by Tony Scherrer and William Smead, Smead Capital Management

On June 4, 2020, eBay (EBAY) released a business update to make investors aware that the quarantine circumstances have caused their business to perform “significantly better than expectations,” compared to their earnings report on April 29, 2020. Here is what they shared:

- Strength in global gross merchandise volume (GMV) seen in April has continued through May, and the Company now expects full Q2 volume growth rates to land between 23% and 26% as compared to the prior year period.

- All major verticals are accelerating significantly compared to previous quarters, including Home & Garden, Electronics, Fashion, Auto Parts and Collectibles.

- Demand strength is driven by increased organic traffic, better marketing efficiency, and higher platform conversion.

- Active buyer growth is accelerating, with approximately 6 million new and reactivated buyers added in April and May.

- More sellers are joining eBay through efforts like Up & Running. Since March 2020, tens of thousands of small business sellers have been added to the platform.

- Classifieds revenues are performing at the high end of previous expectations disclosed on the Q1 earnings call with automotive subscription revenues recovering as dealerships reopen across international markets.

Contrast this update with what the CEO of Amazon (AMZN), Jeff Bezos, said about first quarter results:

Amazon expects to spend $4 billion or more — the predicted operating profit for the company’s entire coming quarter — just on COVID-19-related expenses. In a quarterly earnings release today, Amazon CEO Jeff Bezos said the expenses will come from spending on personal protective equipment (PPE), cleaning for facilities, “higher wages for hourly teams,” and expanding its own COVID-19 testing capabilities.

This got us thinking about business models and how profitable they can be. These companies are in e-commerce and have had the state governments of the U.S. shut down most of the physical locations of their competitors. The last three months were effectively two Christmas selling seasons spread from late winter into spring. Why is one of these business models responding so well to these circumstances? How profitable have these two platforms been in the past? Why does EBAY sell for such a steep discount to AMZN?

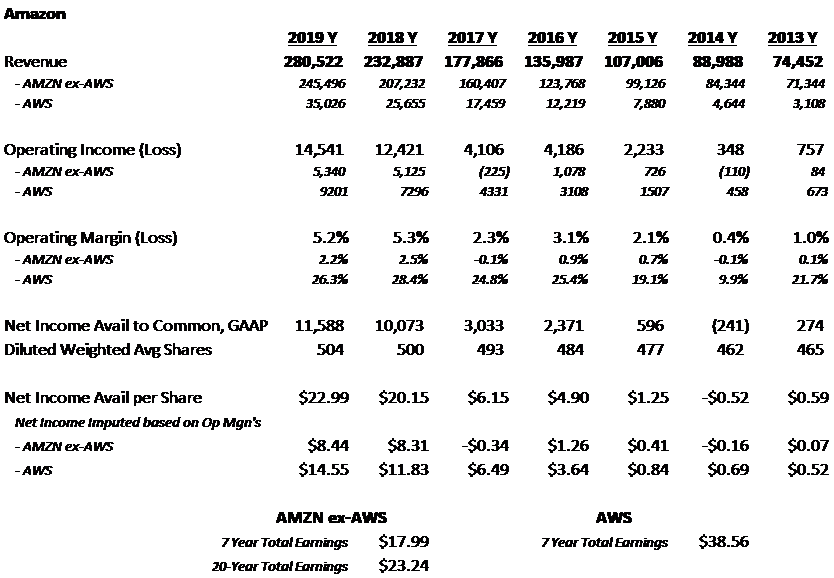

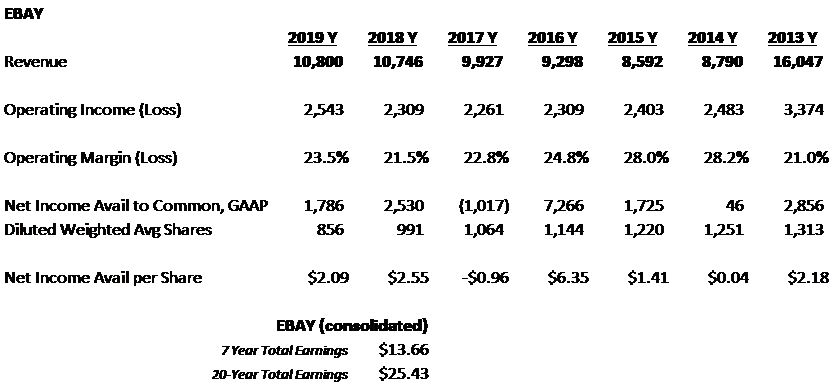

To answer these questions, our Director of Research, Tony Scherrer, and I decided to become 28-year-old business school students at Harvard and do a case study. The study seeks to determine how profitable these business models have been over the last 20 years. To do this, we had to back out the GAAP profits AMZN received from Amazon Web Services (AWS) beginning in 2013. We then compared 20 years of e-commerce profits on a per-share basis.

Here is a snapshot of the last seven years on each:

Source: Amazon Annual Report, Bloomberg

Source: eBay Annual Report, Bloomberg

There are several obvious contrasts. First, EBAY has generated more cumulative earnings per share for its shareholders over the last 20 years than AMZN has, sans its cloud business. Amazon’s e-commerce business boasted 8x more in revenue than EBAY’s over the last 20 years, but EBAY was able to generate $25 in earnings per share from its revenue vs. the $23 per share that Amazon could bring to its bottom-line. Second, the operating margins on EBAY have averaged 24%, versus AMZN’s without AWS of less than 1% over the last seven years. Third, the average annual earnings growth for the past decade has been 4.4% for EBAY vs. 12.8% for AMZN (ex-AWS). It’s notable that EBAY has shrunk its share count by 35% since 2013 vs. AMZN increasing its by 8%. The cash-flow generated by EBAY has allowed it to buy back ample amounts of its own stock.

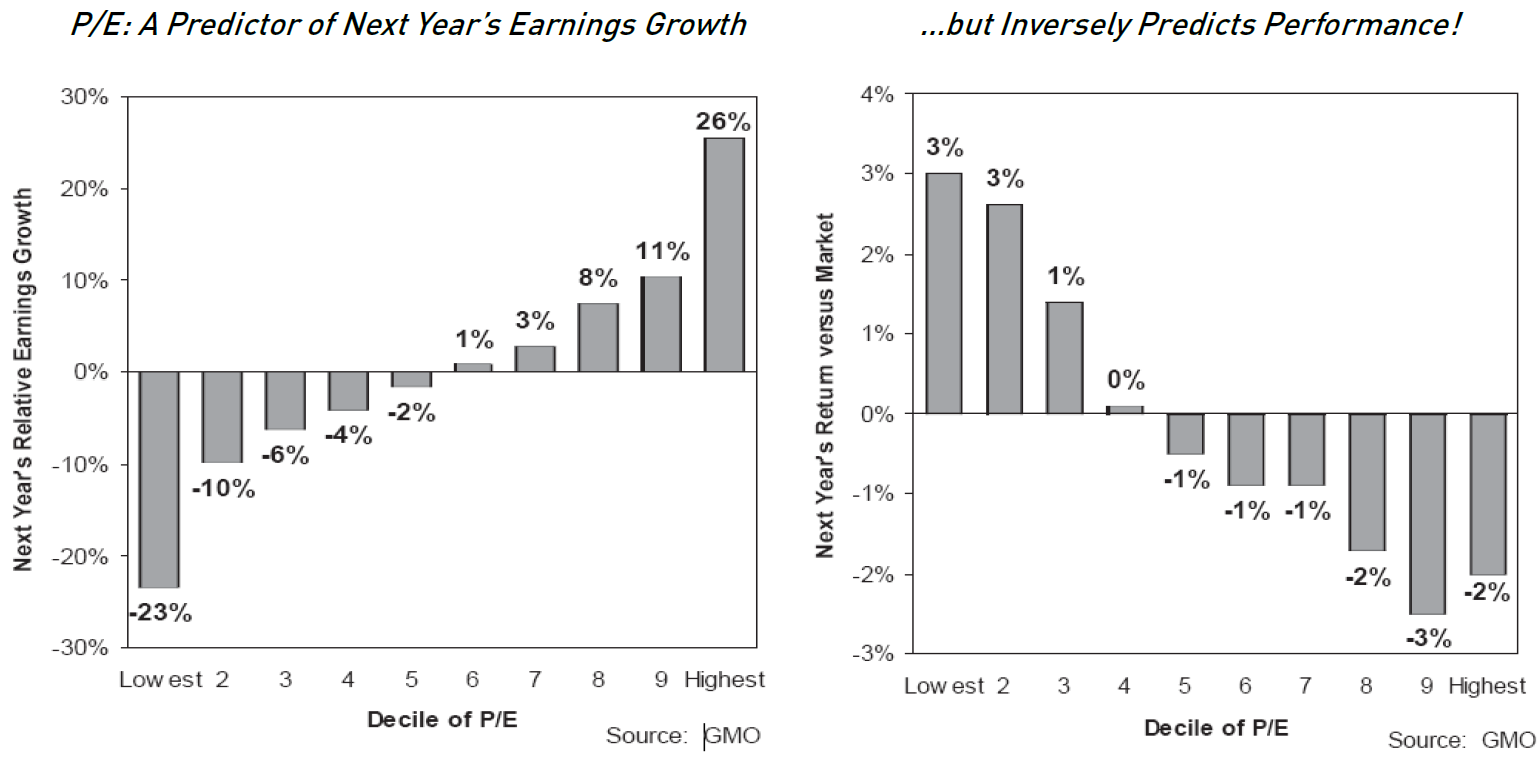

Ben Inker, of Grantham Mayo Van Otterloo, has done strong work in showing that high price-to-earnings (P/E) stocks do a great job in predicting what companies will generate high earnings growth over the next 12-months. Unfortunately, it also shows that these same highly valued stocks are inversely related to forward stock price performance.

Source: Grantham Mayo Van Otterloo

The EBAY vs AMZN comparison may be a case in point for Inker’s work. Current consensus opinion on Amazon’s future long-term earnings growth rates is 26% per annum, consolidated. This compares to eBay’s consensus of 12%. Benjamin Graham, in his revised formula for valuation published in The Intelligent Investor gives credit for high growth companies. Using the forward expected GAAP earnings of $3.50 for eBay, Graham’s formula implies Intrinsic Value of $91 per share vs. its current price of $47.69 per share as of June 15, 2020. Using forward GAAP expectations of $18.86 for AMZN implies $927 per share Intrinsic Value against it’s current $2,550 trading level.

Over the last 20 years, EBAY’s consolidated e-commerce model has produced more earnings than AMZN’s, but is a distinctly different business model. EBAY is a virtual exchange where buyers and sellers meet. There is no membership fee, no inventory, no logistics and no grief. The industry analysts have 2020 consensus estimates for them to earn $3.50 after-tax profit per share, which means EBAY trades at just over 14 times this year’s profit. They are preparing to sell the classified advertising business for $8-10 billion and EBAY has a market capitalization of $40 billion. They have $3 billion in cash and $7 billion of existing debt, while gushing copious free-cash flow.

AMZN has two main components, AWS and e-commerce. It has a market cap of $1.27 trillion. Using a very healthy multiple compared to other high-growth digital behemoths, we estimate that AWS would be worth about $350 billion at 50 times after-tax profits. Readers can insert their own multiples here in picking whatever number they think is realistic. Remember, we are a couple of hypothetical 28-year-old business students at Harvard. If AWS is worth $500 billion, or around $1,000 per share of Amazon, then the stock market (Mr. Market) is pricing the e-commerce/fly wheel side of Amazon at $1,550 per share and putting a P/E multiple of 188 times on its 2019 GAAP earnings. Is eBay’s business, which has produced the most e-commerce profit in the last 20 years, really worth that much less than the one which is adored by investors?

EBAY has a business model far different from Amazon, which is drastically easier to run and maintain. It does not have to own and operate warehouses, delivery trucks, fleets of long-haul trailers or airplanes. EBAY does not have to fight the ever-increasing call of antitrust and is not continually working against its own sellers as it develops and increases its own private-label brands. This may explain why eBay shrank its headcount from 17,700 a decade ago to 13,300 today vs. Amazon’s 24,300 headcount in 2000, which has exploded to today’s eye-popping 798,000. Accordingly, EBAY does not have any costs associated with Covid issues for warehouse workers, wage-creep, or the other labor-oriented issues that Amazon has had to deal with lately. Therefore, AMZN’s e-commerce business model is doomed to low profit margins as they pursue massive totally addressable markets.

We have been thrilled to own EBAY for 12 years and like its prospects for the future. We are comfortable owning businesses based on free cash flow and profit growth. We will leave the AMZN stock in the “too hard” pile and tip our caps to those who it makes wealthy despite these contrasts.

Warm regards,

William Smead

Tony Scherrer, CFA

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, and Tony Scherrer, CFA, Director of Research and Portfolio Manager, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2020 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.