Pre-opening Comments for Wednesday December 28th

U.S. equity index futures were higher this morning. S&P 500 futures were up 9 points in pre-opening trade.

Boeing added $0.36 to $189.76 after BOC Aviation ordered 40 Boeing 737 Max aircraft.

Generac advanced $0.52 to $91.67 after Janney initiated coverage with a Buy rating and a target of $160.

Costco gained $0.20 to $458.70 after Cowen upgraded the stock to Top Pick.

Home Depot slipped $0.25 to $319.30 despite Cowen upgrading the stock to Top Pick.

EquityClock’s Daily Comment

Headline reads “While the technicals of growth stocks continue to look poor, seasonal tendencies suggest that this may not be the area to short through the first half of January”.

http://www.equityclock.com/2022/12/27/stock-market-outlook-for-december-28-2022/

Technical Notes

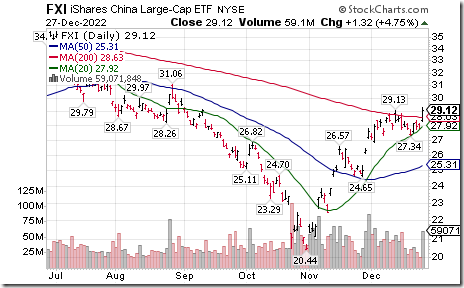

China iShares $FXI moved above $29.13 resuming an intermediate uptrend. Morgan Stanley A Shares Fund $CAF (Tracks China A Shares) moved above $14.29 completing a reverse Head & Shoulder pattern.

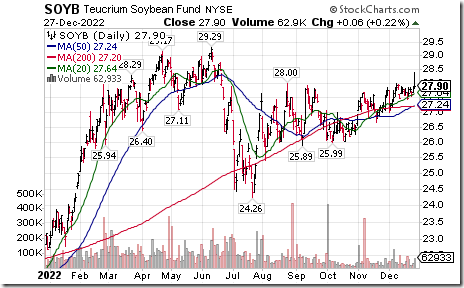

Soybean ETN $SOYB moved above $28.00 extending an intermediate uptrend.

Travelers $TRV a Dow Jones Industrial Average stock moved above $190.21 to an all-time high extending an intermediate uptrend.

Merck $MRK, a Dow Jones Industrial Average stock moved above $112.17 to an all-time high extending an intermediate uptrend.

DexCom $DXCM a NASDAQ 100 stock moved below intermediate support at $110.13.

Pan American Silver $PAAS is responding to higher silver prices. It moved above $17.58 completing a reverse Head & Shoulders pattern. Gold equity ETFs (eg. GDX, GDXJ) also moved to six month highs.

Gold Bug Index $HUI moved above $239.18 extending an intermediate uptrend.

Trader’s Corner

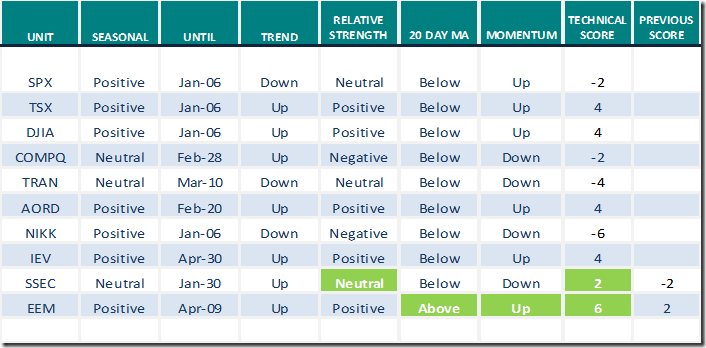

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

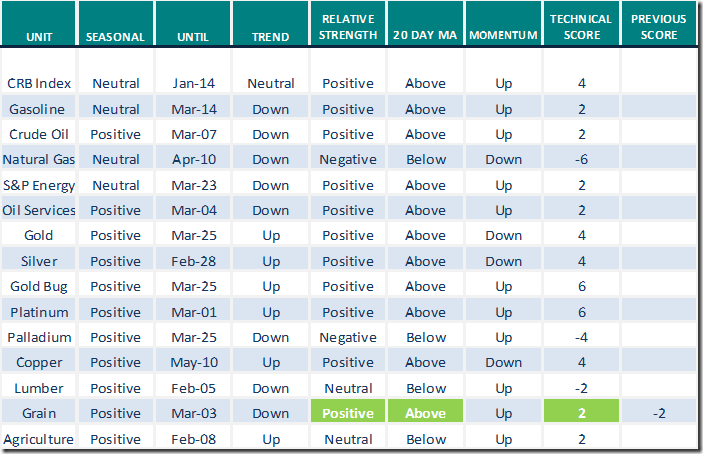

Commodities

Daily Seasonal/Technical Commodities Trends for December 27th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

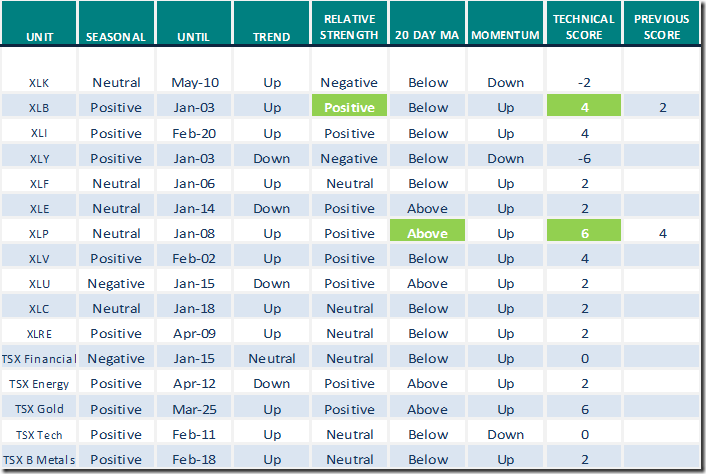

Daily Seasonal/Technical Sector Trends for December 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.40 to 56.60 yesterday. It remains Neutral.

The long term Barometer added 1.00 to 52.80 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed