Happy Independence Day to our United States of America readers.

The Bottom Line

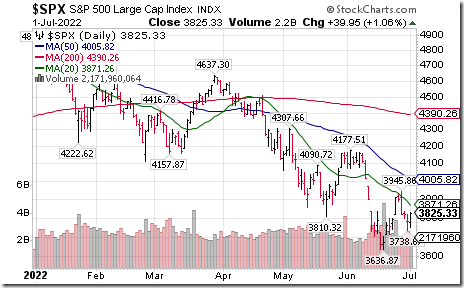

Base building patterns by U.S. and Canadian equity indices continue. Historically, broadly based North American equity indices reach the bottom of the U.S. Presidential cycle in June during the second year of the President’s mandate. History is repeating.

Earnings and Revenue Outlook for S&P 500 companies

Consensus earnings estimates for S&P 500 companies on a year-over-year basis in the second quarter of 2022 were reduced slightly last week. According to www.FactSet.com second quarter earnings on a year-over-year basis increased 4.1% (versus 4.3% last week) and revenues increased 10.1% (versus 10.2% last week).

Consensus earnings and revenue estimates for S&P 500 companies beyond the second quarter on a year-over-year basis also slipped slightly last week. According to www.FactSet.com earnings in the third quarter are expected to increase 10.5% (versus 10.6% last week) and revenues are expected to increase 9.7% (versus 9.8% last week). Earnings in the fourth quarter are expected to increase 9.7% (versus 10.0% last week) and revenues are expected to increase 7.5%. Earnings on a year-over-year basis for all of 2022 are expected to increase 10.2% (versus 10.4% last week) and revenues are expected to increase 10.7%.

Economic News This Week

U.S. May Factory Orders released at 10:00 AM EDT on Tuesday are expected to increase 0.5% versus a gain of 0.3% in April.

June Non-manufacturing ISM PMI released at 10:00 AM EDT on Wednesday is expected to slip to 54.5 from 55.9 in May.

FOMC Meeting Minutes are released at 2:00 PM EDT on Wednesday.

June ADP Employment Report released at 8:15 AM EDT on Thursday is expected to increase to 200,000 from 128,000 in May.

U.S. May Trade Deficit reported at 8:30 AM EDT on Thursday is expected to slip to $85.00 billion from $87.10 billion in April.

Canada’s May Merchandise Trade Balance reported at 8:30 AM EDT on Thursday is expected to show a surplus of $2.20 billion versus a surplus of 1.50 billion in April.

U.S. June Non-farm Payrolls reported at 8:30 AM EDT on Friday are expected to slip to 265,000 from 300,000 in May. June Unemployment Rate is expected to remain unchanged from May at 3.6%. June Average Hourly Earnings are expected to increase 0.3% versus a gain of 0.3% in May (Year-over-year 5.0% versus 5.2%).

Canadian June Employment reported at 8:30 AM EDT on Friday is expected to increase 20,000 versus a gain of 39,800 in May. June Unemployment Rate is expected to remain unchanged from May at 5.1%.

Selected Earnings News This Week

Nil

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for July 1st 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for July 1st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Greg Schnell describes a new look at the commodity sector

Commodity Reckoning | The Canadian Technician | StockCharts.com

Michael Campbell’s Money Talks for July 1st (Canada Day Special)

Our Canada Day Special – The Entire Show (mikesmoneytalks.ca)

According to Tom Browley “Wall Street says NO to inflation”

Wall Street Says NO To Inflation | Tom Browley | Your Daily Five (07.01.22) – YouTube

Tom Browley says “Falling VIX spells BIG trouble for the bears”.

Falling VIX Spells BIG Trouble For The Bears | Trading Places with Tom Bowley | StockCharts.com

John Kosar discusses “How to identify the upcoming big market bottom”

Mark Leibovit weekly comment for June 30th on www.HoweStreet.com

https://www.howestreet.com/2022/06/market-meltdown-update-mark-leibovit/

Victor Adair’s Trading Notes for July 2nd

https://www.howestreet.com/2022/07/trading-desk-notes-for-july-2-2022/

Link from Mark Bunting and www.uncommonsenseinvestor.com

11 Reasons to Get More Bullish on Equities – Uncommon Sense Investor

More links to follow

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

Semiconductor stocks and related ETFs moved lower following lower guidance by Micron. Applied Materials $AMAT, ASML$ASML, KLA Tencor $KLAC, Lam Research $LRCX, Analog Devices $ADI, Texas Instruments $TXN and Micron $MU moved below intermediate support extending an intermediate downtrend.

Gold ETN $GLD moved below $168.01 extending an intermediate downtrend.

Auto ETF $CARZ moved below $44.78 extending an intermediate downtrend.

South Africa iShares $EZA moved below $41.63 extending an intermediate downtrend.

S&P 500 Momentum Barometers

The intermediate term Barometer added 9.20 on Friday and 1.80 last week. It remains Oversold. Short term trend is up.

The long term Barometer added 3.40 on Friday and 1.80 last week. It remains Oversold. Short term trend is up.

TSX Momentum Barometers

The intermediate term Barometer slipped 2.09 to 12.56 last week. It remains Oversold.

The long term Barometer slipped 2.09 last week to 23.85. It remains Oversold.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.