by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

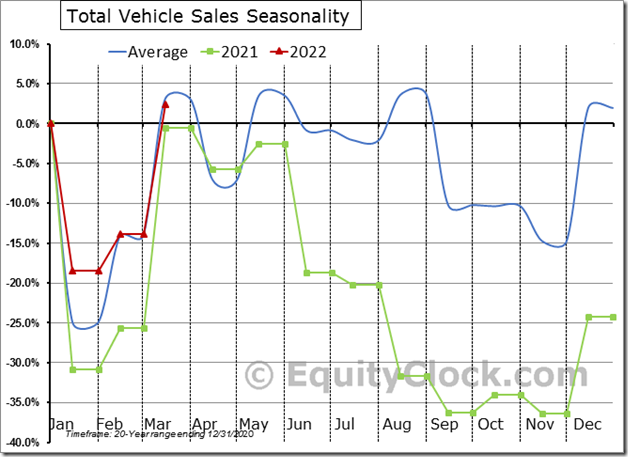

US Vehicle Sales continue to struggle compared to the seasonal average trend this year, but it does not appear to be a factor of weak demand. Vehicle sales increased by 18.9% in March, which is shy of the 20.9% increase that is average for the month. $STUDY $MACRO $CARZ $TSLA $GM $F

The 10-year US treasury yield is breaking above a massive band of resistance, now on its way to 3%, a level that the equity market is likely to take issue with. equityclock.com/2022/04/05/… $TNX $IEF $TLT $TYX

Major U.S. Bank SPDRs $KBE moved below $50.85 extending an intermediate downtrend.

Weakness by major U.S. Banks was led by Goldman Sachs $GS on a move below $318.55 extending an intermediate downtrend.

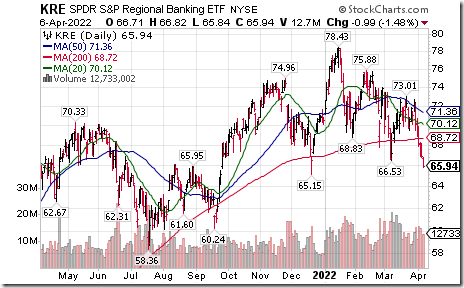

Regional Bank SPDRs $KRE moved below $66.53 extending an intermediate downtrend.

Home Depot $HD a Dow Jones Industrial Average stock moved below $297.49 extending an intermediate downtrend.

Applied Materials $AMAT a NASDAQ 100 stock moved below $118.17 extending an intermediate downtrend

Ford $F an S&P 100 stock moved below $15.51 extending an intermediate downtrend.

Qualcomm $QCOM a NASDAQ 100 stock moved below $139.05 extending an intermediate downtrend.

Simon Property $SPG an S&P 100 stock moved below $126.49 extending an intermediate downtrend.

Base metal equities and related ETFs are under technical pressure. HudBay Minerals $HBM.CA moved below Cdn$9.26 completing a double top pattern.

General Motors $GM an S&P 100 stock moved below $39.75 extending an intermediate downtrend.

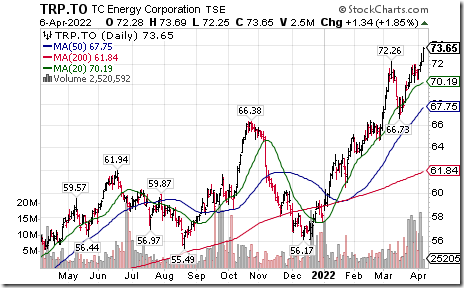

TC Energy $TRP.CA a TSX 60 stock moved above $72.26 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to August 9th . If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/transcanada-corporation-tsetrp-seasonal-chart-2

Metro $MRU.CA a TSX 60 stock moved above $72.85 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to May 21st. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/metro-inc-tsemru-seasonal-chart

Trader’s Corner

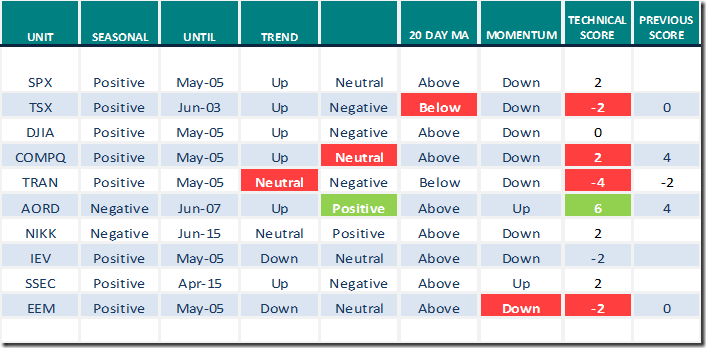

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 6th 2022

Green: Increase from previous day

Red: Decrease from previous day

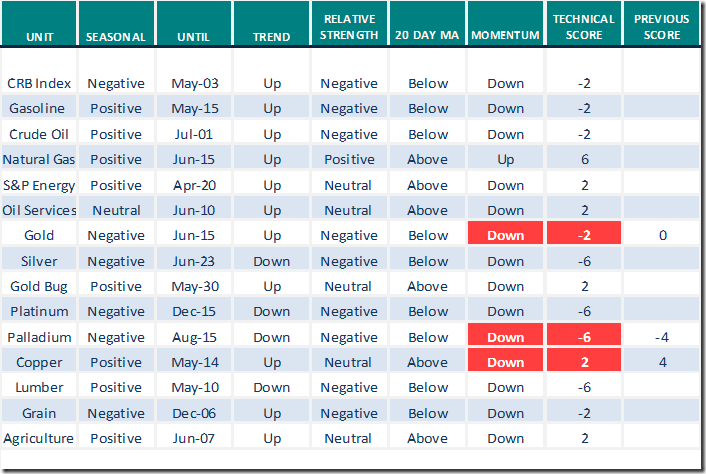

Commodities

Daily Seasonal/Technical Commodities Trends for April 6th 2022

Green: Increase from previous day

Red: Decrease from previous day

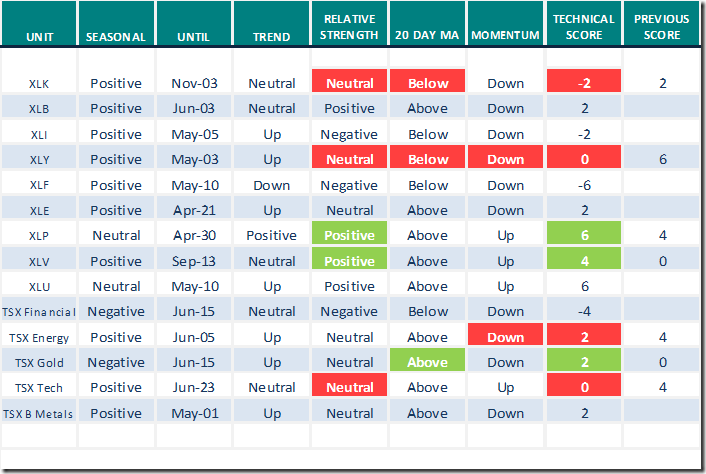

Sectors

Daily Seasonal/Technical Sector Trends for April 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from a Valued Provider

Greg Schnell discusses “A new strategy for investing”

https://www.youtube.com/watch?v=SWTqBiHZ5s0

Greg Schnell discusses “Market under pressure”.

https://www.youtube.com/watch?v=eqkdiD9pygM

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 5.01 to 56.11 yesterday. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

The long term Barometer slipped 0.20 to 49.70 yesterday. It remains Neutral. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer plunged 6.09 to 56.19 yesterday. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

The long term Barometer slipped 0.35 to 60.18 yesterday. It remains Overbought. Trend is down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.