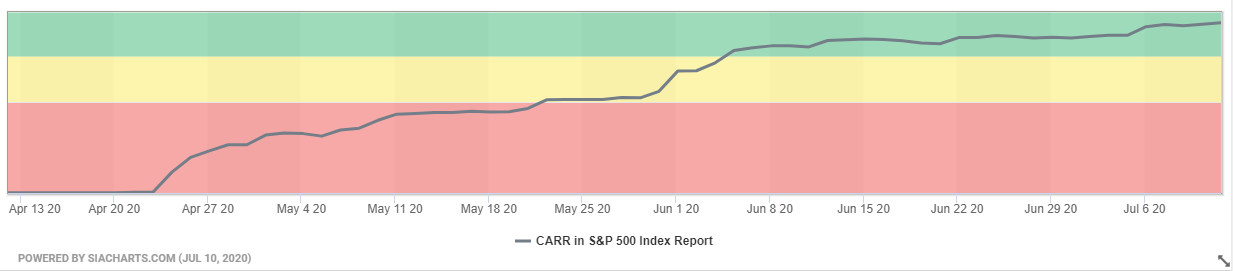

Since being spun out of United Technologies back in March, furnace and air conditioner producer Carrier Global (CARR) has climbed up from the Red Zone to the Green Favored Zone in the SIA S&P 500 Index Report. On Friday, CARR moved up another 4 spots to 35th place.

Since being spun out of United Technologies back in March, furnace and air conditioner producer Carrier Global (CARR) has climbed up from the Red Zone to the Green Favored Zone in the SIA S&P 500 Index Report. On Friday, CARR moved up another 4 spots to 35th place.

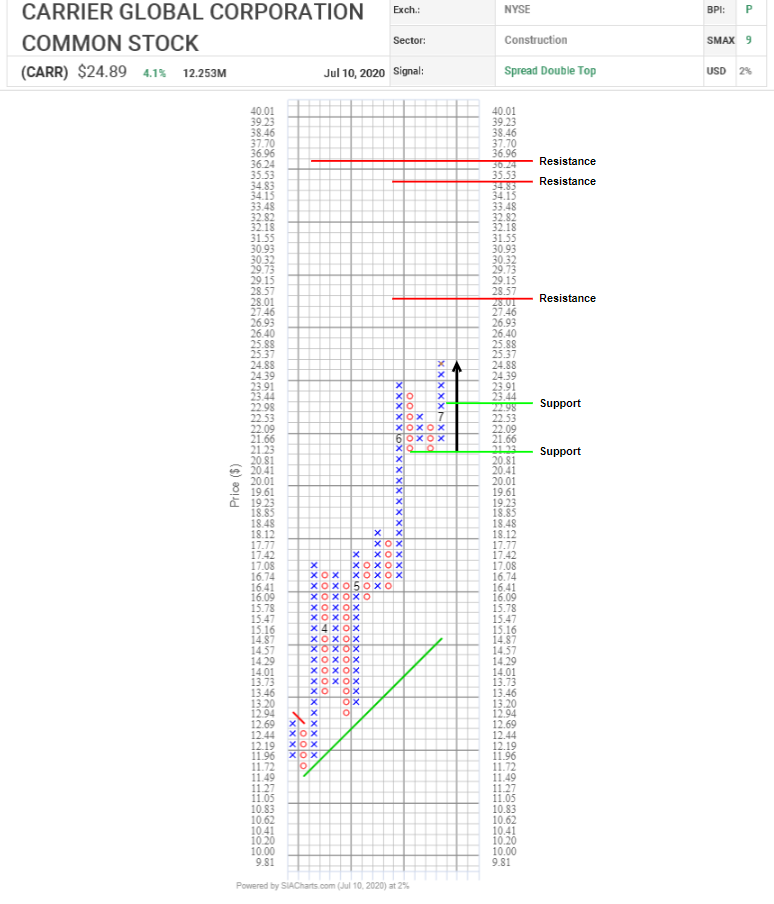

Carrier Global (CARR) staged a major breakout on Friday, blasting through $24.50 to a new all-time high, and completing a bullish Ascending Triangle pattern to signal the start of a new uptrend. With trend support in place near $23.00, next potential measured resistance on trend appears near $29.00, then the $30.00 round number.

Back in April, CARR shares bottomed out near $13.00, and since then, they have been under steady accumulation. A breakout rally carried the shares up into the $21.00-$24.oo range where they consolidated at a higher level. On Friday, the shares broke out to the upside completing a bullish Spread Double Top pattern and signaling the start of a new upleg. Next potential resistance tests appear near $28.55 based on a horizontal count, then the $30.00 round number and the $35.50 to $37.00 area based on vertical counts. Initial support appears near $23.00 based on a 3-box reversal.

With a perfect SMAX score of 10, CARR is exhibiting near-term strength across the asset classes.

With a perfect SMAX score of 10, CARR is exhibiting near-term strength across the asset classes.