by Kristina Hooper, Invesco Canada

The U.S. Treasury yield curve, specifically the spread between the 10-year U.S. Treasury rate and the 2-year U.S. Treasury rate, briefly inverted on the morning of Aug. 14. As of early afternoon, the spread was roughly 1 to 2 basis points wide. The brief inversion follows the inversions earlier this year between the spread of short-term rates (such as the federal funds rate and the 3-month Treasury bill) and the benchmark 10-year rate.

The equity market immediately sold off due to fears of a looming recession – of all the macro indicators, the bond market has tended to get it right more often than most others. Case in point: An inverted yield curve that lasts for a prolonged period (not briefly in one morning!) has preceded seven of the past nine recessions.1 And in those seven time periods, the U.S. economy tipped into a recession 22 months following the inversion, on average.1 Interestingly, stocks, as represented by the S&P 500 Index, have been positive, on average, in the 12 months following the yield curve inversion.1

What is our take on the situation?

We would caution investors from assuming that the brief inversion of the yield curve is bound to lead to a forthcoming recession. Business cycles typically end with policy mistakes. In most instances, the policy mistake has been the U.S. Federal Reserve (Fed) over-aggressively raising short-term interest rates to lessen inflationary pressures and/or curb excesses. Importantly, the recessions tend to be preceded by the Federal Open Market Committee raising the federal funds rate above the 10-year Treasury rate – not by the 10-year rate falling below the 2-year rate after the Fed has already completed its tightening cycle.

It might be more constructive to consider periods such as the mid-1980s and mid-1990s. In the mid-1990s, the yield curve briefly inverted, and the Fed countered by keeping rates generally stable over the following four years. This year, the Fed has already lowered interest rates to begin undoing the rate increases/potential policy mistakes of 2018.

In this instance, long rates briefly rallied below the 2-year Treasury rate as the ongoing uncertainty of the U.S.-China trade conflict has been eroding sentiment and slowing business investment. Importantly, protectionism, in and of itself, has historically led to inefficient economic outcomes, but not necessarily recessions. Rather, it’s the uncertainty surrounding the future trade guidelines that has been grinding investment to a halt. In simplistic terms, it is difficult for businesses to plan when they do not know the rules of the game.

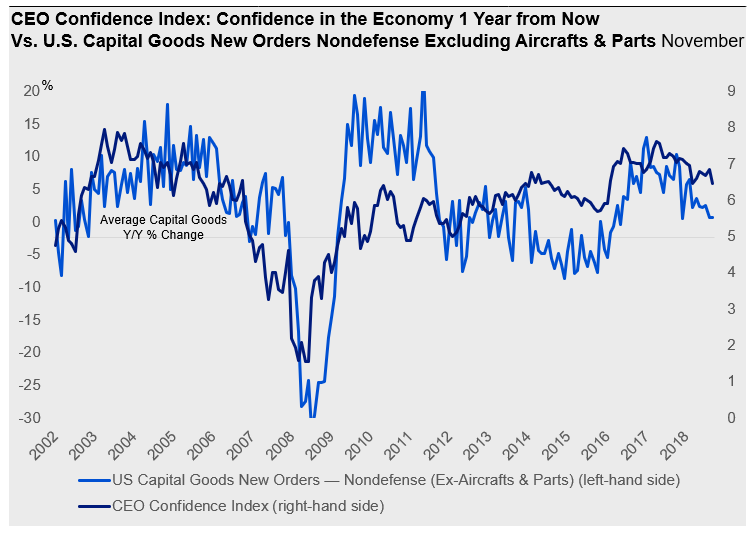

In Figure 1, we highlight the weakness in business investment growth, as represented by capital goods orders, as business confidence wavers.

Figure 1: C-suite confidence has been falling, but is not yet at the 2016 low

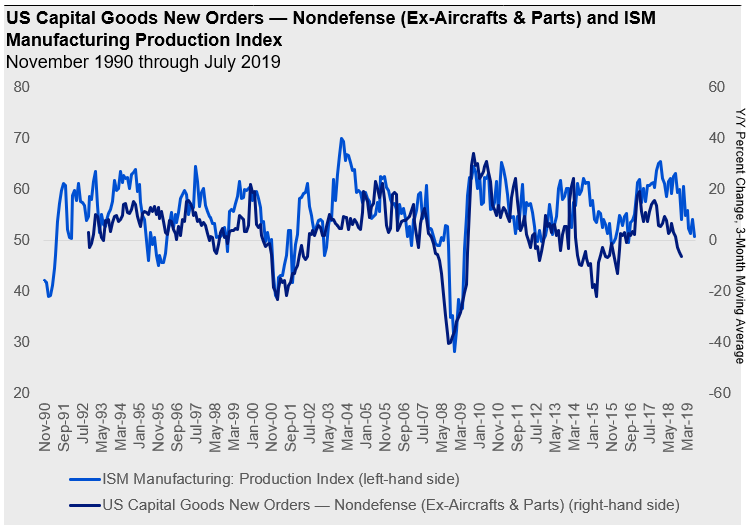

In Figure 2, we highlight the weakness in the ISM Manufacturing Production Index, a leading indicator of future economic activity (below 50 signals contraction), as capital goods orders have fallen.

Figure 2: Growth in capital goods orders has been negative, pointing toward further weakness in production

In our view, a silver lining for investors is that the U.S.’ current troubles are largely self-inflicted, the lagged result of last year’s Fed tightening and the lack of clarity on trade from the Trump administration. The Fed has already backed off its tightening stance. All eyes are now on the administration, as we believe there is still time to intervene in this slow-motion accident and avoid a recession.

What are the investment implications?

Market downturns tend to commence with policy uncertainty. In the near-term, longer duration bonds, lower volatility strategies, and the more-defensive equity sectors may outperform, in our view.

Ultimately, we believe that a more-significant drawdown would likely lead to U.S. policymakers acting to counteract the effects of the current trade conflict. In our view, “winning” the trade conflict with China is very unlikely, and we hold out hope that the U.S. will recognize this. This may prompt the administration to capitulate and avoid further self-inflicted damage, perhaps by accepting a deal with only minor concessions from China. We would also expect the Fed to respond accordingly with further interest rate cuts and other policy accommodations.

In this environment, we believe the probability of recession has increased, but our base case remains that we are in a slowing-growth environment with monetary policy largely accommodative globally. Typically, that has been a positive backdrop for secular growth companies and credit. Importantly, we note that thus far, U.S. credit markets have largely behaved, and the U.S. dollar has not strengthened meaningfully. We view both as favorable for investors, and we believe that the volatility is likely to create opportunities for selective, discerning investors.

This post was first published at the official blog of Invesco Canada.