Technical Notes yesterday

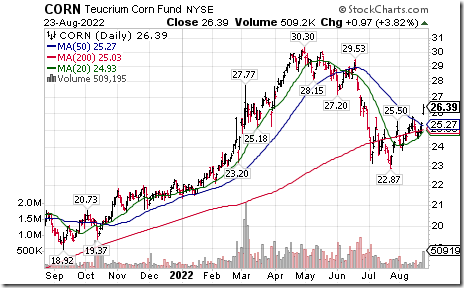

Corn ETN $CORN moved above $25.79 completing a reverse Head & Shoulders pattern

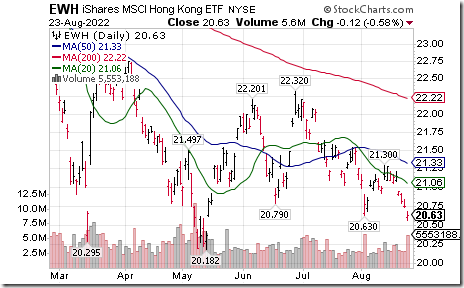

Hong Kong iShares $EWH moved below $20.63 extending an intermediate downtrend.

Treasury Bond iShares $TLT moved below intermediate support at $111.85

Verizon $VZ a Dow Jones Industrial Average stock moved below $43.76 extending an intermediate downtrend.

Biogen $BIIB a NASDAQ 100 stock moved below intermediate support at $204.18

ZOOM $ZM a NASDAQ 100 stock moved below intermediate support at $96.11

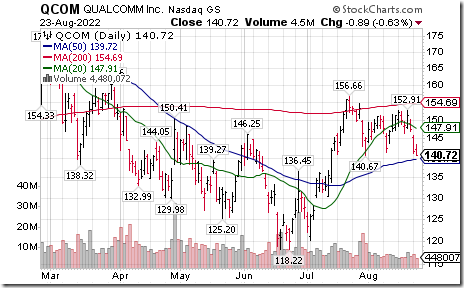

QualComm $QCOM a NASDAQ 100 stock moved below $140.67 setting an intermediate downtrend.

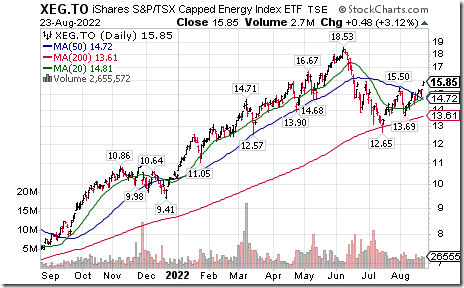

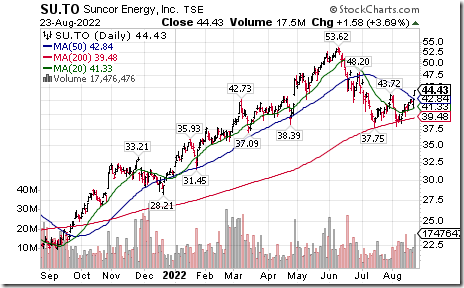

Canadian energy equities responded to higher crude oil and natural gas prices. Cdn Energy iShares $XEG.TO moved above $15.50 resuming an intermediate uptrend. BMO Equal Weight Canadian Oil ETF $ZEO.TO moved above $64.98 resuming an intermediate uptrend. Suncor $SU.TO a TSX 60 stock moved above $43.72 resuming an intermediate uptrend. Imperial Oil $IMO.TO a TSX 60 stock moved above $62.56 resuming an intermediate uptrend.

Trader’s Corner

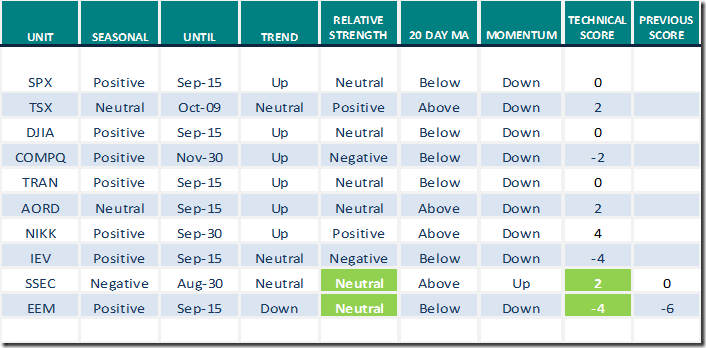

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

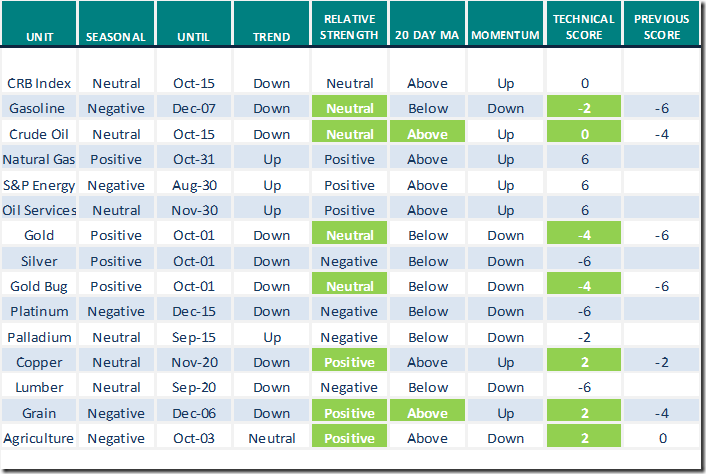

Commodities

Daily Seasonal/Technical Commodities Trends for August 23rd 2022

Green: Increase from previous day

Red: Decrease from previous day

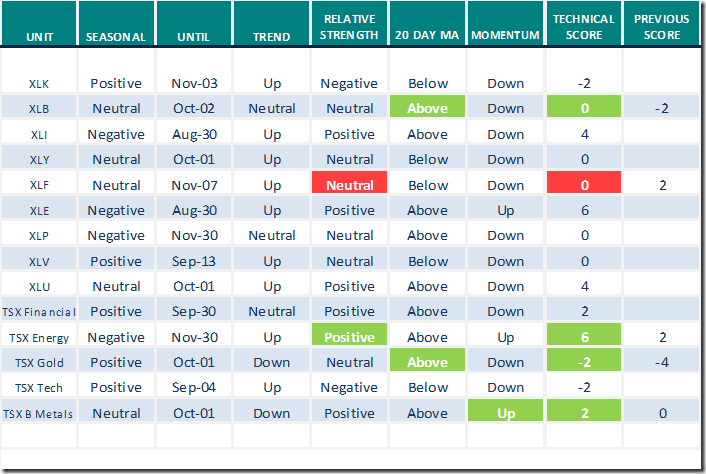

Sectors

Daily Seasonal/Technical Sector Trends for August 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

Links from valued providers

Mark Hulbert says “September is the worst month of the calendar for the U.S. stock market”.

Glenmede strategist says “Beware of a ‘bear trap’ retreat in stocks after the big summer rally”.

Tom Bowley says “S&P 500 Tumbles Below Key Moving Average”.

S&P 500 Tumbles Below Key Moving Average | Tom Bowley | Trading Places (08.23.22) – YouTube

Vivien Lou Chen says “Disappointing U.S. data has traders considering possibility of a half-point Fed rate hike in September.”

Craig Johnson, CFA CMT of Piper Sandler shares his year-end target for the S&P 500 at 4770

https://www.youtube.com/watch?v=wtqWUaGrsMo

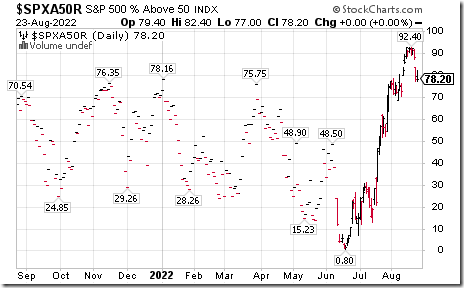

S&P 500 Momentum Barometers

The intermediate term Barometer was unchanged at 78.20 yesterday. It remains Overbought.

The long term Barometer slipped 0.40 to 37.20 yesterday. It remains Oversold. Trend remains down.

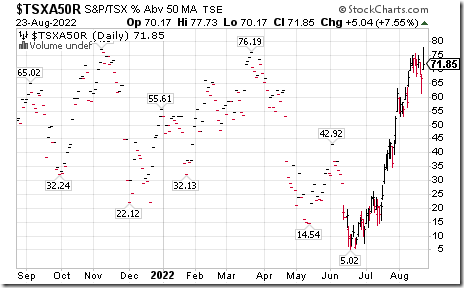

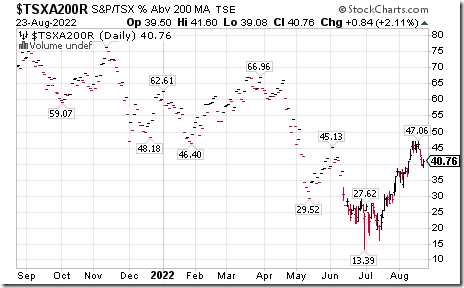

TSX Momentum Barometers

The intermediate term Barometer added 5.04 to 71.85 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 0.84 to 40.76 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed