More infections lead to more worry, while the commercial real estate and tourism sectors are put to the test.

by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

Summary

- The Coronavirus Breaks Containment

- Space Available

- The Cost of Staycations

Carl offers thoughts on the progress of the pandemic.

I belong to an international economic association that meets annually during the summer. We had been set to gather in Madrid earlier this month, but COVID-19 forced us to scuttle those plans. Fortunately, we were able to share conversation via video conference; unfortunately, we had to schedule those discussions at odd hours to accommodate members from around the world. There is nothing more stimulating than a 3 a.m. lecture on modern monetary theory.

Many of the presenters began their segments with a review of the pandemic’s progress through their regions. Some (Australia, Japan) are well past peak rates of infection; others (Brazil, India) are seeing cases increase rapidly. As we discussed in our recent essay covering the four curves of recovery, the path of the virus will have a critical impact on economic performance in the quarters ahead.

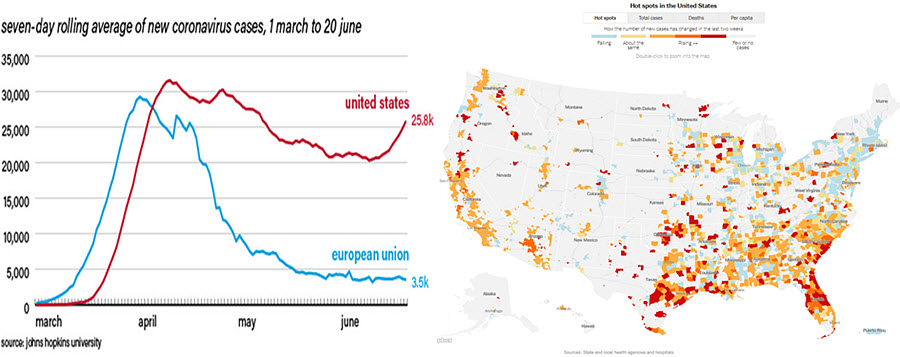

On that front, the United States is not faring well. The U.S. is almost alone among countries in having seen contagion fall from a peak, only to accelerate a second time. A handful of U.S. states have witnessed a significant increase in cases during the past several weeks. In general, the areas that reopened earlier and were more relaxed about enforcing preventative measures have seen the biggest outbreaks.

In response, some places have slowed their reopening schedules and reinforced requirements for masks and social distancing. The risk of renewed closures is rising. Even if communities stick to reopening plans, consumers may hesitate to go out again amid the renewed risk of infection. After gaining nicely over the past month, restaurant reservations in some of the hotter spots for COVID-19 have fallen off.

The economic consequences of the resurgence in cases could be substantial. More people will be out of work for longer, and more firms will face bankruptcy. Policy will be challenged to address a more prolonged period of business interruption.

Earlier this year, some public health officials predicted that the pandemic would burn itself out by summer. Unfortunately, it still appears too hot to handle.

Re-Building

For decades, cities have raced to enhance their skylines with tall structures. A strong architectural profile, it is thought, projects the image of a strong economy and society. And filling those buildings with office workers adds to the vitality of the central business district. But as the global economy emerges from the COVID-19 lockdown, our relationships with commercial property will evolve in important ways.

The office sector entered the crisis in reasonably balanced condition, with steady vacancy rates and solid rental rates. But most office-based businesses have transitioned their employees to working remotely, leaving landlords in an unusual position: Office spaces are leased and furnished, with no one showing up to them. Most office tenants are still paying rent, but most are also taking a hard look at when—and whether—to return.

The recession is weighing on tenants’ prospects. Property manager JLL reported that as the crisis took hold, more than 42% of its 8,500 tenants had inquired about rent relief. The requests came from all types of businesses and all property classes, with ground-floor retail occupants of commercial buildings feeling the greatest stress. Moody’s Analytics forecasts a vacancy increase from 16.8% in 2019 to 19.4% by the end of 2020.

“The lockdown is leading businesses to question their office needs.”

The long-term outlook for the office market is tentative. The lockdown has proven the viability of remote work for many sectors. In years to come, location strategy shifts may lead to less demand for office spaces, especially in dense, higher-rent areas.

The industrial sector is more resilient. One immediate effect of the lockdown has been a greater reliance on e-commerce for shopping and delivery. Goods sold online must be stored and fulfilled in warehouses, bolstering demand for warehouse space. Outside of warehousing, industrial properties also stand to benefit from trade tensions. As global supply chains are called into question, demand for local production is poised to increase, which would increase demand for production facilities.

Multifamily residential properties are holding up well thus far. The National Multifamily Housing Council reported that 92.2% of renters had fully or partially paid their June rent as of June 20, consistent with the figure in 2019 and building on the already-strong 90.8% who had paid in May. However, other surveys suggest landlords of smaller properties are seeing a higher rate of non-payment. Thus far, U.S. households are benefitting from a greater ability to maintain income by working from home, the economic incentive payments made in April and expanded unemployment insurance. Stress will build as one-time stimulus payments are spent and limited-time supports expire before tenants can return to work.

We will watch with keen interest whether the lockdown experience changes tenant preferences. The appeal of living in a small but centrally located apartment is diminished when offices and nearby amenities are all closed. Workers who can work remotely may come to prefer the extra

space and greater affordability of living in a more remote location. Early readings from the areas surrounding London suggest buyers are moving toward lower-cost areas.

Turning to retail, the outlook worsens. The long-running trend toward e-commerce has reduced demand for in-person retail shopping. The vacancy rate for retail locations has been elevated for years; now, as businesses fall behind on rent, it will rise further.

Not all retail tenants are troubled. Essential businesses like grocery stores and pharmacies have stayed open. Garden and home improvement stores are finding even more businesses as consumers pay greater attention to their homes. But not all tenants have been so fortunate. Many businesses are now reopening with dramatically altered business models, like restaurant dining rooms sitting empty and masked barbers working by appointment only.

“Hotels and many retailers are at the mercy of the virus.”

Commercial rent delinquencies have spiked in the retail sector. The outlook for these portfolios is tough; while people will continue to visit businesses, much of the altered demand will persist. The most accessible, visible locations will find occupants, while less-desirable locations will struggle.

Hotels are another sector facing a long journey back to normal. Though they entered the crisis on sound footing, they are a highly cyclical sector that experienced an overnight collapse in demand. Tourist nights in hotels will return mildly as more destinations reopen. The outlook for business travel, however, is much more cautious: Employers do not want to place their employees at risk by asking them to travel, nor are many businesses open with workers on-site to receive visitors.

Across asset classes, relief for tenants has been limited. With cash flows going to zero, making the rent is beyond many businesses’ capacity. The Paycheck Protection Program (PPP) allowed for small businesses and restaurants to use up to 40% of loan proceeds to pay non-payroll expenses like rent, but the program is already winding down. Central bank interventions are holding the cost of debt low, but businesses must be creditworthy to qualify for loan approvals and bond issuance.

Owners of commercial properties have little recourse. While they are within their rights to evict a non-paying tenant, they would then be left with a vacant space that will be difficult to fill. Many banks that hold commercial property loans on their balance sheets are offering to work with borrowers to defer principal payments. Commercial mortgages packed into commercial mortgage backed securities (CMBS), however, are less flexible. Working out a modification for CMBS loans is a complex and slow-moving process that may not end in the borrower’s favor. This week, the U.S. House of Representatives called upon the Treasury and Federal Reserve to extend a credit lifeline and simplify repayment plans for commercial property owners.

With all these words of caution in place, many old aphorisms about property markets still stand: “They aren’t making any more land.” “Location, location, location.” Opportunistic buyers are finding deals, such as Canadian asset manager Brookfield recently launching a new fund to purchase commercial properties in Europe. Throughout modern history, city living has stayed in demand due to cities’ combination of commerce, convenience and culture. Those dynamics will remain in place, especially in well-connected global cities.

More than three months into the lockdown, many of us are forgetting what offices and hotel rooms look like. Reopening post-COVID will require adaptability, not merely to social distancing, but to a new understanding of where and how we live and work.

Hotspots

Vaibhav reviews the hit to global tourism.

A few days ago, I had my mid-year review discussion with my manager. Among several other important exchanges, he asked me to plan some “time off” this summer. I think he deliberately avoided using the word “vacation.” While our company policies support getting away from our computer screens for a while, our possibilities are limited this year.

Restrictions on travel introduced in response to COVID-19 are gradually being lifted. Domestic flight services have resumed. According to the United Nations World Tourism Organization (UNWTO), as of June 15, about 22% of world destinations have eased travel restrictions, compared to just 3% in mid-May, with Europe leading the way. But about 65% of locations (141 destinations) still have their borders fully closed to foreign visitors.

“Tourism accounts for more than 10% of global GDP.”

The $8.9 trillion travel and tourism sector, equivalent to 10.3% of world gross domestic product (GDP) and the source of employment for 330 million people, has taken a serious hit. From tour guides to street vendors and airlines to hotels, businesses dependent on tourist spending are incurring heavy losses. Inbound arrivals have tanked and are likely to remain depressed this year. Oxford Economics and UNWTO expect arrivals to fall by over 50% in 2020. In a worst-case scenario where intercontinental travel restrictions remain in place until November, the UNWTO expects international arrivals to drop by over 70%, contributing to about 200 million job losses.

Regions with high dependency on tourism dollars are the most affected. More than 25 countries rely on tourism for substantial amounts of their GDP. In some cases, the dependency is well above one-fourth of national output. Caribbean and South East Asian economies like the Maldives, British Virgin Islands and Dominica are the most reliant on tourism. Among developed markets, already vulnerable European nations like Greece, Portugal, Spain and Italy are the most dependent. China figures prominently, not just as a frequent destination, but also as the largest outbound travel market. Chinese visitors took 150 million international trips in 2019.

Many governments have responded swiftly to soften the blow of COVID-19 on this hard-hit, labor-intensive sector. Interventions thus far include incentive programs to airlines, new loan schemes for tourism businesses, cash flow assistance to travel agencies and wage subsidies to retain jobs. These relief measures might prevent the sector from falling into a deeper hole but won’t help businesses emerge from it.

Enduring travel restrictions aren’t the only factor that will hold back tourism. Fears of contracting COVID-19 and drained consumer confidence amid the unprecedented economic contraction will also continue to weigh on the sector.

With international travel unlikely to normalize anytime soon, countries are turning inward. Owing to their high domestic travel share, large countries like the U.S., Japan, China and Australia are less vulnerable to international travel restrictions. Paired with stringent safety norms, initiatives to restart and promote domestic tourism policies are nations’ best bet; this is one of the few benefits of nationalism in these times. Many countries are running campaigns promoting virtual tourism, which could offer minor solace but would still confine travelers to their four walls.

“Domestic tourism is the best hope for the sector’s revival this year.”

Sidelined globetrotters are missing the holiday vibes and reminiscing by watching travel videos on their electronic devices. During my “time off,” I will probably enjoy some of those videos myself—from the comfort of my living room.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2020 Northern Trust Corporation