by Gates Moss, Jeremy Taylor, AllianceBernstein

Hydrogen’s potential as an energy source is attracting renewed attention. It may take 20 years or so for the potential to be realized. But the effects are likely to be felt within the planning horizons of most long-term investors—a good reason to start thinking now about the investment implications.

Interest in the “hydrogen economy” is rapidly growing. Japan is collaborating with 30 countries to establish 10,000 hydrogen refuelling stations by 2030. France and Germany have made multi-billion dollar investments in a transition to hydrogen as part of their COVID-19 recovery plans. And the Australian government launched a fund in 2020 to help develop a hydrogen industry.

While hydrogen won’t be a silver bullet that instantly decarbonizes society, we believe that it is likely to become an important component of the global energy mix over a 20-year time frame. So what do investors need to know?

Cleaner and Lighter Than Traditional Fuels

Five key facts about hydrogen can help frame the investment issues:

1. The technology is not new. The simplest way to produce hydrogen is by passing a direct electrical current through water, creating energy that liberates hydrogen and oxygen. Electrolysis of water dates back to 1800. And in 1869, Belgian electrical engineer Zénobe Gramme invented the Gramme machine for the cheap production of hydrogen. The chemistry is simple, and the technology path is well trodden.

The conversion of renewable energy to hydrogen began in the 1930s, when Norsk Hydro, at its Rjukan plant in Tinn, Norway, used hydroelectric power to produce hydrogen for the manufacture of ammonia as a fertilizer. In this century, conversion of renewable energy to ammonia will be one of the next steps in “greening” global industrials, with the potential to replace 175 million tonnes a year of ammonia produced from fossil fuels. It is also a credible replacement for fuels in shipping and as a substitute fuel in coal-fired power plants.

2. Weight matters. Hydrogen is the lightest atom on the periodic table. This makes it very useful as a transport fuel, as the energy contained in a kilogram of hydrogen is roughly three times that contained in a liter of diesel. It is also more than 100 times that contained in the batteries currently made by Tesla.

When weight matters, hydrogen can be the ideal fuel. This is why NASA chose hydrogen as the fuel for the Saturn V rocket used in the Apollo 11 mission to land on the moon. In this century, Hyundai’s production hydrogen vehicle, the Nexo, has a range of more than 600 kilometers on only six kilograms of hydrogen fuel.

This weight advantage has led Airbus to announce that its carbon-neutral fleet of the future will be powered predominantly by hydrogen. On the ground, the next revolution in auto and truck fleets could very well be a combination of hydrogen fuel cells (for range) and batteries (for power). If drivers want the distance and power of a rocket, it makes sense to use rocket fuel.

3. Renewable hydrogen is not economic today. While we believe green hydrogen has a bright future, the economics don’t generally work at the moment. When competing directly in transport applications, hydrogen is two to four times more expensive than the most competitive solutions for the storage and transport of energy. In existing industrial processes that use hydrogen as a feedstock, “green” hydrogen is not competitive with its carbon-intensive forerunner, “gray” hydrogen, which is generally produced through the steam-reforming of natural gas.

The good news is that the economics will improve dramatically.

4. Four factors will improve the economics of green hydrogen. First, as the industry grows, plants will increase in size and the inevitable cost benefits of scale will reduce unit costs. Second, the construction of more plants will foster greater technological expertise. We are already seeing cost benefits from the application of polymer electrolyte membranes in electrolyzer construction. Third, the intermittent nature of renewable energy is providing a natural space in the market. As wind and solar power supplies have become more integrated into the electrical grid, some countries have seen increasing instances of zero or even negative spot electricity prices during periods of oversupply, when weather conditions are right to maximize renewable generation. Such oversupply can be turned into hydrogen. Since electricity is hydrogen’s largest variable cost, this dramatically reduces the short-term break-even point.

Finally, governments are more willing to help. “Green bank” funding for hydrogen is increasing, helping to cover capital costs and to accelerate the three factors noted above. And the application of carbon prices in some markets will narrow the cost gap between hydrogen and fossil-fuel competitors.

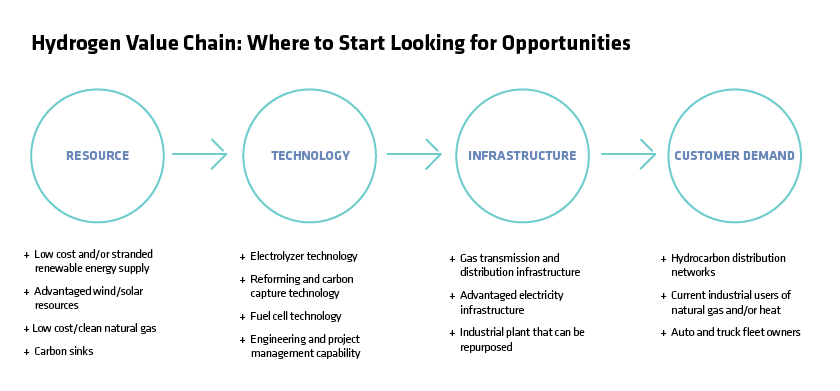

5. Many companies likely to benefit already exist. The challenge for investors, at this stage, is to identify them. The implications of hydrogen, in our view, are broad and likely to touch on many types of companies around the world. While we don’t yet know which companies will benefit most, it’s possible to list the attributes that they will likely need to take advantage of the opportunity. Arranging these attributes along a hydrogen industry value chain can serve as a guide to how companies along the chain might benefit (Display).

What types of companies could fall into the hydrogen investment universe? Examples include retail fuel distributors with multiple roadside services stations that could be converted to sell hydrogen in the future; natural gas suppliers with networks of pipelines that could be converted to supply hydrogen; or owners of natural gas processing plants that could add, or change to, hydrogen production.

How Investors Can Prepare

The foundations of the hydrogen economy are only beginning to be laid. But a 20-year time frame deserves attention, given the considerable impact that hydrogen could have on industry, consumer lifestyles and investment portfolios. Investors can start to prepare now by understanding how different companies might be exposed to the hydrogen value chain. As the technology and business of hydrogen matures, more specialized knowledge and research will be needed to assess individual stocks on their technical and financial merits.

Gates Moss is Senior Research Analyst and Portfolio Manager—Australian Equities at AllianceBernstein (AB)

Jeremy Taylor is Senior Research Analyst and Portfolio Manager—Value Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..