by Lance Roberts, RIA

Is it still a “bear market rally?” After a big surge from the lows following the Russian invasion of Ukraine, Mike Wilson from Morgan Stanley thinks so. To wit:

“The first quarter was one of the worst on record for the collective performance of stocks and bonds, with the latter worse than the former. This makes sense given that investor concern focused more on the ‘Fire’ (inflation and the Fed) than the ‘Ice’ (growth slowdown). However, that leaves us more constructive on bonds than stocks over the near term as growth concerns take center stage – hence our doubling down on a defensive bias.

The rally was predictable from a technical perspective, but it was always a bear market rally in our view, and now we think the bear market rally is over.” – Morgan Stanley

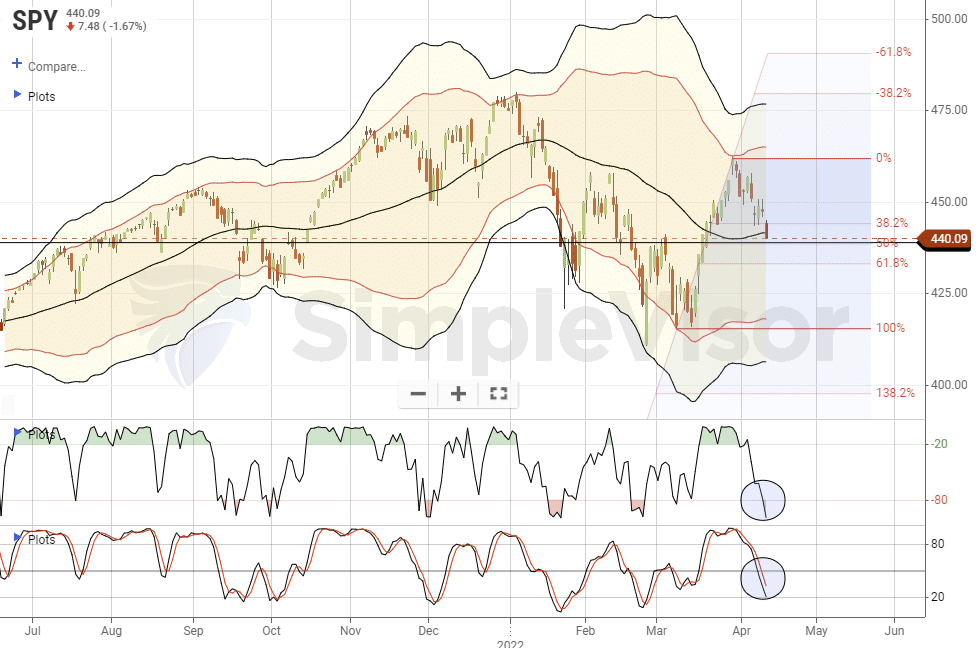

There are certainly some technical reasons to suggest the bear market rally may be complete. As shown, the market swung from a deeply oversold to an overbought condition in a very short period. Such is usually indicative of bear market rallies.

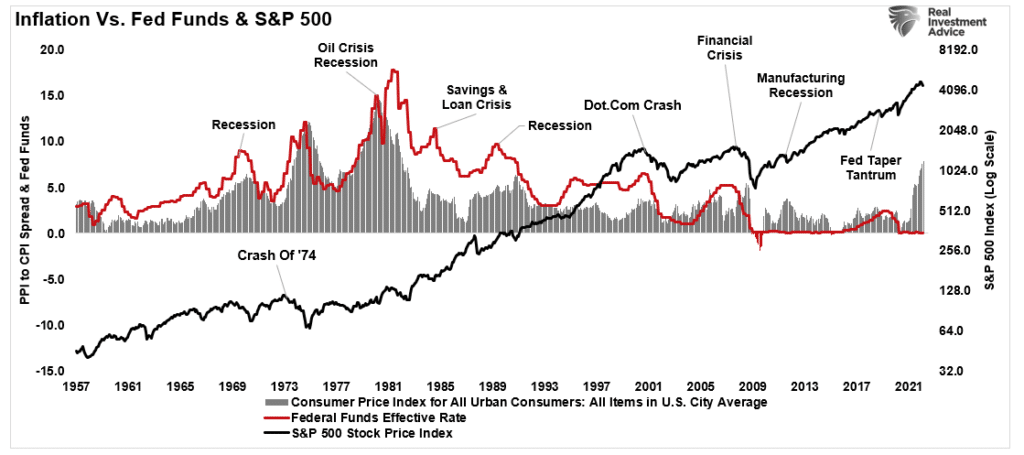

Adding to Mike’s “bearish case” is that liquidity is reversing, and the Fed is set to drastically tighten monetary policy. The latter point, when combined with already high levels of inflation, is almost certain to cause a problem.

Looking back historically, high levels of inflation combined with Fed tightening of monetary policy led to either a recession, bear market, or a crisis.

During those periods, bear market rallies were quite common. As is always the case, the market does a good job of luring investors back in at exactly the wrong time.

However, before you jump on the “sell everything and pile into cash” train, there are several signs that the bull market rally may not be done just yet.

Did Hedge Funds Go Too Far?

Just recently, Goldman Sachs presented a contrarian view of the current market. During the first couple of months of 2022, hedge funds went into liquidation mode. Per Goldman Sachs, despite the recent rally in the market, there was net selling of equities.

As we discussed in “Bear Squeeze,” the rally from the March lows had all the earmarks of a “short-squeeze.”

That short-covering appeared in the most heavily shorted names and primarily in many of the “meme” stocks that were hit the hardest with the sell-off.

However, with hedge funds now “offsides” in terms of their allocations, underweight equities, and overweight cash, that has historically been a contrarian indicator as noted by BofA.

“What we have found is that consensus Wall Street strategists are a very reliable contrarian indicator. When they are telling you to dial down your equity exposure and increase your allocation to cash, that’s actually net bullish.”

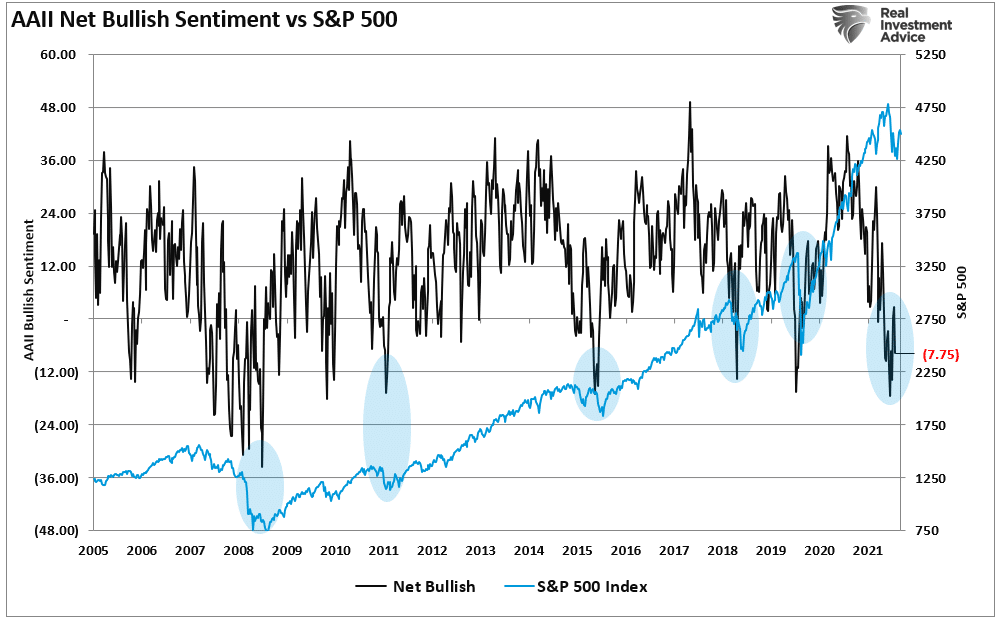

Furthermore, retail investor sentiment remains negative which is also another “contrarian signal.”

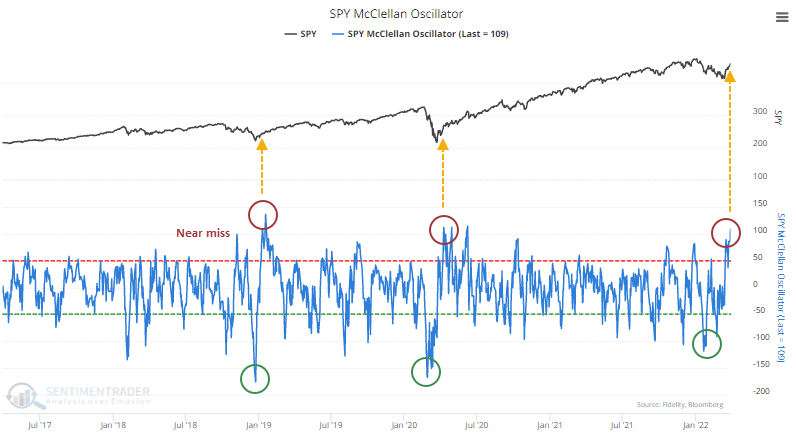

Furthermore, with sentiment and positioning negative, the recent thrust in the McClellan Oscillator adds to the contrarian argument for the bear market rally.

“This is only the 3rd time the indicator has made such an extreme round trip over the past 5 years. The other two coincided with significant bottoms.” – Sentiment Trader

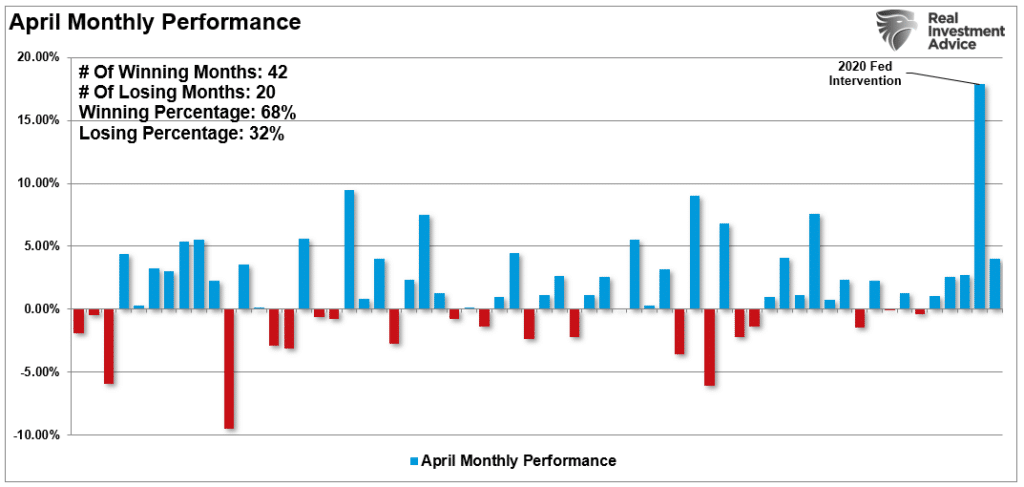

The contrarian view of Mike Wilson’s bear market rally is also countered by the month of April which has a historical tendency of positive performance.

While there are many logical factors supporting a more bearish view of the market currently, be careful getting overly bearish without a technical confirmation.

It is easy to get trapped on the wrong side of the trade.

Confirming A Bear Market Rally, Or Not.

So, is this a bear market rally, or a return to a more bullish market?

The honest answer is we don’t know, and in the short term, all we can rely on is our technical indicators to guide our risk management strategy.

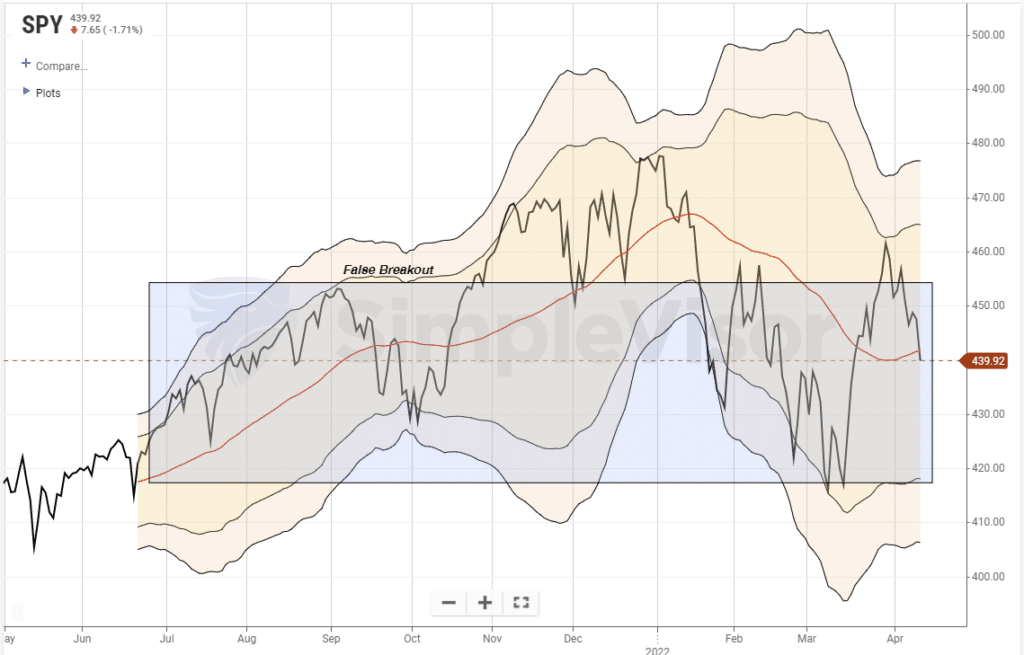

Over the last six months, the market has made very little progress after its surge from the March 2020 lows.

If you had bought into the market in early September, you are at about the same level 6-months later. However, the volatility was nauseating, to say the least.

The problem for investors currently is that the broad trading range now makes risk management very difficult. To confirm a “bear market” is resuming, we will need to break the “Russian Invasion” lows. However, to confirm a return of a “bull market,” would require a breakout to all-time highs.

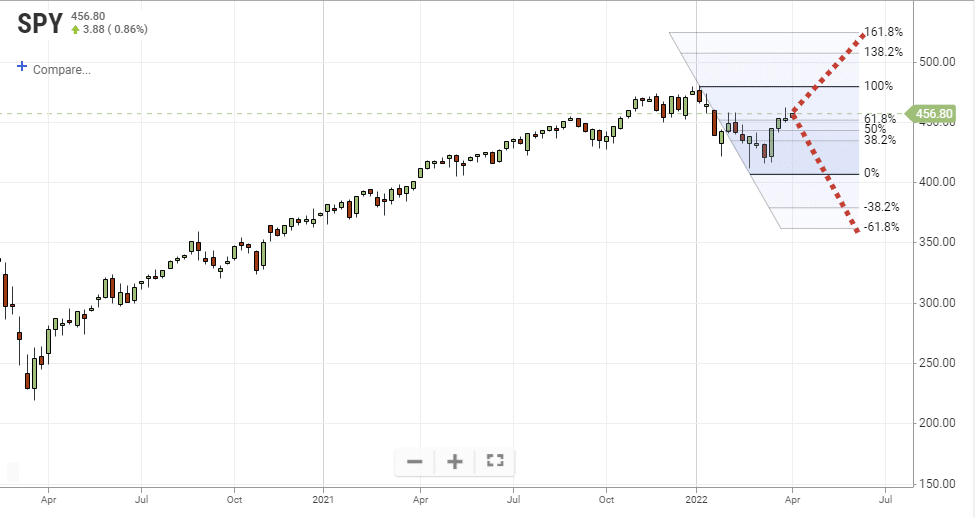

A standard Fibonacci extension can give us clues as to breakout, or breakdown, levels, and next targets.

With such a wide trading range and no clear direction for the markets, we continue to recommend following basic risk management protocols.

- Re-evaluate overall portfolio exposures.

- Raise cash as needed. (Cash is a risk-free portfolio hedge)

- Review all positions (Sell losers/trim winners)

- Look for opportunities in other markets and assets.

- Add hedges to portfolios.

- Trade opportunistically.

- Drastically tighten up stop losses.

If the bulls are right, then it is a simple process to remove hedges and reallocate back to equity risk accordingly.

However, if this is just a “bear market rally,” then a more conservative portfolio will protect capital during the decline.

Unfortunately, we will have to wait and see who is right.

Copyright © RIA