by Adam Burleson, Russell Investments

In this three-part series, I’m going to discuss the steps advisors can take to help build a better business.

- Determine your accelerators: actions you can take to potentially propel growth.

- Identify and find ways to reduce your limiters: activities that hinder success

- Develop your checklist: locking in the weekly activities that will help guarantee success (whatever that means to you).

Let’s start with accelerators. I think about this topic a lot. What activities will drive success? Success means different things to different people. Do you want to increase your overall assets under management (AUM)? Do you want to have fewer clients but retain the same AUM level? Do you want to have more time to spend with family? All of these are valuable goals, but what activities will get you there?

Here are some ideas to consider:

1. Find and work your niche – This is the biggest misconception that I run across daily. When I ask advisors what their niche is, I usually get folks who are retiring soon or maybe an AUM limit. This isn’t a niche—it’s a category. To find your niche, you have to get granular. Perhaps take a close look at your best clients? Do they have anything in common beyond an asset threshold? What common problems do they have? Casting a wide net and accepting anyone who fogs a mirror has the opposite effect on getting new business. The more focused your niche, the more focused you can be on solving a specific set of problems.

2. Outbound calls and marketing activity – Know your worth! How much money do you make per call or email? This number is easier to figure out than you would think. If you make 25 calls to prospects each week, how many meetings do you set? How many of those meetings result in clients? What is your average AUM and return on assets (ROA)? If you know these numbers it can make picking up the phone a lot easier.

3. Take time to build a prospecting list – Now that you know how many calls you need to make, you should create a list and determine what your goal is from that list. Do you want to ask current clients for referrals? Build the list the night before.

4. Learning – What do you want to get better at? Spend dedicated time on that area. You would be amazed how much better you can get by just focusing 30 minutes or one hour a week on one topic. Want to get better at referrals? Client discovery? Set aside one hour a week to research how.

5. Cultivate COIs (Centers of Influence) – Once you find your niche, you can then pinpoint other professionals who help individuals with a common problem. Spend time every week cultivating those relationships.

6. Spend time on your online presence – Write blogs, update your website, go to other advisor websites and see what they do. I go on advisor websites all the time, and you would be amazed at the differences. Look for ways to amplify your own value. More and more clients are doing research online before they meet with an advisor. This is no secret. Think about your own buying path. How much time do you spend searching for customer reviews when making a large purchase? Make sure that potential clients can learn about you online.

7. Get better at virtual meetings

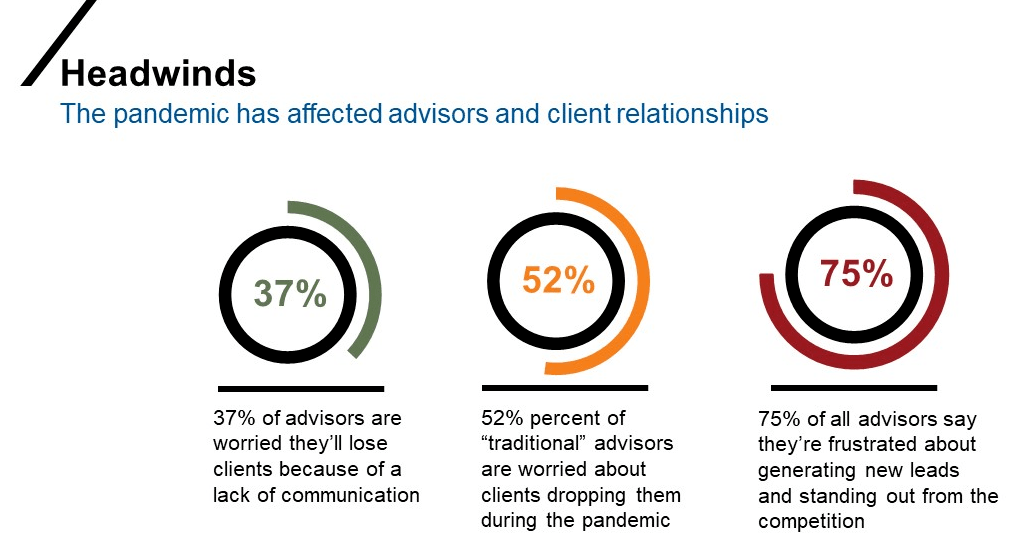

- 37% of advisors are worried they will lose clients because of COVID-related restrictions due to lack of communication

- 52% of traditional advisors are worried their clients will drop them during the pandemic

- 75% of advisors are frustrated with their attempts to generate new leads during the pandemic

Leverage the technology your firm has given you. Zoom, WebEx, Microsoft Teams, Go To Meeting … whatever it is, turn your camera on! Learn how to share your screen!

Click image to enlarge

Source: Financial AdvisorIQ, Close to Half of FAs Are Worried About Client Defections in 2020

8. Community involvement – At a time when people want to band together due to unprecedented uncertainty, we are seeing significant wins from advisors who have gotten involved with their community and clients in order to make an impact.

- Example: serve as a local expert on the CARES Act to build meaningful connection in your local business community

- Create a forum for your professional and business owner clients to meet, support each other, share referrals and collaborate to benefit the local community (create a client advisory board!)

9. Send pure gifts

-

-

- – These aren’t holiday gifts or thank yous for a referral. Sending just an out of the blue gift that applies to the client would be a great use of time.

-

The bottom line

Hopefully you are doing these things already. How many of the above activities do you do? What will help guarantee success? If you want to have more information on that, keep an eye out for the second part of this series where we discuss the actions that could limit your success. And in the third round of this series, we are going to talk about how to come up with the checklist for your success.

Copyright © Russell Investments