by Don Vialoux, EquityClock.com

Technical Notes for Tuesday February 16th

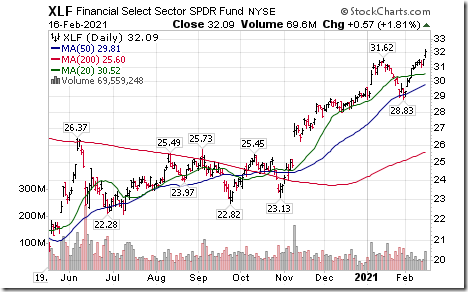

Financial SPDRs (XLF) moved above $31.62 to an all-time high extending an intermediate uptrend.

Strength in Financial SPDRs was led by JP Morgan (JPM), a Dow Jones Industrial Average stock moving to an all-time high above $142.75

Bank of America (BAC), an S&P 100 stock moved above $34.37 extending an intermediate uptrend.

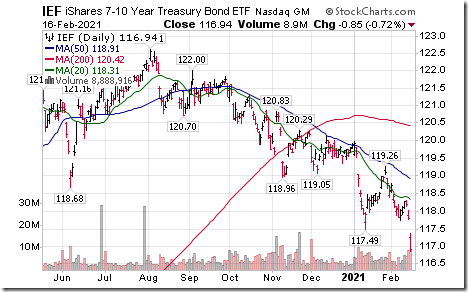

U.S. Bank stocks and related ETFs are benefitting from a widening in U.S. interest rate spreads: Short term rates remain low while longer term interest rates are rising (i.e. U.S. medium and long term bond prices are moving lower. Intermediate term U.S. Treasuries extended their downtrend yesterday by moving below $117.49

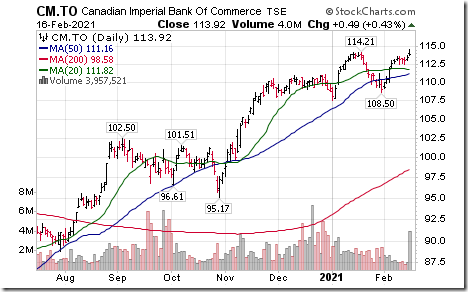

Canadian Bank stocks also are responding to widening short term/long term rates in Canada. They also are on the move prior to release of their fiscal first quarter results at the end of this month. Commerce Bank (CM) a TSX 60 stock moved above $114.21 to an all-time high.

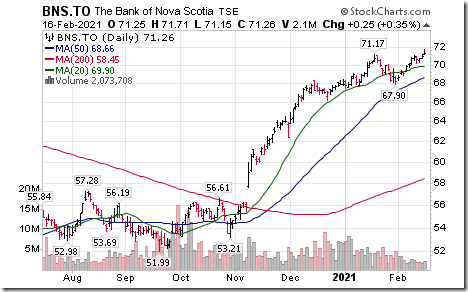

Scotia Bank (BNS), a TSX 60 stock moved above $71.17 and $71.26 to a 3 year high extending an intermediate uptrend.

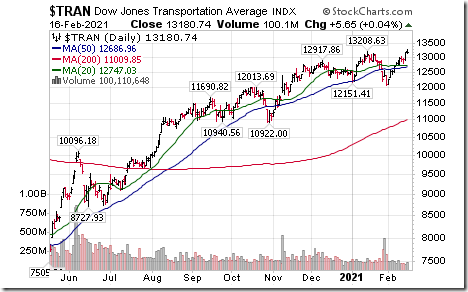

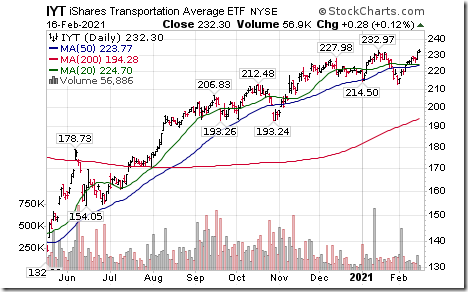

Dow Jones Transportation Average and its related ETF (IYT) moved above 13,208.63 and $232.97 respectively to all-time highs extending an intermediate uptrend.

Energy SPDRs (XLE) moved above $45.00 extending an intermediate uptrend. Triggered by record low temperatures in the southern U.S.! Crude oil, gasoline, natural gas and heating oil prices were sharply higher in overnight trade.

Conoco Phillip (COP) responded to higher prices by moving above $$47.85 extending an intermediate uptrend.

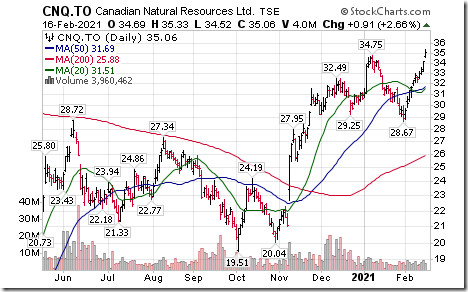

Canadian energy stocks also responded strongly to overnight strength in oil, gasoline and natural gas prices. Canadian Natural Resources, (CNQ), a TSX 60 stock moved above $34.75 extending an intermediate uptrend.

Cenovus (CVE), a TSX 60 stock moved above $8.78 extending an intermediate uptrend.

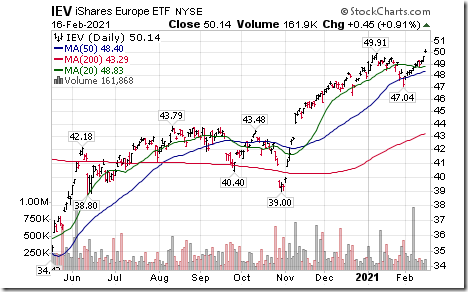

European equities and related ETFs are breaking to all-time highs. Eurozone iShares (EZU) moved above $45.84 extending an intermediate uptrend.

Europe iShares (EZU) that include a U.K. component moved above $49.91 extending an intermediate uptrend.

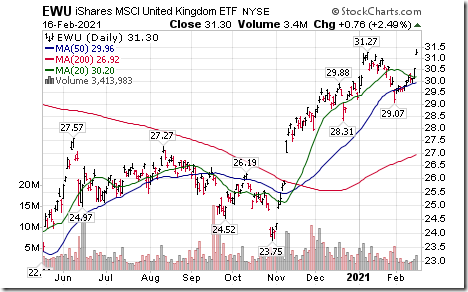

U.K. iShares (EWU) moved above $31.27 to an all-time high extending an intermediate uptrend.

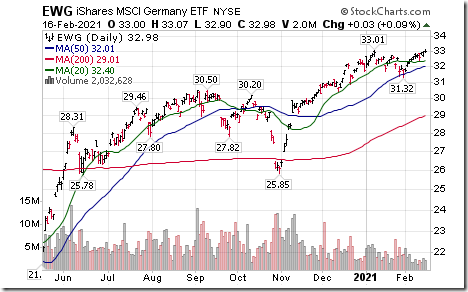

Germany iShares (EWG) moved above $33.01 to a three year high extending an intermediate uptrend.

Base Metal stocks and related ETFs moved strongly higher thanks to strength in base metal and lithium prices. Lithium ETN (LIT) moved above $72.95 to an all-time high extending an intermediate uptrend.

Base metals ETF on the TSX (XBM) moved above $16.80 to an all-time high extending an intermediate uptrend.

Base metals ETF in the U.S. (PICK) moved above $41.60 to an all-time high extending an intermediate uptrend.

Ditto for BMO Equal Weight Base Metals ETF (ZMT) on a move above $55.97!

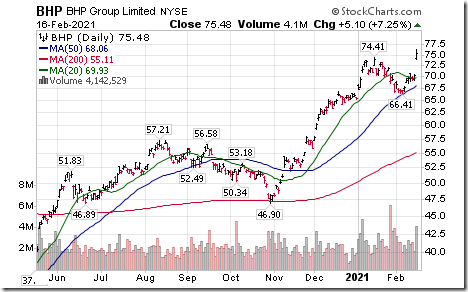

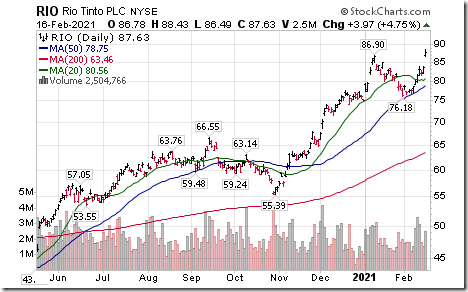

The largest base metal stocks in the world led the advance in base metal ETFs. BHP Billiton moved above $74.41 to an all-time high extending an intermediate uptrend. Rio Tinto moved above $86.90 to an all-time high extending an intermediate uptrend.

In Canada, First Quantum (FM), a TSX 60 stock was a leader on a move above $26.72.

On the other hand, Canadian gold stocks and related ETFs (e.g. XGD) remained under technical pressure. Agnico-Eagle (AEM), a TSX 60 stock moved below Cdn$81.12 extending an intermediate downtrend.

Bristol-Myers (BMY), an S&P 100 stock moved below intermediate support at $59.45

Frontier iShares (FM) moved above $29.94 extending an intermediate uptrend.

Trader’s Corner

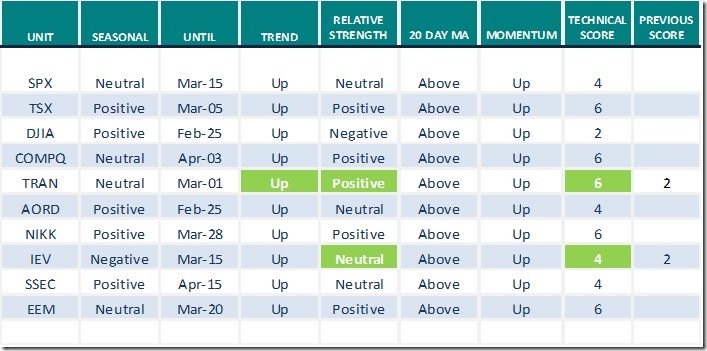

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for February 16th 2021

Green: Increase from previous day

Red: Decrease from previous day

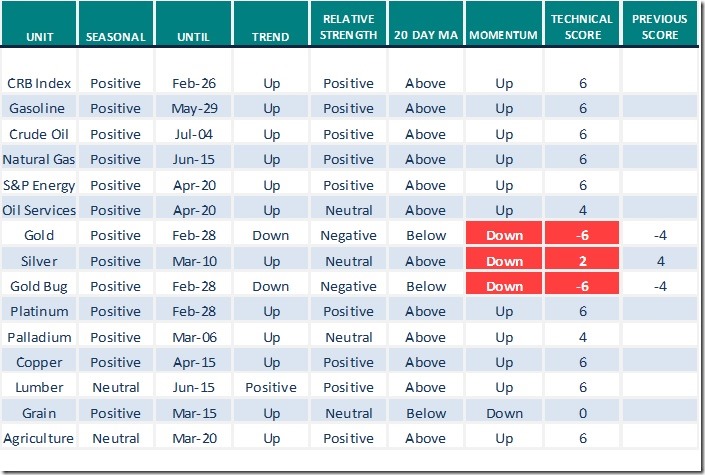

Commodities

Daily Seasonal/Technical Commodities Trends for February 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

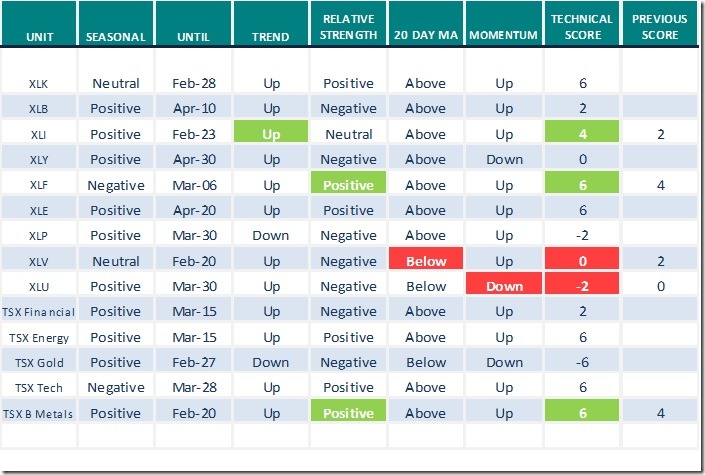

Sectors

Daily Seasonal/Technical Sector Trends for February 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.