by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

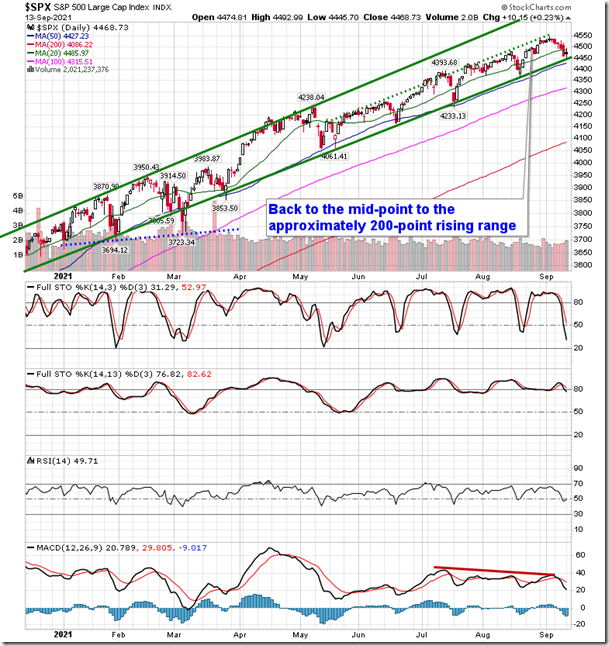

Intermediate trend of the S&P 500 Index stays alive with the positive test of rising trend line support. equityclock.com/2021/09/13/… $SPX $SPY $ES_F

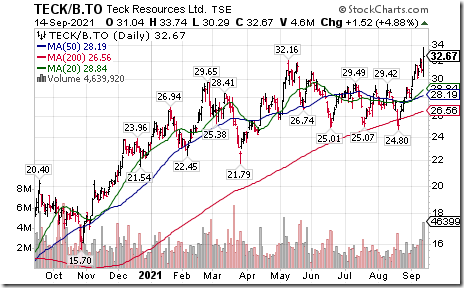

Base metal stocks are responding to higher base metal prices. Teck Resources $TCK.B.CA a TSX 60 stock moved above Cdn$42.62 to a three year high extending an intermediate uptrend.

Editor’s Note: Teck announced possible sale or spin off its coal business valued at $8 billion.

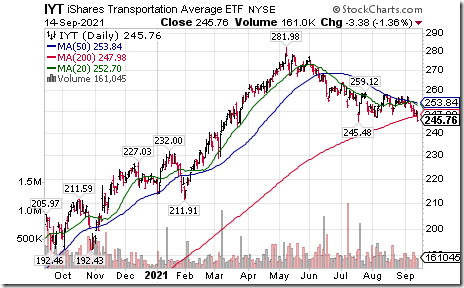

Dow Jones Transportation Average iShares $IYT moved below $245.48 extending an intermediate downtrend.

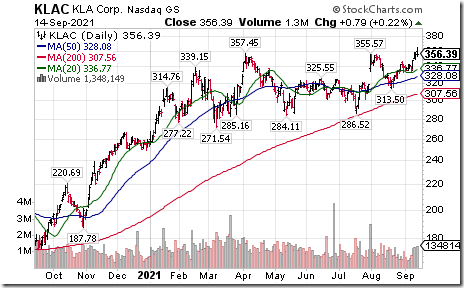

KLA Tencor $KLAC a NASDAQ 100 stock moved above $357.45 to an all-time high extending an intermediate uptrend.

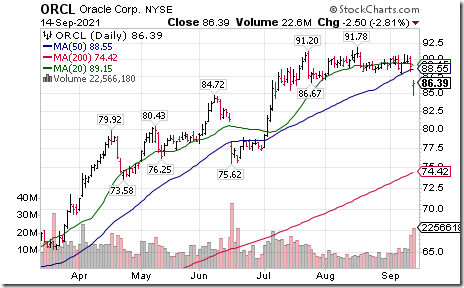

Oracle $ORCL an S&P 100 stock completed a double top pattern on a move below $86.67 after reporting lower than consensus fiscal first quarter revenues.

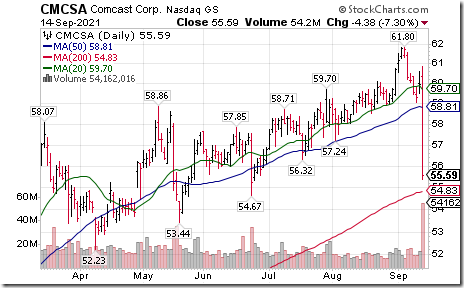

Comcast $CMCSA an S&P 100 stock moved below intermediate support at $57.24.

Sirius XM Radio $SIRI a NASDAQ 100 stock moved below $6.00 extending an intermediate downtrend.

CSX $CSX a NASDAQ 100 stock moved below $30.55 completing a double top pattern.

Other interesting charts

The CRB Index moved above 221.25 to a six year high extending an intermediate uptrend.

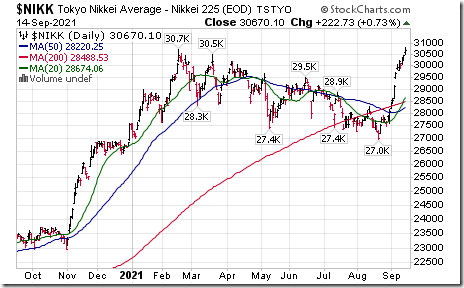

The Nikkei Average moved above 30,560.49 to at least a 20 year high extending an intermediate uptrend.

Trader’s Corner

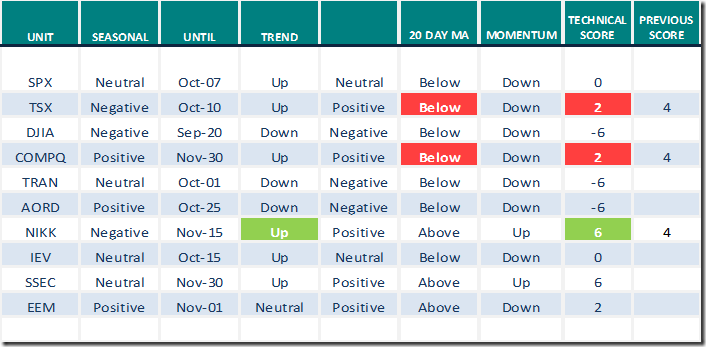

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for September 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for September 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Investor’s Digest

Tech Talk was interviewed yesterday by Investor’s Digest on the outlook for base metals prices, base metals equities and base metals ETFs. Release of the article to Investor’s Digest subscribers is scheduled on Friday.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 8.82 to 47.90 yesterday. It extended a downtrend.

The long term barometer slipped 2.81 to 73.75 yesterday. It continues to trend down.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.49 to 60.78 yesterday. It remains Overbought.

The long term Barometer slipped 1.47 to 70.59 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2021/09/clip_image0027_thumb.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2021/09/clip_image0025_thumb.png)