by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

- July 20 marks the fiftieth anniversary of man walking on the moon

- Tech remains a key growth driver for the United States economy

- Fundamentals continue to support a move higher for the info tech sector

"The Eagle has landed” was the famous message from astronaut Neil Armstrong 50 years ago (July 20) as he and Buzz Aldrin landed the Apollo lunar module on the moon to cement the U.S.’ space supremacy. But it was more than a moon landing as this accomplishment has had entrepreneurial, economic, and political repercussions to this day. With the future of technology remaining bright and necessary for the U.S. to remain the dominant global superpower, we continue to view technology as one of our favorite equity sectors.

- Entrepreneurial Spirit | As Armstrong became the first person to walk on the moon he proudly exclaimed, "that's one small step for man, one giant leap for mankind.” That monumental moment crystalized the American spirit. What once seemed impossible now is possible with the help of technology. Robotics, artificial intelligence, medical discoveries, and other improvements in technology will continue to develop at an ever increasing pace. The good news is that the U.S. is likely to remain at the forefront of innovation. In fact, 12 of the largest 15 technology companies in the world are headquartered in the U.S.

- Economic | Technology is one of the biggest growth engines for the U.S. economy, both recently and over the last 20 years. Analyzing corporate and government spending, technology-related investment has remained healthy amidst the recent trade tensions and is growing 8.5% year-over-year (YoY), the fastest pace since 2000. This trend has been consistent on a longer-term basis as well with tech-related investment outpacing total GDP growth (ex-tech investment) in the last 20 quarters. Additionally, it has nearly doubled the pace of ex-tech GDP growth over the past 20 years (4.5% vs 2.0% respectively). Consumer purchases have also been strong as tech-related annualized personal consumption growth of 6.8% has strongly outpaced overall annualized personal consumption growth of 4.3% over the last 20 years. This spending does not include how much more efficient, effective, and productive we are on the job (and home) as a result of technological advancements.

- Political | Back in the 1960s, the U.S. was embroiled in the Cold War with Russia. Since the Russians were ahead in the Space Race due to the success of the Sputnik satellite program, the U.S. had to reach the moon first to display its technological might. As a result, the U.S. invested a significant amount of money into technology to beat the Russians in the Space Race. Today, technology is once again a driver of a tense political situation, but this time with China. While trade war and tariffs get the headlines, make no mistake we are in a tech war as well. Some of the focal points behind the U.S./China tensions are intellectual property theft (estimated to be up to $600 billion/year), forced technology transfer, cyber attacks, and the development of 5G technology (which has the ability to shape the internet, communications, and military capabilities going forward).

Overall, we continue to favor the Technology sector for several reasons:

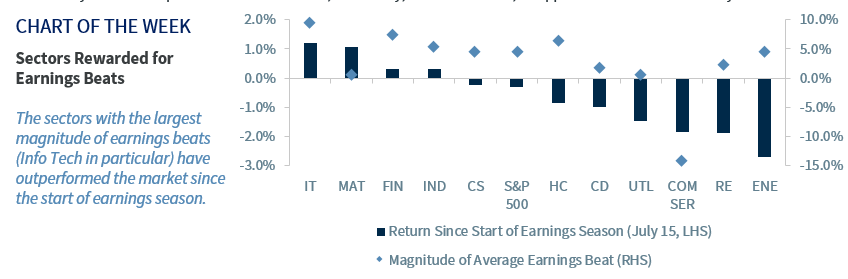

- Fundamentals Remain Solid | While Tech has faced headwinds as a result of uncertainty surrounding trade (and potential sales to Huawei), fundamentals remain supportive. Tech is expected to experience strong dividend growth and boasts the strongest buyback yield of any S&P 500 sector for 2019. Additionally, while valuations for the Tech sector relative to the S&P 500 are in line with longer-term historical averages, those valuations may prove conservative as this sector historically beats earnings expectations by ~7% (this is a 12 quarter average). Key tech names such as Alphabet, Visa, Paypal, and Intel will release their earnings next week.

- Long-Term Earnings Trends | The secular global shift to more technologically-oriented platforms should continue to drive increased investment to the Tech sector and be supportive of earnings growth. In fact, tech earnings have strongly outpaced the S&P 500 over the last 20 years (8.7% vs 6.2% on an annualized basis). Going forward, earnings will likely remain strong as the San Francisco Fed Tech Pulse Index (which measures current activity within the Tech sector, and is positively correlated to tech earnings) continues to move higher and is now at the strongest level since 2001.

- Congressional Bark Louder Than Bite | While calls for increased regulatory and anti-trust scrutiny against big tech companies have grown louder, the sector’s importance to the U.S. economy (particularly amidst the trade/tech war with China) will likely lead Congress to “bark louder than its bite” in order to allow the U.S. to maintain its leadership on the global stage.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.