by Jeff Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income, Blackrock

The bonds that held market expectations and central bank policies closely together during the COVID-era are starting to break. BlackRock's quant bond experts discuss the latest developments in inflation dynamics, liquidity in the financial system, and changes in China's policy reaction.

Key Points

01) Inflation raises central bank uncertainty

Inflation looks like it will “stick” around into 2022—leaving the near-term outlook for central bank policy highly uncertain and inflation-adjusted yields on fixed income firmly negative.

02) When the liquidity spigot shuts off

Markets are witnessing an unwinding in the historic amounts of liquidity pumped into the financial system—adding risk to the prolonged period of reach-for-yield behavior.

03) A sea change in China’s policy reaction

China may be shifting its “lather, rinse, repeat” pattern of policy accommodation—creating a potential drag on global growth.

For the past two years, a set of shared assumptions between market participants and policy makers helped create a somewhat benign investment environment. Inflation would be “transitory,” allowing for a prolonged period of accommodative low rates and stable rate expectations. Ample monetary liquidity would be supplied providing a tailwind for markets to continue to climb. China would answer any domestic slowdown with stimulus, helping to keep global growth on track.

Now, these key assumptions and relationships are in question. The final destination of transitory inflation remains in flux, casting central bank policy into tightening mode in some geographies and uncertainty in the U.S. and Europe. Unprecedented amounts of liquidity are starting to slowly drain from the financial system, creating risks for market participants that have been reaching for yield. China’s reluctance to inject stimulus into its flagging economy may create waves in global growth projections.

Heading into 2022, core fixed income is already on track to post negative yearly returns for only the fourth time since 1976.1 The weakening of these key relationships is creating new challenges for an already challenged asset class.

Inflation raises central bank uncertainty

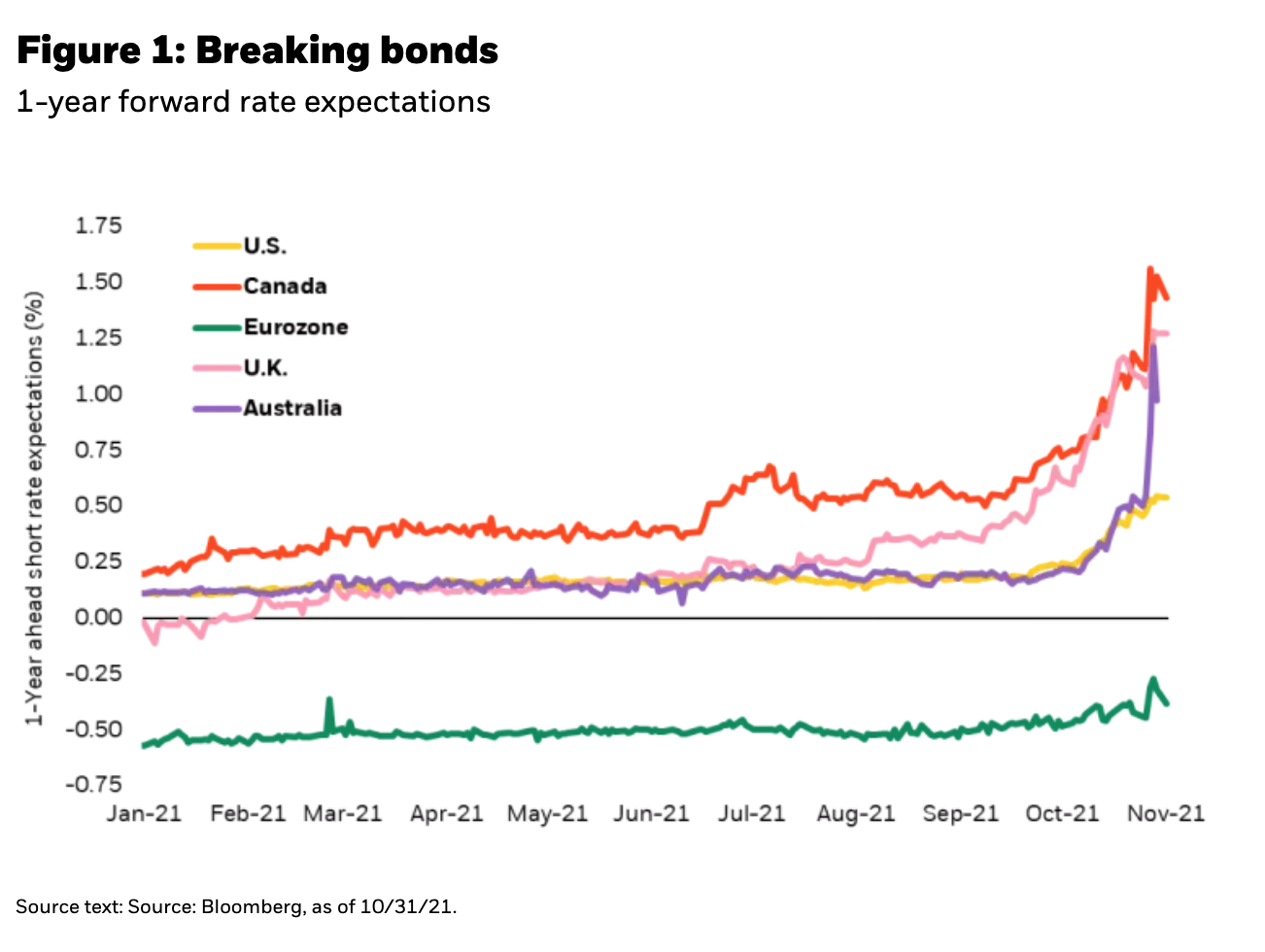

The market’s trust in a patient pace of rate normalization by central banks has been upended by increasing evidence of “sticky” inflation. A surge in front-end rate expectations reflects that many are reevaluating the thesis that inflation pressures are “transitory” (Figure 1).

Our previous commentary, Tempting FAIT, described the risk of moving from a “demand-pull” inflationary environment to a “cost-push” environment. Demand-pull inflation is typically short-lived as the supply side catches up and demand eventually normalizes. Cost-push, on the other hand, can result in more sticky inflation when high goods and services costs result in workers demanding higher wages, and with higher wages feeding back to higher input costs.

As global economies reopened in the beginning of the year, inflation reflected the combined forces of a surge in demand with a significant disruption in supply. The most recent inflation reports highlight spreading inflation pressures into key areas associated with sticky rather than transitory inflation in rent, wages, and passthrough sale price increases from higher input costs. Trimmed measures of inflation, which look at broad measures and discount outlier spikes in a single category, no longer look contained. Inflation is broadening and has surged well past 2%, leading to more concerns over a cost-push inflation cycle.

Adding pressure to this issue, the recent spike in global energy prices results in more purchasing power getting siphoned off into energy consumption. When rising inflation outstrips consumers nominal earnings growth, the real value of income falls. So, despite having seen strong consumption contribution to growth so far, a more persistent inflation that erodes the purchasing power of the consumer can undermine the outlook for real growth.

Going into the end of 2022, the outlook for prolonged energy costs may hinge on the forecast for the weather. An exceptionally cold winter in the northern hemisphere could bring natural gas prices even further beyond the stratospheric increases already seen—with knock-on effects for consumers and producers across the global economy.

Focusing on real fixed income yields

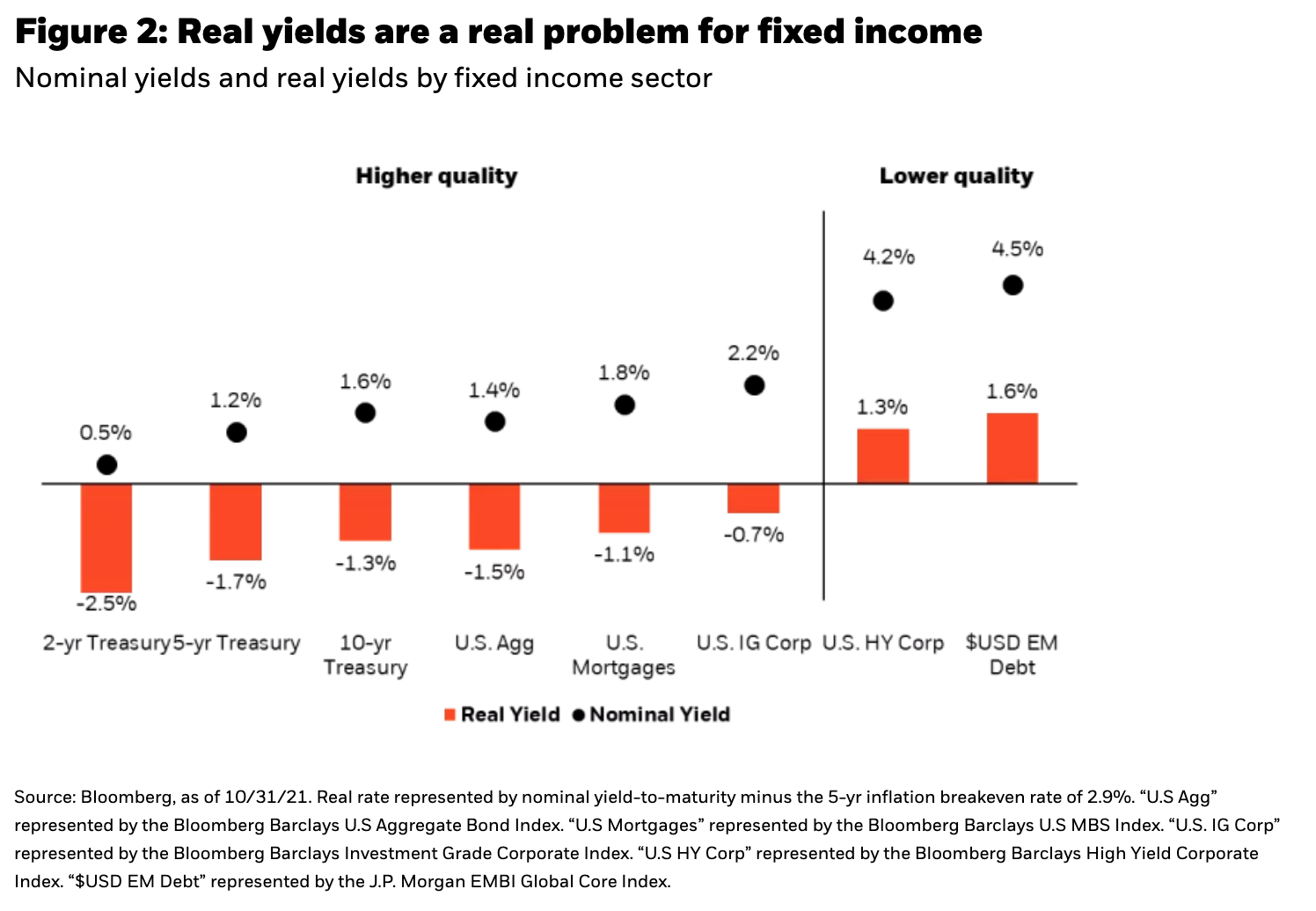

Prospects for a more durable increase in inflation is coming at a time of historically low compensation for inflation risk premia. Figure 2 outlines the after-inflation real yields of different fixed income asset classes based on the current nominal yield minus the market-implied rate of inflation over the next five years of about 2.9%.

High quality bonds such as U.S. Treasuries, mortgages, and investment grade corporates all result in strongly negative annual rates of real yield. To gain any positive real yield, investors must look at lower quality holdings such as U.S. high yield corporate bonds or dollar-denominated emerging market debt to gain low single-digit after-inflation yields. The prospect of rising inflation makes the outlook for real returns to fixed income even more challenging.

When the liquidity spigot shuts off

For financial markets, the massive global liquidity injections to support economies have been one of the major underlying drivers of returns for the past two years. The excess liquidity has lifted asset prices far and wide and arguably stands behind the surge in new types of non-traditional assets like special purpose acquisition companies (“SPACs”), cryptocurrencies, and non-fungible tokens (“NFTs”). This has also sparked a spectacular rise in more old fashioned non-financial assets like real estate and in even more niche categories like trading cards, fine art, and wine futures.

Now, however, financial markets are witnessing the beginning of an unwinding in the epic amounts of financial liquidity that was injected into the system during COVID. With this central bank and market bond now in question, let’s unpack the ramifications of an eventual draining of liquidity.

Watching the “water level” of money

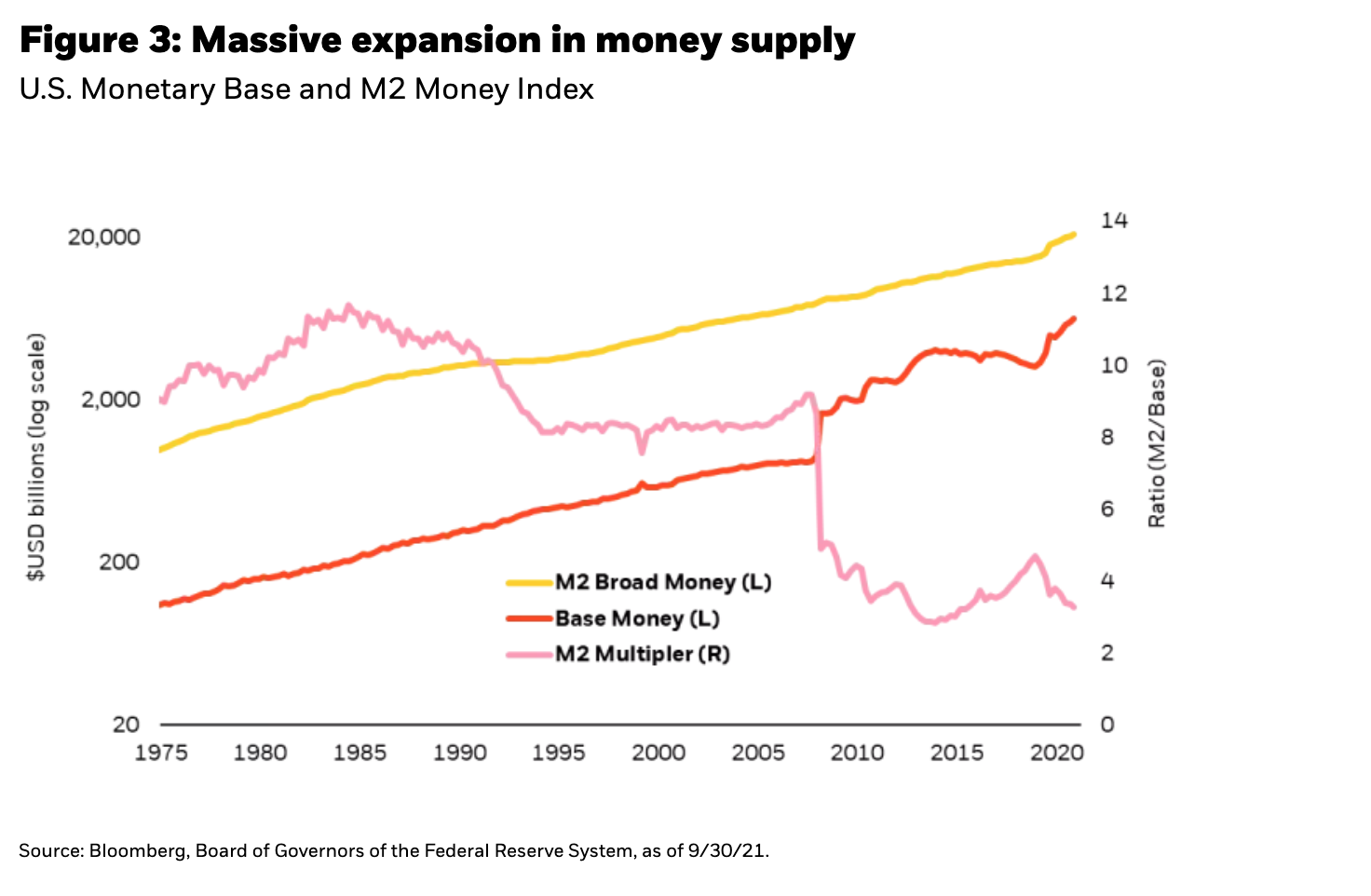

When global central banks expand the money supply to purchase government bonds, as many of the world’s central banks have been doing, it directly supports low financing costs for government borrowing. Coupled with a massive expansion in government debt issuance to fund historic expansions in fiscal policy, this central bank action helped avoid significant lasting economic damage from the COVID shutdowns and helped fuel the robust global recovery.

But where does all that money go after central banks purchase the bonds? To oversimplify, the central banks have raised the “water level” of money sloshing around in the system. This initial expansion of money in the system is called “base money,” and it can lead to an even bigger flood of money when multiplied in the financial system, measured by “broad money.”

Figure 3 highlights the enormous growth of the U.S. money supply as an example of this flood of liquidity. Post COVID, almost every central bank across developed markets (“DM”) and emerging markets (“EM”) was expanding its balance sheet, flooding the market with liquidity and supporting the fiscal authorities’ efforts to combat the COVID crisis.

This massive expansion in the base money supply by the government is not entirely new. Following the 2008-2009 Global Financial Crisis (“GFC”), central bankers similarly flooded the system with liquidity.

However, that crisis was at its heart a crisis of an over-levered and over-extended financial system. As a result, the expansion of the base money did not multiply into significant gains in broad money because the banking institutions did not have the capacity to do so (in fact, the multiplier fell post 2008).

In contrast, the financial system came into the COVID crisis healthy, due in part to regulatory reforms and a long period of economic expansion with limited credit losses. This time around the financial system was ready, and the response to massive liquidity injections of base money saw a banking system that vigorously expanded the supply of broad money.

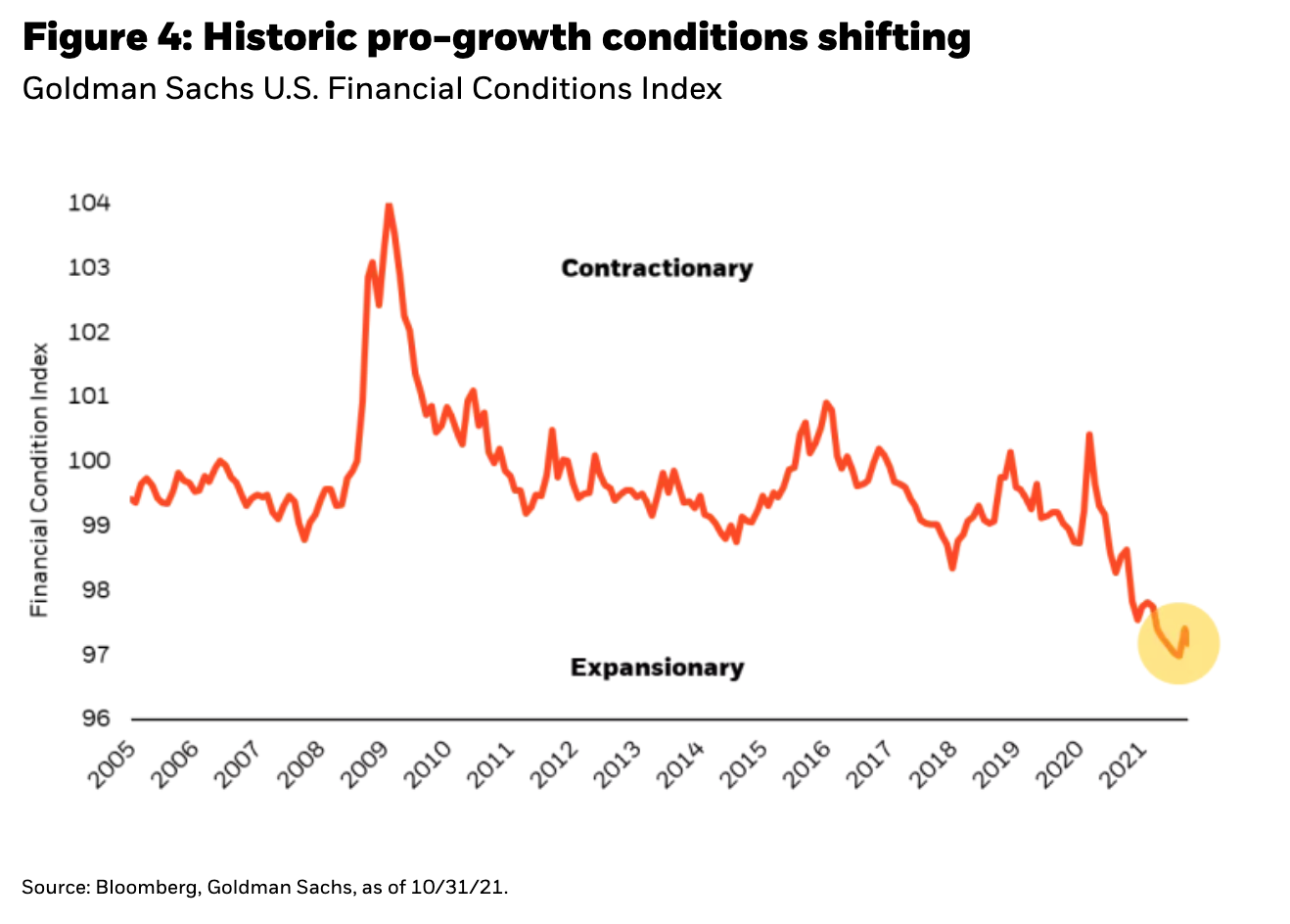

This ample supply of money led to historic pro-growth measures of financial conditions (Figure 4). But now, that process is reversing. We are seeing reductions in government deficits leading to reduced government debt issuance and central banks pulling back on COVID-era programs of quantitative easing. The net is a crosscurrent of supply vs. demand leaving an increase in interest rate uncertainty in its wake. With the water level of money no longer rising, the period of easy money—and by extension, easy returns—may be behind financial markets.

When to turn down the spigot?

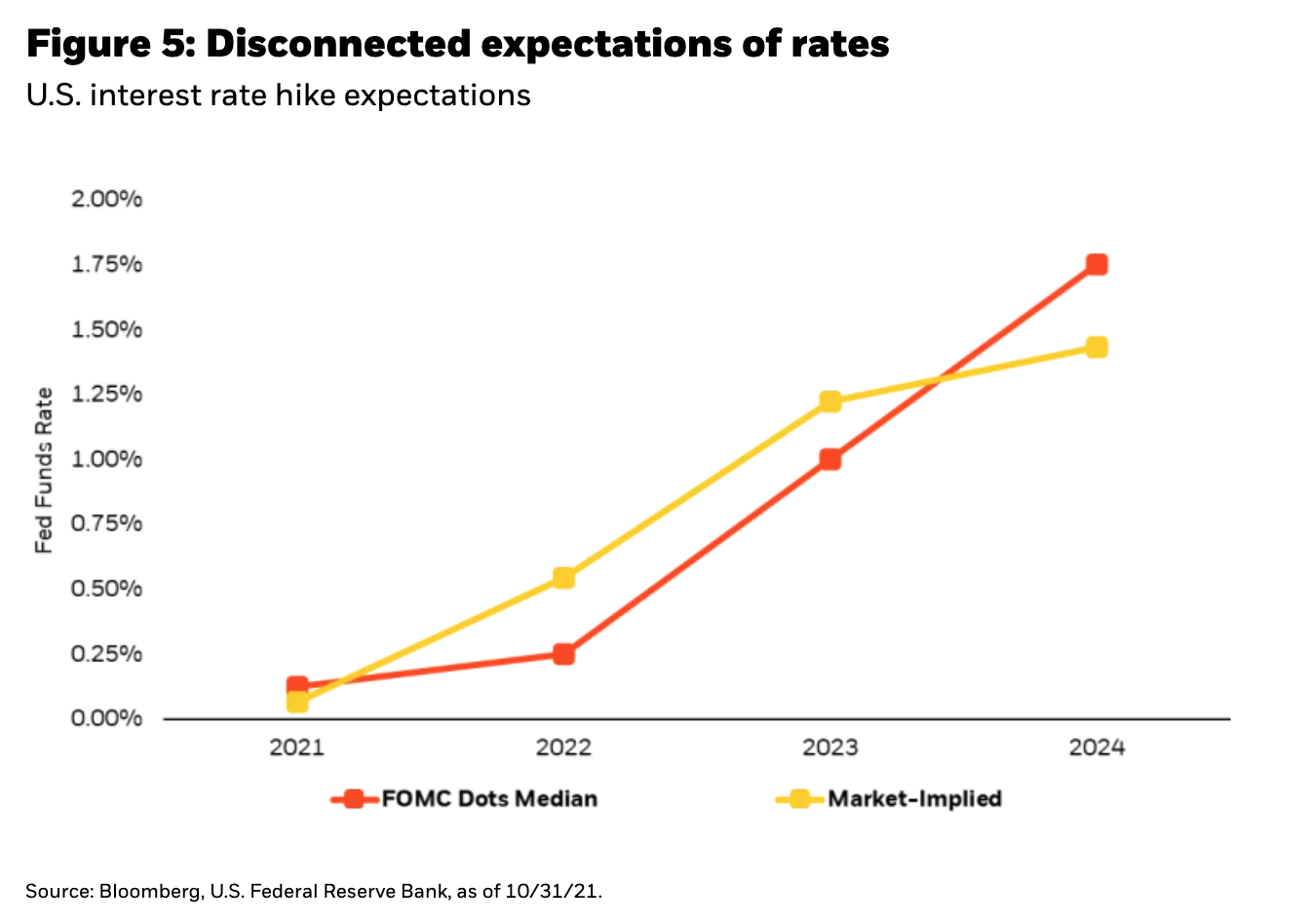

With the U.S. Federal Reserve (“Fed”) now embarking on tapering bond purchases amid rising inflation fears, markets have begun pricing a more aggressive rate hiking cycle (Figure 5). This turning down of the liquidity spigot will likely bring with it a pullback in the current levels of pro-growth financial conditions.

The rise in rate expectations by the market now implies two hikes for 2022 and both a faster and larger amount of tightening than currently indicated by FOMC policy makers in their “dot plots.” Yet the lower view of the ultimate terminal rate (as seen in 2024) suggests markets are pricing for a “policy error” of the Fed. In this instance, they see a Fed overreacting to near-term inflation concerns with rate hikes, resulting in a longer run slowdown that leads back to policy easing.

While the U.S. Fed and European Central Bank remain accommodative, other developed Central Banks with more of a singular focus on inflation are signaling a shift towards tighter policy. This reflects a more traditional focus on inflation and a recognition (or fear) that inflation increases may prove persistent.

That has led to a rapid repricing for rate expectations in global bond markets and leaving the patient approach of the U.S. and Europe as outliers. Overall, this inflation uncertainty creates policy uncertainty. And while the sudden market reaction implies that many expect the Fed to move rates up to fight inflation, the speed and pace is still an open question with clear tradeoffs on either side.

Larry Summers, Former U.S. Secretary of the Treasury, laid out the consequences of a strong policy response to inflation. Summers highlights that the current environment of a flat Phillips curve—one where significant decreases in unemployment don’t directly result in substantial increases in inflation—allows the Fed to run more accommodative policy for longer without overheating the economy.2 However, this relationship cuts both ways. Specifically, due to the same low responsiveness of inflation to unemployment, when trying to address an unexpected rise in inflation, very significant increases in unemployment would be required to rein in inflation.

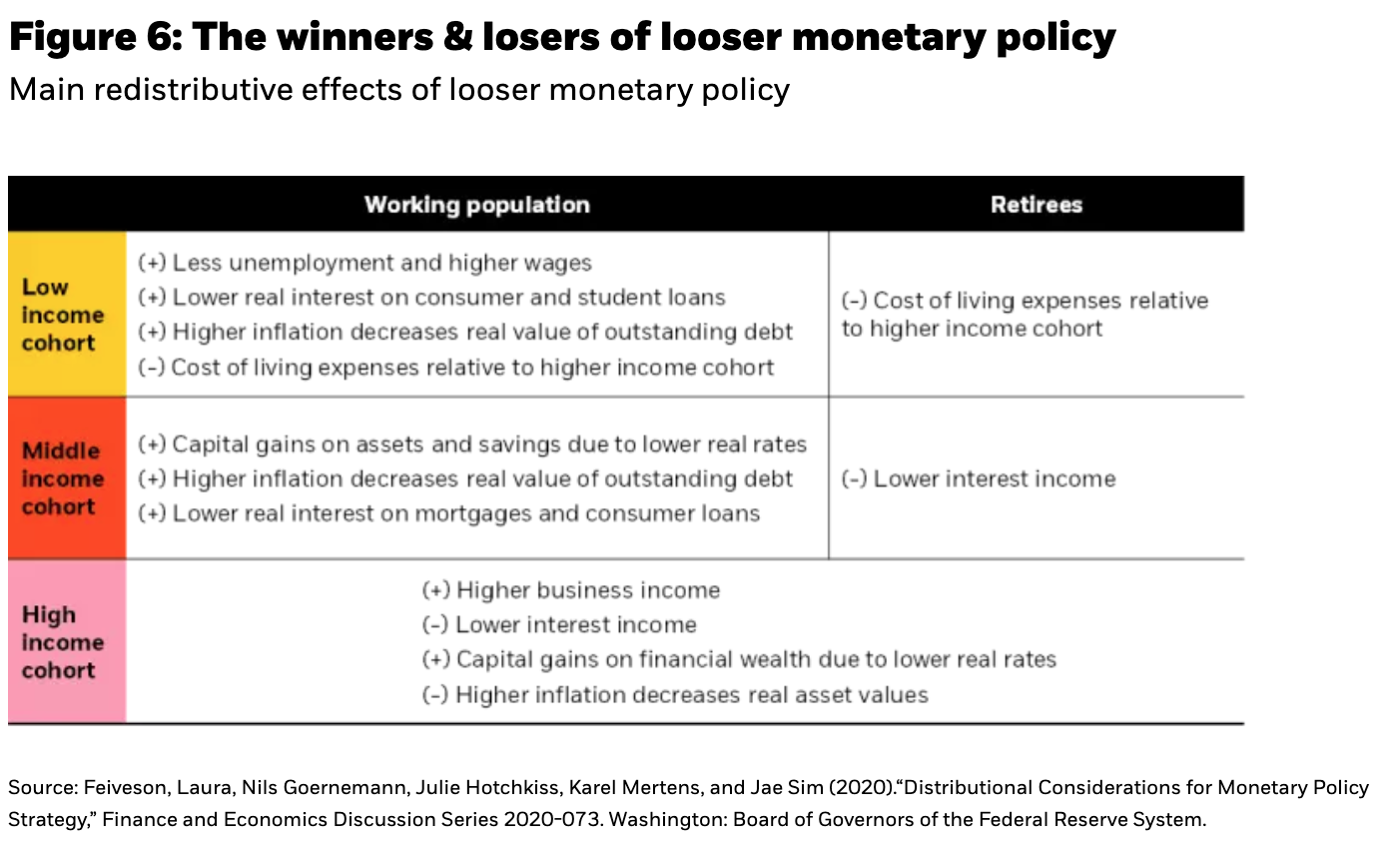

But such a tradeoff may not be palatable in today’s political and policy environment. That stands as an argument on the side of the Fed not moving rates up faster in 2022. Indeed, for the Fed, the policy choices may even favor running higher levels of inflation for its distributional benefits. Figure 6 highlights the main summary of distributional “winners and losers” from a recent Federal Reserve Board paper. In sum, looser monetary policy favors borrowers and lower income working populations at the expense of retirees (with offsetting factors to high income populations).

Adding uncertainty to the equation is a potential sizeable shift in the leadership of the Fed with appointments for the Chair, Vice Chair, two Board seats, and two regional bank Presidents all coming up for reappointment. These future policy makers will decide between the costs and benefits of tightening while also taking into consideration the expectations baked into bond markets.

Risks of leaving the spigot on too long

While the Fed is belatedly turning towards slowing the spigot of liquidity, the issue of excesses of liquidity and its consequences remains a concern for the market. In credit markets we see the end product of too much liquidity with the erosion of lending standards leading to future default risks. Yet, the very presence of excess liquidity helps to mask these risks as the rolling over of debts with new debt ensures continued payment. In our often-repeated favorite characterization of bond market behavior, a rolling loan gathers no loss.

Furthermore, the abundance of central bank liquidity is contributing to the protracted low yield and low credit risk premia environment. Investors have responded by increasing allocations to higher risk, higher yielding assets in areas like high yield corporate bonds and EM debt. Looking at the Bloomberg Barclays Multiverse Index as a proxy for the entire $71 trillion investable global bond market today, we see a “4-and-4 environment” with less than 4% of bonds yielding more than 4%. Ten years ago, the share of bonds yielding more than 4% was 17.7% and just five years ago it was 7.5%.3

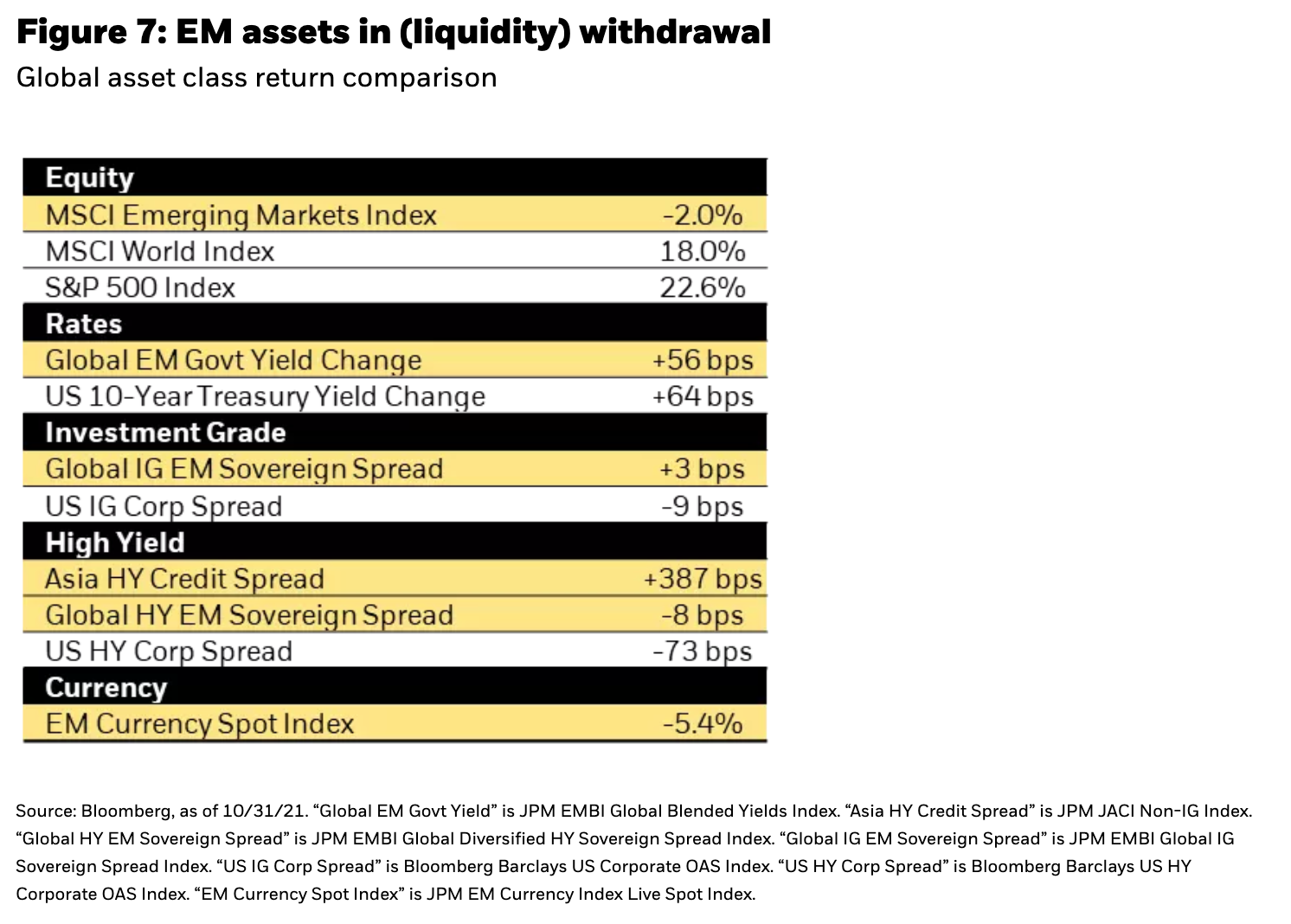

This reach-for-yield behavior can backfire when liquidity is withdrawn. While most DM assets in 2021 continue to benefit from strong liquidity-fueled tailwinds, EM assets highlight the potential consequences for a reversal in that trend. In an environment where EM central banks have been tightening policy this year, returns of EM stocks, bonds, and currencies have significantly underperformed compared to their DM counterparts (Figure 7).

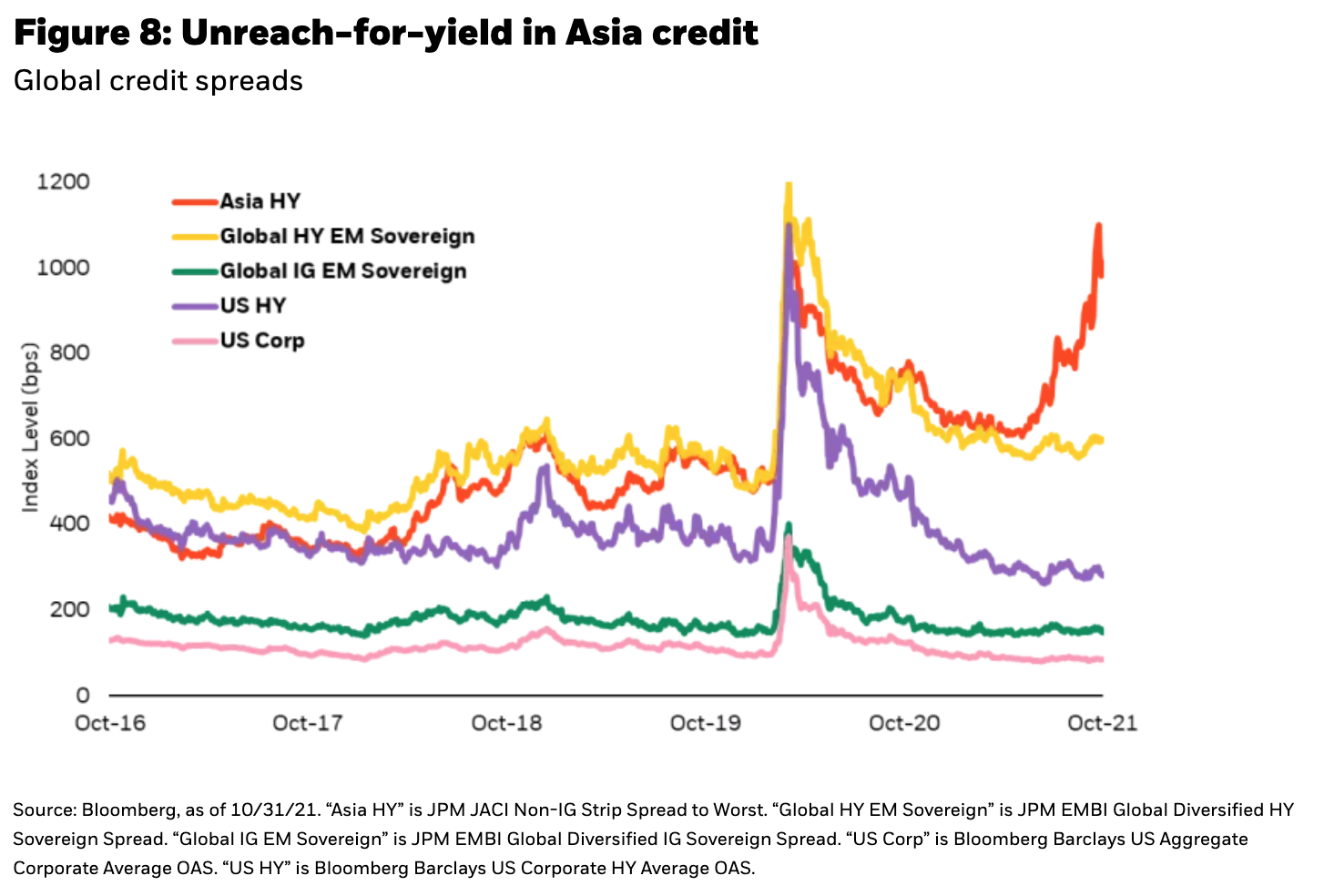

Figure 8 highlights the clear divergence in U.S. and global high yield versus non-investment grade Asian debt. A large part of that divergence reflects the ongoing default concerns in the Chinese property sector, but some of the underperformance of overall EM credit reflects the spillover effects of higher interest rates and the prospect for further tightening.

At the same time, we are seeing what we may call unreach-for-yield behavior. As risk-free rates rise, the relative value between risky and lower risk assets changes. The pursuit of risky yields appears more and more unattractive if risky asset compensation does not rise commensurately with the risk-free rate. But that repricing leads to capital losses, which can lead to a further reallocation away from risky assets.

At some point the risky asset expected returns (or loss adjusted yields) start to become competitive again with the new lower risk asset yields. Shifts in reach-for-yield behavior tend to overshoot on the way up and overshoot on the way down, adding incremental near-term volatility when risk-free rates change.

Overall, the volatility and underperformance in higher risk assets in EM may foretell the challenges for DM credit markets under more aggressive central bank tightening policy.

A sea change in China’s policy reaction

In China, we are also seeing a breakdown in market expectations and central bank policy actions. While China eased financial conditions immediately following the COVID outbreak in 2020, it was one the first countries to turn less accommodative. Most recently, they have maintained this stance even in the face of a slowdown in the property sector. That may hint at a broader shift in policy with global significance.

Lather. Rinse. Repeat.

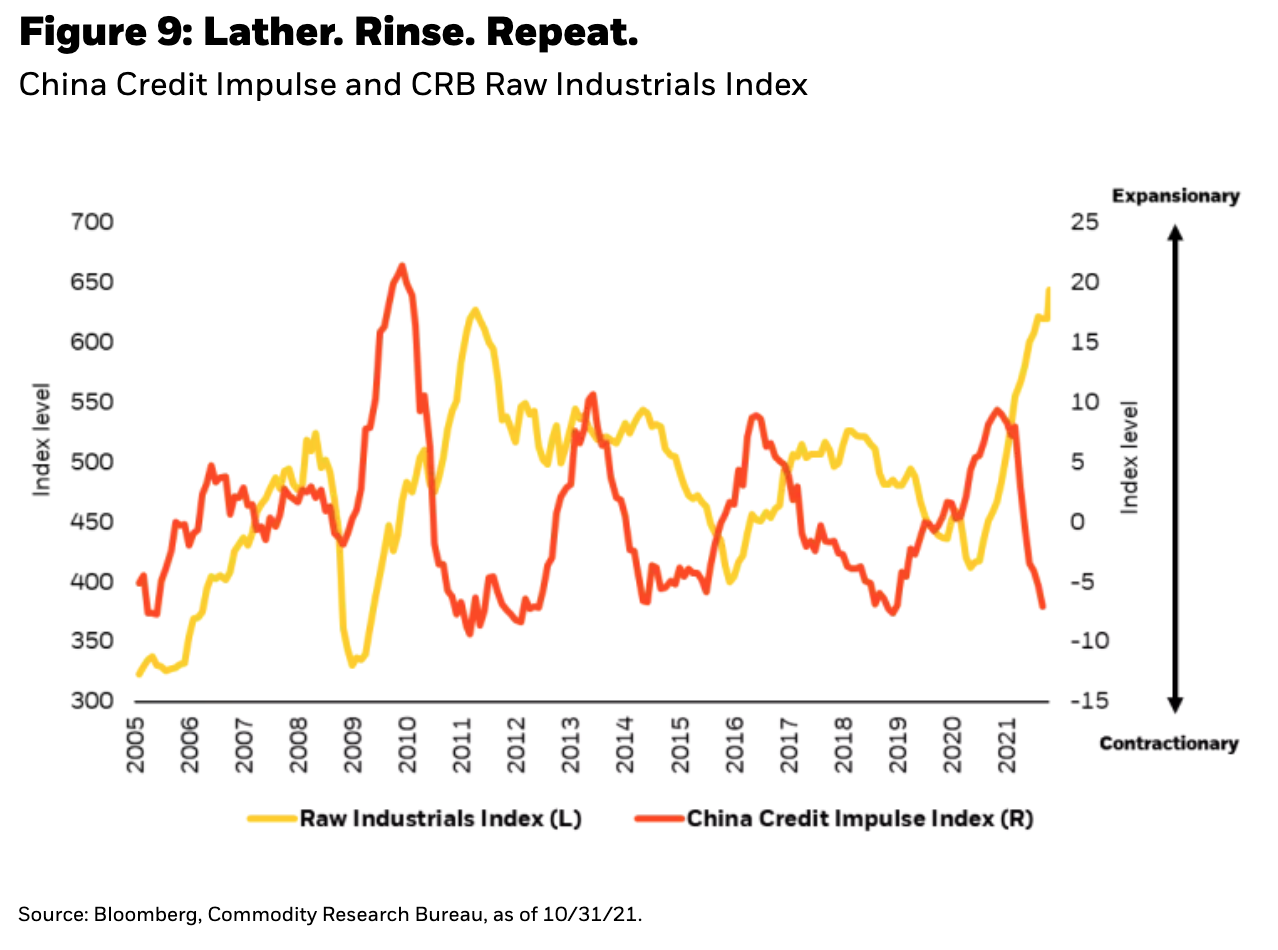

We have long characterized China’s policy to control financial conditions as a pattern of “lather, rinse, repeat.” The process begins with a large accommodative expansion of credit availability and stimulus (lather), then concerns over too much stimulus creating financial excesses lead to a pullback in the stimulus (rinse), and then concerns over the resulting slowdown in growth prompting another round of stimulus (repeat). This pattern can be observed in the China Credit Impulse Index (Figure 9). The index measures the impact of new lending growth to GDP growth, with positive readings equating to expansionary policy and negative readings equating to contractionary policy.

Given that much of the expanded credit availability that China makes available ends up being utilized in the real estate and infrastructure sectors—both of which have a large thirst for commodities—we have typically seen significant, but lagged, increases in industrial commodity prices as a consequence of periods of expanding China credit. The opposite has held true as well, with a tightening Credit Impulse resulting in less demand for commodities and falling prices. This change in the Credit Impulse has typically translated to incremental changes in global GDP growth both through the direct impact on China’s economy and its influence on other world economies.

But so far in 2021, we have not seen China begin to shift policies towards a significant loosening, even with concerning headlines emanating from the domestic property sector. The property sector has historically been extremely important to China as it has been a large driver of its top line economic growth over the past decade. Real estate and related industries account for as much as 30% of Chinese GDP. The financial strain on Evergrande marks a potentially pivotal moment for global markets. The company is one of the world’s largest real estate developers with annual revenues around $100 billion, but with over $300 billion in liabilities.

Admittedly, even though the China Credit Impulse has remained negative, we have not seen a corresponding drop in commodity prices either. In contrast, they are surging. For now, this likely reflects the impact of the economic restart and supply disruptions elevating prices, but those price surges may eventually prove temporary as demand tapers off and supply catches up—creating ripples through the global economy.

Focus on the sea change not the weekly change

The key lesson? While it’s easy to focus on the weekly change as it relates to China’s real estate saga, it’s more important to focus on the potential sea change in policy reaction. This may be the first step in China trading lower headline growth for the economy for better underlying makeup of that growth—think quality over quantity. China’s willingness to tolerate slowdown and spillovers (including defaults in real estate-related debt) may signal that a 6% growth rate may be less important than in the past. Consequently, China’s contribution to global growth in 2021 and in future years may end up less than the market currently expects.

Breaking bonds

As the bonds that held market expectations and policy makers close all year begin to crack, the outlook for fixed income is caught in the middle.

Core fixed income faces a trifecta of unforeseen challenges: inflation causing uncertain central bank policy, the start of a slow drain in liquidity from the system, and the potential for China to tolerate a significantly lower contribution to global growth.

Overcoming negative inflation-adjusted real yields in fixed income may require looking deeper and deeper into lower quality and less liquid securities. At the same time, the withdrawal of liquidity by global central banks makes that reach into higher risk and less liquid parts of the market an even riskier proposition. The next evolution of this withdrawal of support is interest rate normalization. Rising interest rates, and the timing and pace, are likely to add headwinds for bond price returns in 2022 and beyond.

Finally, the potential sea change in China’s policy reaction to future domestic slowdowns adds a wildcard element to the rate and pace of global growth coming out of the restart.

Jeffrey RosenbergSr. Portfolio Manager, Systematic Fixed IncomeJeffrey Rosenberg, CFA, Managing Director, leads active and factor investments for mutual funds, institutional portfolios and ETFs within BlackRock's Systematic Fixed ...

Jeffrey RosenbergSr. Portfolio Manager, Systematic Fixed IncomeJeffrey Rosenberg, CFA, Managing Director, leads active and factor investments for mutual funds, institutional portfolios and ETFs within BlackRock's Systematic Fixed ...

Copyright © Blackrock