by Blackrock Institute

2022 has sparked questions about the future durability of the traditional 60/40 portfolio and highlights why investors may want to add alternative investments to the mix.

1. The 60/40 portfolio today

Inflation poses a challenge to the traditional stock-bond portfolio. The diversifying nature of the relationship is under increasing pressure, making rethinking portfolios more critical than ever.

2. Rebuilding resilience

The next evolution of portfolio construction may require rethinking classic asset allocations by adding alternative sources of diversification and return.

3. Three Ds of alternative diversifiers

When looking for an alternative investment to rebuild portfolio resilience, we believe it should offer the potential for diversification, durability, and defensiveness.

The 60/40 today

The foundational 60/40 portfolio, where 60% is invested in stocks and 40% in bonds, is the initial starting point for many portfolios. The balance of this 60/40 mix then adjusts based on an investor’s time horizon, risk tolerance and financial goals, but its stock-bond combination is core to what is considered a “diversified” portfolio.

Typically, when growth assets, like stocks, sell off due to economic slowdowns, safer assets like bonds appreciate as investors seek stability. While stocks tend to suffer in a recession due to less economic growth, bonds can rally because the U.S. Federal Reserve typically cuts interest rates to support the economy. When interest rates are cut, bond yields drop but bond prices go up. This provides a shock absorber in the portfolio, helping to cushion overall returns when stocks are falling.

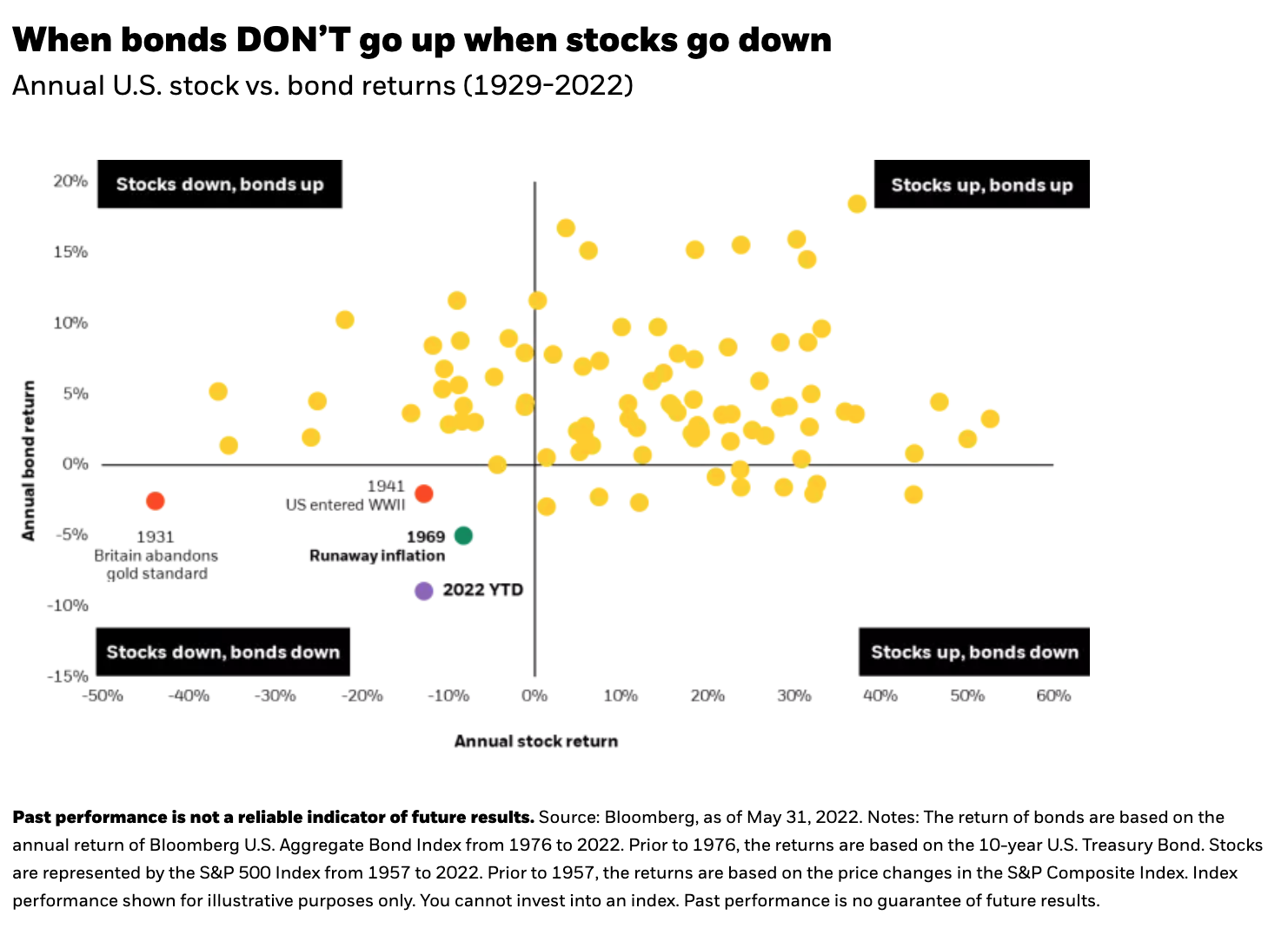

The 60/40 stock-bond balancing act of “diversified” portfolios has been the foundation of investing for decades. Going back to 1929, there have only been 3 years where bonds didn’t go up when stocks went down. In 1931, we saw a currency crisis that forced Britain to abandon the gold standard. In 1941, the U.S. entered World War II. Both years include a very unique set of circumstances. But the 1969-70 episode is perhaps the most relevant today. In that period, a combination of many factors including loose monetary policy, generous fiscal stimulus, and energy supply disruptions sparked a decade of higher inflation. Sound familiar? Those same factors are at play in 2022.

What we can learn from 1969

In the mid-1960s, as prices rose, the Fed belatedly shifted into inflation-fighting mode by rapidly raising interest rates. The move eventually led to an economic recession and a period of negative returns for stocks and bonds. Bonds were able to provide a hedge to equities eventually, but only after the Fed had sufficiently snuffed out inflation.

The key lesson: Bonds may be a reliable diversifier when economic growth is slowing – but not necessarily when inflation is increasing. Why? Because when stocks decline due to rising inflation concerns, the Fed may simultaneously have to raise interest rates to slow inflation. In the end, bonds may lose out as well, potentially exacerbating losses in a diversified 60/40 portfolio.

Rebuilding resilience

With the 60/40 portfolio becoming increasingly challenged, now may be the time to consider alternatives that can add diversification and target new sources of return. One of the ways to do this is to add strategies that go long AND short* securities.

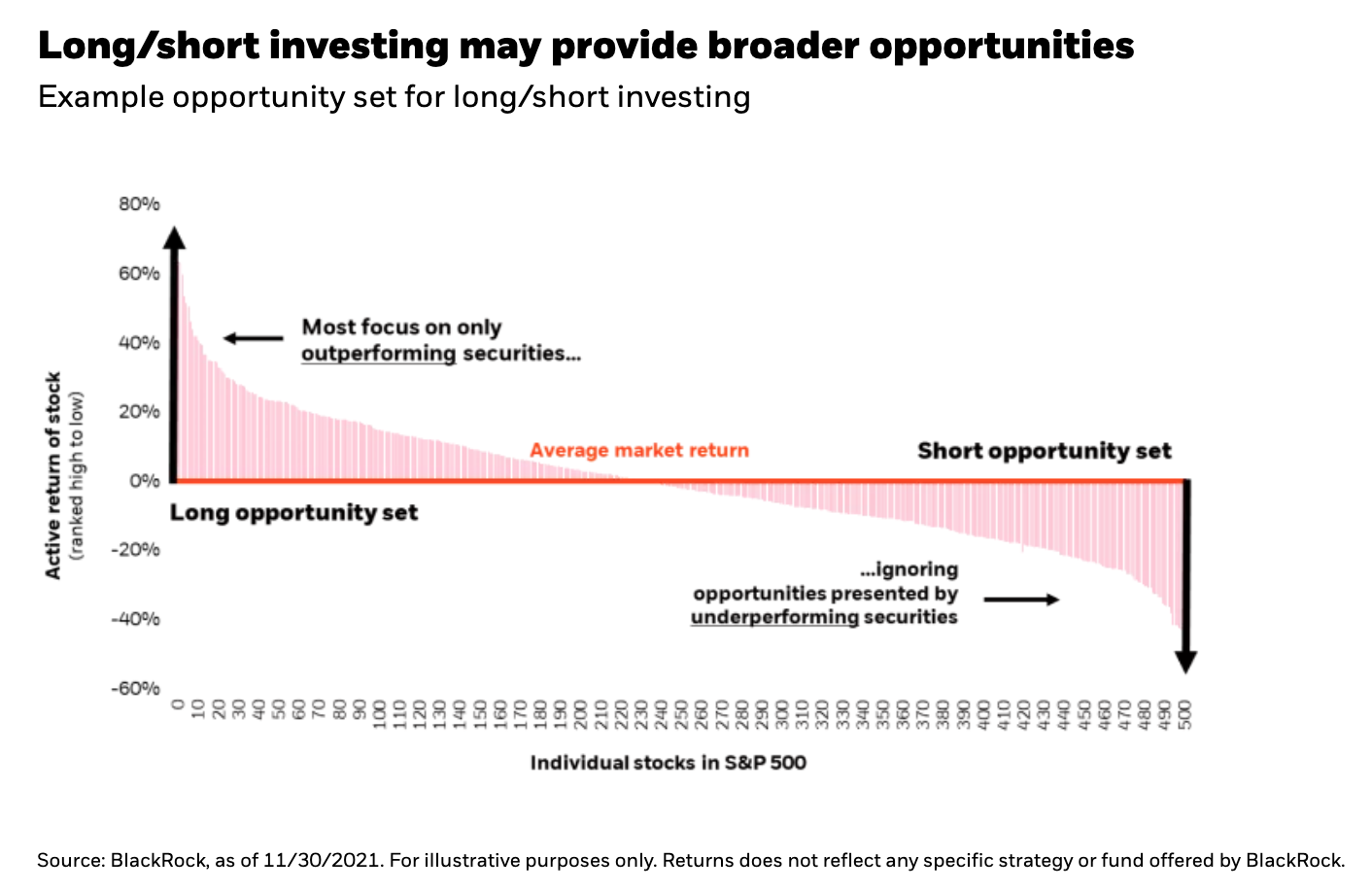

Unlike traditional long-only strategies that target “best-in-class” securities that are expected to outperform the market, long/short strategies seek to target the entire opportunity set—what is believed to be the best and the worst investments available. They seek to generate returns by going long companies that will outperform and going short companies that will underperform. In this way they can generate returns on both sides of the market and tap into an opportunity set that long-only investments cannot access.

Beyond a more expansive opportunity, structuring the portfolio to be “market neutral” where long and short positions are relatively matched, can result in a return stream that captures the unique differences in security returns across the market. In effect, the ups and downs of the overall market, or beta, is largely stripped out of the return stream.

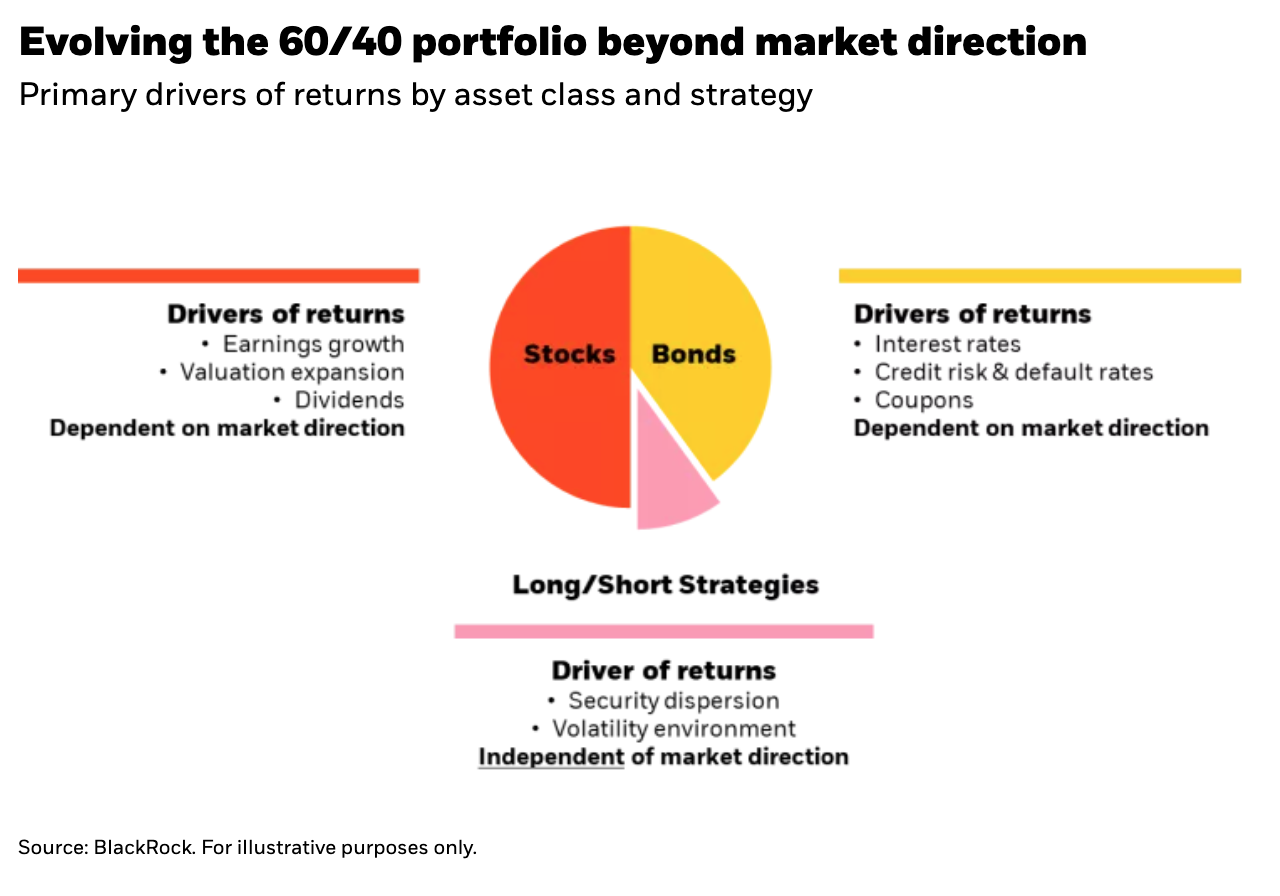

From a portfolio construction perspective, this type of alternative strategy enables investors to tap into an alternative source of return, called security dispersion, that is not currently captured in 60/40 portfolios.

What is security dispersion? Dispersion is the difference between winners and losers in the market. High dispersion implies a wide difference between winners and losers, while low dispersion implies a narrow difference between winners and losers. Long/short strategies can thrive in high dispersion environments because they can go long companies who may become outsized winners and go short companies that may become relative losers.

Taking advantage of security dispersion can act as another form of return in a portfolio that a traditional 60/40 construct overlooks. Why? The returns of a 60/40 portfolio are based on market direction. Equity returns are driven by growth in earnings, the valuation multiple of those earnings, and to a lesser degree the payment of dividends. These are heavily dependent on the direction of economic conditions and overall direction of equity markets. Similarly, bond returns are driven by prevailing interest rates, credit spreads, and coupon payments. If market returns are muted, buy-and-hold asset allocation becomes considerably less effective.

Dispersion, however, is not dependent on market direction. It can exist in markets with low absolute returns or even downward trending markets—the very time a 60/40 portfolio needs alternative sources of return the most.

The three Ds of alternative diversifiers

Alternative investments, and in particular long/short strategies, vary widely. Understanding the characteristics of a strategy is crucial because many in the same category or with similar labels may produce vastly different portfolio outcomes.

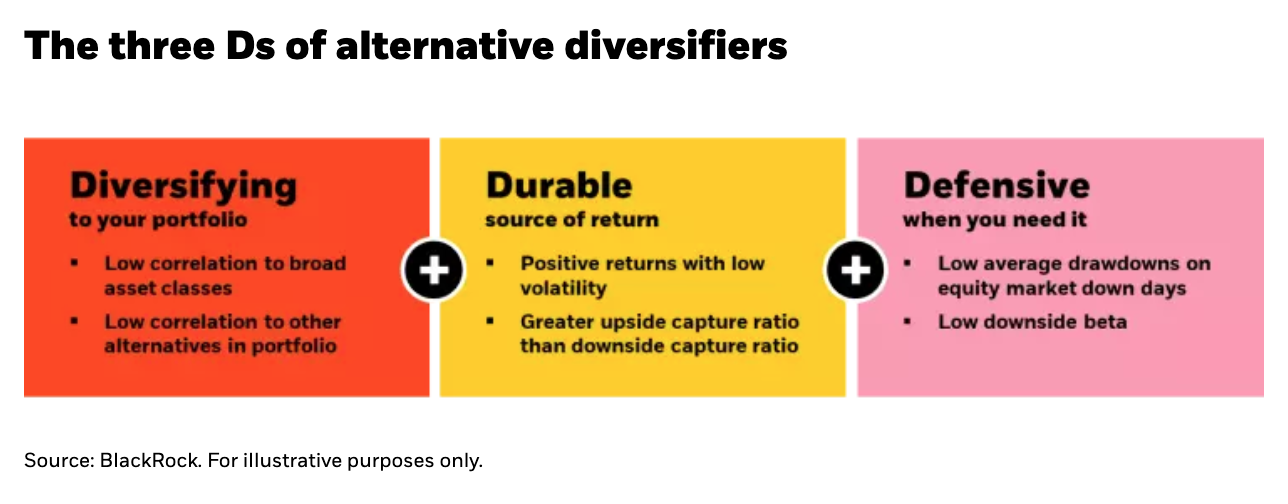

When looking for an alternative to diversify a portfolio, we believe it’s key to ask if it has historically exhibited the three Ds: diversification, durability, and defensiveness.

First, does the strategy diversify your current portfolio? A telling characteristic to look for is low correlations to other broad asset classes in your portfolio—think risky assets like U.S. and global equities, high yield bonds, or private markets. Many alternative strategies offer strong double-digit returns, but with very high correlation to equities and other risky assets—essentially doubling down on the pre-dominant risk you have in the portfolio. Others offer more modest returns but deliver them without the same level of equity-related risk. Consider finding a middle ground between return potential and low correlations when evaluating alternative diversifiers. Another dimension of an alternative’s diversification potential is the correlation to other alternatives you may already have in your portfolio. A low correlation between another liquid alternative can signal that they are complementary and additive to your current allocation.

Next, does the strategy have a history as a durable source of return? As a long-term holding in an asset allocation, it is key that your capital is put to good use to produce positive returns. Consistent returns with relatively low volatility can help balance out the loss of return from other low risk asset classes like core bonds, but still deliver the stability that has made core bond allocations attractive in the past. Furthermore, a positively skewed upside/downside capture ratio (one where you capture more upside on up days, than downside on down days) can signal that the strategy is not just providing a watered-downed version of market beta, but rather, demonstrating a source of durable return.

Finally, is the strategy defensive when you need it? The timing of returns matter. Potential ways to gauge if a strategy is truly defensive is by looking at how the strategy has historically performed in significantly negative equity markets of 5, 10 or even 15%—the time when defense is needed most. An alternative diversifier may not always exhibit defensiveness across all market environments or events—all investments have ups and downs—but what is essential is the alternative’s diversifying behavior doesn’t consistently disappear at the same time other assets in your portfolio are selling off. An alternative diversifier that is defensive when other assets are under pressure may allow your total portfolio to better weather different market environments.

The long and short of it

Inflation poses a unique challenge to the traditional stock-bond portfolio that we haven’t seen since the 1970s. The diversifying nature of the relationship is under increasing pressure, making rethinking portfolios more critical than ever.

Long/short strategies have two major benefits for 60/40 portfolios. First, by going short companies they can greatly expand the opportunity set to generate returns. Second, by going long and short in equal amounts they can tap into changes in security dispersion. Dispersion is independent of market direction and can act as a new source of return that is not available in the 60/40 framework.

Finally, when looking for alternative diversifiers, we believe it’s best to ask the right questions. Is it diversifying to your current portfolio? Does it offer a durable source or return? Has it been defensive when the rest of your portfolio needed it most? Finding the right alternative may make portfolios more resilient to not only inflation scares, but also many different future market environments.

Copyright © Blackrock