by Simona M Mocuta, Chief Economist, Amy Le, CFA, Investment Strategist, Venkata Vamsea Krishna Bhimavarapu, Economist, State Street Global Advisors

Two main macro narratives are competing for attention at the moment. There is a soft landing type of scenario, predicated on a constructive view on inflation that calls for a powerful disinflationary episode to unfold early and convincingly enough to facilitate a dovish pivot from central banks before they cause genuinely crippling damage to labor markets and tip the global economy into outright recession. The alternative is a harsher, bumpier, if not outright hard landing scenario. Insufficient progress on inflation forces central banks onto an even more aggressive tightening path that causes something in the economy to break. That the crack may not first appear in the labor market (given strong starting point) only emboldens policymakers’ hawkish stance. And yet, something, somewhere, snaps, triggering a chain reaction of financial market stress that then reverberates throughout the real economy, driving an abrupt shift from the appearance of resilience to the threat of failure.

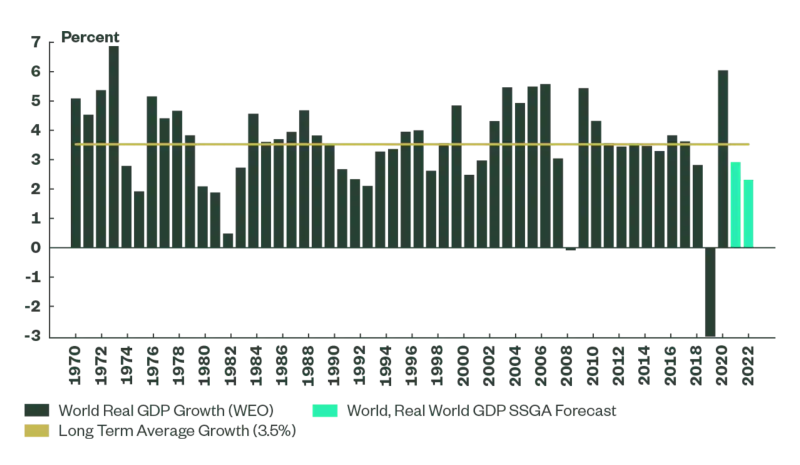

We still favor the first scenario but less confidently so than three months ago. The latest signals from key central banks remain very hawkish in spite of what to us are clearly improving leading indicators of inflation. The risk of overtightening has risen considerably. Elevated borrowing costs in the context of rapidly diminishing excess savings, vanishing pent-up demand, little to no room for fiscal expansion, and ongoing geopolitical tensions, create a dangerous backdrop as we enter 2023.

Copyright © State Street Global Advisors