by Carl R. Tannenbaum, Executive Vice President and Chief Economist, Northern Trust

A cooler housing market isn't a bad outcome.

We shared dinner with good friends recently, and they were in shock. They’d been thinking about downsizing, which brought them into contact with the frenzy that is the American housing market. The unit they wanted to buy was the object of 31 bids, and ended up selling for 30% over the list price…without a contingency for a home inspection.

It has been difficult to square this account (which is not at all isolated) with warnings of impending trouble for residential real estate. Conditions in the industry are no longer perfect, but they are not bad at all.

When the pandemic emerged, the housing sector was of significant concern. Increases in unemployment and depreciation in asset markets raised the possibility of widespread foreclosures and evictions. To cushion the blow, loan forbearance programs and eviction moratoria were implemented across the United States. Fortunately, a crisis was averted.

The housing market was also a substantial beneficiary of broader COVID-19 support programs. Households received stimulus checks and extended unemployment benefits. The Federal Reserve initiated a huge quantitative easing program, which brought down long-term interest rates. Part of the program found the Fed purchasing mortgage-backed securities, which further improved financing conditions for residential property.

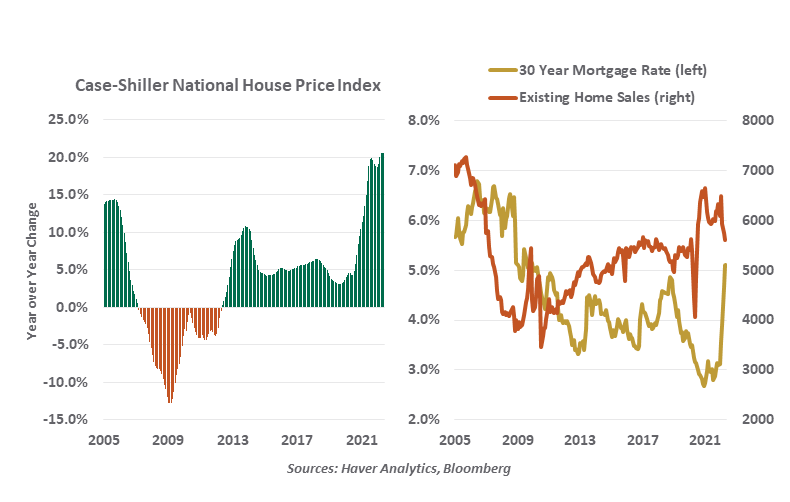

The results exceeded expectations…maybe too much so. Fiscal stimulus came at a time that many families were seeking more space to accommodate remote work. Mortgage rates hit 50 year lows. The combination of these factors contributed to a huge surge in housing demand. The inventory of homes for sale has been constrained for a decade by headwinds facing contractors; tangled supply chains have made construction even more difficult over the past two years.

This is why bidding wars for property have become common. Overall, residential property prices have risen by about 20% over the past twelve months, higher than the appreciation seen prior to the 2008 mortgage meltdown.

Increases in home prices gradually feed into inflation measures through the cost of shelter, which has been rising at a 6% annual pace. Because this component is the largest in all of the major consumer baskets, it has a significant influence on overall inflation. And that has made it a particular target of the Federal Reserve.

Throughout 2022, the Fed has been sounding and acting more hawkish. Reflecting the change of tone, long-term interest rates are much higher than they were at the beginning of the year. The combination of higher mortgage rates and higher home prices has diminished affordability. Existing home sales have consequently fallen by 14% from their peak. Homebuilder confidence has dropped by a comparable amount.

It should be noted, however, that both of these quantities had been standing at very high levels. And they still stand at levels consistent with a healthy housing market. Demand remains strong: household balance sheets are still in very good condition, and the need for space to work remotely remains a consideration. Current homeowners seeking new quarters have plenty of equity to roll into a new purchase. And while 5% might seem like a high mortgage rate to the thirty-somethings who are entering the market, it hardly seems threatening for those of us who grew up with double-digit borrowing costs.

A little less heat in the housing market wouldn’t be a bad thing.

Longer term, the number of new household formations (young people who are ready to live on their own) has been growing more rapidly than the supply of new housing stock. These trends are favorable for real estate.

That said, the three rules of real estate are location, location and location. Housing sales and housing prices have held up much better in some places than others; in a departure from past patterns, many urban centers have lagged while less populous locations have led.

Moving to a remote location was not an option for our friends, who want to be close to their grandchildren. FaceTime is no substitute for face time.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Carl R. Tannenbaum

Carl R. Tannenbaum

Executive Vice President and Chief Economist

Carl Tannenbaum is the Chief Economist for Northern Trust. In this role, he briefs clients and colleagues on the economy and business conditions, prepares the bank's official economic outlook and participates in forecast surveys. He is a member of Northern Trust's investment policy committee, its capital committee, and its asset/liability management committee.

Copyright © Northern Trust