by John Mauldin, Mauldin Economics

Behind the Curve

Weak Demand

Excess Confidence

Dallas and the Oil Patch

Two weeks after SIC ended, I’m beginning to assimilate everything. Different pieces are connecting in my head. I’d like to tell you I have a vision for uninterrupted peace and prosperity. Sadly, that’s not the case. Good things are coming, but not just yet.

For now, we are stuck in an awkward interregnum. It looks like the economy will grow for a while, just not very fast. And we simply don’t know what will happen when the Federal Reserve tightens in the face of a slowing economy. Housing is clearly slowing, as are certain kinds of consumer spending. But consumers seem intent upon spending on experiences and travel. I’ve been traveling this week, and I can tell you the hotels and airports are full, as well as restaurants. This may give the Fed additional room to tighten without hurting growth.

While we don’t know everything that’s coming, some of it is probably not good. In other words, we are between a rock and a hard place. That’s not a great position, but you can survive it if the rock doesn’t fall. The best solution: keep your eyes open… and keep moving.

Behind the Curve

On Day 5, we started pulling the pieces together. Bill White, the former chief economist at the Bank for International Settlements and, before that, a top Bank of Canada official, knows central banking and monetary policy from the inside out. I have often said that Bill is my favorite central banker. Right now, it would be an understatement to say he’s concerned.

Lacy Hunt interviewed Bill White, adeptly drawing out the reality we would rather not hear. A few key points:

- The core problem, which central banks aren’t recognizing, is that the global economy faces multiple serious supply shocks. It’s not just COVID. We were having supply chain problems even before the pandemic. China has major issues. The whole world has demographic challenges. He thinks climate change is an economic problem, whether the answer is to adapt to it or mitigate it. All these generate inflation pressure in various ways.

- Bill’s top fear is the Federal Reserve may get so far behind the curve it can’t ever catch up. This could happen if inflation rises faster than the Fed hikes. In that case, real interest rates would actually be moving lower. That’s when people start fleeing a currency. Then inflation gets very high, and worse things follow. He didn’t predict this but thinks it is possible. This isn’t just a US problem. It is potentially even worse in Europe and much of Asia.]

- Lacy asked about reports that the Fed waited to tighten because it wasn’t clear if the president would nominate Powell for another term as Fed chair. Bill carefully said he didn’t know their motivations. He noted Powell is a wealthy man who doesn’t need the Fed job. It shouldn’t have been a barrier to doing what needed to be done if that’s what they saw.

- Like what you’re reading?

- Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

- Asked about China, Bill said China has basically tried to follow the Japanese postwar growth model, using low exchange rates to generate exports. Beijing now wants to change this, but can’t, because the old regime is of great benefit to certain people and because the transition is hard. They will keep trying but will ultimately fail.

Bill’s most interesting point is one I have made many times: central banks are overconfident in their own ability to control the economy. He says it more eloquently, so I’m going to quote him at length.

“Mark Twain said, ‘It ain’t the things that you don’t know what gets you, it’s the things what you know for sure, what ain’t so.’ And Oliver Cromwell wrote a letter to the Scottish parliament, I think it was… And what he said was, ‘Brothers, I beg you in the bowels of Christ, think it possible that you might be wrong.’ And this problem of people holding on to false beliefs seems to me to have been around for a very long period of time. The first question, I guess, is, do we think that the Central Bankers actually have got it wrong?

“They’ve got the wrong model, the wrong framework, and I’ve said and written this a number of times. I think they have made what I call a profound ontological error. It’s almost a philosophical error that they have misunderstood the nature of the system that they’re trying to control and what all of these models are based upon—and not just the Neo-Keynesian models, but the big structural models too—they’re based upon the idea that the economy is actually very simple and it’s static, essentially. It is understandable because it’s simple and static and, therefore, it is controllable.

“The models have all got that as fundamental assumptions, but there’s a problem. And the problem is, it’s not true. Because the economy is not simple, it is complex; it is not static, it is adaptive. Everybody’s constantly reacting to all the stuff that’s going on and changing their behavior.

“And in consequence, the economy is not understandable, and it is not controllable. Maybe controllable within certain limits, but it will not take the maximization that has been going on without having some unintended consequences that, over some longer run, will come back and bite you in the bum. And that’s precisely what’s been going on.

“And I think the degree to which the Fed—and the other Central Banks too—have gotten wedded to this fundamental, philosophical misconception is really unfortunate because it has allowed them to conduct a policy, which, again, as I’ve said before, this ultra-easy monetary policy going back decades almost, has been both unneeded because deflation is not always and everywhere, a bad idea. We can talk about that a bit more. That policy has proved to be ineffective for reasons that you know well, Lacy. Easy money encourages a buildup of debt, which over time then weighs negatively against further growth.

“And lastly, I think this policy has just been very dangerous because of all of the unintended consequences. In addition to the debt overhang, you’ve got all of those financial imbalances that I just spoke about a few moments ago. And in addition, I think what you’ve got is that ultra-easy monetary policy—and this goes back to Hayek and the Austrians—does lead, in the end, to misallocations of real resources that actually slow down aggregate supply every bit as much as it slows down aggregate demand.

“So, I do think it’s unfortunate that this approach has been so widely taken because it has allowed us to go down a path that has generated the problems that we are currently facing and which, as I said earlier, I fear could lead us to a rather sticky end. Not saying it’s inevitable, but it does seem to me to be quite likely.”

These are profound words: “The economy is not understandable, and it is not controllable.” Powerful people at the Fed and other banks disagree. They think they do understand the economy and they can control it. They’re wrong on both counts, and their mistakes are causing enormous damage.

This echoes a point I have made in numerous past letters. Easy money and quantitative easing have contributed to the excessive wealth disparity in the world. It is clearly the root cause of the financialization of the economy, which leads to the distortions that Bill mentions.

Weak Demand

Next, we heard from Lacy Hunt on his own, and as always, he came armed with a stunning array of charts and data. I can’t possibly summarize all of it, so I’ll share just a couple of important points.

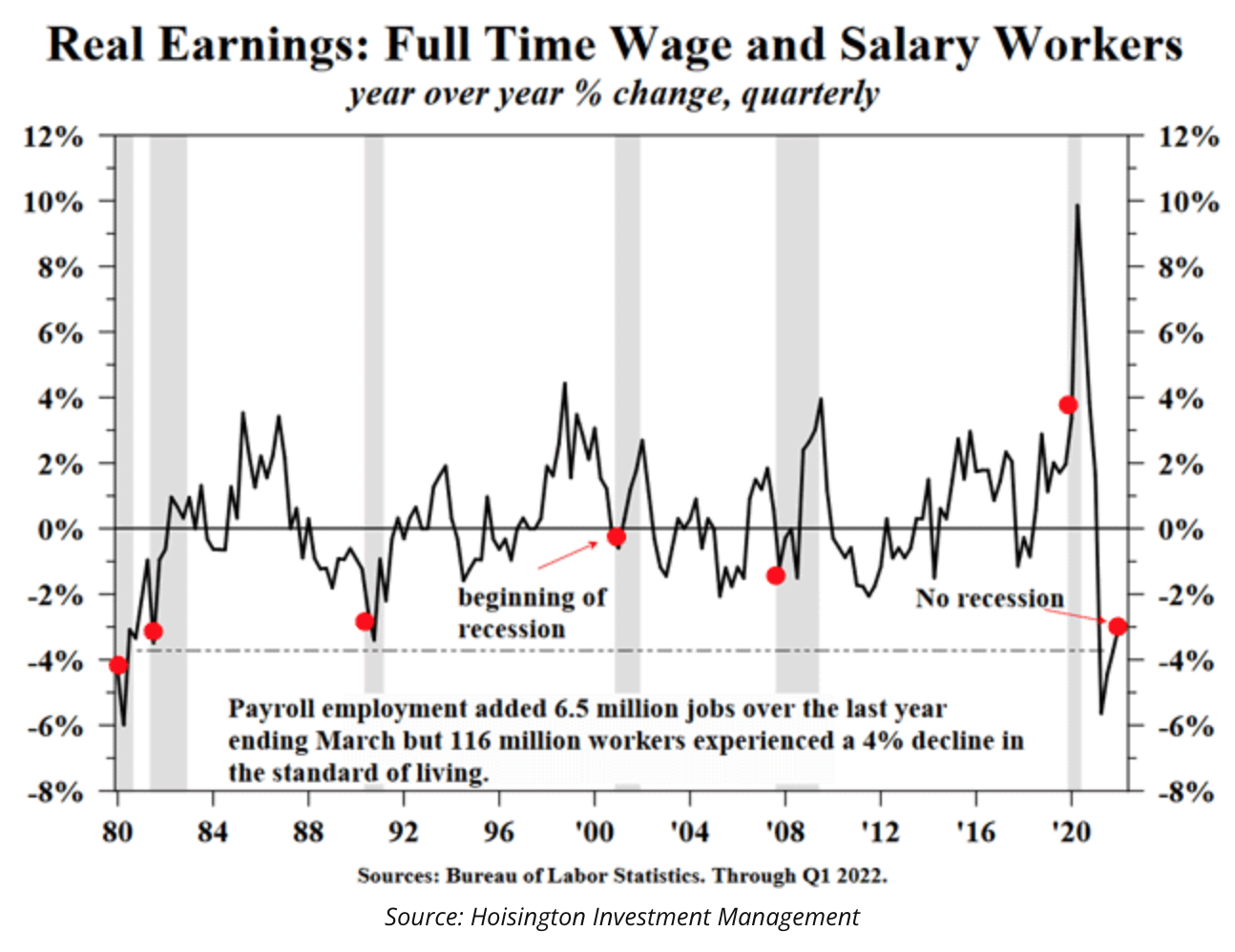

First, Lacy says inflation is hurting many more Americans than the strong job market is helping. This is important because boosting employment and wages is a key reason the Fed didn’t begin tightening sooner.

He shared this chart. The last red dot marks the most recent 12 months, during which full-time workers, on average, saw their inflation-adjusted earnings drop by 3%.

In the past, this only happened during or just before recessions. This time we are not technically in recession (though it is probably coming within a year or less). Adding up all the workers and retirees who lost real income, Lacy estimates about 116 million workers lost ground while the economy added only 6.5 million new jobs.

This is a classic cost-benefit tradeoff. Of course, it’s good that millions of previously unemployed people found work. Are there policies that could have achieved that without also robbing real income from over 100 million others? My answer would be yes, but now, we’ll never know.

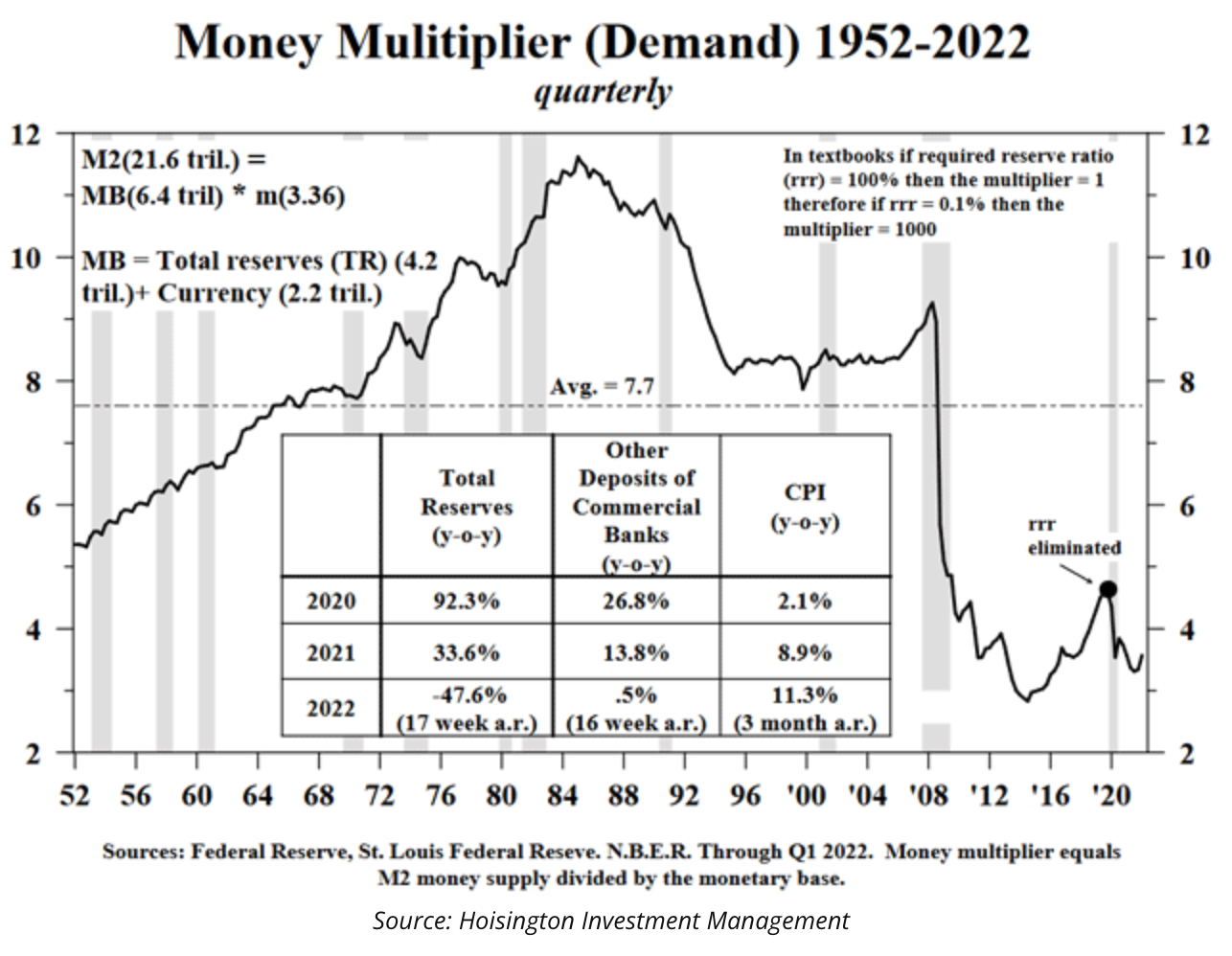

Lacy also looked at monetary policy and what it reveals about the economy. He showed this chart of the “money multiplier,” which is essentially the demand for money. It typically rises when the economy is growing as businesses make capital investments and consumers make major purchases.

You can see the multiplier plunged in the 2008 recession and the following years when GDP growth was at a crawl. It picked up a bit after 2015 but remained very low. Then it fell again after COVID. That means the economy’s fundamental demand is weak even as inflation is rising—a toxic combination.

Excess Confidence

I was thrilled to have Tom Hoenig at SIC. Over 20 years (1991–2011) as president of the Kansas City Federal Reserve Bank, he sat on the Fed’s policy committee and saw the decisions happen. And he wasn’t thrilled with some of them.

Most of this was during the Alan Greenspan era. The initial mistakes seemed innocent. The Fed became more accommodating to markets in the Mexican peso crisis, then later with Asian and Russian debt crises. These were indeed bad situations. The Fed had to respond, which it did, preventing the markets from imploding. Wall Street hailed Greenspan as a genius. But then bankers and investors came to think the Fed could manage its way out of any crisis. This was the genesis of the overconfidence Bill White talked about, and other central banks had it, too.

Hoenig saw early on the Fed was really just bailing out hedge funds. Later, he saw them announcing policies with open-ended, “for a considerable period” commitments. This came to be called the “Greenspan Put.”

I think we all kind of knew what was happening, but it’s still startling to hear this inside description. Fed officials knew full well their policies were creating asset inflation—higher stock and real estate valuations, etc. They thought that was fine as long as it didn’t become broader price inflation. Which it wasn’t, at least according to the Fed’s benchmarks. (Anyone trying to rent an apartment or pay for healthcare saw plenty of inflation in those years.)

This went from bad to worse in 2007 as Ben Bernanke became Fed chair. A small group—not the entire FOMC—came up with the “Bernanke Doctrine” of zero rates and large-scale asset purchases. This was well before the Bear Stearns and Lehman Brothers failures.

We all know what happened next. You can argue the Fed did what it had to, but Hoenig saw it doing far more. As he had predicted years earlier, these policies that were so easy to introduce proved very hard to end. He said so, dissenting as the lone “no” vote at several FOMC meetings. Here he is, describing what sounds like a very tough year in 2010.

“I know we still had high unemployment, but it was coming down, and yet we have to do another quantitative easing. I said, ‘That doesn’t make sense. You’re going to further inflate asset value, further make it difficult to normalize your balance sheet, further have the economy adjust from an equilibrium other than zero,’ which is very unstable almost by definition. And yet, I was clearly outvoted every time 11 to 1.

“And so that was part of the disappointment in terms of the policy that, for me, seemed pretty clear in terms of we needed to remove this excess stimulus carefully, slowly, while we had the time. But instead, it was, 'Yes, we got to go full guns because we want unemployment down to 3% overnight.’ Well, that’s wishful thinking in the best of circumstances.”

In one sense, this is water under the bridge, but it’s also important. It means Federal Reserve leaders knew what they were doing as they propped up the markets. They had a chance to change course and didn’t take it. This launched a decade of low rates and slow GDP growth but strong market performance. The Fed choked, and it led directly to the financialization and stifled competition that contribute to today’s price inflation.

Hoenig thinks there is a very real chance the Fed will soon make that same mistake again.

“Will the Fed stay the course? Will the Fed even keep rates where they are? Let’s say they’re 2% by summer and they’re taking out the $95 billion a month, and the market begins to have a real anxiety attack. Will the Fed stay the course?

“And I don’t mean keep raising rates. Would they even keep them at the same level? Would they not reverse their quantitative tightening to quantitative easing? That’s the question I think will be really important and will determine a lot for the future. I fear that they will get cold feet and back away, and if they don’t, I also am very concerned that we will have a recession.

“And, once that unemployment rate starts to rise and the market starts, will the Fed be able to stay the course? If they think they’re under a lot of pressure now, I think two months from now, it’s going to be really difficult for them, and I don’t know that they won’t back down. If you look at their past performance, their past actions of the last several months and years, actually, you would be skeptical that they would not reverse policy.”

This is my fear as well. We saw a similar situation in 2018. I was critical at the time of the Fed doing what I called a “two-variable experiment.” The Fed was tightening, markets didn’t like it, and Powell gave in. He “crawdadded,” as I called it back then. He will soon be tempted to do the same again.

I don’t have the words to explain how risky this is. As Bill White said, a behind-the-curve Fed will mean lower real interest rates. That is how inflation gets out of control and currencies crash. For that to happen in the global reserve currency and the world’s largest economy would be indescribably catastrophic.

I have that same criticism today. They should just raise rates and maybe let the mortgages roll off the balance sheet, but not both. If something breaks, what do you blame? Do you cut rates and do more QE in an attempt to fix what broke? What if you just need to do one? The way they are conducting monetary policy is far too risky in this environment. They should simply be raising rates about 50 basis points at every meeting until inflation begins dropping toward 3%. I’m just not that bothered by the balance sheet. The balance sheet got very large in the 1930s, and the Fed did nothing, and we just grew out of it. I suspect the same thing could be done today.

I’ll stop there and let you chew on the possibilities. Next week I’ll wrap this series with our SIC closing panel. We talked about the Great Reset and where it all leads.

We may be between a rock and a hard place, but we still have a path forward. There are lots of opportunities.

Dallas and the Oil Patch

For 14 years back in the day, Dallas was best known for the TV show starring Larry Hagman about the Ewing family’s oil empire. The first episode was in 1978. It clearly was not true to life, but there are indeed many oil operators in the Dallas area. I am there today talking to a few.

I have long avoided getting involved with oil because of its relentless boom-bust cycle. Now I think the ESG movement is putting such a crimp in the amount of drilling that oil and gas prices are likely to stay elevated for some time. And while one way to play that rising price is to buy oil producers on the public markets, I think I may be more interested in actually buying oil and gas in the ground. Admittedly somewhat riskier, but there are ways to hedge that. I will let you know what I find, if I find something, in the future.

Sadly, the Dallas Mavericks did not win in San Francisco Thursday night, so I will be flying back to Puerto Rico on Friday evening. But I do get to spend the evening with Shane.

Have a great weekend, and for those in the US, enjoy the Monday holiday. I got to spend a little time with Tiffani while I was in Dallas, and my youngest son Trey turned 28 on Friday. It all happened so fast.

Your trying to get a handle on the economy’s direction analyst,