by Stephen Dover, Executive Vice President, Head of Equities, Franklin Templeton Investments

As the US economic cycle continues to age, many are starting to question when—and how—it will end. Our Head of Equities Stephen Dover says it’s certainly wise for investors to prepare, but doesn’t see reason to think a recession is on the immediate horizon.

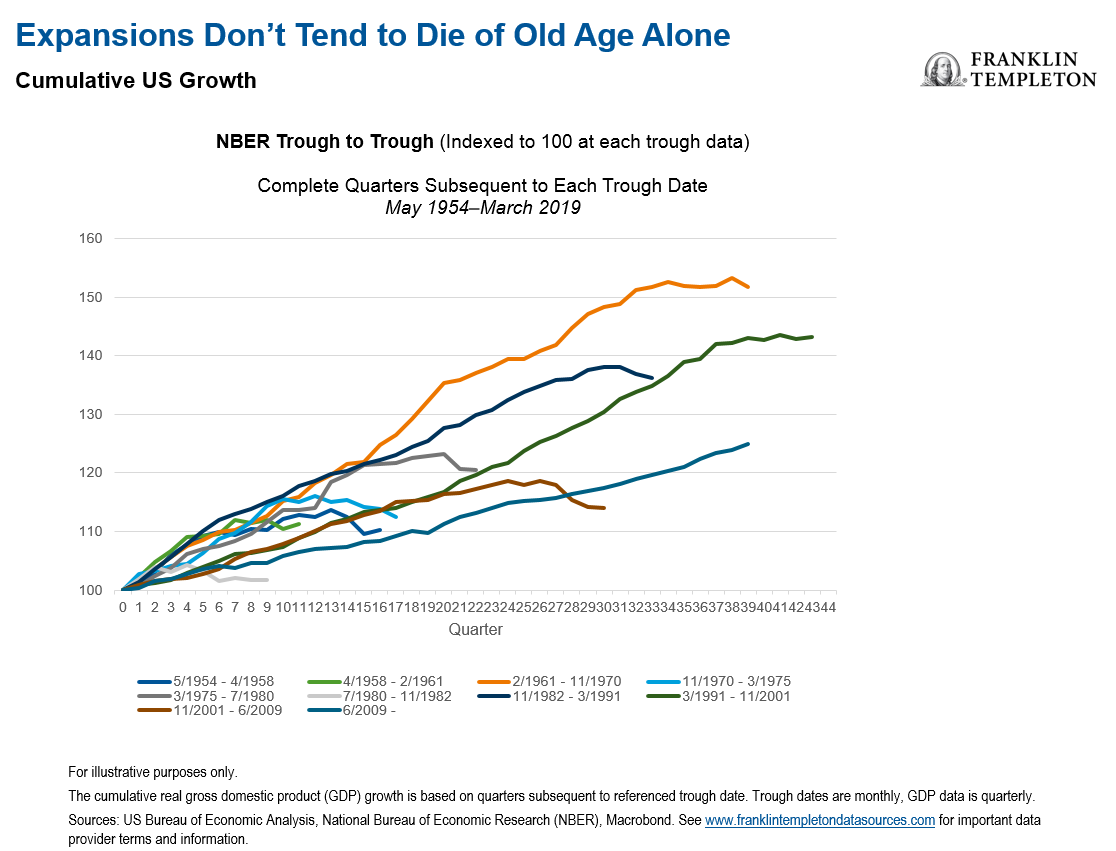

Although we don’t believe the length of the economic expansion by itself should be a concern for investors, one of the big questions we have heard recently is: “When are we going to have the next recession?”

We are not trying to predict or time a downturn, but there’s no doubt to us that we are near the end of a very long economic cycle. The economic cycle fluctuates between periods of expansion and contraction and each is marked by certain characteristics. The peak of a cycle marks a time of maximum output, typically accompanied by imbalances which need to be corrected. Following that peak thus comes a contraction, then a trough, or recession.

Historically, when the United States economy was manufacturing-based, recessions happened when inventories got too big. Over the last 20 years, as the United States has moved more into a service-based economy, there isn’t that same inventory dynamic. So, I don’t think we can conclude a recession is imminent just because the current expansion is longer than it has been in the past.

It’s true that the expansionary phase of the current US economic cycle has been running much longer than what is typical, now more than 10 years from the last trough in 2009. However, Australia has the record for the longest expansion—now more than 20 years.

As far as we can see at this point, it doesn’t look like a recession is going to happen within the next year or two, so we think the US expansion can continue. That said, we think investors should certainly be prepared for the cycle to change.

Positioning an Equity Portfolio for the Late Cycle

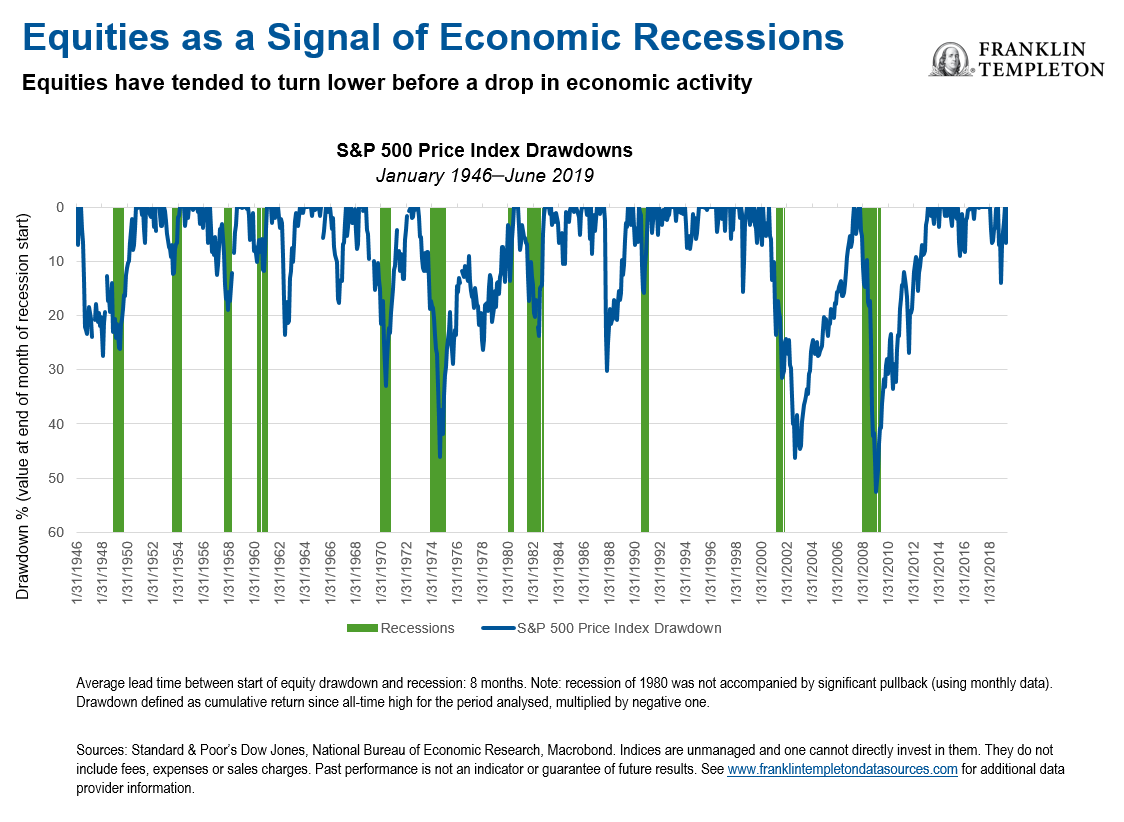

Equity markets tend to be leading indicators of the onset of a recession. Fearing a downturn in the cycle, market participants start to revise their expectations, and this is reflected in lower stock prices. Our analysis shows that the average lead time between the start of an equity drawdown and the start of a recession is eight months.

However, there can be false signals. Obviously not every equity market decline leads to a recession; notably, the recession of 1980 was not preceded by a significant equity market pullback.

Sectors That Can Shine

In many ways, our approach to end-of-cycle management is similar to our regular investment approach. We remain focused on building portfolios that we believe should be poised to benefit from multi-year secular growth themes or innovation.

We take a long-term view and leverage our bottom-up research to identify businesses that have dominant brands or franchises with high-quality management teams, healthy financial returns and a track record of resilience.

In the current environment, our portfolio managers in general are avoiding high-debt companies, while targeting companies where we see strong cash-flow generation.

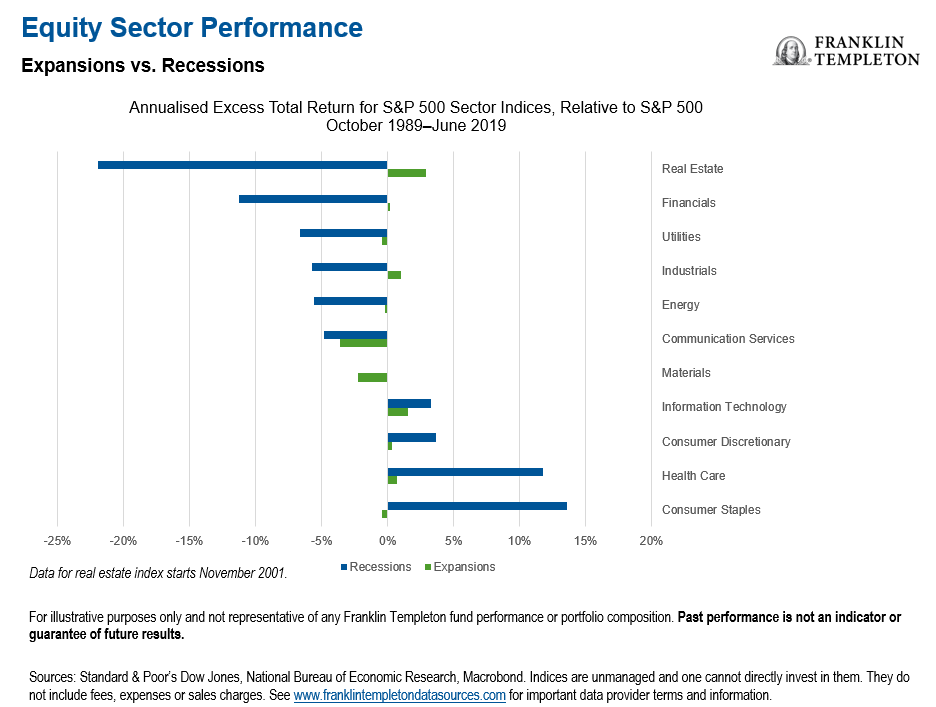

Meanwhile, it’s important to recognise that traditionally, different sectors have responded differently during recessions. Consumer staples, health care, energy, materials and utilities sectors have a history of outperforming the market in periods of decline, as these goods are relatively inelastic. For example, during a recession, consumers will cut back their spending in areas such as entertainment or air travel, but not likely on things like toothpaste or electricity.

Global Diversification

By most analysis, the United States is at a later stage of its cycle than other countries, so we are alive to opportunities globally in terms of diversifying our portfolios.

European markets tend to do well late in the cycle, due to their high exposure to inflation- and rate-sensitive sectors like commodities and financials, which tend to outperform in a rising price and interest-rate environment.

European companies have been vastly under-earning their US peers while trading at historic valuation discounts, offering scope for both profit improvement and multiple expansion as policy conditions normalize.

Value Stocks Have Often Become More Attractive in a Recession

Volatility in the global markets is currently near-normal levels, and we look at that as an opportunity. Value investors are looking for mispriced stocks, and when there’s not a lot of volatility, you don’t get a whole lot of mispricing. But as investors pull their money out of the market, they tend to pull it out somewhat indiscriminately. That indiscriminate selling often creates mispricing of stocks based on their fundamentals. Value investors look for opportunities to step in and take advantage of that mispricing as volatility increases.

That said, we believe both growth and value investment styles can be well-positioned for the cautiously optimistic scenarios we see. The outlook for corporate earnings growth looks positive to us, as does the outlook for global economic growth in 2019.

Focus Should Return to Stock-Picking

In my opinion, over the last few years, many equity investors have been thinking a bit too much about the wrong things.

Traditionally, equity investors would look at earnings when seeking out viable companies to invest in. However, the last 10 years of accommodative central bank monetary policy have made a lot of investors more macro-oriented, rather than micro-oriented. We think these investors should go back to looking at the differences in individual stocks and not be so focused on the actions of central banks—particularly the US Federal Reserve.

While we don’t see a near-term recession, that doesn’t mean we think stocks will always continue to rise. To have a healthy bull market, you have to have volatility and the occasional pullback or correction. Ultimately, we focus on companies that have good quality earning streams.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

Important Legal Information

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Diversification does not guarantee profit or protect against risk of loss.