The Fed decided on Wednesday to hold the federal funds rate steady at 1.63% and saw no need for any rate change in 2020. It was not any surprise. Their was less than a one percent chance that a rate change up or down was in the cards and Fed funds futures were pricing out additional rate cuts going forward.

The money market believes that the monetary authorities orchestrated a skillful switch in the U.S. monetary stance at the beginning of 2019. Three interest rate cuts harmoniously prevented the summer economic slowdown from tumbling into a recession. The Fed is clearly pleased. The policy rate is exactly where the neutral rate is and the yield curve is upward sloping.

Consequently, interest rates should be left alone. The FOMC members were in complete agreement that the current monetary stance suits existing economic conditions. Perhaps, the level of interest rates and the shape of the yield curve may indeed be in a good enough place to keep the U.S. out of the deflation anemia plaguing the other advanced economies, to spur price increases and to offer enough juice for continued expansion.

It was bold of Jerome Powell to press ahead with a sudden U-Turn. The Fed tends to operate by consensus. Based on press releases, interviews and FOMC minutes, unanimity was absent. All of that has changed now. Under the moulding effort of Messrs. Powell, Clarida and Williams, a consensus has formed. This so-called troika has gained the support of the regional reserve bank presidents. The rate setting committee made its first unanimous decision since May, voting 10-0.

As a result of this unanimity, three important non-political changes in macroeconomic thinking are emerging in favour of letting the rate of inflation exceed the target rate of 2% per year and enabling the financing of more fiscal stimulus.

Firstly, the Fed is considering the introduction of a new rule that when the inflation target is missed, it will temporarily raise that the target to make up for lost inflation. It’s a “make-up strategy” that would allow the inflation rate to run far-above the 2.0% for as long as necessary to reach a cumulative ceiling which would equate to 2.0% a year.

Secondly, in collaboration with other major central banks, the Fed can be expected to push lawmakers for more fiscal stimulus.

Thirdly, the Fed has a high bar for moving rates up as new data keeps forcing the monetary authorities to lower their view of the natural unemployment and neutral interest rates. They are likely to stay in an easing monetary mode for quite a while. It basically means that the Fed and others want inflation to run hot for at least a while.

As consequently, of the high confidence level of consumers and improvements in business sentiment, along with the anticipated increases in fiscal spending (finance with the support of central bank balance sheet expansion), inflationary pressures are starting to pop up in the financial markets and in newly printed economic data even though scant attention is being paid to the possibility of an overheating inflation risk.

Inflationary expectations are rising in the bond market. For example, the inflation component of the ten-year note is presently 1.75% compared to 1.45% in October. The NY Fed’s consumer inflation expectation model is ticking higher near the annual rate of 3.0%. It makes sense since the money supply is growing significantly faster than N-GDP. Moreover rising material prices and ascending wage rates are increasing the cost of production. The U.S. unit labour cost in Q/3 was 2.3% higher than it was a year ago and for the second straight month consumer prices rose more than expected. Year-over-year, the headline inflation gauge rose 2.1% and core prices were 2.3%. The Cleveland Fed Inflation NowCasting Model has an estimated annual rate of increase of 2.6% for the Consumer Price Index in Q/4.

Also, there are regional Federal Reserve Banks which have their own inflation gauges which tell a similar story. The Atlanta Fed’s Sticky-Price CPI, which is a weighted basket of items that change price relatively slowly, is running at 2.8%. Moreover, it has been above 2% since mid-2014. Additionally, the Dallas Fed’s inflation measure has consistently held at or above 2.0% since early 2018.

Understanding that the price performance of gold is essentially a function of changes in the level of real short term interest rates, it is interesting that gold prices are unfazed by the Fed’s neutral stance. Presently, compared to core CPI, the real two-year bond yield is minus 0.65%. Negative interest rates are bullish for the gold price.

The gold market might be signaling a prospective rise in inflation. It’s known to be an effective inflation hedge. An increase in the rate of inflation would make short rates more negative. The high inflation hurdle for a return of central bank rate intervention limits the nominal rate upside, making it challenging for real rates to increase together with inflation .

Correspondingly, the DXY--a trade-weighted dollar index--peaked ten weeks ago, extending its drop on Wednesday below its 200-day moving average and the copper-to-gold ratio has risen of late. The futures market is messaging that inflationary tendencies are rising and recession risks are receding.

I appreciate that these signals are small nudges. But they are far better indicators than the bombardment of useless information that tends to paralyse our perception of what is truly going on, making us completely uncertain about what could happen. I’m old school. Cognizant of the lag in monetary policy, I can’t help believing that the maintenance of trillion-dollar budget deficits and of an easy monetary stance, will not eventually bring about an inflation rate beyond 2.0%

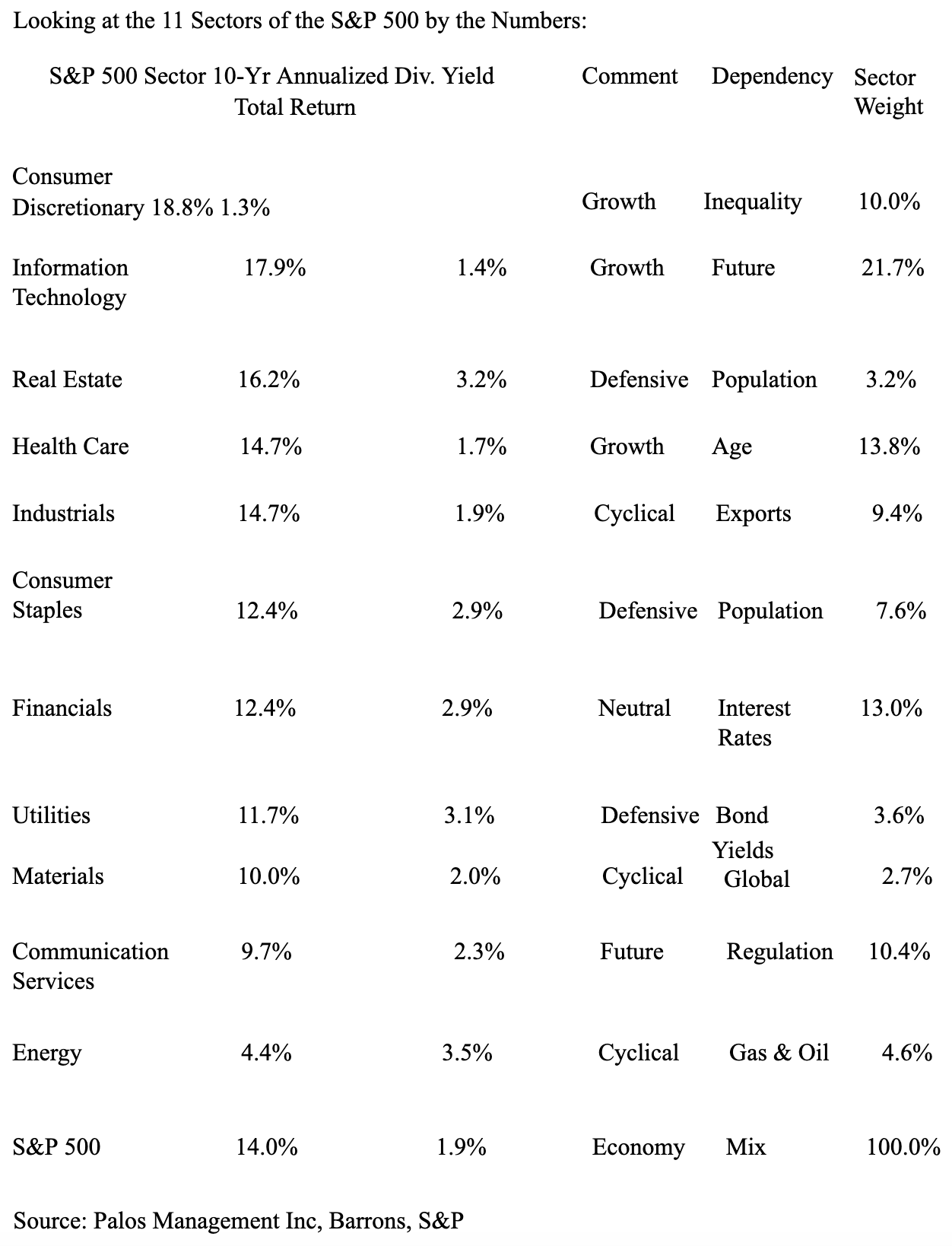

Based on the assumption that no recession is in sight and the historical observation that stock prices usually peak on average between 3 to 6 months before the start of a recession, my target price for the S&P 500 in 2020 stands at 3375--that is about a 7.0% increase from the current level, favouring technology, consumer discretionary, financial, industrial and material stocks at the expense of the defensive sectors. Why? Because the bulk of the estimated 9.0% increase in corporate profit for 2020 will be concentrated in the cyclical areas of the economy, I’m holding on to a lot more inflation and cyclical sensitive stocks than I used to.