by Craig Basinger, Derek Benedet, Chris Kerlow, Alexander Tjiang, Brett Gustafson, Richardson GMP

Canada’s energy sector has gone through a rather painful evolution over the past few years. High oil prices, oh so many years ago, unleashed a long-term global supply response during the past decade including large long-term projects and the acceleration of the U.S. shale revolution. This has created a world with too much oil, which has been exacerbated by the pandemic-induced global recession demand shock. Add a policy environment that is not the most supportive and continued uncertainty around energy infrastructure – in short, it has been a painful journey.

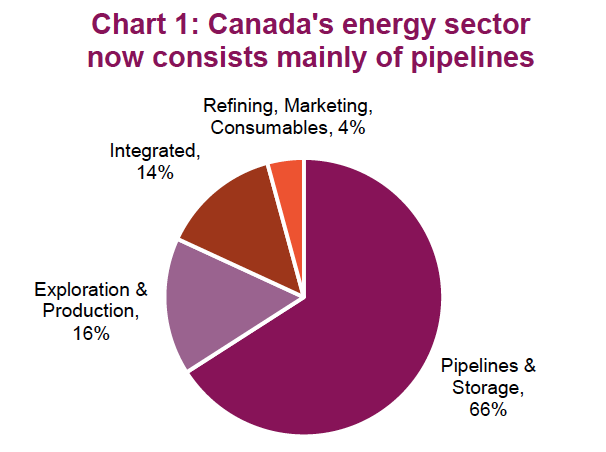

A decade ago the TSX Energy sector carried an index weight of about 25%; today it is closer to 11.2%. But the composition has also changed materially. Drillers and services are no longer present in the index. Producers and integrated energy companies only carry a combined 30%, with most of the energy index comprised of pipelines. Yes, that means 66% of Canada’s energy sector now consists of pipelines. That is a material change in the weight and composition over time.

In this edition of Ethos we share our views on the demand/supply environment, provide a deeper look at pipelines given their increased importance in the energy sector and offer up our investment thoughts.

Demand and supply considerations

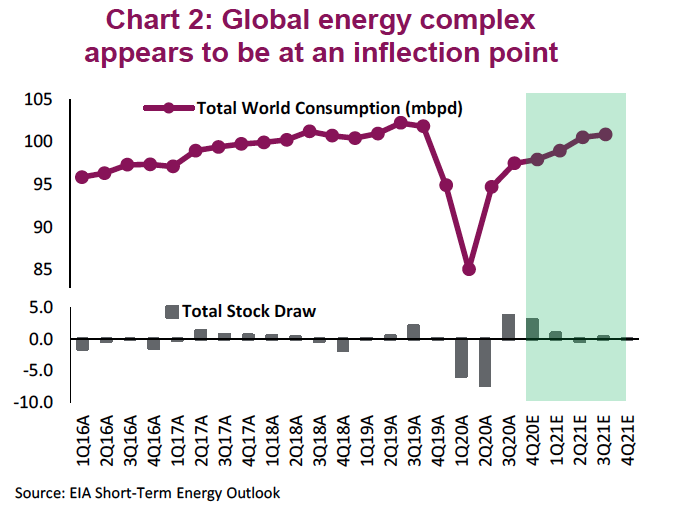

In our view, the global energy complex appears to be at or getting close to a key inflection point. Though clouded in uncertainty, prospects for a continued gradual recovery on the demand side while a reduction of a supply glut all point towards a much-awaited market rebalancing (Chart 2).

Demand - Trying to get a handle on gauging end-market oil demand has rarely been more challenging. The current opaque predicament and changing behaviours caused by the global pandemic is a challenge to traders, investors, and producers alike. One sign of this uncertainty is the growing spread in forecasts by the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC). Demand forecasts for the next calendar quarter differ by 1.3 million barrels a day, double the average gap in 2019.

Last week, OPEC revised its 2020 oil demand outlook lower, which was the second straight month in which the cartel reduced its demand forecast. The diminished outlook is a result of concerns about a second wave in COVID-19 cases and a stalling recovery. The pandemic path and reopening pace remain the big unknowns.

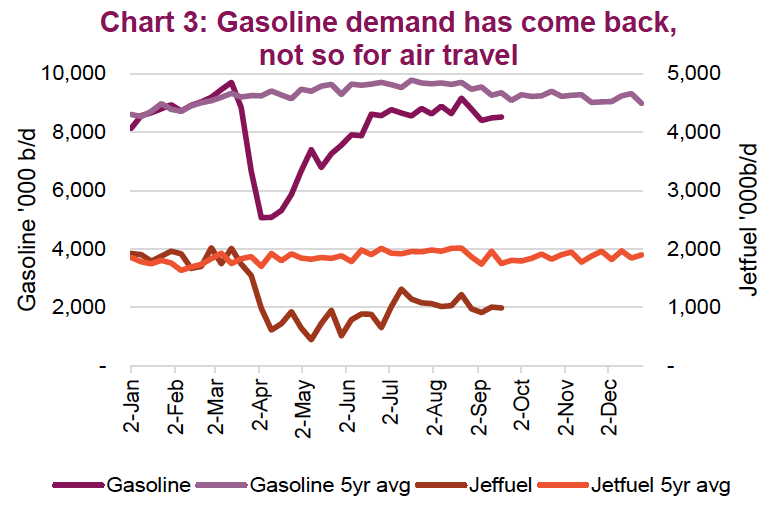

There is good news though. The global trend towards reopening continues, with some stumbles along the way. U.S. gasoline demand is down slightly from last year but has recovered most of the declines from earlier this year. It seems that driving is now in vogue with fewer folks choosing to fly or hop on a bus. Flight departures have improved but remain well below previous levels (Chart 3). Demand is improving and progress on a vaccine, along with better testing will likely accelerate this trend.

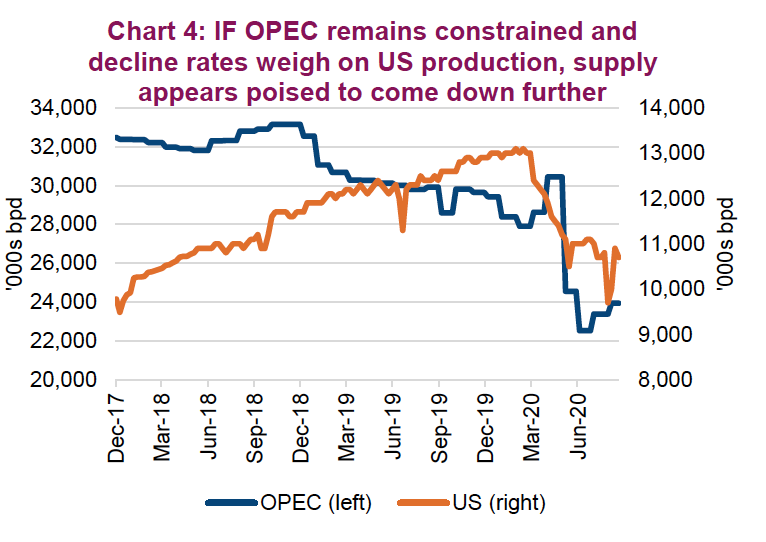

Supply - On the supply side, the realization of a longer-term drawdown is contingent on OPEC plus production staying in check; current prices are still significantly below a large portion of the world’s supply cost curve, which should assist in keeping production low. U.S. production, on the other hand, has become somewhat of a wildcard in the forecasting equation. Energy companies have significantly reduced capital spending this year, to the detriment of future growth. While U.S. production has regained what was lost due to hurricanes in the gulf, it is still down nearly 20% from where it was in March. For now, the U.S. shale producers remain focused on capital preservation. Given the current low drilling activity, natural decline rates should begin to significantly weigh on production in the coming quarters (Chart 4).

Oil inventories remain elevated, but the demand situation has improved from a few months ago. On a positive note, gasoline inventories have come back to historical levels. Refiners are running at lower utilization rates, pulling forward maintenance schedules to take advantage of the lull in demand. One outlier at the moment is historically high distillate/diesel inventories. Overall though inventories are much improved relative to the 2nd quarter.

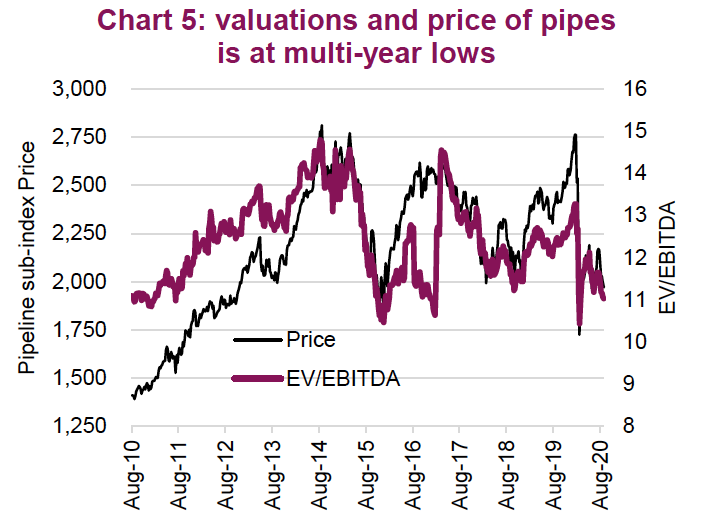

A look at the pipes

The pandemic severed global energy demand and caused a glut of over-supply of oil globally that is still being worked through. This has led to project cancellations, limiting future growth and current pipeline under-utilization, which is weighing on over-levered balance sheets for mid-stream pipeline companies. Those are known facts to most energy market participants. That bearish backdrop seems to be baked into valuations. Most mid-stream companies are not trading much above their March lows. The path forward we envision has demand slowly begin to normalize and the lack of investment we have seen over the trailing several quarters rationalizes supply of oil and takeaway capacity of pipelines. This appears to be an attractive entry point for more patient investors, assuming of course the economic recovery continues and builds into a more constructive 2021.

Capex plans from most mid-stream players have been drastically dialled back to preserve cash for debt and dividends. Combined, the 20 largest North American mid- stream companies have cut back capital spending this year by 29% or $10bb versus 2019. This should help relieve some stresses on the balance sheet debt loads. But not all capex was eliminated as some projects were already under construction and others are still expected to be built, such as Enbridge’s Line 3. As new capacity already under construction comes online, utilization rates could fall further, hurting profitability. This can be an issue because typically these businesses use extensive amounts of debt to operate and probably did not model in the downside of a pandemic.

Much of the recent increase in U.S. production from the shale region was being exported instead of displacing the heavy crudes from Canada and Mexico. This is because shale producers and pipes are hamstrung as the oil drilled is too light on middle distillates such as diesel and jet fuel, which are much higher in demand than gasoline. The U.S. is now expected to produce 1.5-2mm fewer barrels per day this year compared to last. U.S. export capacity is more than capable of handling falling shale crude supply in the next few years; which will hurt future growth prospects for U.S. energy infrastructure.

Canadian producers and pipes seem to be in a better spot. There is continued demand for heavier Canadian oil. However, regulatory / political hurdles remain the biggest challenge in any new project approvals. This does increase the value of any pre-existing pipeline but limits growth. With the new environment of lower prices and demand, those growth projects might be even harder to get through the approval process.

Investment implications

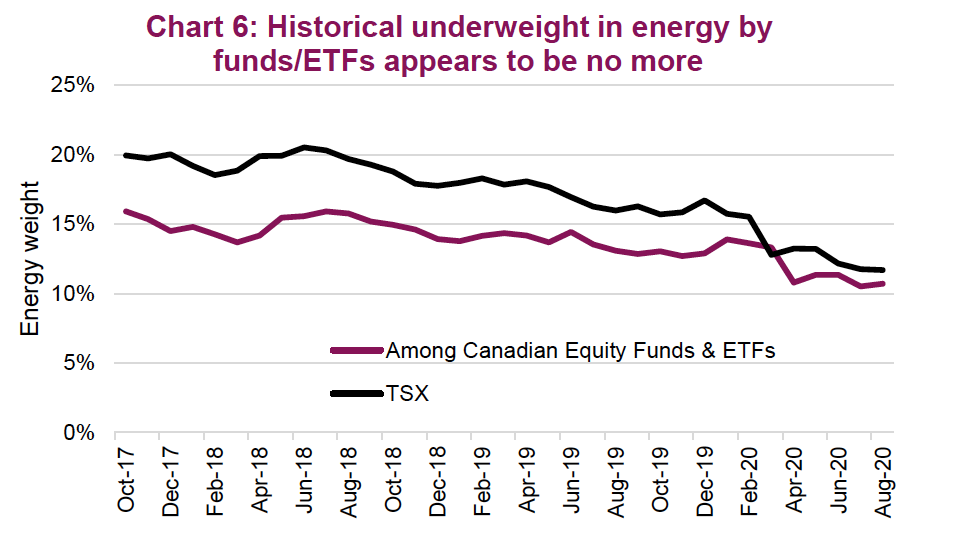

The near-term path of the pandemic and economic recovery remain the big questions as to whether this is a timely period for energy or a continued value trap. However, lower prices reduce risk, especially for those companies that are more financially resilient or stable. And prices are certainly lower. This does have us more constructive on the sector now than in the past. It is also worth noting that historically Canadian funds/ ETFs have been typically underweight energy. In 2017, when the energy sector carried a 20% weight in the index, the fund world was about 5% underweight (a good call). Today, with the index around 11%, that underweight gap has largely closed. Perhaps more portfolio managers are starting to see value in this long beaten down sector.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson GMP Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, NL and PEI. Additional administrative support and policy management are provided by PPI Partners. Insurance products are not covered by the Canadian Investor Protection Fund.

Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.

Copyright © Richardson GMP