by Don Vialoux, EquityClock.com

Weakness in U.S. equity prices yesterday

Weakness can be attributed partially to traders who delayed profit taking until start of 2021. Also, poll results over the weekend for the Georgia Senate run-off elections today moved more in favour of wins by the two Democrat candidates. At least one major U.S. broker predicted a 5%-10% downdraft in U.S. equities if Democrats win both seats. Following is a link to the latest poll results:

https://projects.fivethirtyeight.com/georgia-senate-polls/

Technical Notes for Monday January 4th

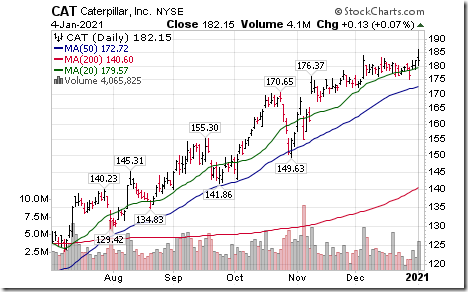

Caterpillar (CAT), a Dow Jones Industrial Average stock moved above $183.81 to an all-time high extending an intermediate uptrend.

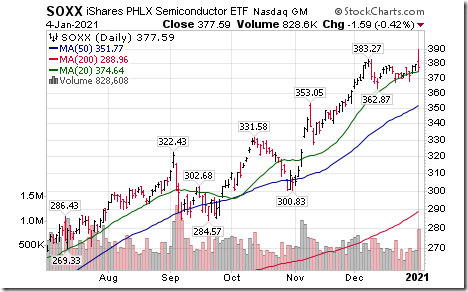

Semiconductor iShares (SOXX) moved above $383.27 to an all-time high extending an intermediate uptrend.

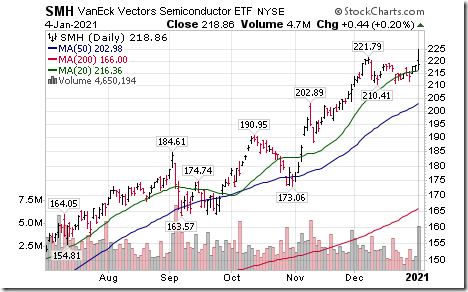

Semiconductor ETF (SMH) moved above $221.79 to an all-time high extending an intermediate uptrend.

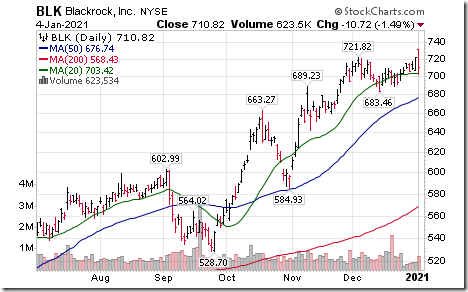

Blackrock (BLK), an S&P 100 stock moved above $721.82 to an all-time high extending an intermediate uptrend.

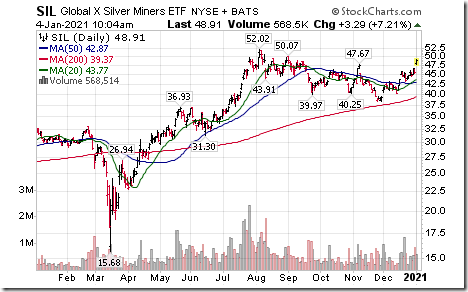

Silver equity ETF moved above $47.67 resuming an intermediate uptrend. Responding to higher silver prices!

Hecla Mining (HL) led the Silver equity sector higher by moving above $6.78 to a four year high.

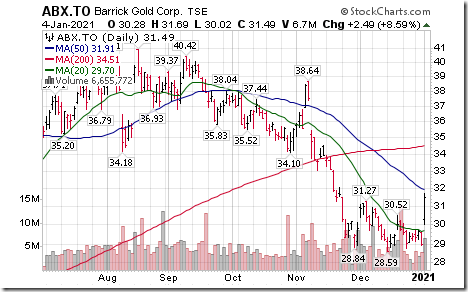

Kinross Gold (KGC), a TSX 60 stock moved above US $7.84 and Cdn $10.03 completing a double bottom pattern. Responding to higher gold prices!

Barrick Gold (ABX), a TSX 60 stock moved above $31.27 completing aa double bottom pattern.

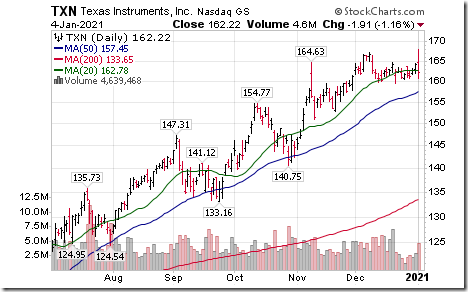

Texas Instruments (TXN), a NASDAQ 100 stock moved above $167.24 to an all-time high extending an intermediate uptrend.

FedEx (FDX), an S&P 100 stock moved below $255.78 completing a double top pattern.

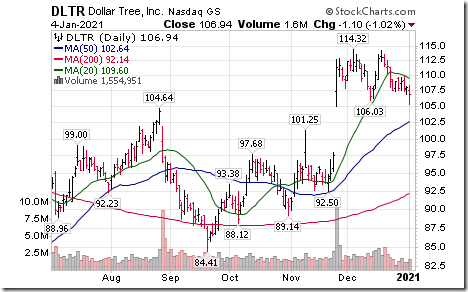

Dollar Tree (DLTR), a NASDAQ 100 stock moved below $106.03 completing a double top pattern.

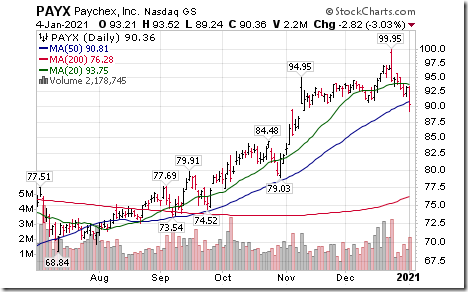

Paychex (PAYX), a NASDAQ 100 stock moved below $89.44 completing a double top pattern.

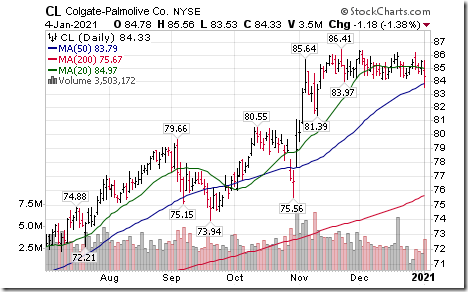

Colgate Palmolive (CL), an S&P 100 stock moved below $83.97 completing a double top pattern.

Trader’s Corner

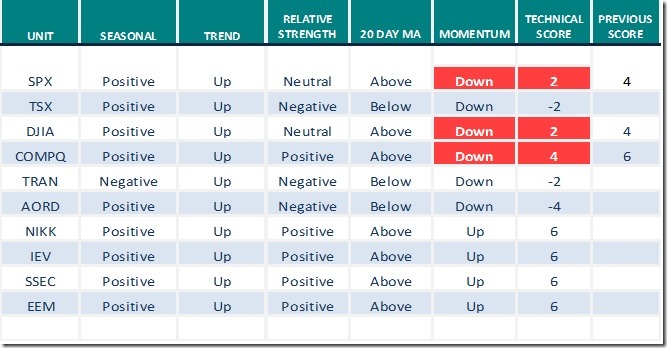

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

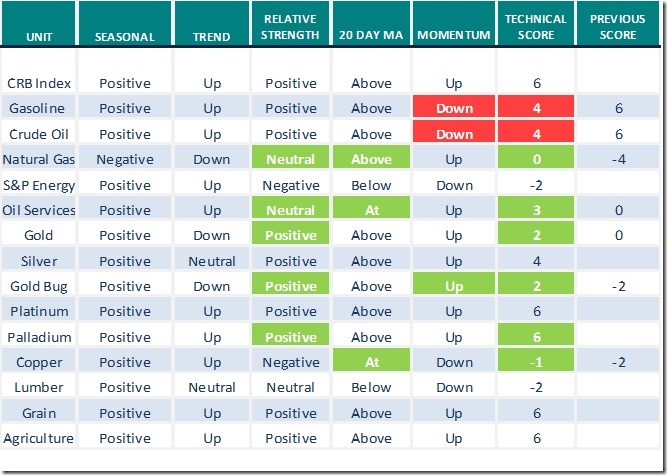

Commodities

Daily Seasonal/Technical Commodities Trends for January 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

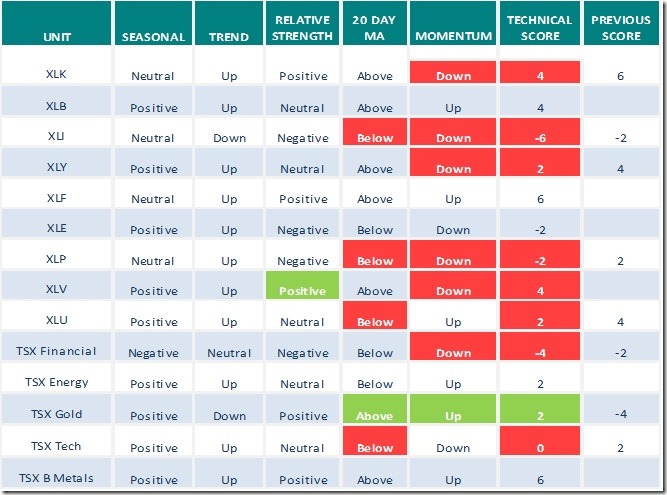

Sectors

Daily Seasonal/Technical Sector Trends for January 4th 2021

Green: Increase from previous day

Red: Decrease from previous day

Please note that seasonality ratings on several equity indices and several U.S. sectors are scheduled to change on January 7th. Most of the changes are downgrades from Positive to Neutral.

S&P 500 Momentum Barometer

The Barometer dropped 12.42 to 74.15 yesterday. It changed from extremely intermediate overbought to overbought on a move below 80.00 and established a short term downtrend.

TSX Momentum Barometer

The Barometer added 2.84 to 73.46 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.