by Chris Kerlow, Alexander Tjiang, Craig Basinger, Derek Benedet, Richardson GMP

“Everyone has a plan until they get punched in the mouth” – Mike Tyson

The great financial crisis of 2008 was spurred in large part by the implosion of the U.S. housing market. The cause of today’s crisis is much different; it all began in a wet market in Wuhan, China. Which has led to a recession and double-digit unemployment figures, with our service industries hardest hit as forced lockdowns rolled across the globe. With restrictions easing for businesses in North America, we are beginning to get back to what will now be called “normal”. Every business owner is taking a calculated approach to restarting and many are still trying to figure out how to survive these challenging times fraught with uncertainty. At the top of this list (hopefully) is safety for workers, customers, and society. Just below is business sustainability. In every business owner’s sustainability plan, costs need to be rationalized, and one of the largest costs that operators incur is tied real estate.

Many a business owner or C-suite executive would have come into 2020 with a long-term plan for their real estate needs. It now must feel like those plans got punched in the mouth. Still, it would be imprudent not to consider what options are available at the end of your commercial lease. The nature of a business ultimately determines the urgency of the real estate decisions. Many retail and service business have had to already make tough decisions to stop paying rent or ask for a deferral. In aggregate, Canadian retail REITs collected only 65% of rent during April.

Dissecting REITs

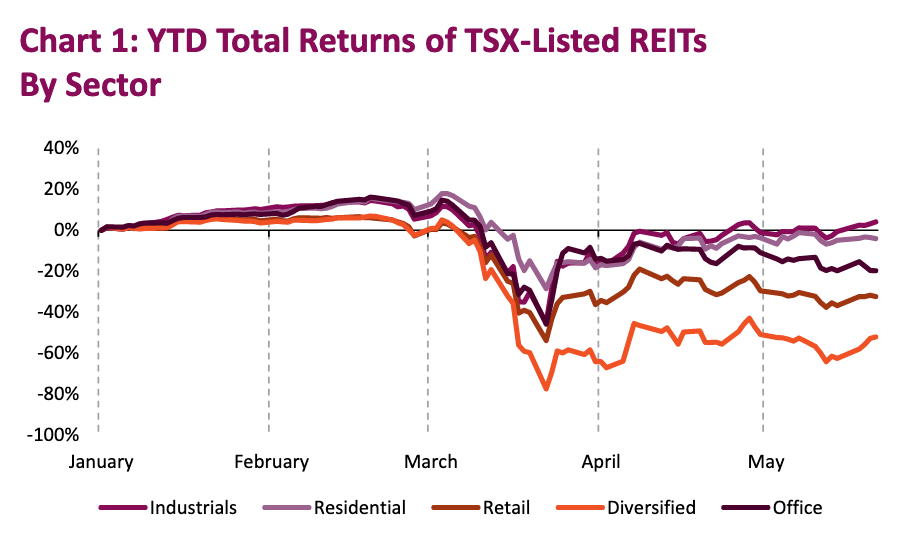

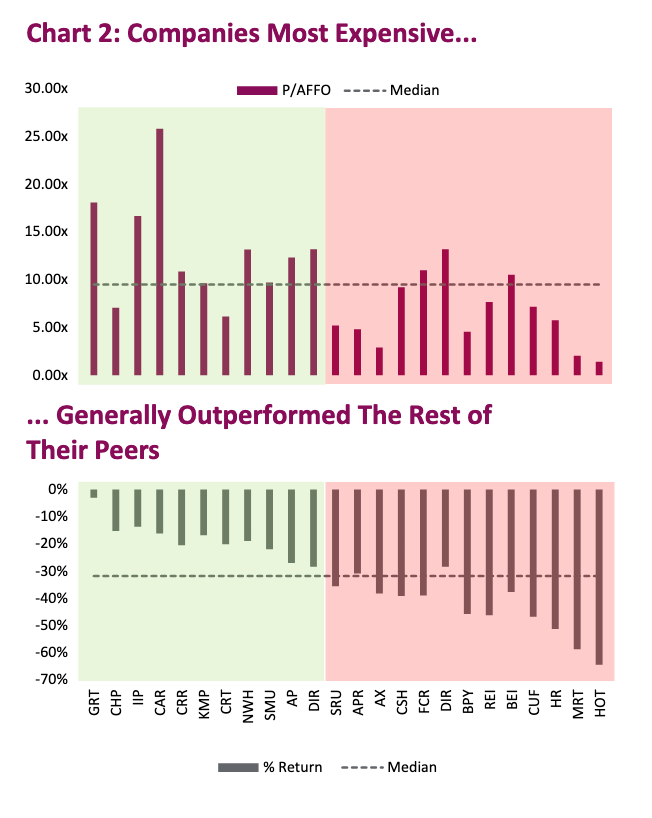

Buildings and houses do not price every single day. However, public REITs that own these assets do. During the sell off, the entire REIT sector was dragged down alongside the market (Chart 1) and some sub-sectors largely missed out on most of the recovery. For context, the sum of those parts, the S&P TSX REIT Index is still down more than -25% year to date. However, looking at the average does not tell the whole story. Sub-sectors such as data centers, industrials, and some multi-residential REITS have fared decently, all things considered. Yet valuations already reflect that optimism (Chart 2). Increasing demand of data-centric space and fulfillment center warehouses has likely increased, but the outlook for office and retail is quite grim, with residential falling somewhere in between.

Crises rarely start lasting trends. However, they can mark important inflection points: consider how more advertising programs having shifted from physical mediums to more digital outlets after the ‘08 crisis, or the intensification of safety protocols at airports after 9/11. We had already started to move in that direction in both those cases, but it took that punch in the face to make it the new normal. Prior to this crisis, society was already witnessing a movement away from shopping at malls to e-commerce; work from home or hoteling office space was also increasing in popularity. These last several weeks have irrefutably forced us in that direction and will likely leave a lasting impression. Both trends could have staying power.

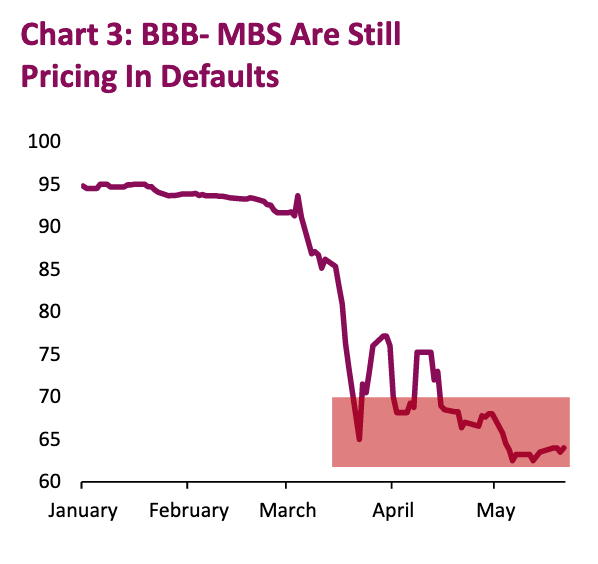

That ominous outlook for the necessary physical space needed for office and retail is further reflected in publicly traded REITs. However, we note that it may still be too early to discern whether the data has been fully baked into prices. Great Street Advisors, which manages a commercial real estate index based on appraisals ex-transactions, estimates that commercial real estate prices fell by -10% in April across the U.S. The Markit CMBX BBB- index, which is a reference of the bottom tranche of commercial mortgage- backed securities, fell off a cliff with most credit measurements during the start of the market sell-off in mid-March. Unlike most other asset classes, however, it has only got worse and still sits at 64- to-par (Chart 3), suggesting that the market has yet to price out defaults.

Low bond yields and the high relative REIT payouts are likely not going to be enough to boost share prices until we have crossed the chasm and have visibility for cash flow sustainability. Cash flow disruption as it pertains to rent collection has put dividends at risk for some REITs. By its legal nature, a REIT must distribute 90% of its taxable income to shareholders. Therefore, as cash flows recede, dividend yields are likely to follow.

Admittedly, near-term cash flow issues may very well prove to be transitory and improve as social distancing fades. However, for many office-based and retail companies, social distancing is going to cause operating profits to fall, especially if buildings or insurers require personal protective equipment, sanitizing stations, and protocol to be followed in order to operate. Yet even if compliance is not mandatory, we live in an era with a loud consumer voice and strong public opinion that may nonetheless force compliance onto more operators. Top-lines will also be challenged for a variety of reasons as the restart takes time to ramp up causing consumer demand to lag.

The Operator’s Dilemma

Longer term structural issues are of great concern as companies around the world contemplate reducing their physical footprint. According to Toni Wodzicki, Principal Selling at Avison Young’s commercial real estate division, “Pre-Covid, there was so much demand in major markets you could get off any lease right away and back away, there was so much demand. Everything is on pause right now.” This will potentially take years to play out. At first, social distancing will require more space per employee. In office spaces over the last decade, there has been a trend away from cube farms towards more benching of employees. Given current circumstances, this may begin reversing. However, Toni highlighted the increased demand for lower floors in Manhattan following 9/11 faded over a few years as the desire for city views returned.

For most buildings, lease expiry dates tend to be laddered. If companies are truly looking to downsize their space and demand for new listings softens due to buyers being more selective or not opting in, the market may be prone to a cascading effect of supply influx. Watching the ratio of listings to sales should help as a forward-looking indicator. According to Toni, there was already excess being built in outskirts of major metropolises to accommodate future growth of the services sector; our economy, after all, continues to morph in that direction. Those locations will be even harder to fill now and will likely have to reduce rent to attract potential tenants. Blackstone, one of the largest real estate investors in the world, noted during their earnings call that they are “starting to see some rescue situations”, but added that “distress takes time to play out.”

Portfolio Implications

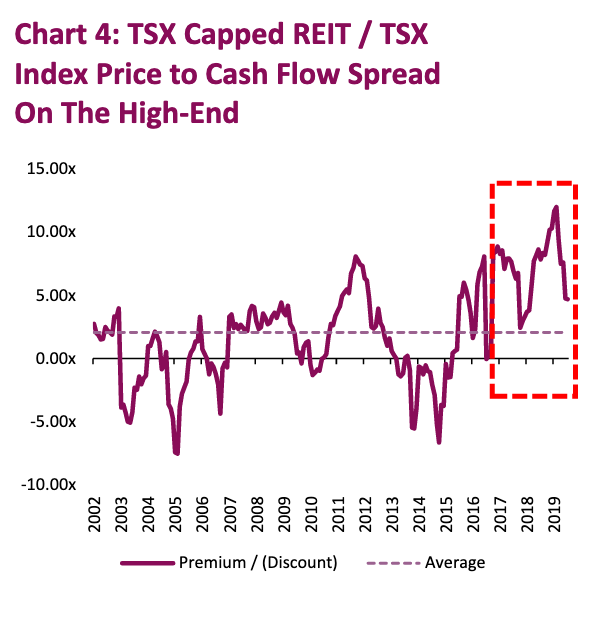

As equities investors, we are constantly considering relative opportunities to place capital. We entered the crisis with very limited REIT exposure, with a large underweight. Our view at the time was that bond yields would grind higher and rent would be challenging to grow quickly from elevated levels. Admittedly, we can’t say we were positioned that way because we saw a pandemic coming. During the sell-off, we opportunistically added some light industrial real estate exposure through Dream Industrial REIT. However, relative valuations of the sector to the market are not attractive and, on many measures, such as price to cash flow, expensive (Chart 4).

The path forward is likely going to become more challenging before it gets easier for real estate operators. Thus, security selection and a focus on both balance sheet strength and macro sub-sector outlooks should be emphasized when investing in the space during these unprecedented times. Next week in our investor strategy report we will take a closer look at the residential real estate environment and share our detailed views there.

*****

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson GMP Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, NL and PEI. Additional administrative support and policy management are provided by PPI Partners. Insurance products are not covered by the Canadian Investor Protection Fund.

Richardson GMP Limited, Member Canadian Investor Protection Fund. Richardson and GMP are registered trademarks of their respective owners used under license by Richardson GMP Limited.

Copyright © Richardson GMP