by Greg Valliere, AGF Management Ltd.

THE THREAT OF A GOVERNMENT SHUTDOWN will dominate the weekend talk shows — but we think it can be avoided just before the Oct. 1 deadline. Neither party wants its fingerprints on a shutdown, so a continuing resolution (CR) is likely, keeping the government open for a few more weeks.

IN ORDER TO GET THIS DEAL, Democrats have to drop their insistence that a debt ceiling hike should be included in this CR. Passing a “clean” CR would keep the government open, but a debt ceiling crisis still looms by late October.

THESE TWO ISSUES HAVE OBSCURED the other major conflict — the infrastructure tax and spending packages, which have a chance of passage in the House next week, only to stall in the Senate, where there simply isn’t enough support for spending $3.5 trillion or more.

SO THESE ISSUES WILL fester this weekend, into early next week, as Congress kicks the can down the road until an epic battle in late fall that raises the debt ceiling, keeps the government open, passes about $1 trillion in basic infrastructure outlays, and probably approves a greatly-reduced social spending bill.

THIS WON’T BE EASY — it will be complicated, and key players in both parties will have to make compromises. We continue to believe this will look so dysfunctional that the Federal Reserve may have to wait until winter, when there’s fiscal clarity, to begin tapering its asset purchases.

* * * * *

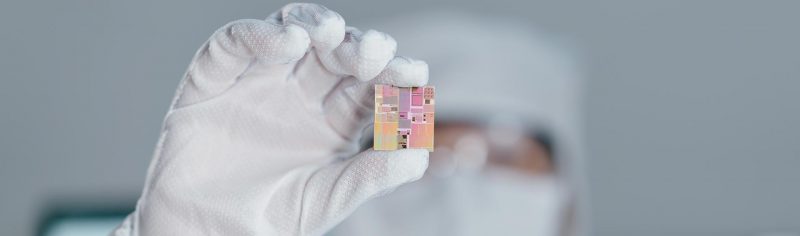

THE SEMICONDUCTOR CRISIS WORSENS: Rising Covid infections in Southeast Asia have further slowed production of semiconductor chips, causing more production delays. Auto and electronics companies are suspending production, according to a sobering article in this morning’s Washington Post.

TOP INDUSTRY OFFICIALS WENT TO THE WHITE HOUSE yesterday with this grim prediction: the chip shortage won’t improve until 2023; this will have a major impact on automakers, most of which are cutting production. Eventually there will be federal funding for chip makers, and Intel is about to announce the construction of two huge chip factories in Arizona, costing $20 billion. But this won’t make a difference for another year or two.

* * * * *

STOP THE PRESSES — BIDEN WON ARIZONA !! After insisting that he won Arizona, Donald Trump faces a repudiation today: the shadowy vote counting firm that was determined to find fraud didn’t uncover anything special. Biden won Arizona, just as he won Pennsylvania, Wisconsin, Georgia, etc.

YET TRUMP’S FANATIC BASE will cling to a narrative that the election was stolen; about 70% of all Republicans believe that Biden was not legitimately elected. One problem: there’s no credible evidence.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The views expressed in this blog are provided as a general source of information based on information available as of the date of publication and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Speculation or stated believes about future events, such as market or economic conditions, company or security performance, or other projections represent the beliefs of the author and do not necessarily represent the view of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and AGF accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Any financial projections are based on the opinions of the author and should not be considered as a forecast. The forward looking statements and opinions may be affected by changing economic circumstances and are subject to a number of uncertainties that may cause actual results to differ materially from those contemplated in the forward looking statements. The information contained in this commentary is designed to provide you with general information related to the political and economic environment in the United States. It is not intended to be comprehensive investment advice applicable to the circumstances of the individual.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is a registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

©2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.