by Alessio De Longis, Invesco Canada

Alessio de Longis weighs in on the pause in the cyclicals/reflation theme and recent monetary policy developments following the U.S. Federal Reserve’s latest meeting.

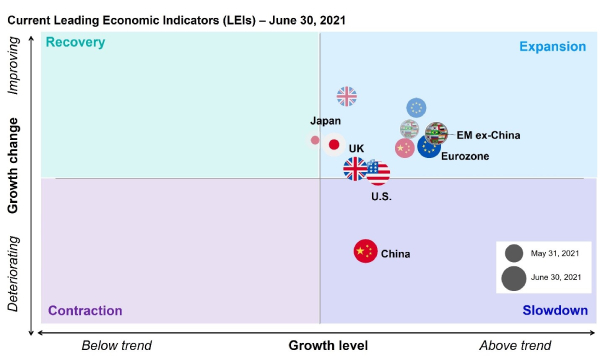

Our framework continues to suggest the economy is in expansion. Looking ahead, we assess the probability of a short-term peak in the cycle over the next few months and place it in context with recent monetary policy developments.

Macro update

Over the past month, markets experienced a pause in the cyclicals/reflation theme that drove global asset prices for the past year. Large caps and quality stocks outperformed small caps and value stocks, and cyclical sectors such as financials, materials, and industrials underperformed growth and defensive sectors like technology, communication services, and health care. The U.S. yield curve flattened by about 25 basis points (bps), commodities leveled off, and breakeven inflation expectations declined by about 15 bps in the month of June.1

While the extent of the price action is indicative of overcrowded positioning in the reflation trade, the catalyst for such reversal has valid fundamental justifications related to the hawkish tone from the last U.S. Federal Reserve (Fed) meeting, the repricing of monetary policy expectations, and the sharp decline in long-term bond yields.

With the Fed acknowledging the strength of the recovery, markets have repriced a higher probability of interest rate hikes in 2023 and 2024. However, the far more relevant and peculiar development occurred in the long end of the curve which saw U.S. 10-year and 30-year bond yields decline by about 15-20 bps in June. Such repricing is consistent with market expectations that any early withdrawal of monetary policy support, coupled with the gradual normalization of budget deficits, will quickly lead the economy back to the low-growth, low-inflation paradigm that characterized the post-GFC (global financial crisis) environment.

As policy support is gradually removed, the strength of the economy will depend on private sector demand stepping in to make up the difference. Ultimately, the low level of real interest rates is driven by global excess savings relative to consumption, and expectations for high propensity to save in the private sector. In other words, the low level of long-term bond yields is effectively implying a low trend-growth rate and low inflation environment driven by high precautionary savings.

Paradoxically, the hawkish innovation of the Fed led to lower bond yields and easier financial conditions, while at the same time meaningfully reducing “inflation fears” that characterized a growing risk scenario for asset prices over the past few months. We believe this is a good development for financial markets, likely leading to lower volatility and less dispersion in returns across asset classes.

How do these developments relate to our macro framework, and what can we expect over the next few months?

As of now our framework still points toward an expansionary regime, where growth is expected to be solidly above trend for the foreseeable future and continuing to improve in the near term (Figure 1).

However, we believe that the post-Fed repricing of medium-term growth expectations is not at odds with our macro analysis. Looking at our global leading economic indicator from a long-term perspective does suggest we are approaching levels that have historically coincided with cyclical peaks in the economy (Figure 2).

Figure 1: The expansion continues across regions, with strong momentum in the eurozone and the UK

Similarly, our measure of global market sentiment has also reached levels consistent with previous cyclical highs, increasing the probability of a peak, and a rollover, in the next few months. As the market tends to discount growth expectations six to 12 months ahead, a deceleration in global risk appetite in the next few months would be consistent with a slowdown in the economy in the second half of 2022.

We will monitor the evolution of our indicators in real time and reposition accordingly. However, over the past month we have not implemented any changes to our investment positioning, and we wait for more clear evidence of a change in the macro backdrop.

Figure 2: We may be approaching levels that have historically coincided with cyclical peaks in the economy

Investment positioning

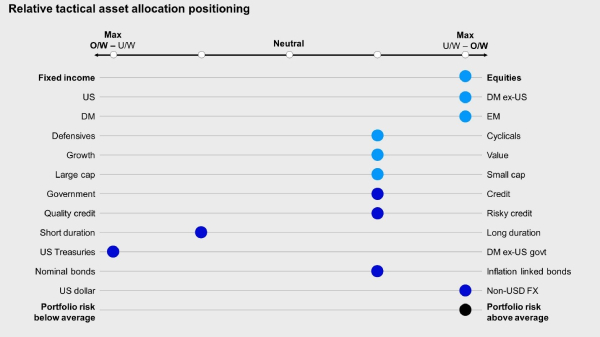

- Within equities, we favour emerging markets and developed markets outside the U.S., driven by improving global growth, rising risk appetite, and a rebound in growth momentum relative to the U.S. We remain tilted in favour of (small) size and value. In addition, we are tilted in favour of momentum which, in line with the growth-versus-value rotation, is gradually moving away from quality and mega-cap stocks toward smaller-capitalization and value segments of the market.

- In fixed income, we are overweight credit risk2 and underweight duration. We favour risky credit despite tight spreads, seeking income in a low-volatility environment. We are overweight high yield, bank loans, and emerging markets debt at the expense of investment grade credit and government bonds. We favour U.S. Treasuries over other developed government bond markets given the yield advantage.

- In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. We remain constructive on emerging markets foreign exchange given attractive valuations, an improving cycle, and a favourable backdrop for capital inflows, favouring the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Brazilian real. Within developed markets, we favour the euro, the yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar.

Figure 3: Global cycle remains in expansion regime

1 U.S. yield curve measured as the spread between 10-year and two-year bond yields. Breakeven inflation expectations measured as the spread between 10-year U.S. Treasuries and 10-year TIPS.

2 Credit risk defined as DTS (duration times spread).

This post was first published at the official blog of Invesco Canada.