by Erin Bigley, AllianceBernstein

Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the US Federal Reserve has expanded support for corporate bonds. This is good news for companies that were financially solvent until the coronavirus crisis led to funding woes. We also see it as good news for global credit markets, as significant new supports could effect a regime shift in volatility.

On April 9, the Fed shared details around this support. Up to US$1.35 trillion—more than half of the funds provided under the CARES Act—will be available to support corporations through expanded corporate purchase facilities and the Main Street Lending Program (MSLP).

Specifically, the Fed will expand its Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF) to a total of US$750 billion in purchases, backed by US$85 billion from the US Treasury. The Fed will use the MSLP to buy up to $600 billion in small and midsize business loans outright, using $75 billion from the US Treasury.

Within the corporate purchase programs, the Fed has made some fallen angels—corporate debt downgraded from investment grade to below investment grade—eligible for purchase. These credits must have been rated investment grade as of March 22 but since been downgraded to BB. The central bank will also purchase high-yield ETFs as part of their ETF purchase program.

These actions are another demonstration of the Fed’s willingness to do whatever is necessary to keep the financial system functioning so the economy can restart quickly after the public health crisis has eased.

A Critical Liquidity Backstop for US Corporate Markets

Each of the three corporate-related programs has major implications for the US corporate markets.

First, the SMCCF’s inclusion of fallen angels and high-yield ETFs as eligible purchases should help stabilize markets. The potential for a blizzard of fallen angels to overwhelm the high-yield market in terms of both comparative volume and difference in average market duration (interest-rate sensitivity) has exerted enormous pressure on both bonds rated BBB– and the highest-rated high-yield bonds. With the Fed prepared to buy certain fallen angel debt, that pressure will be reduced.

Second, the PMCCF reduces the risk that fallen angels might not be able to access the capital markets. Through this facility, companies can now meet their refinancing needs within the three months prior to a maturity. The PMCCF also provides fallen angels with liquidity during the crisis. Companies may borrow up to 130% of long-term maturity borrowings, as long as ratings for the incremental debt are affirmed at low BB or better.

Third, the MSLP could be a potential source of capital for high-yield and leveraged-loan issuers. Under the program, the Fed can provide up to US$600 billion of loans for US companies with fewer than 10,000 employees or US$2.5 billion in 2019 revenue.

This could be quite helpful, since the PMCCF isn’t open to below-investment-grade issuers apart from recent fallen angels. That said, there are meaningful constraints in terms of leverage and borrowings, as well as executive compensation, stock buybacks and dividends. These constraints may limit the effectiveness of the program in bridging gaps for high-yield companies.

The Fed’s latest actions don’t change our overall expectations for a proliferation of fallen angels and defaults. We estimate that 8.5% of the US corporate market that was rated investment grade on March 31—representing a total of US$440 billion—will be downgraded below investment grade. In fact, some of these downgrades have already begun. Our expectations for fallen angels and defaults are driven by our bottom-up, fundamental views of companies directly affected by the coronavirus crisis and the oil-price shock. In our view, today’s most stressed issuers will still find it hard to access funding.

But we do expect these programs to provide an essential liquidity backstop for US companies that were otherwise financially solvent before the coronavirus crisis interrupted their access to relatively inexpensive funding. That makes the program expansions fundamentally supportive of weaker BBBs and BBs and technically supportive of the broad high-yield market.

With the expanded programs kicking off as soon as April 16, we expect new issuance of investment-grade corporates to remain robust and high-yield primary issuance to resurge for a range of lower-quality, still-solvent credits.

History Rhymes: Echoes of Europe’s Credit Markets in 2016

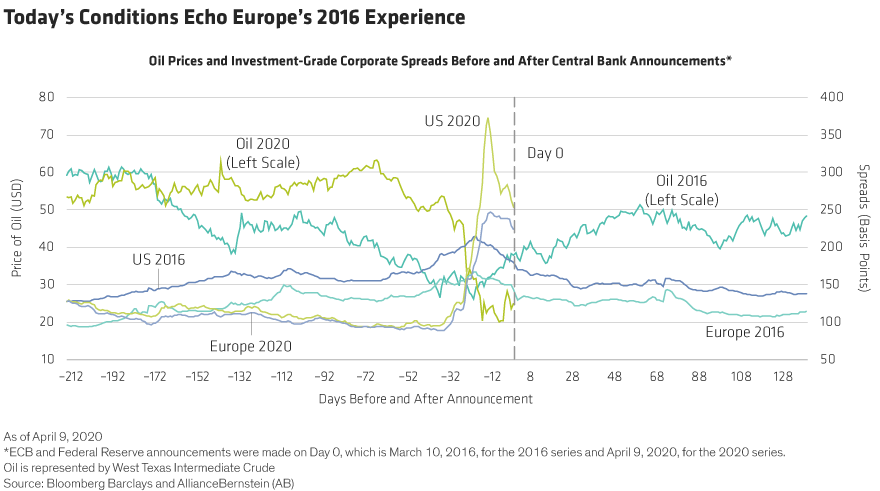

The Fed’s April 9 announcement reminds us of the announcement by the European Central Bank (ECB) of its corporate purchase program in March 2016. In 2016, corporate bond spreads were very wide, oil was in the US$20 range, and fund and ETF outflows and reduced liquidity were creating a challenging environment for corporate bond investors. When the ECB announced its purchase of corporate bonds, spreads began to tighten and oil came off its lows, even though the recovery felt fragile.

That’s very similar to today’s environment in the US. And as in 2016 with the ECB, last week’s announcements from the Fed led to a near-term spread rally (Display). Investment-grade global corporate bond valuations are more attractive today than they’ve been in many years.

Though we are left with many uncertainties and market liquidity remains challenged—and will likely continue to exacerbate sell-offs whenever investors move as a group—we see the Fed’s entry as a holder of US investment-grade corporate bonds as a regime shift. We don’t expect the Fed to be as significant an owner in the US market as the ECB is in the European market, but the presence of the Fed as a long-term, large holder of US corporate bonds should help to temper market volatility worldwide.

Lastly, remember that once central banks begin a program, it’s difficult for them to stop. That was the case when the ECB ended its asset purchase program in 2019 only to resume it 11 months later. The Bank of Japan has also been unable to scale back its 2016 initiative, Qualitative and Quantitative Monetary Easing with Yield Curve Control.

Though we can’t say with certainty that we’ve seen the worst of the coronavirus-driven sell-off in credit markets, we are encouraged by the size and scope of central bank responses. We continue to view global corporate bonds as attractive at current valuations. And we caution investors to be selective in their choice of credits. As corporate winners and losers emerge from the global pandemic, active security selection will be paramount to success.

Erin Bigley is a Senior Investment Strategist for Fixed Income, Eamonn Buckley is a Portfolio Manager for Fixed Income, and Tiffanie Wong is Director of US Investment-Grade Credit, all at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..