by Invesco Tax & Estate team, Invesco Canada

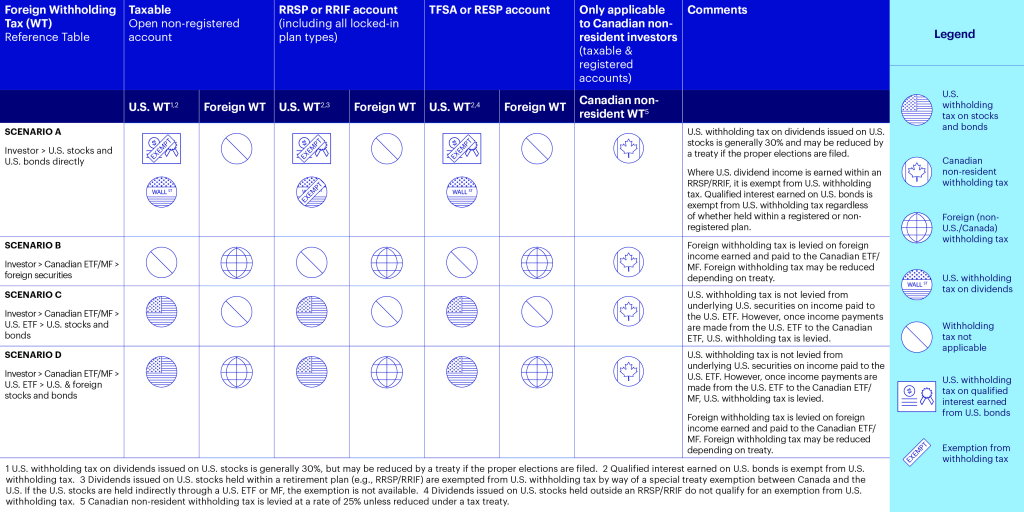

Depending on how an investor holds foreign securities, foreign withholding taxes may apply. Here is a quick reference that walks through four different scenarios.

A diversified portfolio opens opportunities for an investor while concurrently assisting in managing risk. In addition to holding different asset classes, diversification commonly means holding marketable securities in both Canadian and foreign markets. Those securities may be held directly (e.g., stocks and bonds) or through pooled structures (or funds) such as exchange-traded funds (ETFs) and mutual funds (MFs). While most Canadian investors will hold Canadian ETFs and MFs, an investor could also hold a fund resident elsewhere, with the United States being the next most likely jurisdiction. In turn, a foreign ETF or MF may invest in its own domestic securities or beyond its borders. Finally, a fund may hold another fund, and that latter fund may be Canadian or foreign-resident. For an investor to understand and report income originating from foreign sources, these potential combinations and permutations can be confusing. As well, the incidence and mechanics of foreign and domestic tax must be managed.

This InfoCardis a quick reference that shows how foreign withholding taxes may apply under each structure and how withholding tax is reconciled for Canadian tax reporting purposes. Please refer to our “Mutual Funds, ETFs and Foreign Withholding Taxes” InfoPage and accompanying InfoCard for a detailed explanation of the application of foreign withholding tax.

Let’s analyze the flow of foreign income and the incidence of foreign withholding tax through four scenarios.

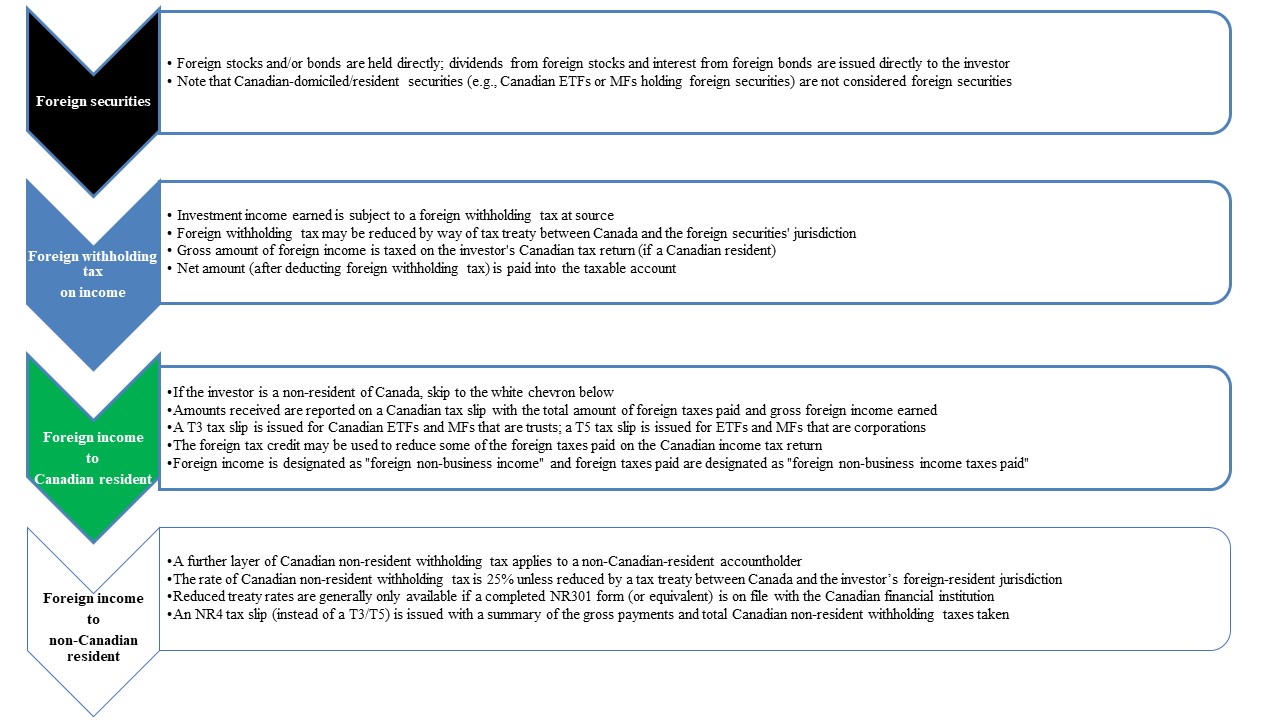

In Scenario A, a Canadian-resident individual invests directly in foreign stocks and bonds in a taxable (or non-registered) account. Investment income generated and paid to the investor from the foreign securities is first subject to foreign withholding tax. This is the first layer of withholding tax. The rate of foreign withholding tax varies and may be reduced by way of a tax treaty between Canada and the foreign jurisdiction. For direct investments in U.S. securities, the treaty may exempt the income from U.S. withholding tax, as shown in the Foreign Withholding Tax Reference Table below.

Scenario A – Taxable account – Investor holds foreign securities directly

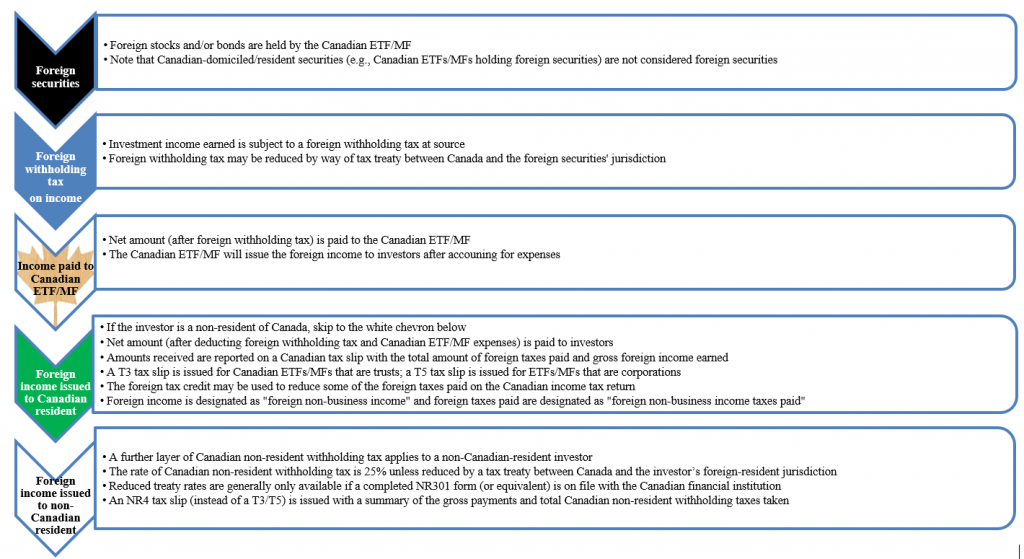

In Scenario B, the same Canadian-resident individual holds the foreign securities indirectly through a Canadian ETF or MF. In this scenario, there is only one layer of withholding tax, despite the fact that the investor holds the foreign securities through a Canadian ETF/MF. Note that when the investor is a non-resident of Canada, Canadian non-resident withholding tax applies, which represents a second layer of tax (see the white chevron below).

Scenario B – Taxable account – Investor holds foreign securities indirectly through Canadian ETFs or MFs

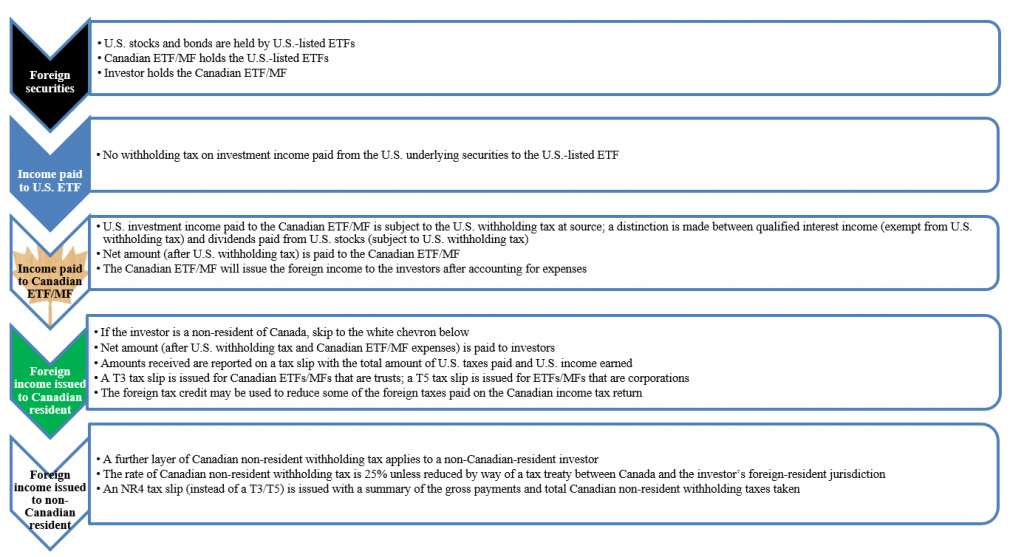

In Scenario C, a Canadian-resident individual invests in a Canadian ETF/MF, which invests in a U.S-listed ETF. The U.S.-listed ETF itself invests directly in U.S. stocks and bonds. Effectively, there are two investment structures between the Canadian-residen4t investor and the underlying investments. Investment income generated and paid on the underlying U.S. securities will not be subject to U.S. withholding tax when paid to the U.S. ETF since they are both U.S. residents. It is only payment of investment income from the U.S. ETF to the Canadian ETF/MF that triggers U.S. withholding tax (the first layer of tax). The second layer of tax (Canadian non-resident withholding tax) only applies when distributions of income from the Canadian ETF/MF are issued to a non-resident of Canada (see the white chevron below).

Scenario C – Taxable account – Investor holds Canadian ETFs or MFs that hold U.S.-listed ETFs with U.S. underlying securities

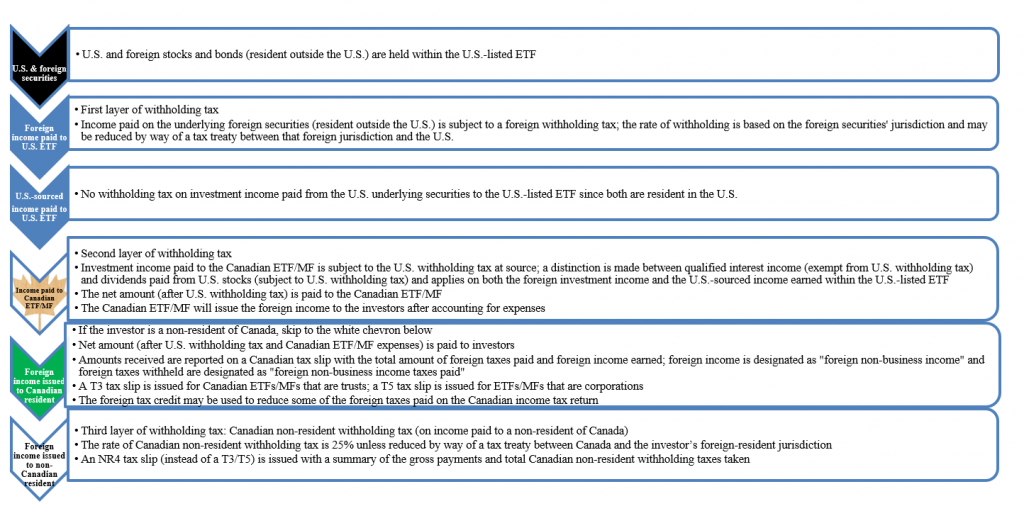

Finally, in Scenario D, a Canadian-resident individual invests in a Canadian ETF/MF, which invests directly in a U.S-listed ETF. The U.S.-listed ETF itself invests in foreign securities and U.S. securities. Again, there are two investment structures between the Canadian-resident investor and the underlying investments. Investment income generated and paid on the underlying U.S. securities will not be subject to U.S. withholding tax when paid to the U.S. ETF. However, foreign withholding tax will apply on income paid from the underlying foreign securities (held outside the U.S.) to the U.S.-listed ETF. This is the first layer of tax. A second layer of withholding tax applies when investment income is paid from the U.S. ETF to the Canadian ETF/MF. This second layer of tax is the U.S. withholding tax. A third layer of tax (Canadian non-resident withholding tax) would only apply if the distribution of income from the Canadian ETF/MF is issued to a non-resident of Canada (see the white chevron below).

Scenario D – Taxable account – Investor holds Canadian ETFs/MFs that hold U.S.-listed ETF with underlying U.S. and foreign securities

This post was first published at the official blog of Invesco Canada.