by Capital International Asset Management

Investors often flee the market during a decline and buy when stocks are skyrocketing. Both can have negative impacts.

You wouldn’t be human if you didn’t fear loss.

Nobel Prize-winning psychologist Daniel Kahneman demonstrated this with his loss aversion theory, showing that people feel the pain of losing money more than they enjoy gains. The natural instinct is to flee the market when it starts to plummet, just as greed prompts people to jump back in when stocks are skyrocketing. Both can have negative impacts.

But smart investing can overcome the power of emotion by focusing on relevant research, solid data and proven strategies. Here are seven principles that can help fight the urge to make emotional decisions in times of market turmoil.

1. Market declines are part of investing

Over long periods of time, stocks tend to move steadily higher, but history tells us that stock market declines are an inevitable part of investing. The good news is that corrections (defined as a 10% or more decline), bear markets (an extended 20% or more decline) and other challenging patches haven’t lasted forever.

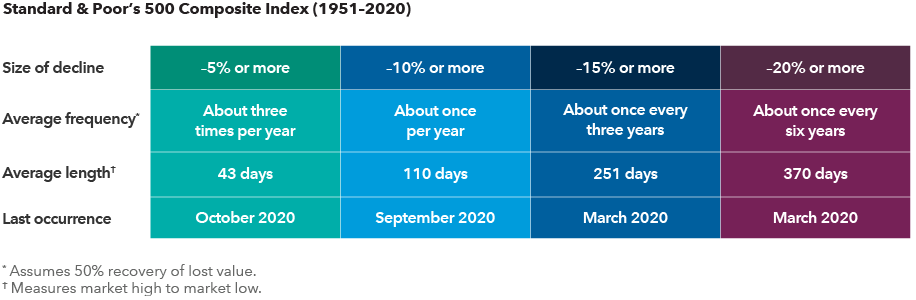

Market downturns happen frequently but don't last forever

Sources: Capital Group, Standard & Poor’s.

The Standard & Poor’s 500 Composite Index has typically dipped at least 10% about once a year, and 20% or more about every six years, according to data from 1951 to 2020. While past results are not predictive of future results, each downturn has been followed by a recovery and a new market high.

2. Time in the market matters, not market timing

No one can accurately predict short-term market moves, and investors who sit on the sidelines risk losing out on periods of meaningful price appreciation that follow downturns.

Every S&P 500 decline of 15% or more, from 1929 through 2020, has been followed by a recovery. The average return in the first year after each of these declines was 54%.

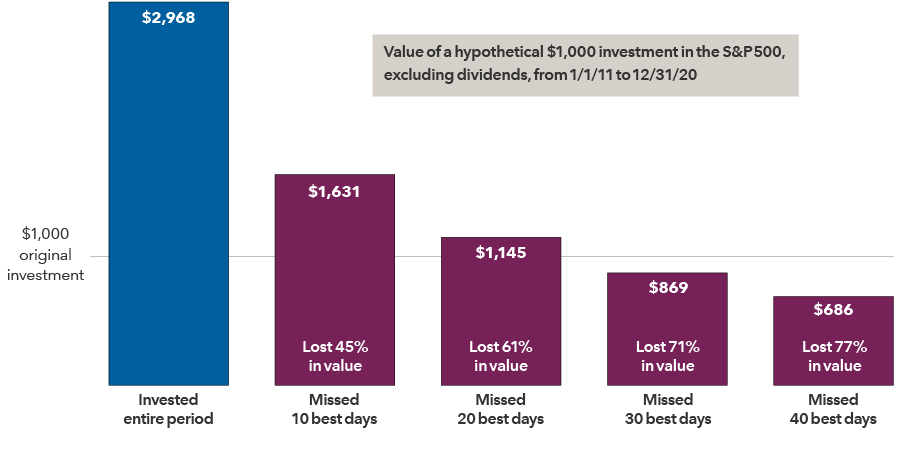

Even missing out on just a few trading days can take a toll. A hypothetical investment of US$1,000 in the S&P 500 made in 2011 would have grown to more than US$2,900 by the end of 2020. But if an investor missed just the 10 best trading days during that period, he or she would have ended up with 45% less.

Missing just a few of the market's best days can hurt investment returns

Sources: RIMES, Standard & Poor’s. As of 12/31/20. Values in USD.

3. Emotional investing can be hazardous

Kahneman won his Nobel Prize in 2002 for his work in behavioural economics, a field that investigates how individuals make financial decisions. A key finding of behavioural economists is that people often act irrationally when making such choices.

Emotional reactions to market events are perfectly normal. Investors should expect to feel nervous when markets decline, but it’s the actions taken during such periods that can mean the difference between investment success and shortfall.

One way to encourage rational investment decision-making is to understand the fundamentals of behavioural economics. Recognizing behaviours like anchoring, confirmation bias and availability bias may help investors identify potential mistakes before they make them.

4. Make a plan and stick to it

Creating and adhering to a thoughtfully constructed investment plan is another way to avoid making short-sighted investment decisions — particularly when markets move lower. The plan should take into account a number of factors, including risk tolerance and short- and long-term goals.

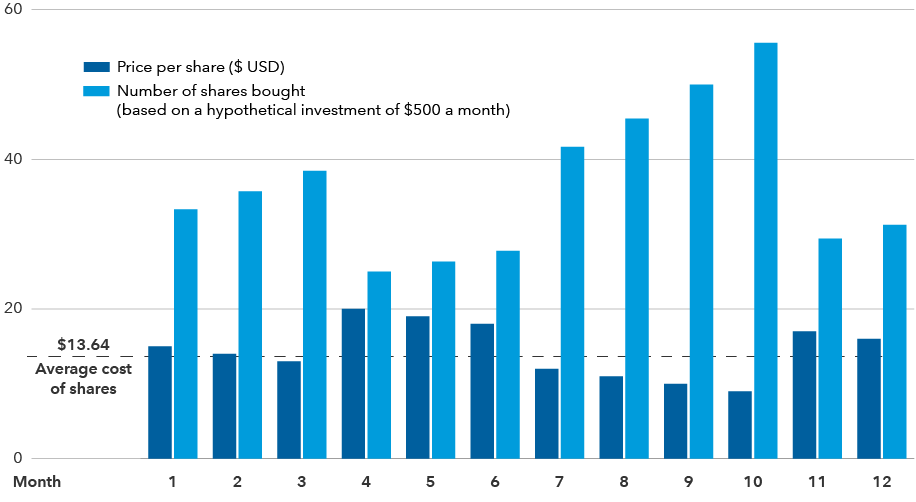

One way to avoid futile attempts to time the market is with dollar cost averaging, where a fixed amount of money is invested at regular intervals, regardless of market ups and downs. This approach creates a strategy in which more shares are purchased at lower prices and fewer shares are purchased at higher prices. Over time investors pay less, on average, per share. Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

When stock prices fall, you can get more shares for the same amount of money and lower your average cost per share

Source: Capital Group. Over the 12-month period, the total amount invested was $6,000, and the total number of shares purchased was 439.94. The average price at which the shares traded was $15, and the average cost of the shares was $13.64 ($6,000/439.94). Hypothetical results are for illustrative purposes only and in no way represent the actual results of a specific investment. Regular investing does not ensure a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Retirement plans, to which investors make automatic contributions with each paycheque, are a prime example of dollar cost averaging.

5. Diversification matters

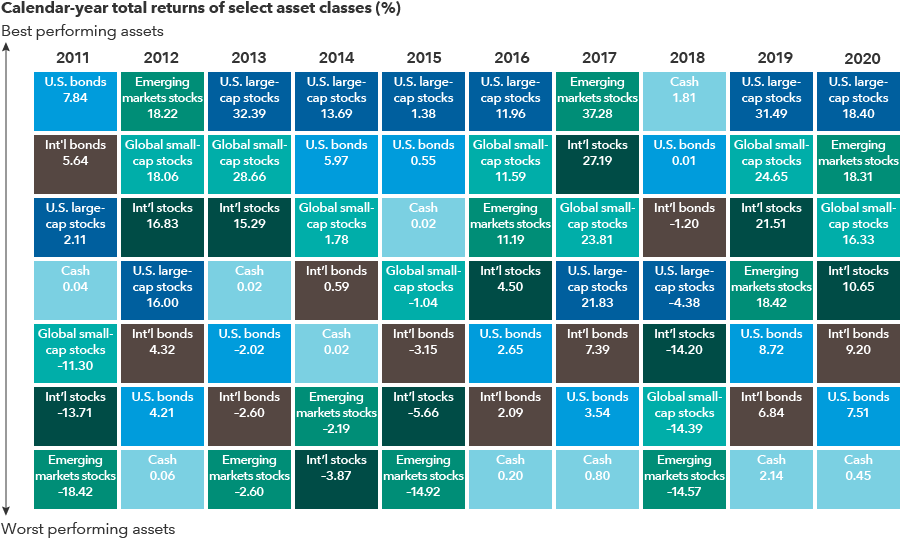

A diversified portfolio doesn’t guarantee profits or provide assurances that investments won’t decrease in value, but it does help lower risk. By spreading investments across a variety of asset classes, investors can buffer the effects of volatility on their portfolios. Overall returns won’t reach the highest highs of any single investment — but they won’t hit the lowest lows either.

For investors who want to avoid some of the stress of downturns, diversification may help lower volatility.

No asset class has consistently offered the best returns year in and year out

Source: RIMES. U.S. large-cap stocks — Standard & Poor's 500 Composite Index; Global small-cap stocks — MSCI All Country World Small Cap Index; International stocks — MSCI All Country World ex USA Index; Emerging markets stocks — MSCI Emerging Markets Index; U.S. bonds — Bloomberg Barclays U.S. Aggregate Index; International bonds — Bloomberg Barclays Global Aggregate Index; Cash — 30-day U.S. Treasury bills, as calculated by Ibbotson Associates.

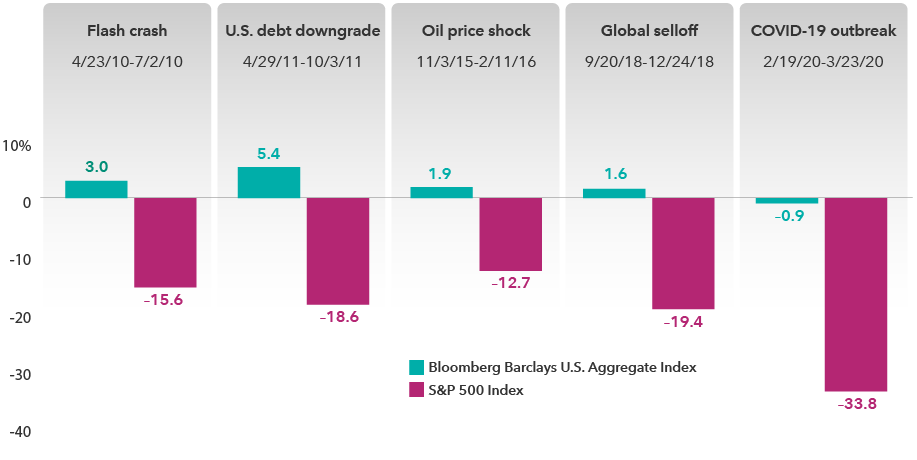

6. Fixed income can help bring balance

Stocks are important building blocks of a diversified portfolio, but bonds can provide an essential counterbalance. That’s because bonds typically have low correlation to the stock market, meaning that they have tended to zig when the stock market zagged.

High-quality bonds have shown resilence when stock markets are unsettled

Sources: Capital Group, Morningstar. Dates shown are based on price declines of 12% or more (without dividends reinvested) in the unmanaged S&P 500 with at least 50% recovery persisting for more than one business day between declines. The returns are based on total returns in USD. As of 6/30/21.

What’s more, bonds with a low equity correlation can potentially help soften the impact of stock market losses on your overall portfolio. Funds providing this diversification can help create durable portfolios, and investors should seek bond funds with strong track records of positive returns through a variety of markets.

Though bonds may not be able to match the growth potential of stocks, they have often shown resilience in past equity declines. For example, U.S. core bonds were flat or positive in five of the last six corrections.

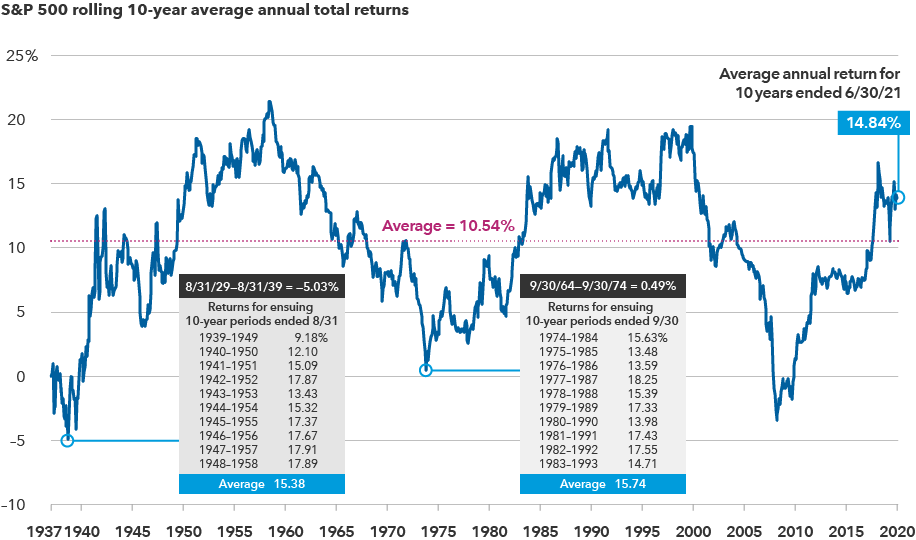

7. The market tends to reward long-term investors

Is it reasonable to expect 30% returns every year? Of course not. And if stocks have moved lower in recent weeks, you shouldn’t expect that to be the start of a long-term trend, either. Behavioural economics tells us recent events carry an outsized influence on our perceptions and decisions.

It’s always important to maintain a long-term perspective, but especially when markets are declining. Although stocks rise and fall in the short term, they’ve tended to reward investors over longer periods of time. Even including downturns, the S&P 500’s average annual return over all 10-year periods from 1937 to June 2021 was 10.54%.

S&P 500 rolling 10-year average annual total returns

Sources: Capital Group, Morningstar, Standard & Poor’s. As of 6/30/21. Returns are in USD.

It’s natural for emotions to bubble up during periods of volatility. Those investors who can tune out the news and focus on their long-term goals are better positioned to plot out a wise investment strategy.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2021. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, "Bloomberg"). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, "Barclays"), used under licence. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds and Capital International Asset Management (Canada), Inc. are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.