S. equity index futures were higher this morning. S&P 500 futures were up 18 points at 8:30 AM EDT.

KB Homes advanced $1.00 to $37.80 after reporting higher than consensus fiscal first quarter revenues and earnings.

Steelcase added $0.42 to $7.60 after reporting higher than consensus quarterly earnings. The company also offered positive guidance.

Darden Restaurants gained $2.05 to $153.10 after reporting higher than consensus fiscal third quarter revenues and earnings.

Accenture added $11.73 to $265.00 after reporting higher than consensus fiscal second quarter revenues and earnings.

EquityClock’s Daily Comment

Headline reads “Treasury yield spreads are showing signs of bottoming and this is not a good thing”.

http://www.equityclock.com/2023/03/22/stock-market-outlook-for-march-23-2023/

Responses to FOMC and Fed Chairman Powell’s comments

Target for the Fed Fund Rate announced at 2:00 PM EDT was increased 0.25 to 4.75%-5.00% as expected. Reponses by key markets were as follow:

U.S. equity index futures initially moved higher, but virtually collapsed in late trade.

The U.S. Dollar ETN dropped sharply after 2:00 PM, but recovered slightly in late trading.

Long term bond prices moved higher as yields moved lower.

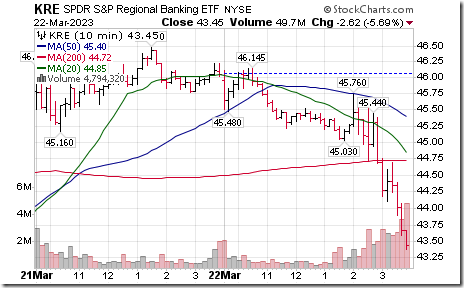

Regional Bank SPDRs dropped sharply.

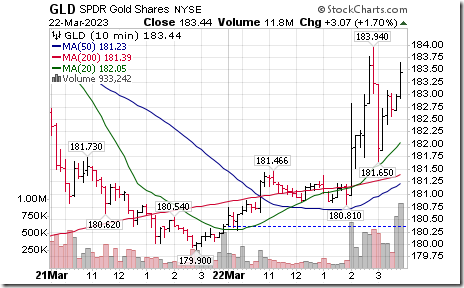

Gold Bullion ETN moved smartly higher.

Gold equities and related ETFs also moved higher.

Technical Notes

Semiconductor iShares $SOXX moved above $438.11 in early trade extending an intermediate uptrend.

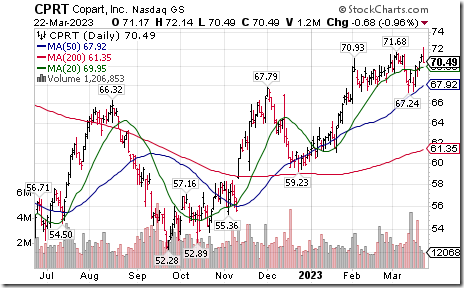

Copart $CPRT a NASDAQ 100 stock moved above $71.68 extending an intermediate uptrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

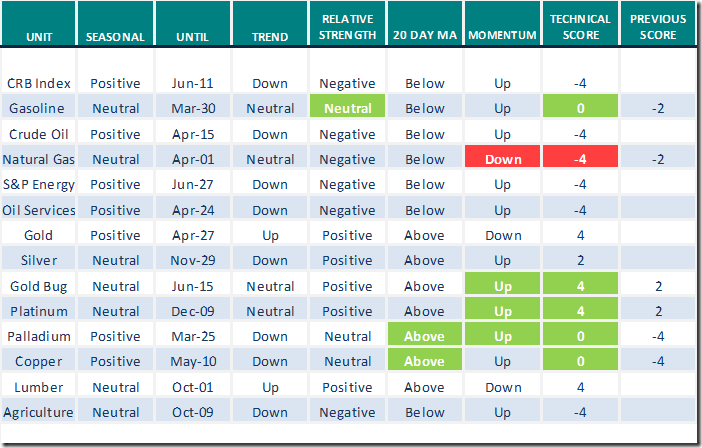

Commodities

Daily Seasonal/Technical Commodities Trends for March 22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for March 22nd 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive Seasonal ratings: www.equityclock.com

Canadian Association for Technical Analysis meeting

Next CATA meeting is tonight at 8:00 PM EDT. Speaker is Joe Rabil.

Joe Rabil, President of Rabil Stock Research, has 30 years of experience in the area of technical analysis of individual stocks, industry groups and market indices. He has built a reputation as a trusted advisor to some of the best performing money managers on Wall Street by successfully identifying portfolio holdings that are technically improving or deteriorating. Joe is a recognized expert on Trend, Trend Momentum, and Multiple Time Frame Analysis.

Everyone is welcome. Not a member of CATA? See Contact Us – Canadian Association for Technical Analysis (clubexpress.com)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.60 to 19.80. It remains Oversold.

The long term Barometer dropped 6.40 to 43.20. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 2.98 to 31.06. It remains Oversold.

The long term Barometer dropped 3.40 to 51.59. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed