by Don Vialoux, EquityClock.com

The Bottom Line

Equity markets around the world moved higher last week. Greatest influences on North American equity markets remain growing evidence of a second wave of the coronavirus (negative) and timing of distribution of a vaccine (positive).

Observations

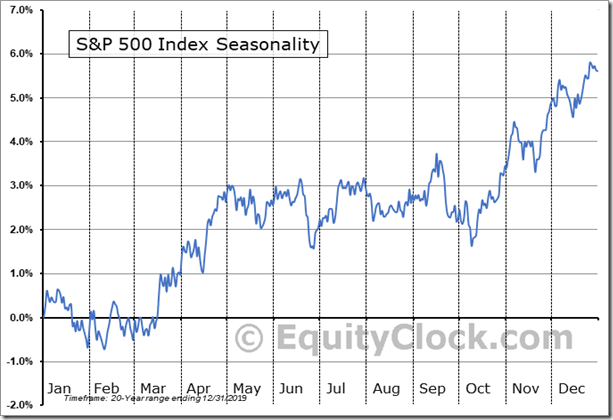

“Santa Claus Hangover” period continues. On average, the S&P 500 Index during the past 20 periods from January 8th to February 14th dropped 1.5% per period: All of the gains recorded during the Santa Claus Rally period from December 14th to January 8th were lost during the Santa Claus Hangover period. This is the time of year when U.S. consumers and investors are paying down debts accrued during the Santa Claus Rally period.

What about this year? On Friday, the S&P 500 Index moved to an all-time high and the Dow Jones Industrial Average tested its all-time high. Short term weakness in U.S. equity indices into late February could come from another recurring event, response to regime change from one party to the other in the year after a U.S. Presidential election. On average, the Dow Jones Industrial Average and S&P 500 Index were virtually unchanged from the first week in January to the first week in February followed by more than 3.3% drop to the third week in February.

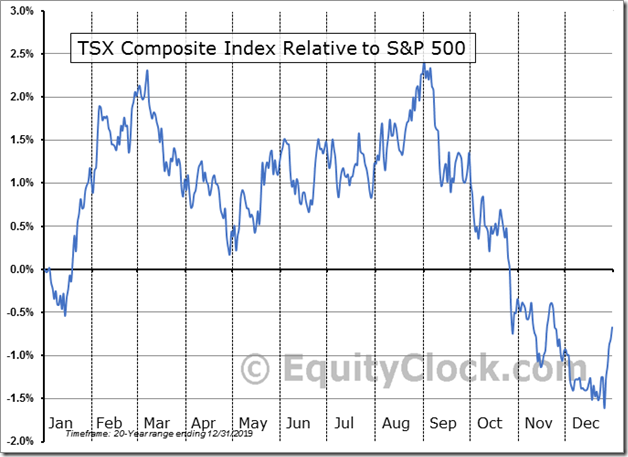

Note that the “Santa Claus Hangover” normally does not happen in the Canadian equity market. The main reason: Canadian investors focus on contributing to their RRSPs during the first 60 days in the New Year and subsequently invest more funds into the equity market. Strongest period in the year for the TSX Composite Index relative to the S&P 500 Index is from mid-December to the first week in March. As indicated in the chart below, average gain per period for the TSX Composite Index relative to the S&P 500 Index during the past 20 periods was 3.3%. So far since December 31st, performances of the TSX Composite Index and the S&P 500 Index have been equal.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week. It changed from intermediate neutral to intermediate overbought. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average). recovered slightly last week and remains at an extremely overbought levels.. See chart at the end of this report.

Medium term technical indicator for Canadian equity markets moved higher last week. It changed from intermediate oversold to intermediate overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) was slightly higher last week. It remains intermediate overbought. See Barometer chart at the end of this report.

Short term short term indicators for U.S. equity indices, commodities and sectors (20 day moving averages, short term momentum indicators) moved higher last week.

Short term momentum indicators for Canadian indices and sectors also moved higher last week.

Year-over-year 2020 consensus earnings by S&P 500 companies turned positive last week. According to www.FactSet.com, fourth quarter earnings on a year-over-year basis are expected to increase 1.7% (versus a drop of 2.3% last week) and revenues are expected to increase 2.7% (versus previous 1.7% increase last week). Earnings for all of 2020 are expected to fall 11.4% (versus previous 12.1% decline) and revenues are expected to decline 1.1% (versus previous 1.3% decline).

Consensus estimates for earnings and revenues by S&P 500 companies turn more positive on a year-over-year basis in the first quarter of 2021. According to www.FactSet.com earnings in the first quarter of 2021 on a year-over-year basis are expected to increase 21.0% (versus previous 19.6% increase last week) and revenues are expected to increase 5.6% (versus previous 4.8% increase). Earnings in the second quarter are expected to increase 49.4 % (versus previous 48.7% increase) and revenues are expected to increase 15.6% (versus previous 15.1% increase). Earnings in the third quarter are expected to increase 16.7% (versus previous 16.0% increase) and revenues are expected to increase 9.3% (versus previous 9.0% increase). Earnings in the fourth quarter are expected to increase 14.6% (versus previous 17.2% increase) and revenues are expected to increase 6.7% (versus previous 7.0% increase). Earnings for all of 2021 are expected to increase 23.4% (versus previous 23.6%) and revenues are expected to increase 9.0% (versus previous 8.7% increase).

Economic News This Week

Quiet week for economic reports!

January Consumer Price Index to be released at 8:30 AM EST on Wednesday is expected to increase 0.3% versus a gain of 0.4% in December. Excluding food and energy, January Consumer Price Index is expected to increase 0.2% versus a gain of 0.1% in December.

February Michigan Consumer Sentiment to be released at 10:00 AM EST on Friday is expected to increase to 80.5 from 79.9 in January.

Selected Earnings News This Week

Fourth quarter report season for S&P 500 and Dow Industrial Average companies passed its peak last week: 59% of S&P 500 companies have reported to date with 81% reporting higher than consensus earnings per share and 79% reporting higher than consensus revenues. This week, another 77 S&P 500 companies and three Dow Jones Industrial Average companies are scheduled to report.

In Canada, frequency of fourth quarter reports for TSX 60 companies reaches a peak.

Trader’s Corner

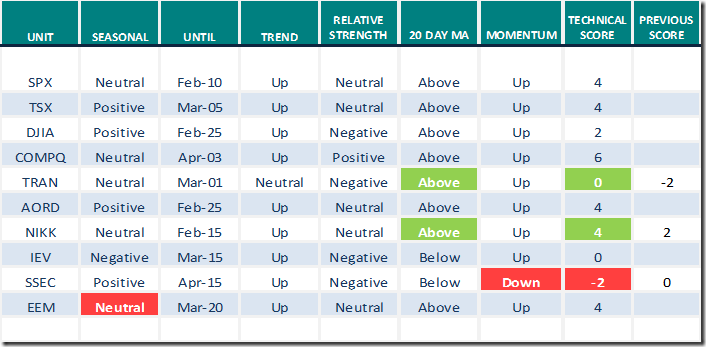

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for February 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

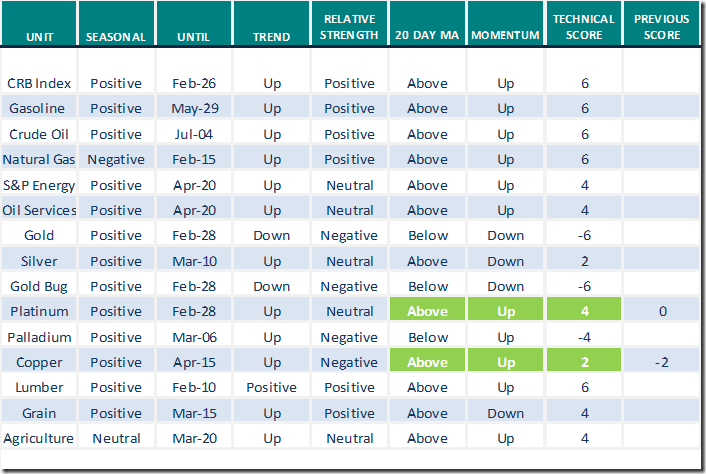

Commodities

Daily Seasonal/Technical Commodities Trends for February 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for February 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

The Canadian Technician

Greg Schnell notes, “The U.S. Dollar continues higher”. Following is a link:

US Dollar Continues Higher | The Canadian Technician | StockCharts.com

Change is Seasonality Rating

Emerging Markets change on a real and relative basis from Positive to Neutral from February 6th to March 20th

TSX Technology Index and related iShares (XIT) change on a relative basis from Positive to Negative on February 6th and from Positive to Negative on a real basis on February 15th

Technical Notes for Friday February 5th

Zoom (ZM), a NASDAQ 100 stock moved above $486.83 resuming an intermediate uptrend.

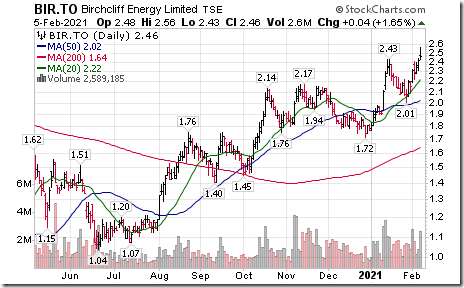

Canadian “gassy” stocks are moving higher. Nice breakout by Birchcliff Energy above $2.42 extending an intermediate uptrend!

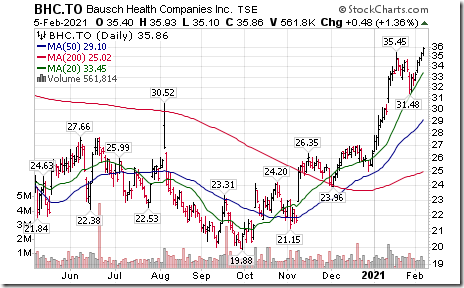

Bausch Health (BHC), a TSX 60 stock moved above Cdn$35.45 extending an intermediate uptrend.

Cisco Systems (CSCO), a Dow Jones Industrial Average stock moved above $47.62 extending an intermediate uptrend.

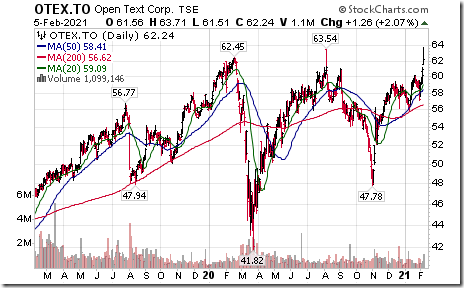

Open Text (OTEX), a TSX 60 stock moved above Cdn$63.54 to an all-time high extending an intermediate uptrend. Eight investment brokers raised their target price on the stock after release of a stronger than expected second quarter report.

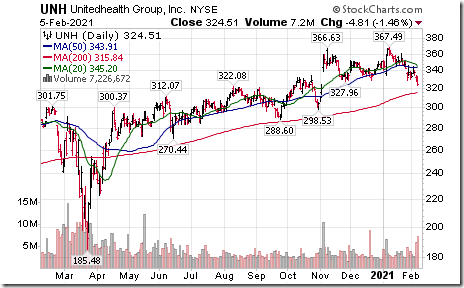

UnitedHealth Group (UNH), a Dow Jones Industrial Average stock moved below $327.96 completing a double top pattern.

MetLife (MET) an S&P 100 stock moved above $51.89 to an all-time high extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate Baromoter added 3.81 on Friday and 30.26 last week to 71.74. It changed last week from intermediate neutral to intermediate overbought on a recovery above 60.00.

The long term Barometer slipped 0.20 on Friday, but added 3.61 last week to 89.98. It remains extremely intermediate overbought by remaining above 80.00.

TSX Momentum Barometers

The intermediate Barometer added 0.96 on Friday and 25.11 last week to 63.36. It changed from intermediate oversold to intermediate overbought on a recovery above 40.00 and 60.00.

The long term Barometer added 0.48 on Friday gained 3.13 last week to 77.40. It remains long term overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.