by Don Vialoux, EquityClock.com

Technical Notes released on Wednesday at

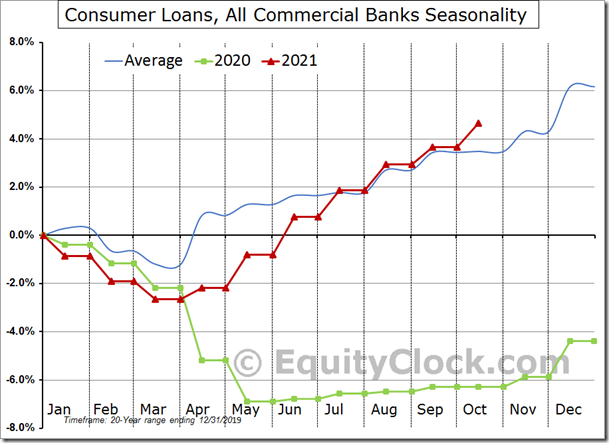

As the financial sector bounces from levels of previous resistance, now support, we are seeing encouraging data on loan growth for October. equityclock.com/2021/11/23/… $XLF $VFH $IYF $KIE $IAK $KBE $KRE

Mexico iShares $EWW moved below $46.19 completing a Head & Shoulders pattern

Electronic Arts $EA a NASDAQ 100 stock moved below $124.88 extending an intermediate downtrend.

Autodesk $ADSK a NASDAQ 100 stock moved below $271.09 setting an intermediate downtrend.

Skywork Solutions $SWKS a NASDAQ 100 stock moved below $153.99 extending an intermediate downtrend.

Okta $OKTA a NASDAQ 100 stock moved below $209.65 extending an intermediate downtrend.

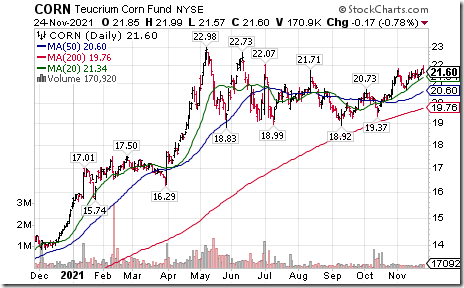

Corn ETN $CORN moved above $21.71 and $21.85 extending an intermediate uptrend. Seasonal influences turn positive in early December and peak in mid-March. If a subscriber to EquityClock, see: https://charts.equityclock.com/corn-futures-c-seasonal-chart

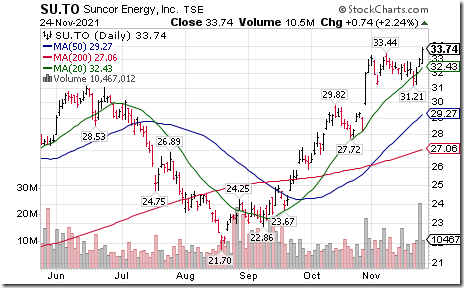

Suncor $SU.CA a TSX 60 stock moved above Cdn$33.44 extending an intermediate uptrend. Seasonal influences are favourable between now and at least early March. If a subscriber to EquityClock, see: https://charts.equityclock.com/suncor-energy-inc-tsesu-seasonal-chart

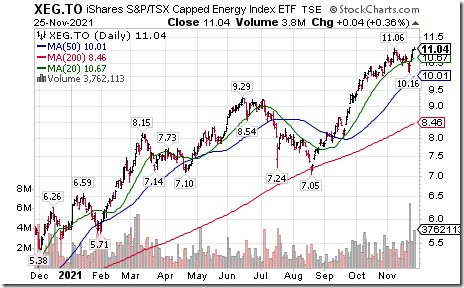

Technical Notes release yesterday at

Canadian Energy iShares $XEG.CA moved above $11.06 to a three year high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to mid-April. If a subscriber to EquityClock, see: https://charts.equityclock.com/ishares-sptsx-capped-energy-index-etf-tsexeg-seasonal-chart

Canadian Natural Resources $CNQ.CA a TSX 60 stock moved above Cdn$55.19 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to late April. If a subscriber to EquityClock, see: https://charts.equityclock.com/canadian-natural-resources-limited-tsecnq-seasonal-chart

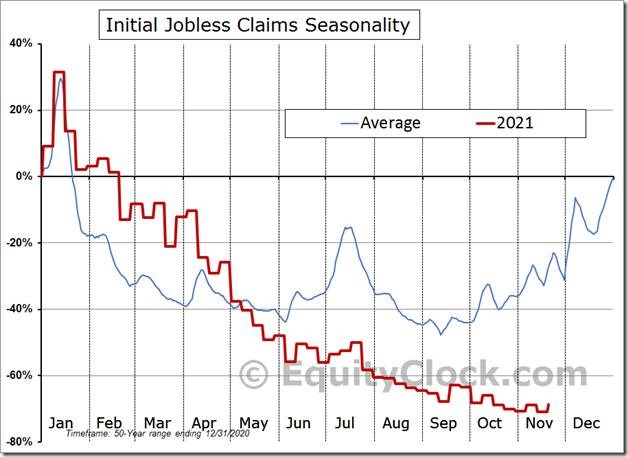

More reason to ignore seasonal adjustments: Headlines point to a sharp drop in initial jobless claims last week, sending the tally to the lowest level since 1969. Stripping out the manipulation, we are seeing the largest one week increase in claims in over a month as the year-to-date change starts to flat-line. Initial claims actually sit at 258,622, up 18,187 from the week prior. $MACRO $STUDY $ECONOMY $EMPLOYMENT

REITs starting to perk up now that their period of seasonal weakness has come to an end. equityclock.com/2021/11/24/… $IYR $XLRE $VNQ

Interfor $IFP.CA moved above Cdn$34.24 extending an intermediate uptrend. ‘Tis the season for strength in Interfor as well as other North American forest product stock. Seasonal influences are favourable between now and next April. If a subscriber to EquityClock, see

https://charts.equityclock.com/interfor-corp-tseifp-seasonal-chart

Telus $T.CA a TSX 60 stock moved above $29.68 to an all-time high extending an intermediate uptrend.

Trader’s Corner

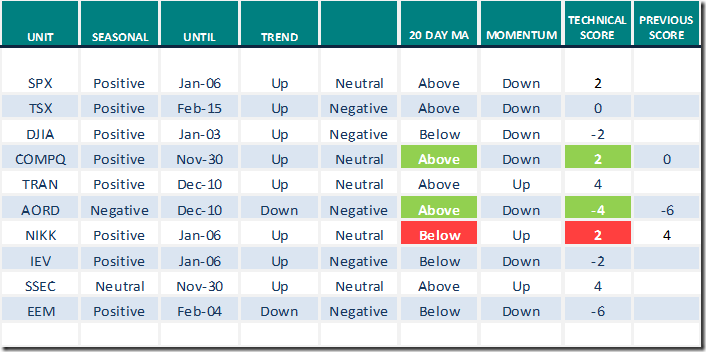

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.24th 2021

Green: Increase from previous day

Red: Decrease from previous day

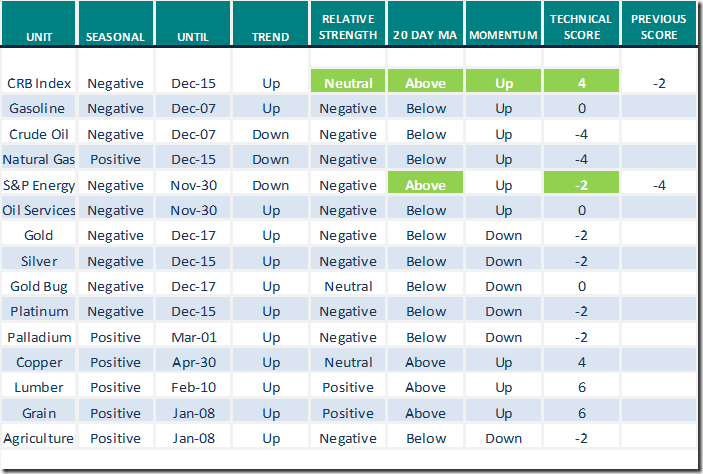

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.24th 2021

Green: Increase from previous day

Red: Decrease from previous day

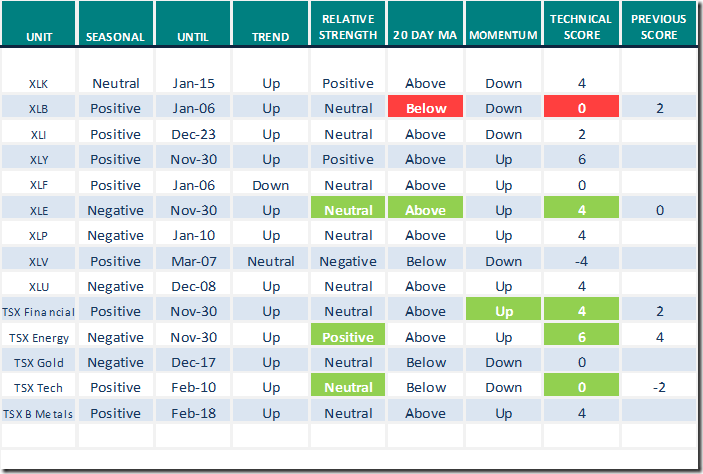

Sectors

Daily Seasonal/Technical Sector Trends for Nov.25th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Early Bird price is $199 versus regular price at $249.

Links Offered by Valued Providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following:

The rise of Chinese bonds

Uncommon Sense Investor, Author at Uncommon Sense Investor

Why China’s regime could topple quickly

Why China’s Regime Could Topple Quickly – Uncommon Sense Investor

S&P 500 Momentum Barometers

for November 24th

The intermediate term Barometer slipped 0.60 to 67.74 on Wednesday. It remains Overbought and trending down.

The long term Barometer eased 0.80 to 72.95 on Wednesday. It remains Overbought and trending down.

TSX Momentum Barometers for November 25th

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed