Technical Notes for yesterday

ETFs moving below intermediate support: TAN, XLB, XLY, EZU, IAI, CARZ, XIT.TO

S&P 100 stocks moving below intermediate support: NKE, TGT, AXP, BAC. COF, JPM, MA, V, MDT, DHR, DD, KMI

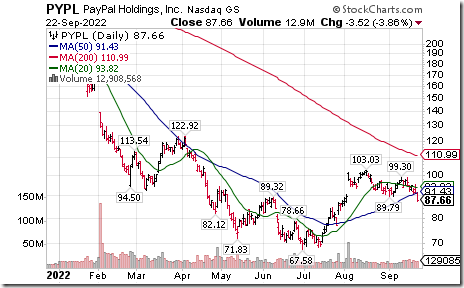

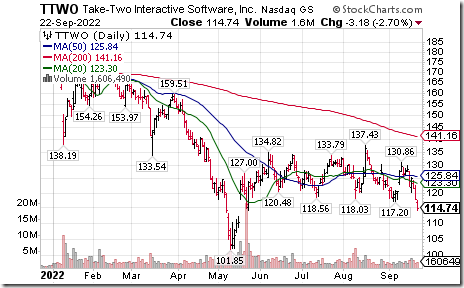

NASDAQ 100 stocks moving below intermediate support: PYPL, SPLK, SWKS, TTWO, MRVL, AMD, ILMN, JD

TSX 60 stocks breaking intermediate support: CP, TRI, CSU, ATD, BNS, MFC

Trader’s Corner

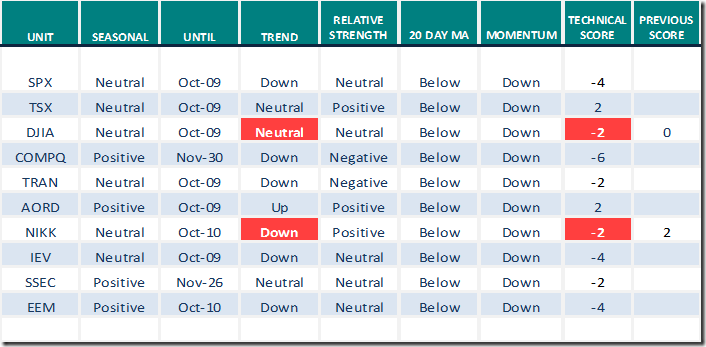

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

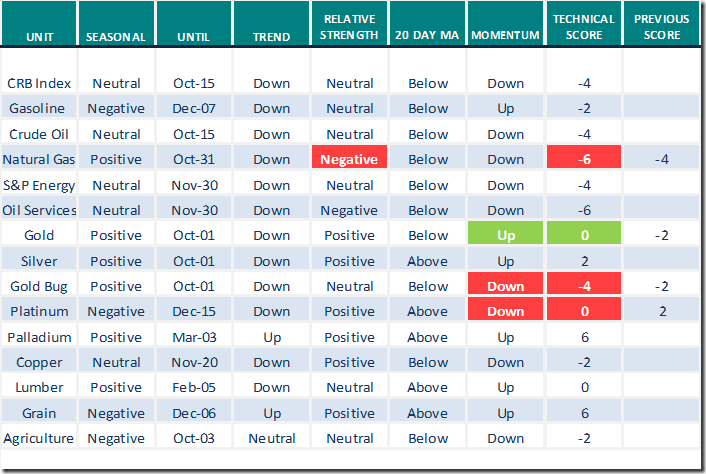

Commodities

Daily Seasonal/Technical Commodities Trends for September 22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for September 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Dave Keller notes “Market snatches defeat from the jaws of victory”.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 4.20 to 12.00 yesterday. It remains Oversold. Trend remains down.

The long term Barometer dropped another 4.00 to 20.20 yesterday. It remains Oversold. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer plunged 11.71 to 24.15 yesterday. It remains Oversold. Trend remains down.

The long term Barometer dropped 2.42 to 27.12 yesterday. It remains Oversold. Trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed