by Fran Lopez de Saa, Russell Investments

Our 2022 ESG manager survey findings reinforced our belief that the integration of environmental, social and governance (ESG) factors into investment processes is here to stay. Stewardship, and the use of the rights and a position of ownership to influence the behavior of issuers, is key to this integration, and a core part of Russell Investments’ investment process. For this reason, we dedicate one portion of our survey to active ownership, and we conduct a deep-dive review of the responses. This informs our industry views, our expectations for the investment managers we assess, recommend and hire, and our own practices. So, let’s get started by digging into the responses.

Engagement

ESG not always on the agenda

While our research and observations note rising efforts around active ownership generally and engagement specifically, ESG topics are not always covered in engagement activity. Over half of the managers who responded to the survey stated that they hold regular meetings with management, and they occasionally cover ESG topics. Just over one-third of them indicated they hold regular meetings with management in which they always discuss ESG issues.

Higher numbers do not necessarily mean better stewardship

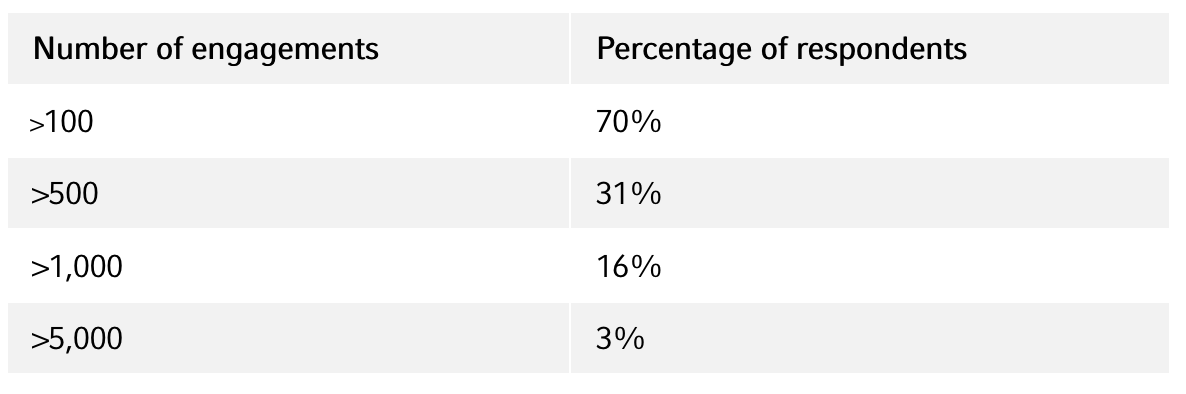

Looking at the number of engagements held by respondents, the survey shows a wide range of responses as set forth in the table below:

We believe that the disparity in numbers across managers indicates that the definition of engagement is not standardized, and this leads to different outcomes in terms of counting. At Russell Investments, we define engagements as dialogue undertaken to understand, influence and/or improve ESG practices and disclosures.1 Engagement can refer to interactions between the investor and current or potential investees (which may be companies, governments, municipalities, etc.) as well as with standard setters on ESG issues.

Increased focus on environmental and social topics

Governance-related concerns remain the top topic with the majority of the respondents covering board-related issues during their engagements. This was closely followed by climate change, a key emerging topic compared to previous years, ESG disclosure, and diversity and inclusion, in that order. While some of the firms cited multiple different engagement topics as being key themes, a good number of participants did not specify any priority issues, and they referred to the materiality assessment whereby each company is evaluated on a case-by-case basis, focusing only on the material ESG-related risks.

Firms tend to divest when engagement fails

Almost two-thirds of the respondents include portfolio managers when conducting engagements activities, with only 10% of the participants having a dedicated active ownership team to engage with issuers. The vast majority of the investors who participated in the survey have partaken in collaborative engagement with other investors. To this end, PRI is the platform most often used, followed by Climate Action 100+.

In terms of engagement tracking processes, approximately 25% of the participants do not document cases of unsuccessful engagement and the steps taken thereafter. This may raise concerns as to:

- How investors are setting engagement objectives and measuring engagement progress and impact

- How investors are holding companies accountable, and their approach to escalation on the back of an unsatisfactory engagement outcome, given that around half of the respondents have divested from investments for this reason

Looking at the responses by asset class, equity managers led the pack in divesting, with 60% indicating they have used divestment as an escalation strategy after unsuccessful engagement activities. Fixed income managers were a close second at 58%. When comparing responses by region, firms based in continental Europe and the UK had higher divestment practices than firms based in the U.S. and Canada.

Voting

A mainstream tool in investment practice, and a shareholder right

It is widely believed that ISS (Institutional Shareholder Services) and Glass Lewis control over 90% of the proxy advice market. Our survey echoes this, and it specifically shows that most of our respondents use ISS’ services.

As part of their fiduciary duty, the majority of the respondents have voted over 80% of their proxies, showing investors’ commitment to exercise their rights as shareholders. Disappointingly, one-third of the respondents do not have a bespoke proxy voting policy in place. Of these, 60% use ISS as a proxy voting provider.

Growing popularity of robo-voting?

As expected, the survey shows that a high percentage of the resolutions have been voted in line with managements’ recommendations. However, when asked about following proxy advisor recommendations, over half of the participants opted not to answer the question. 40% of the respondents indicated they follow proxy advisors in more than 90% of the cases, which reinforces their influence from a proxy voting perspective. This highlights the fact that many investors automatically rely on proxy advisors’ recommendations without evaluating the merits of the recommendations or the analysis underpinning them. This is commonly known as robo-voting, and it is not best practice for exercising shareholder rights.

The bottom line

Our survey and investment work tell us that investors are increasing their focus on ESG matters and thinking about how to implement this into their engagement and proxy voting activities. While governance remains at the top of the agenda for investors, climate risk has risen significantly as a key priority.

On the engagement front, there is scope for improvement in terms of record keeping and engagement tracking practices. This leads to some questions as to how and when escalation strategies are determined in some cases, particularly when divestment decisions are made.

Overall, our survey indicates that investors are using their proxy voting rights to express their positions. However, as the proxy advisor landscape is highly concentrated, the lack of bespoke voting policies and the potential use of robo-voting may be a cause for concern.

Receive the full 2022 ESG Manager Survey

1Source: https://www.unpri.org/Uploads/i/m/n/maindefinitionstoprireportingframework_127272_949397.pdf

Copyright © Russell Investments