by Don Vialoux, EquityClock.com

Technical Notes for Wednesday January 6th

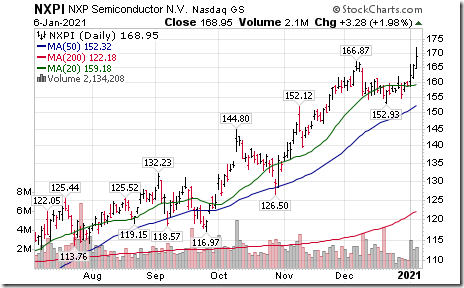

NXP Semiconductors (NXPI), a NASDAQ 100 stock moved above $166.87 to an all-time high extending an intermediate uptrend.

NetEase (NTES), a NASDAQ 100 stock moved above $103.30 to an all-time high extending an intermediate uptrend.

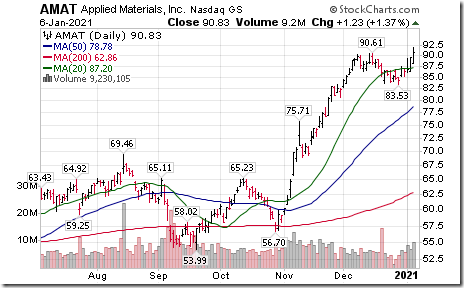

Applied Materials (AMAT), a NASDAQ 100 stock moved above $90.61 to an all-time high extending an intermediate uptrend.

Gilead (GILD), a NASDAQ 100 stock moved above $158.05 completing a double bottom pattern.

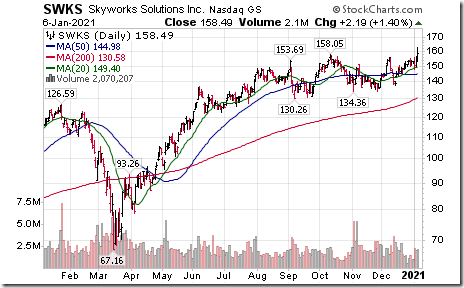

Skyworks Solutions (SWKS) a NASDAQ 100 stock moved above $158.05 to an all-time high extending an intermediate uptrend.

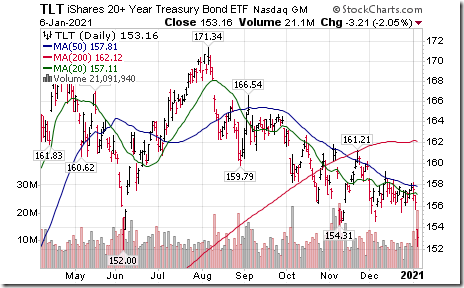

20 year + Treasury Bond iShares (TLT) moved below $154.31 extending an intermediate downtrend.

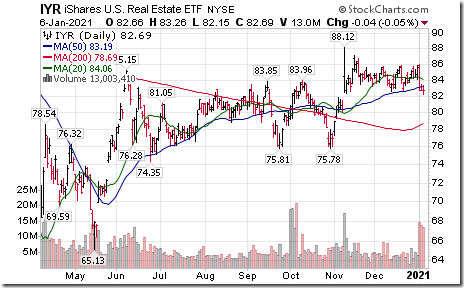

U.S. REIT iShares (IYR) moved below $82.37 completing a double top pattern. Responding to higher U.S. interest rates!

Dow Holdings (DOW), an S&P 100 stock moved above $57.46 to an all-time high extending an intermediate uptrend.

Coca Cola (KO), a Dow Jones Industrial Average stock moved below $51.08 completing a double top pattern.

MetLife (MET), an S&P 100 stock moved above $48.89 extending an intermediate uptrend.

Schlumberger (SLB), an S&P 100 stock moved above $23.89 extending an intermediate uptrend.

Industrial SPDRs (XLI) moved above $89.78 to an all-time high extending an intermediate uptrend.

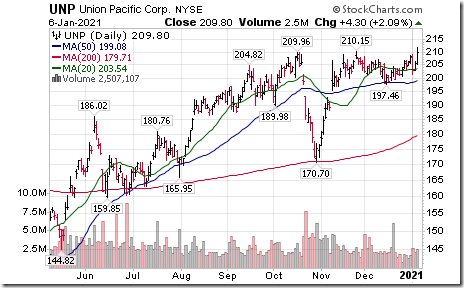

Union Pacific (UNP), an S&P 100 stock moved above $209.96 to an all-time high extending an intermediate uptrend.

General Electric (GE), an S&P 100 stock moved above $11.48 extending an intermediate uptrend.

Pharmaceutical ETF (PPH) moved above $67.21 to an all-time high extending an intermediate uptrend.

TSX Financials iShares (XFN) moved above $38.98 extending an intermediate uptrend.

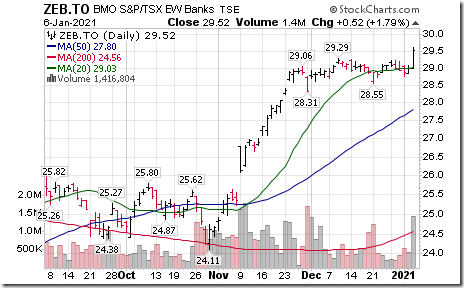

BMO Equal Weight Canadian Banks ETF (ZEB) moved above $29.29 to an all-time high.

BMO Equal Weight Canadian Oil Equity ETF (ZEO) moved above $31.94 resuming an intermediate uptrend.

Manulife Financial (MFC), a TSX 60 stock moved above $23.32 extending an intermediate uptrend.

Power Corp (POW), a TSX 60 stock moved above $29.88 extending an intermediate uptrend.

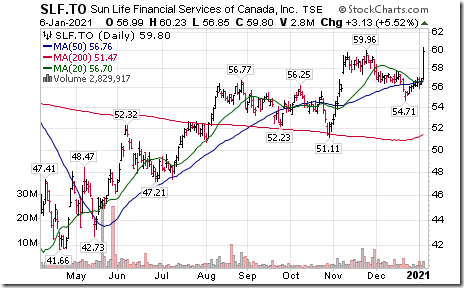

SunLife Financial (SLF), a TSX 60 stock moved above $59.96 extending an intermediate uptrend.

Telus (T), a TSX 60 stock moved above $26.43 to an all-time high extending an intermediate uptrend.

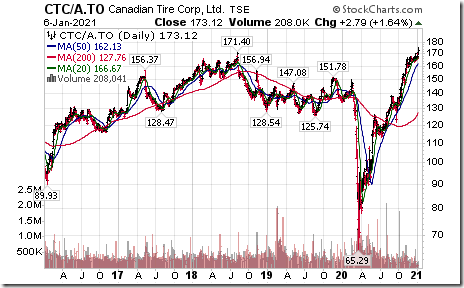

Canadian Tire (CTC.A), a TSX 60 stock moved above $171.40 to an all-time high extending an intermediate uptrend.

Marijuana ETF (HMMJ) moved above $9.12 extending a reverse Head & Shoulders pattern.

U.S. Natural Gas Equity ETF (FCG) moved above $10.02 resuming an intermediate uptrend.

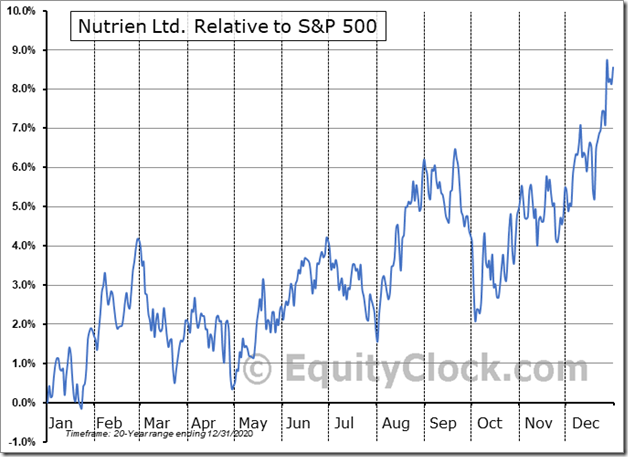

Nutrien (NTR), a TSX 60 stock moved above $64.98 extending an intermediate uptrend.

Seasonal influences for Nutrien (NTR) are positive on a real and relative basis to the end of February

Trader’s Corner

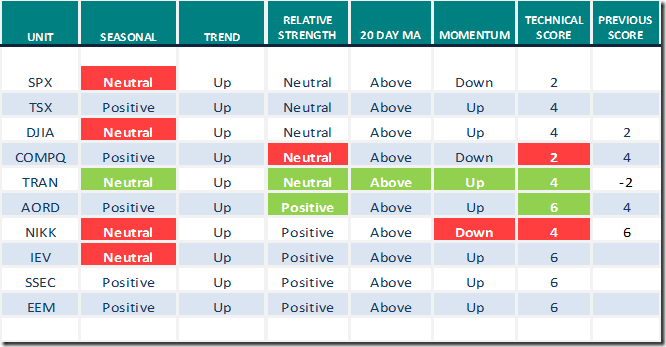

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

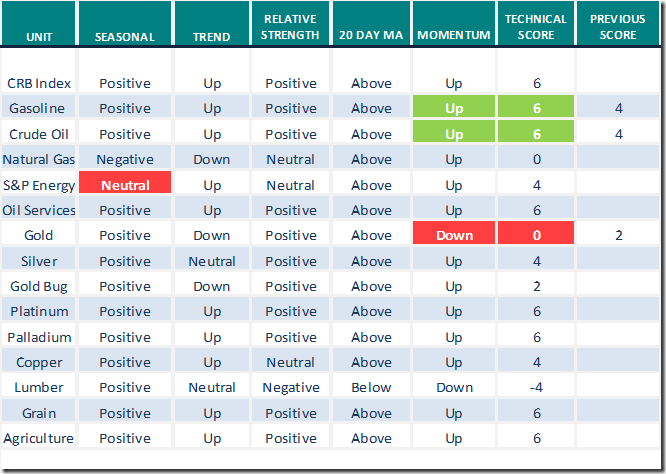

Commodities

Daily Seasonal/Technical Commodities Trends for January 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

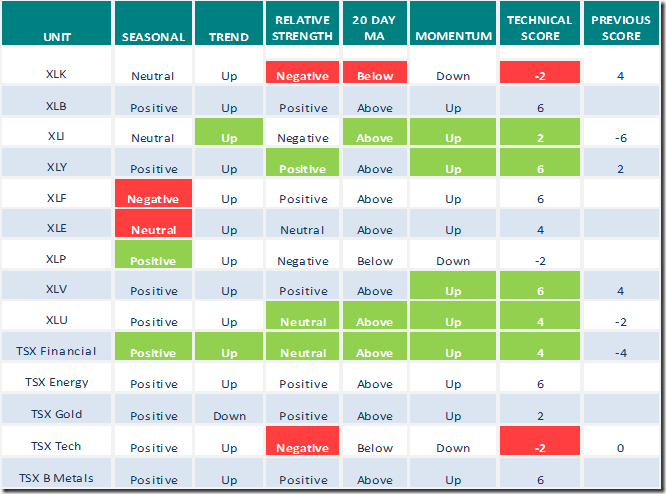

Sectors

Daily Seasonal/Technical Sector Trends for January 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

Are You Watching These Stocks Run?

Greg Schnell’s focuses on stocks impacted by the Georgia runoff Senate elections. Following is a link:

Are You Watching These Stocks Run? | The Canadian Technician | StockCharts.com

Changes in Seasonality Ratings

(Projections during the next two month on a relative basis)

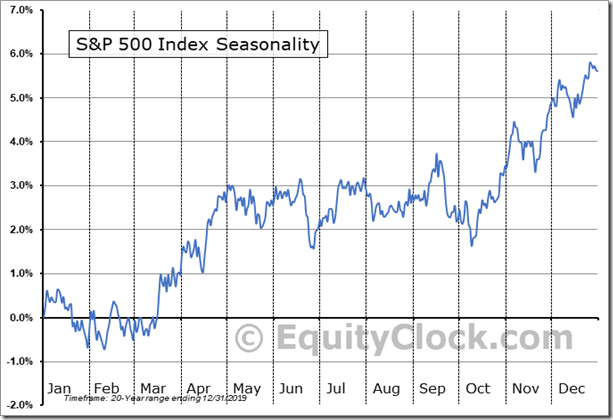

S&P 500: Positive to Neutral

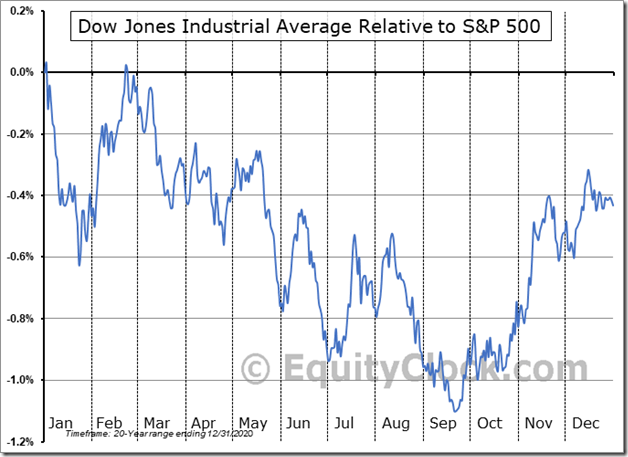

Dow Jones Industrial Average: Positive to Neutral

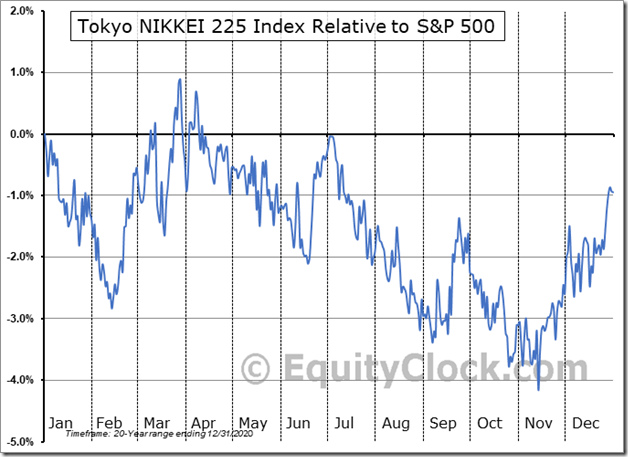

Nikkei Average: Positive to Neutral

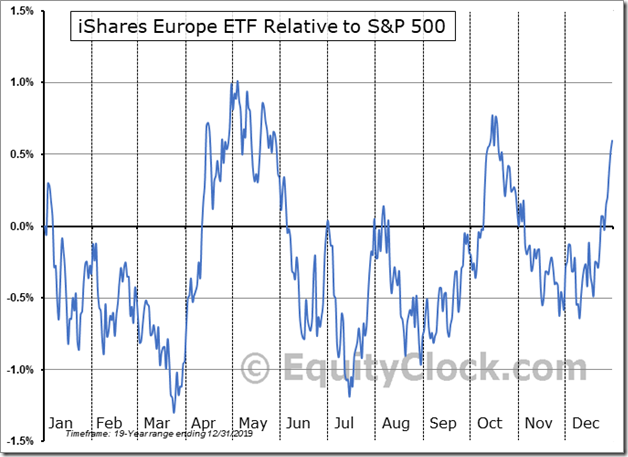

Europe: Positive to Negative

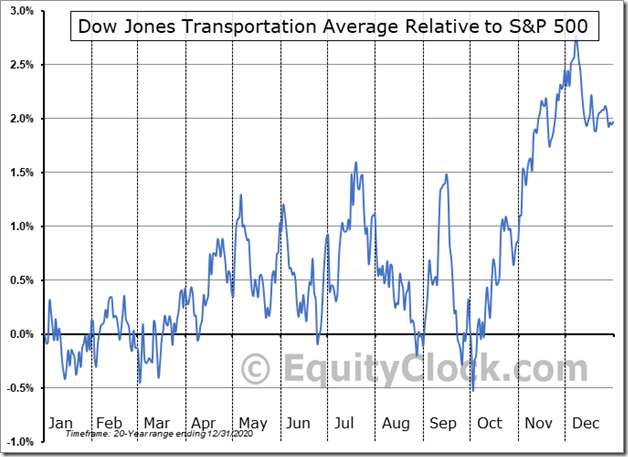

Dow Jones Transportation Average: Negative to Neutral

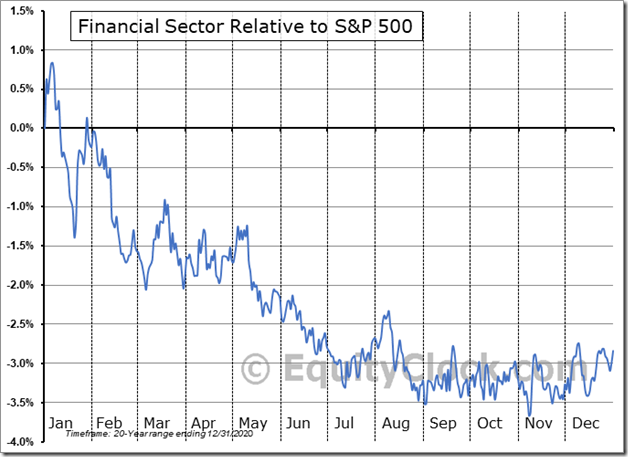

U.S. Financial: Neutral to Negative

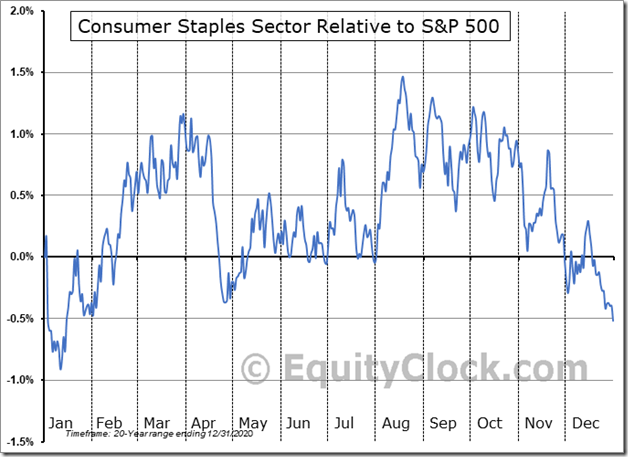

U.S. Consumer Staples: Neutral to Positive

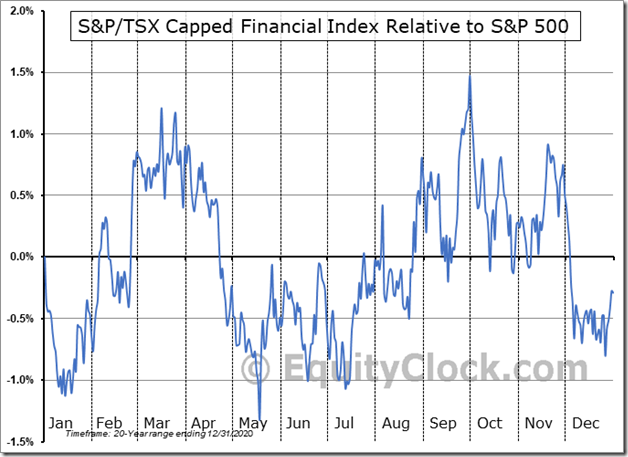

TSX Financials: Negative to Positive

S&P 500 Momentum Barometer

The Barometer added 5.01 to 82.36 yesterday. It changed from intermediate overbought to extremely intermediate overbought on a recovery above 80.00.

TSX Momentum Barometer

The Barometer added 1.32 to 77.99 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.