by Hubert Marleau, Market Economist, Palos Management

What Happened Last Week

In the week ended April 16, stock prices increased nicely, capping off a second week of gains in spite of devastating global economic prints. Millions of North Americans have filed for unemployment insurance and China’s GDP precipitously contracted in Q1. Investors around the world have decided to look through data anticipating that economies are due to reopen, albeit in stages. Several countries are taking baby steps to bring economic activity to more normal levels. On Thursday evening, the White House announced guidelines-- in the form of a three-step process-- for states to end the coronavirus shutdown.

While Trump's recommendations contributed somewhat to the flare-up in the stock prices on Friday, the markets were all abuzz about promising early data from clinical trials with Gilead’s antiviral drug Remdesivir on coronavirus patients. Additionally, the market took notice that more than 200 different programs have been launched to develop therapeutics and vaccines to combat the Covid-19 virus.

Consequently, the narrative that science might be gaining on the pandemic could not have been better from an ethical point of view for those who advocate an end to the shutdown. The conservative media created hope that the authorities will have the means to quell the global spread of the novel virus in the near future and that science will have a real permanent solution down the road. The Lone Star State and the Sunshine State were quick off the line.

Ultimately, the stock market has bought into the idea that it is time to start rebooting the economy. The belief is that personal precautions, social distancing and widespread testing will be sufficient to effectively contain the spread of the virus whilst giving science the time needed to find remedies to counter the virus. Moreover, investors are certain that the government and its agencies, which have already poured $4.0 trillion into the economy, are hell-bent on making it work.

If the above thesis upon which the market is willing to gamble proves to be correct, the current chaotic episode could fadeaway and allow the economy to resume a near-normal level of economic activity. The market, even without absolute proof, is confident that the eye of the storm has passed. Seasoned investors who rely on market history, are convinced that health disruptions are temporary and that the long term trends are consistently up.

The S&P 500 registered a weekly gain of 2.4% to close at 2758. What is reassuring is that other markets correlated with the upward movement in stock prices.

- The foreign exchange value of the U.S. dollar was relatively stable, holding on to its recent gains. There is growing evidence that the DXY’s upside is limited because it is long in the tooth and technical resistance is visible around 100.00. The extraordinary monetary interventions combined with exceptional fiscal measures have brought aboardin a matter of weeks a $1.0 trillion to the monetary base with a $2.0 trillion increase in the money supply, putting a lid on the dollar.

- The shape of the bond curve was stable—yield differential between 10 and 2 year bonds narrowed mildly from 49 bps to 45, signaling that an economic recovery can still be expected.

- Copper prices made some impressive gains rising 3.5% from $2.27 to $2.35--that is 12.5% from the March low. Interestingly, Brent Crude oil contracts for May 2020 are worth $28.08, that is $10 more than Crude Oil WTI--a 55% premium. Moreover, if U.S. users of oil were to buy a December oil contract, he would pay $37.50—87.5% more than the spot price. The commodity markets are clearly suggesting that economic activity is rising in Asia and better economic conditions can be expected later this year in America.

- Credit conditions have significantly improved. Yield differentials between corporate bonds and U.S. Treasuries have narrowed more than 100 bps in less than a month. The Louis Fed Financial Stress Index fell 43 bps to 202 in the week ended April 10, the third straight weekly decline. On March 20, the index peaked at 548 bps. As a matter of fact money flows are normalizing as prime money funds saw a second straight week of inflows and so have high yield funds.

What Is Happening In the Economy

Based on recent economic prints, the U.S. economy will shrink around 9% in the June quarter. The prediction is awful, but a growth spike in late Q3 and Q4 is very probable. The anticipated improvement is based on the thesis that the spread of the virus will fade followed by a partial relaxation of lockdown orders because social distancing and wide imposition of antibody testing will be established.

A survey by Civic Science shows that about 65% of the American population would be willing to resume partial or all normal activities if the governments were to remove the quarantine. While the employment situation has been terrifying, it's reassuring, at this time, that most layoffs appear to be temporary because there have been no major increases in the number of bankruptcies nor any irreparable financial and banking stress.

LVMH and L’Oreal have made optimistic comments saying that the market will recover as soon as closed outlets are reopened and that Covid-19 will not have a lasting impact. LVMH pointed to positive signs from China.

Since the quarantines were lifted in China, sales at Louis Vuitton have risen 50% compared with the comparable period of last year. I’m not suggesting that all industries will experience the same growth but pent-up demand for a variety of consumer goods will likely lead to dramatic increases in retail sale.

Accordingly, I’m betting on S&P 500 EPS of $125 for 2020, $165 for 2021 and $175 for 2022. If one is willing to accept that 2021 is an offsetting year for the write off of 2020, then the S&P 500 will be producing an earning yield of 6.35% in 2021 and delivering an equity risk premium of 5.75%.

In this respect, the Stock to Bond ratio has tumbled 16.6x--the lowest level since 1983. These numbers are suggesting limited downside risk for the S&P 500 (2550) but finite upside potential (3100).

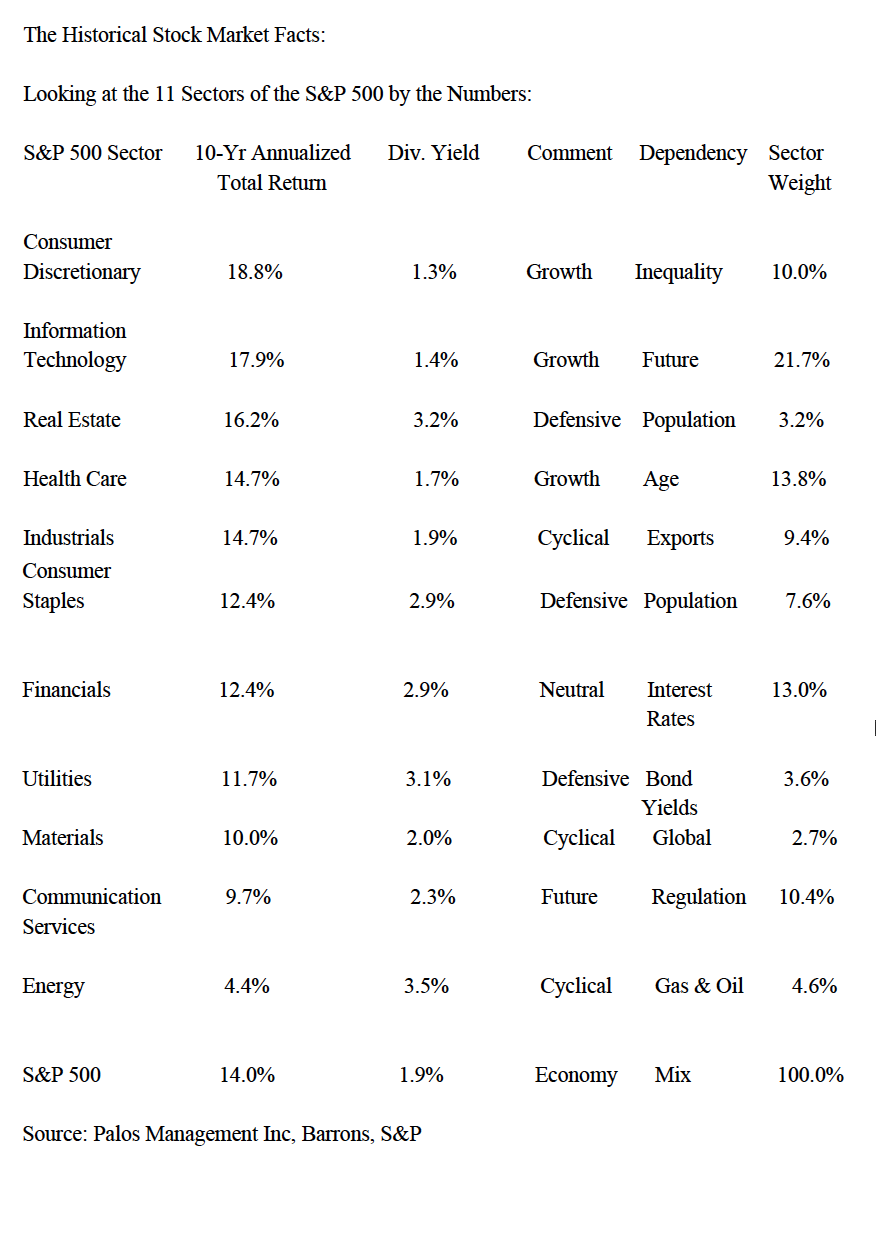

Based on the previous brief, one would conclude that the overall market will likely trade in a relatively narrow range for as long as wealthy investors keep their equity positions frozen and their excess cash remains undeployed. Nevertheless, valuation discrepancies among stocks are very large offering profitable recalibrating strategies, opportunistic pair trades and potential gains in buying depressed values—-about 70% of the stocks that make up the TSX-300 and S&P 500 are in bear market state.

Evidently, there will be many long-lasting effects on relationships in society relative to the composition of economic activity, reliance on the global supply chains and geopolitical issues. Investors have only to examine the March distribution of retail sales and industrial production to get a good idea of where economic activity is heading. While consumers have spent an unusually large amount of money in grocery and health stores, and online for non-essential products, all other classifications have suffered cutbacks---clothing stores, auto dealers, furniture, bars, restaurants, sporting goods, department stores and electronics. During the month of March, the manufacturing industry was running at 70% of its capacity and the production of all durable goods, particularly motor vehicle and auto parts, was down with the exception of high tech goods.

Savings To Outdo Spending

While the details of the changing characteristics of the economy are certainly of interest to investors, the background of the big picture shouldn't be blotted out. In my judgement, increases in personal savings, refinancing existing debt, debt buybacks, infrastructure spending and health services along with decreases in corporate capital expenditures, personal expenditures on durable and semi-durable goods and de-globalization are evident. These broad movements which actually started in 2008 will accelerate from hereon.

State Capitalism Will Interfere With Liberal Capitalism: Big Guys To Become Bigger at the Expense of the Small Ones.

Preservation of what the economy owns will become a priority for governments, replacing liberal capitalism with state capitalism. Thus, dominant businesses with reliable cash flows or strong brands or strong balance sheets which are either monopsonies, monopolies, duopolies, or oligopolies, will flourish as they become government pets. In order not to lose their privileged position, corporations are bound to acquiesce to the goals of the authorities. The fear of being on the wrong side of an unpredictable government is just too menacing. In liberal capitalism, corporations try to balance their short with long term profit objectives; but under state capitalism, corporations must balance the short term political wishes and long term objectives of politically oriented governments. I read in the FT that in 1944, Sewell Avery, chairman of the department store Montgomery Ward and an ardent free marketeer, lost patience with the government rules for negotiating with the store’s unions. “To hell with the government!” he shouted. He was physically carried out of his office by the national guardsmen. I don't think that in this age of social media, few big corporations will want to risk their public reputation over a bad relationship with a majority elected government.

Copyright © Palos Management