The first trading week of 2020 ended up being extremely volatile but at the same time was quite constructive. Markets were rocked by heightened political tensions between the US and Iran which captured the spotlight, but that ended yesterday with a series of large intraday reversals as tensions eased after Iran’s retaliation against the US didn’t kill any military personnel or damage energy production facilities (which Iran could have done if it wanted to).

Over the course of Wednesday, broad indices went from losses to gains while gold (which traded briefly above $1,600/oz) and oil went from big gains to big losses. The fifth trading day of the year ended with the S&P 500 at an all-time high as investor confidence returned.

Unless something unforeseen happens to ratchet up tensions on the military front, it appears investors are ready to turn back to focusing on the business outlook for 2020. Economic news over the last week has been surprisingly strong headlined by positive Manufacturing PMI reports for many countries, strong retail sales for Germany and the EU, and strong US ADP private sector payrolls. At the same time, profit warnings from corporations have been few and far between suggesting we could be heading for another positive earnings season. The coming week brings more economic news headlined by Friday’s US nonfarm payrolls and Canada employment reports.

In this issue of Equity Leaders Weekly, we look at recent gains in Germany’s Dax Index and Lumber as indications of growing investor confidence in stocks and in economically sensitive commodities.

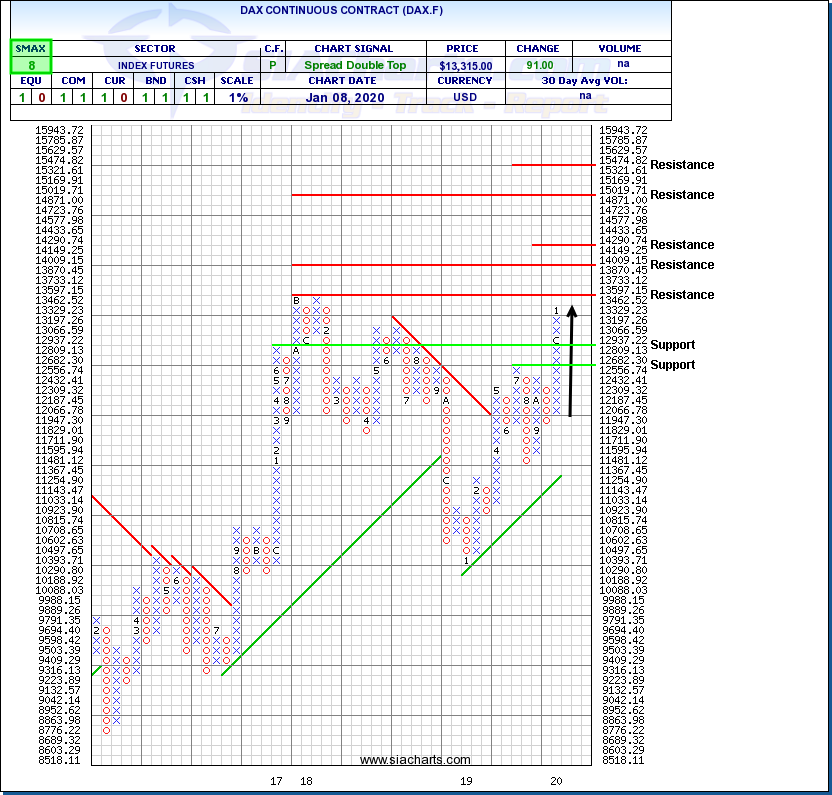

Dax Continuous Contract (DAX.F)

Germany’s large-cap Dax Index (DAX.F) lagged behind its North American counterparts through most of 2019 as uncertainty over how Brexit may impact EU economies and slowing global trade in general weighed on German stocks. Some clarity from the UK election coupled with early signs of an improving European economy has ignited a catch-up rally in Germany over the last month.

A breakout over 12,680 last month completed a bullish Spread Double Top pattern and signaled the start of a new advance that has brought DAX.F to within striking distance of its previous all-time high near 13,600. A breakthrough there would confirm the start of a new upleg with next potential resistance near 14,290 or 15,475 based on measured moves, or the 14,000/15,000 round numbers.

Lumber Continuous Contract (LB.F)

The price of Lumber (LB.F) spend much of 2019 base building after losing over half of its value in a major 2018 selloff, . Higher lows since June suggested renewed accumulation, and recent trading action suggests that the recovery trend may be starting to accelerate.

Lumber’s recent breakout over $429 snapped a downtrend line and completed a bullish Double Top, signalling the start of a new recovery trend and confirming previous bullish pattern breakouts. Next potential resistance appears in a previous trading range between $483 and $534 which contains the $500 round number. Initial support has moved up toward the $400 round number.

Recent gains in lumber can be seen as a sign that investors are expecting construction activity to pick up and the demand for resources to grow as easing trade and political tensions enable economies around the world (particularly outside of North America) to rebound. This environment has the potential to be positive for cyclically sensitive stocks and sectors in general.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.