by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

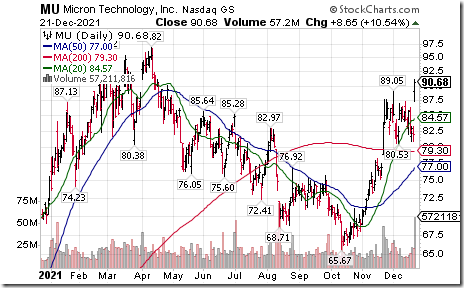

Micron $MU an S&P 100 stock moved above $89.05 extending an intermediate uptrend. The company announced higher than consensus fiscal first quarter results. Seasonal influences are favourable on a real and relative basis to late March. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/micron-technology-inc-nasdaqmu-seasonal-chart

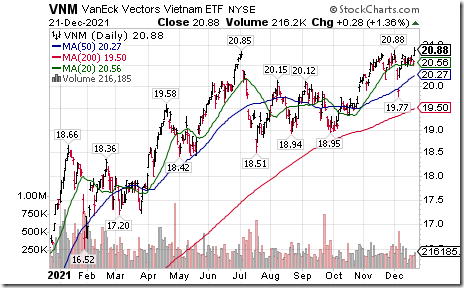

Vietnam ETF $VNM moved above $20.85 and $20.88 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to mid-February. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/vaneck-vectors-vietnam-etf-nysevnm-seasonal-chart

Soybean ETN $SOYB moved above $22.37 setting an intermediate uptrend. Seasonal influences are favourable until at least early March and frequently into June. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/soybeans-futures-s-seasonal-chart

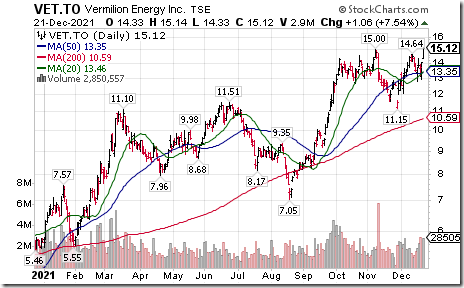

Canadian energy stocks and related ETFs $XEG.CA have recovered smartly during the past few trading days thanks to a rise in Western Canadian crude oil prices. Nice breakout by Vermillion Energy $VET.CA above $15.00 extending an intermediate uptrend. Seasonal influences for Canadian energy stocks are favourable to mid-April. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/ishares-sptsx-capped-energy-index-etf-tsexeg-seasonal-chart

Trader’s Corner

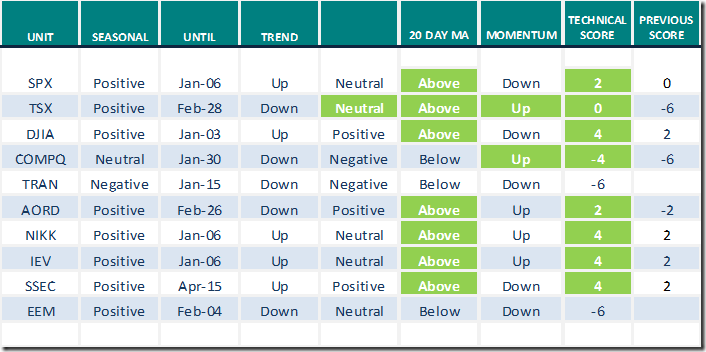

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Dec.21st 2021

Green: Increase from previous day

Red: Decrease from previous day

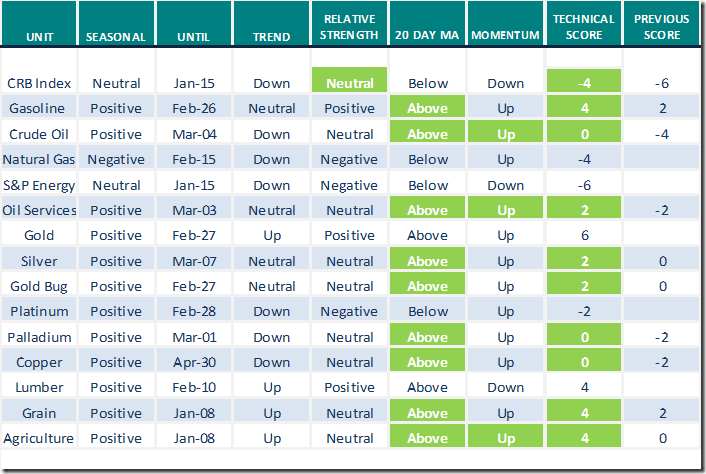

Commodities

Daily Seasonal/Technical Commodities Trends for Dec.21st 2021

Green: Increase from previous day

Red: Decrease from previous day

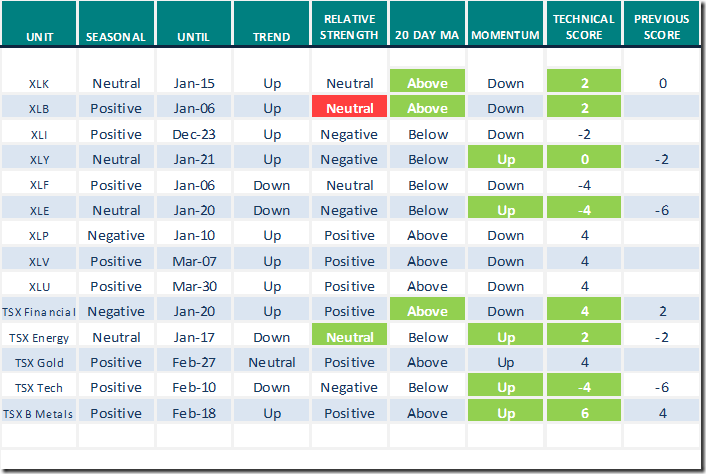

Sectors

Daily Seasonal/Technical Sector Trends for Dec.21st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

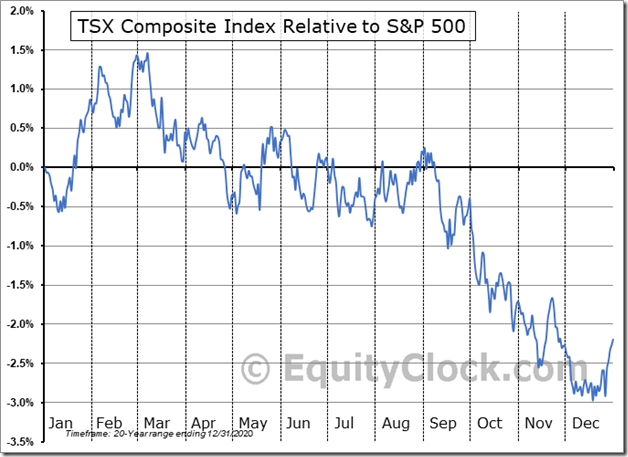

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences by the TSX Composite Index relative to the S&P 500 Index are favourable from now to the first week in March.

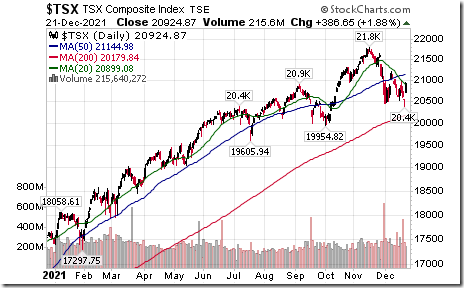

Technicals for the TSX Composite are turning favourable: The Index moved above its 20 day moving average yesterday, daily momentum indicators are recovering from oversold levels and strength relative to the S&P 500 Index turned higher last Friday.

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 14.43 to 53.51 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer gained 7.41 to 57.94 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer advanced 12.89 to 35.16 yesterday. It remains Oversold

The long term Barometer added 5.24 to 53.42 yesterday. It remains Neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.