by Don Vialoux, EquityClock.com

Technical Notes for Monday September 28th

Solar ETF (TAN) moved above $57.95 to an all-time high extending an intermediate uptrend.

TCOM (TCOM), a NASDAQ 100 stock moved above $31.01 extending an intermediate uptrend.

Seattle Genetics (SGEN), a NASDAQ 100 stock moved above $187.99 to an all-time high extending an intermediate uptrend.

Base metal stocks are under technical pressure. Lundin Mining (LUN) moved below Cdn$7.40 completing a double top pattern triggered by an operational disruption at its Chapada mine.

Target Corp (TGT), an S&P 100 stock moved above $156.10 to an all-time high extending an intermediate uptrend.

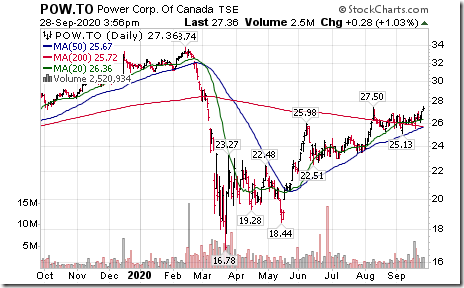

Power Corp (POW), a TSX 60 stock moved above $27.50 extending an intermediate uptrend.

Trader’s Corner

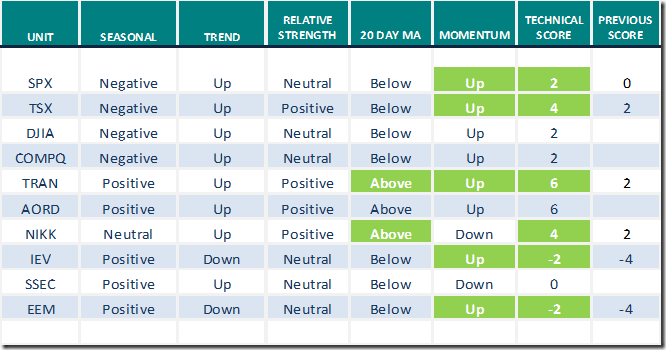

Daily Seasonal/Technical Equity Trends for September 28th 2020

Green: Increase from previous day

Red: Decrease from previous day

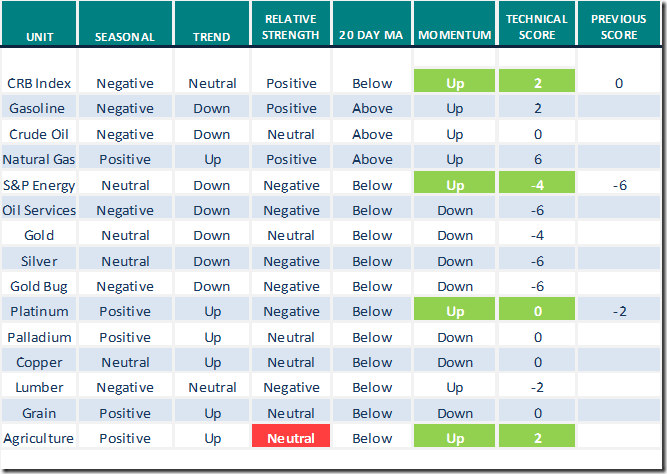

Commodities

Seasonal/Technical Commodities Trends for September 28th 2020

Green: Increase from previous day

Red: Decrease from previous day

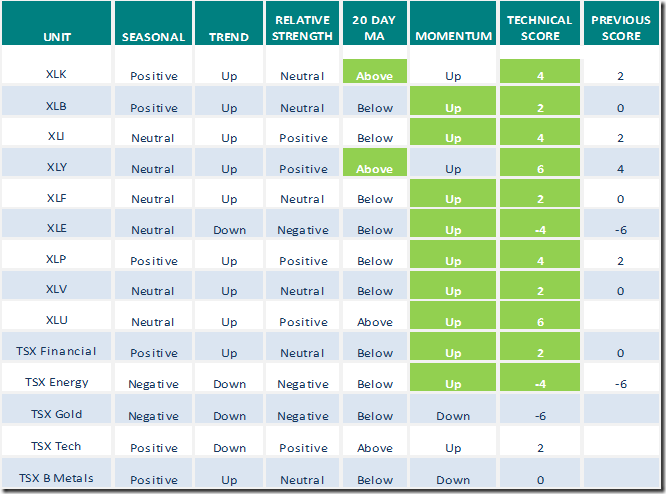

Sectors

Daily Seasonal/Technical Sector Trends for September 28th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads, “Countertrend bounce, COVID spark, Dollar up, yields fall, gold lower, banks launder, green rise, election hint”. Following is the link:

S&P 500 Momentum Barometer

The Barometer advanced 13.03 to 47.29 yesterday. It changed from intermediate oversold to intermediate neutral on a recovery above 40.00.

TSX Momentum Barometer

The Barometer advanced 9.30 to 46.05 yesterday. It changed from intermediate oversold to intermediate neutral on a recovery above 40.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.