Technical Notes

Dow Jones Industrial Average moved below 32,573.43 completing a double top pattern.

Consumer Staples SPDRs $XLP move below $71.60 extending an intermediate downtrend.

Coca Cola $KO a Dow Jones Industrial Average stock moved below $58.88 extending an intermediate downtrend.

AT&T $T an S&P 100 stock moved below $18.70 completing a Head & Shoulders pattern.

Lowe’s $LOW an S&P 100 stock moved below intermediate support at $193.45 following release of fiscal fourth quarter results.

Keurig Dr. Pepper $KDP a NASDAQ 100 stock moved below $34.19 extending an intermediate downtrend.

KraftHeinz $KHC an S&P 100 stock moved below $38.68 setting an intermediate downtrend.

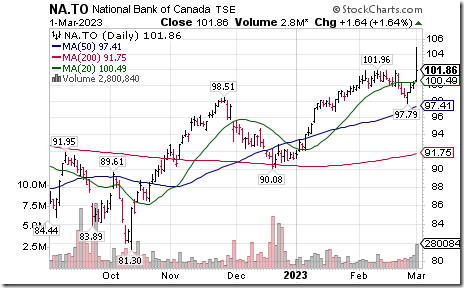

National Bank $NA.TO a TSX 60 stock moved above $101.96 and$101.99 to an all-time high extending an intermediate uptrend.

Gildan Activewear $GIL.TO a TSX 60 stock moved above $43.63 extending an intermediate uptrend.

Trader’s Corner

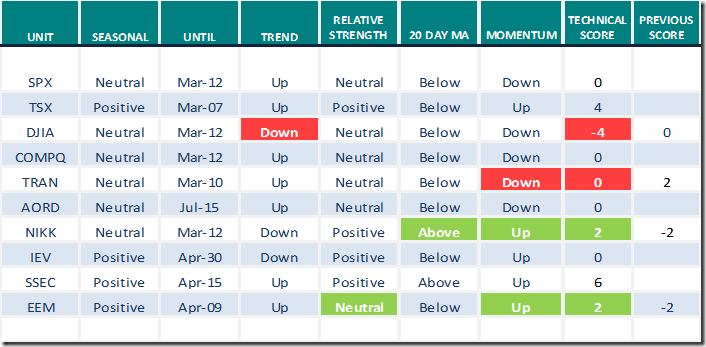

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

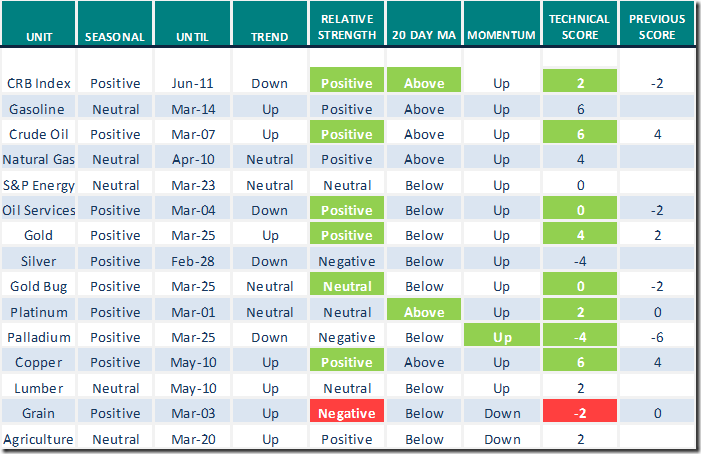

Commodities

Daily Seasonal/Technical Commodities Trends for March 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

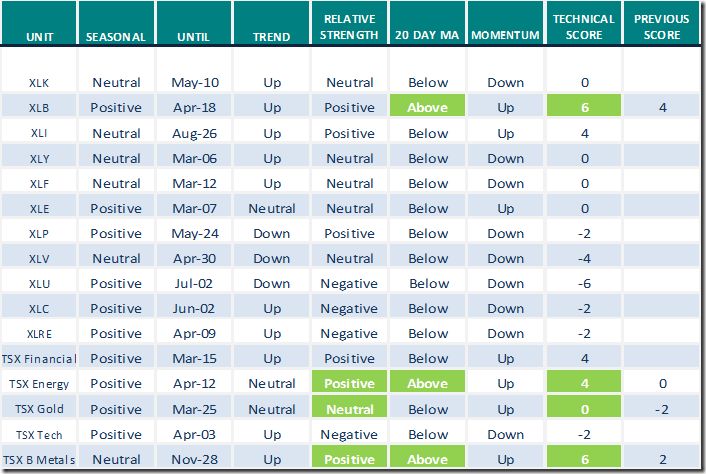

Sectors

Daily Seasonal/Technical Sector Trends for March 1st 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Former Fed Governor: Likelihood of a recession is extremely high.

Former Fed Governor: Likelihood of a recession is extremely high – YouTube

Morgan Stanley’s Wilson: S&P 500 Could Fall About 20%

Morgan Stanley’s Wilson: S&P 500 Could Fall About 20% – YouTube

ISM Manufacturing number at 47.7 and Construction Spending (Both were less than consensus)

ISM Manufacturing number at 47.7 – YouTube

Is It Time For Gold? | Greg Schnell, CMT | Market Buzz (03.01.23)

Is It Time For Gold? | Greg Schnell, CMT | Market Buzz (03.01.23) – YouTube

Market Entering Period of Strong Seasonality | Julius de Kempenaer | Sector Spotlight (02.28.23)

Why March could ‘make or break’ stock-market sentiment with 2023 rally at crossroads

Published: March 1, 2023 at 1:19 p.m. ET By William Watts

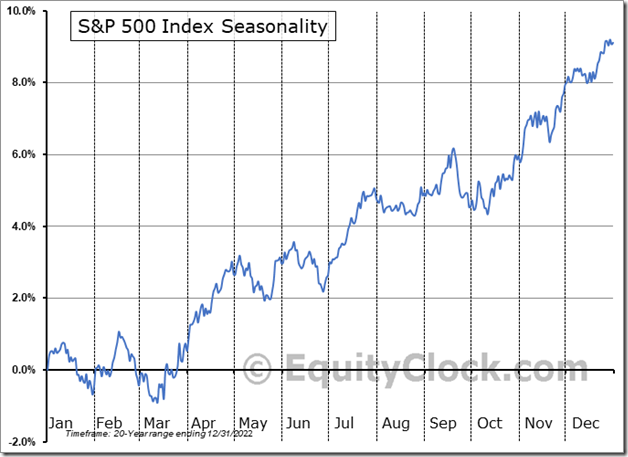

Waiting for a seasonal low/initial buying opportunity in the S&P 500 and related equities/ETFs

Seasonal influences during the past 20 years on average have bottomed in mid-March. This year, that timeline corresponds closely to the next FOMC meeting announcement on March 22nd when the Fed Fund Rate is expected to increase by at least 25 basis points to 4.75%-5.00% and possibly by 50 basis points to 5.00%-5.25%.

Conclusion: Prepare for an important seasonal entry point to buy U.S. equities/ETFs in the second half of March: Develop a list of U.S. equities/ETFs that have favourable technical and seasonal parameters for a trade lasting at least until summer and possibly to the end of the year. Meanwhile, be patient!

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 1.00 to 42.40. It remains Neutral. Trend remains down.

The long term Barometer dropped another 1.60 to 56.20. It remains Neutral. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer added 2.13 to 52.77. It remains Neutral.

The long term Barometer dropped 1.60 to 56.20. It remains Neutral. Trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed