by Don Vialoux, EquityClock.com

Technical Notes for August 10th

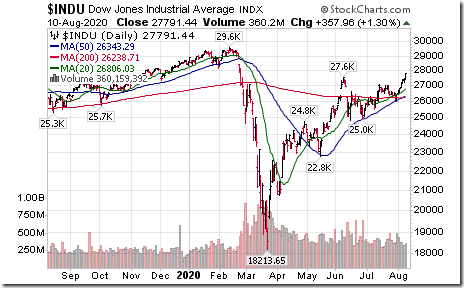

Dow Jones Industrial Average (DJIA) moved above 27,580.21 extending an intermediate uptrend.

Dow Jones Industrial Average ETF (DIA) moved above $275.37 extending an intermediate uptrend.

S&P 500 SPDRs (SPY) moved above $335.62 to an all-time high extending an intermediate uptrend.

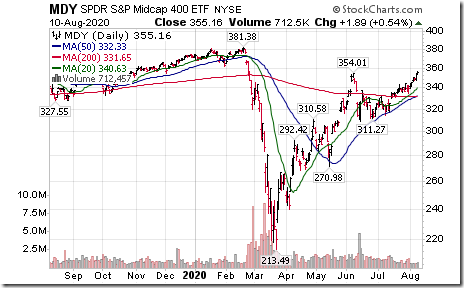

Midcap 400 SPDRs (MDY) moved above $354.01 extending an intermediate uptrend.

Nike (NKE), a Dow Jones Industrial Average stock moved above $104.69 and 105.07 to an all-time high extending an intermediate uptrend.

Steel ETF (SLX) moved above $38.89 extending an intermediate uptrend.

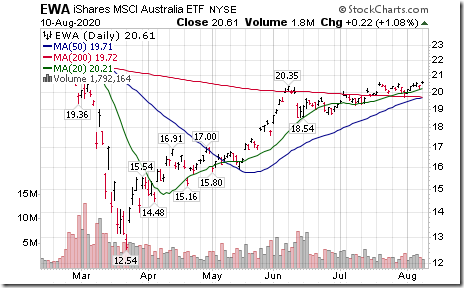

Australia iShares (EWA) moved above $20.60 extending an intermediate uptrend.

Gildan Activewear (GIL), a TSX 60 stock moved above $24.58 extending an intermediate uptrend.

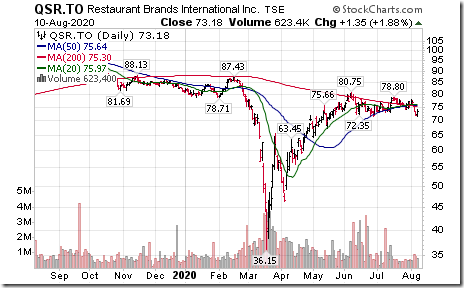

Restaurant Brands International (QSR), a TSX 60 stock moved below $73.35 completing a double top pattern.

Trader interest in Canadian “gassy” stock has returned following news that Canadian Natural Resources has offered to purchase Painted Pony. Advantage Oil & Gas moved above $1.84 setting an intermediate uptrend and Freehold Royalties moved above $4.39.

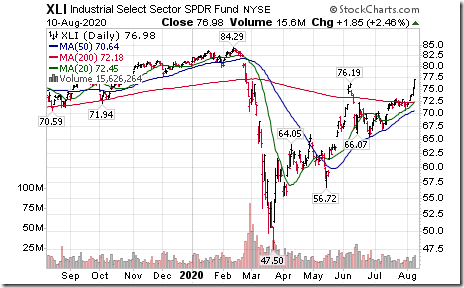

Industrial Sector SPDRs (XLI) moved above $76.19 extending an intermediate uptrend.

Technical Scoop

Latest weekly report by David Chapman and www.EnrichedInvesting.com. Following is a link:

Trader’s Corner

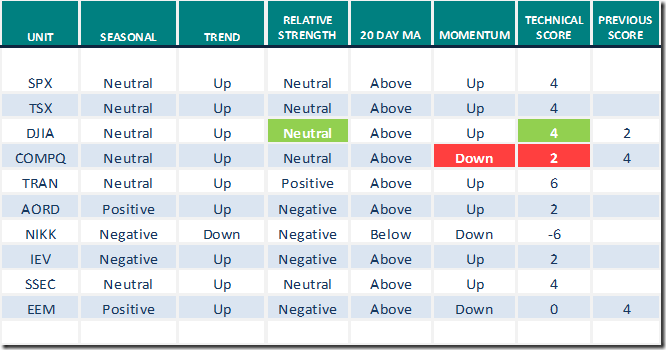

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 10th 2020

Green: Increase from previous day

Red: Decrease from previous day

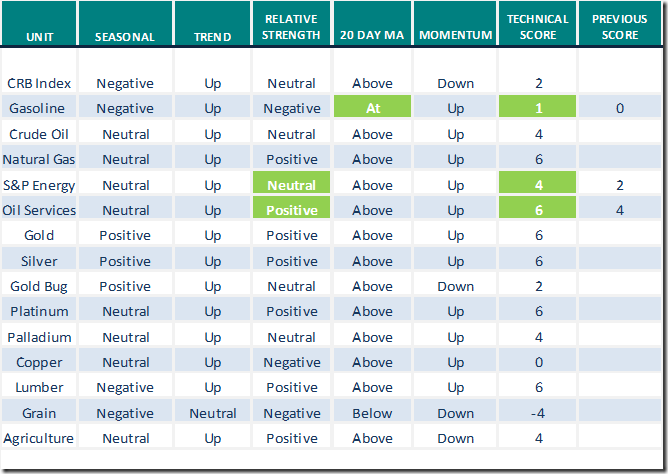

Commodities

Seasonal/Technical Commodities Trends for August 10th 2020

Green: Increase from previous day

Red: Decrease from previous day

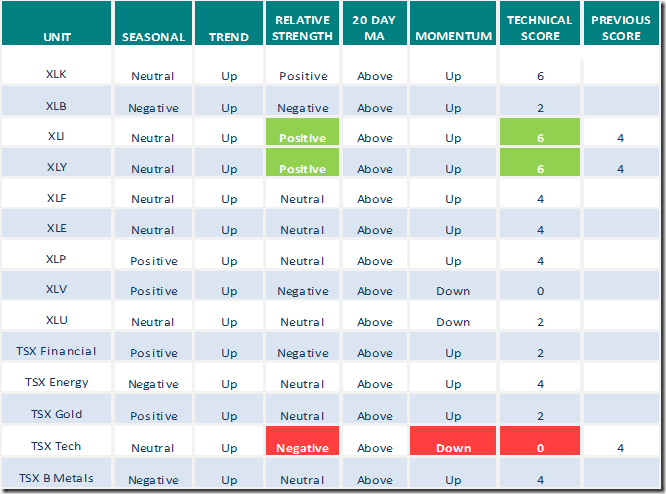

Sectors

Daily Seasonal/Technical Sector Trends for August 10th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer added 5.81 to 80.16 yesterday. It changed from intermediate overbought to extremely intermediate overbought on a move above 80.00.

TSX Momentum Barometer

The Barometer gained 2.86 to 81.90 yesterday. It changed from intermediate overbought to extremely intermediate overbought on a move above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.