by Brian Levitt, Invesco Canada

ADP’s outsized U.S. jobs report for May reignited investor worries about inflation, but it reinforces Brian Levitt’s bullish outlook for stocks.

It wasn’t lost on me that Thursday’s outsized ADP U.S. jobs report supports my view that investors tend to worry too much. Wasn’t it just a month ago that investors were fretting over an astonishingly weak nonfarm U.S. payrolls report?

The narrative built from the April payrolls report was that the U.S. government’s fiscal largesse was enough to keep American workers from returning to the labour force. If there wasn’t to be enough workers to produce the goods to match the ever-growing demand, then a menacing price spiral would be upon us. Never mind that the payrolls report is notorious for undercounting workers out of a recession or that the extended unemployment benefits were to expire in early September.

Anyway, as my daughter might say, that was so one month ago. According to ADP’s report on Thursday, nearly 1 million Americans “got off the couch” in May and returned to work.1 Now, we’re being told that the U.S. job market may be too strong and that the U.S. economy could be at risk of overheating. I understand completely if you’re confused.

The U.S. economy is working through dislocations

I interpret the torrent of economic data releases as reflective of an economy that is working through severe dislocations. In my world, an economy adding 1 million jobs in May 2021 after shedding 19 million jobs in April 2020 is not cause for concern.2

Further, businesses appear to be not only looking to rehire to match the growing demand, but are also investing to rebuild inventories and improve productive capabilities, both of which should suppress inflation concerns. Capital expenditures are back to pre-pandemic levels and strong enough to be deemed “an underappreciated star performer” by one industry veteran.3

Wednesday’s Institute for Supply Management readings showed inventories rising while the regional reports even suggested some over-ordering.4 As an example, for all the hand wringing about the dearth of computer chips, the semiconductor industry is on track to spend $45 billion USD on new equipment over the next 12 months.5 In fact, they’re spending at a pace to meet demand multiple quarters from now. If inflation is caused by, as Milton Friedman says, “too much money chasing after too few goods” then let’s take solace in the business response to the economic reopening.

All of this is not to say that there won’t be inflation fears in the markets in the coming weeks. There may be. That’s to be expected in an economy that is reopening rapidly while still being challenged by the previously Draconian cuts by businesses to workforces and to inventories. That is precisely why, I, for one, am encouraged by the ADP report as well as by the other economic data releases mentioned above. As the economic dislocations recede, so too should the inflation concerns.

What’s the U.S. bond market telling us?

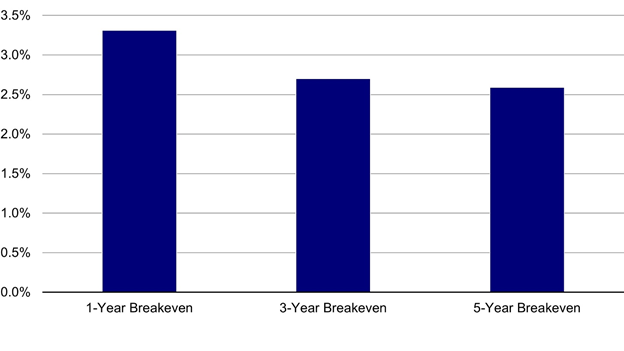

Don’t just take it from me. Take it from the bond market. Much has been made about the 1-year U.S. inflation breakeven (the difference between the nominal yield of the 1-year U.S. Treasury and the yield of the 1-year Treasury Inflation Protected Security) being at 3.3%, well above the U.S. Federal Reserve’s (Fed) perceived “comfort zone”.6 More importantly however is that the 3-year and 5-year breakevens are well below 3%, suggesting the bond market also believes that inflation pressures will be temporary.7

Inflation expectations in the U.S. bond market

Sources: U.S. Treasury, Bloomberg L.P., May 31, 2021

As an investor, I view what the bond market is telling us very favourably. It’s a picture of near-term inflation that’s likely to be supportive of corporate earnings, but not so strong over time to bring forward Fed tightening. That should be a bullish backdrop for risk assets. To me, the ADP job report does nothing to alter that view. If anything, it reaffirms it.

1 Source: Automatic Data Processing, Inc., May 31, 2021

2 Source: Automatic Data Processing, Inc., May 31, 2021

3 Source: Evercore ISI, March 31, 2021

4 Source: Institute for Supply Management, May 31, 2021

5 Source: Semiconductor Equipment and Materials International, May 31, 2021

6 Sources: U.S. Treasury, Bloomberg L.P., May 31, 2021

7 Sources: U.S. Treasury, Bloomberg, L.P., May 31, 2021

This post was first published at the official blog of Invesco Canada.