by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

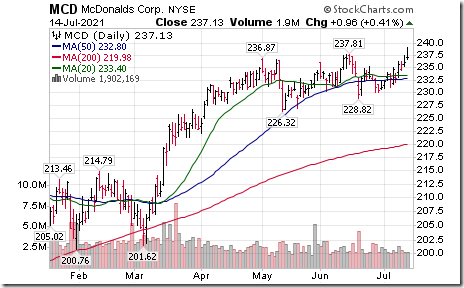

McDonalds $MCD a Dow Jones Industrial Average stock moved above $237.81 to an all-time high extending an intermediate uptrend.

Bank of America $BAC an S&P 100 stock moved below $38.49 setting an intermediate downtrend.

Bitcoin continues to struggle below resistance at its declining 50-day moving average. Find out what we think will happen next and the range that we’ll be enticed to accumulate exposure again. equityclock.com/2021/07/13/… $BTC.X $GBTC $BCH.X $BTC_F #Bitcoin

Coca Cola $KO a Dow Jones Industrial Average stock moved above $56.06 extending an intermediate uptrend.

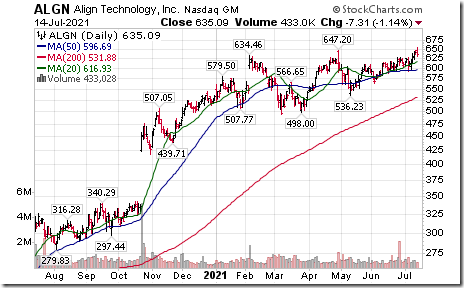

Align Technology $ALGN a NASDAQ 100 stock moved above $647.20 to an all-time high extending an intermediate uptrend.

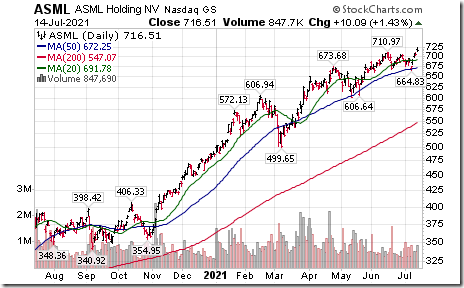

ASML Holdings $ASML a NASDAQ 100 stock moved above $710.97 to an all-time high extending an intermediate uptrend.

Qualcomm $QCOM an S&P 100 stock moved above $144.56 resuming an intermediate uptrend.

Pot stocks and related ETFs $HMMJ.CA moved sharply lower despite a proposal by Senate Democrats to legalize its use of marijuana throughout the United States. However, the proposal also included an Excise Tax that potentially could reduce producer revenue growth.

Canopy Growth $WEED.CA a TSX 60 stock moved below Cdn$26.49 extending an intermediate downtrend

Franco-Nevada $FNV.CA a TSX 60 stock moved above $188.44 extending an intermediate uptrend.

Royal Bank of Canada $RY.CA, a TSX 60 stock moved above $128.72 to an all-time high extending an intermediate uptrend.

Trader’s Corner

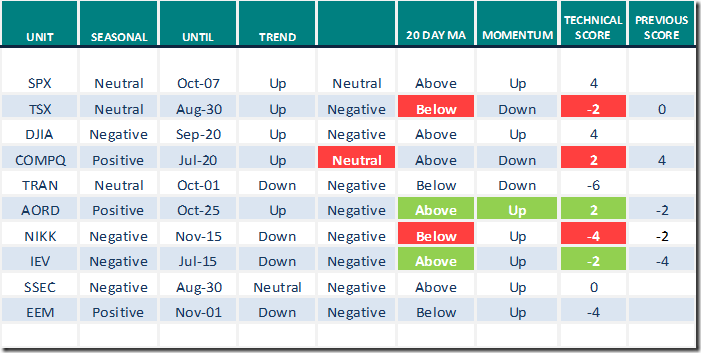

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

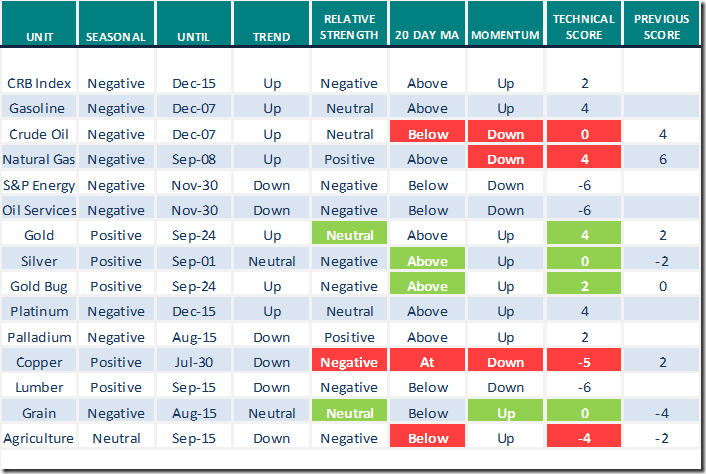

Commodities

Daily Seasonal/Technical Commodities Trends for July 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

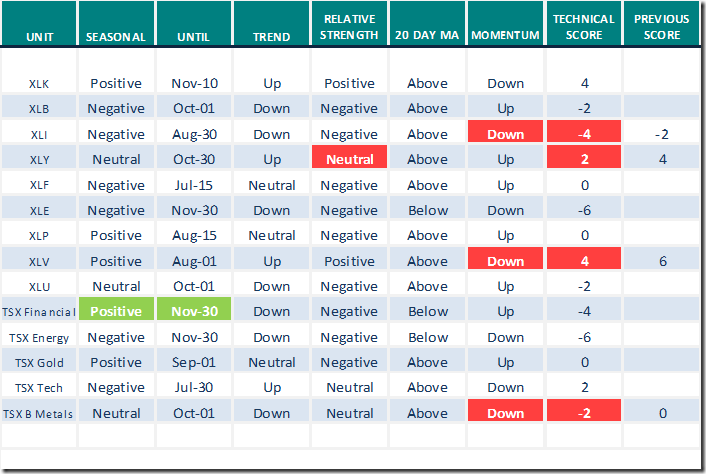

Sectors

Daily Seasonal/Technical Sector Trends for July 14th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Links to reports and videos from uncommon Sense Investor

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following reports:

Six Reasons the Bull Market Could Last Another Five Years

Six Reasons the Bull Market Could Last Another Five Years – Uncommon Sense Investor

The Direction of Stocks Remains Highly Correlated to the Direction of Earnings

(includes comments from Canaccord Genuity’s Tony Dwyer and his comments on the “Summer of Indigestion”)

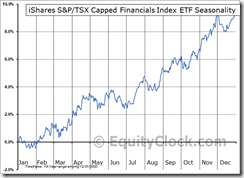

Seasonality Chart of the Day from www.EquityClock.com

Seasonal influences for Canadian Financial ETFs are favourable on a real and relative basis (relative to the S&P 500 Index) between mid-July and the end of November. Seasonality chart on the Equal Weight Canadian Banks ETF: Symbol: ZEB has a similar pattern. Note exceptional strength in Canada’s financial services in the month of July. Also note a link to a report on the Canadian banks released in Monday’s Tech Talk by www.uncommonsenseinvestor.com entitled “Banks Poised for 13% Dividend Boost When Canada Regulators Allow”. Canada’s banks currently are constrained by the Bank of Canada from increasing dividends and share buybacks until COVID 19 infection rates are under control. Similar constraints were imposed on banks in other countries including the U.S. and U.K. Ten days ago, the Federal Reserve removed constraints on major U.S. banks. On Tuesday, the U.K removed constraints on U.K based banks. A logical time for the Bank of Canada to remove constraints on Canada’s big banks is just before the release of fiscal second quarter result at the beginning of August. Strength by Royal Bank to a new all-time high yesterday shows that equity markets are starting to anticipate good news on this front. Following is a repeat link to the report released on Monday:

Banks Poised for 13% Dividend Boost When Canada Regulator Allows (yahoo.com)

S&P 500 Momentum Barometers

The intermediate term Barometer added 0.80 to 50.70. It remains Neutral.

The long term Barometer was unchanged at 90.58 yesterday. It remains Extremely Overbought.

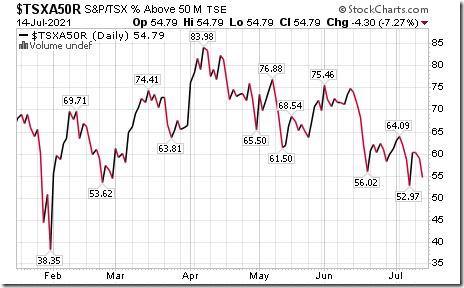

TSX Momentum Barometers

The intermediate term Barometer dropped 4.30 to 54.79 yesterday. It remains Neutral.

The long term Barometer slipped 1.02 to 75.80 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.