by Sound Choices, AGF Management Ltd.

Understanding alternative investments

During the Global Financial Crisis (“GFC”) in 2008/9, many investors experienced sizable losses as correlations of different asset classes converged and failed to provide the diversification and protection benefits investors were anticipating.

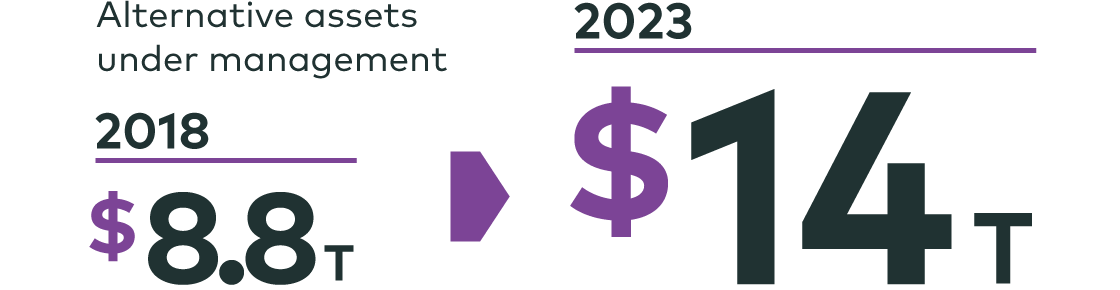

The fallout prompted many investors to seek out new ways to protect their investments from significant drawdowns, leading to an increase in the development and use of alternative investment products globally.

Source: Preqin, Future of Alternatives Report, October 2018.

Alternative investments differ from traditional long-only equity, fixed income or cash investments and can refer to either alternative asset classes or alternative strategies (approaches to investing).

Alternative asset classes

Here are some common examples of alternative asset classes:

- Real estate / REITS – residential, office, specialty

- Infrastructure – airports, highways

- Precious Metals – gold, silver, copper

- Commodities – oil, agricultural products

- Private Equity – companies that have not been listed on a public exchange

- Private Debt – debt investments that are not issued or traded in an open market

Alternative strategies

There are several different kinds of alternative strategies – here are a few of the most common:

- Long/Short – Take both long and short positions while maintaining net-long exposure.

- Market Neutral – Take both long and short positions in equal weights.

- Managed Futures – Take long or short positions using derivative products.

- Multi-Strategy – Combine a portfolio of different alternative strategies.

Why consider alternative investments?

Investors use alternatives for a variety of reasons depending on their investment objectives. Because alternatives tend to behave differently than typical equity and fixed income investments, adding them to a portfolio comprised of traditional asset classes may provide investors with several potential benefits:

Diversification through low to non-correlated return sources

Alternatives are considered to be long-term diversifiers within a portfolio because they tend to have low correlation to traditional asset classes like publicly listed equities and fixed income.

Reduced volatility and risk

A portfolio containing a variety of alternatives may offer reduced risk and volatility without a proportionate reduction in expected return.

Downside protection and capital preservation

Employing alternatives within a portfolio may help to shield investors from a decline in value when markets are stressed.

Greater risk-adjusted returns

Alternatives have been shown to offer opportunities to enhance the risk-adjusted returns of well-diversified portfolios.

Hedging against rising interest rates or inflation

Alternatives can provide a hedge against inflation or rising interest rates due to their uncorrelated risk and return profiles relative to these economic variables.

To learn more about alternative investments, visit agf.com/alternative or contact your financial advisor.

The commentaries contained herein are provided as a general source of information and should not be considered personal investment or tax advice. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained here.The contents of this Web site are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.AGF Management Limited (“AGF”), a Canadian reporting issuer, is an independent firm composed of wholly owned globally diverse asset management firms. AGF’s investment management subsidiaries include AGF Investments Inc. (“AGFI”), AGF Investments America Inc. (“AGFA”), Highstreet Asset Management Inc. (“Highstreet”), AGF Investments LLC (formerly FFCM LLC) (“AGFUS”), AGF International Advisors Company Limited (“AGFIA”), AGF Asset Management (Asia) Limited (“AGF AM Asia”), Doherty & Associates Ltd. (“Doherty”) and Cypress Capital Management Ltd. (“CCM”). AGFI, Highstreet, Doherty and Cypress are registered as portfolio managers across various Canadian securities commissions, in addition to other Canadian registrations. AGFA and AGFUS are U.S. registered investment advisers. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. AGF investment management subsidiaries manage a variety of mandates composed of equity, fixed income and balanced assets.TM The ‘AGF’ logo and ® ‘Sound Choices’ are registered trademarks of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2019 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.