by Craig Basinger, Chris Kerlow, Derek Benedet, Alexander Tjiang, Supriya Sethi, RichardsonGMP

Since the start of 2019, the S&P 500 is up by an impressive 13.9%, including dividends. At the same time, bonds – as measured by a total bond market ETF – are up 6.2%.

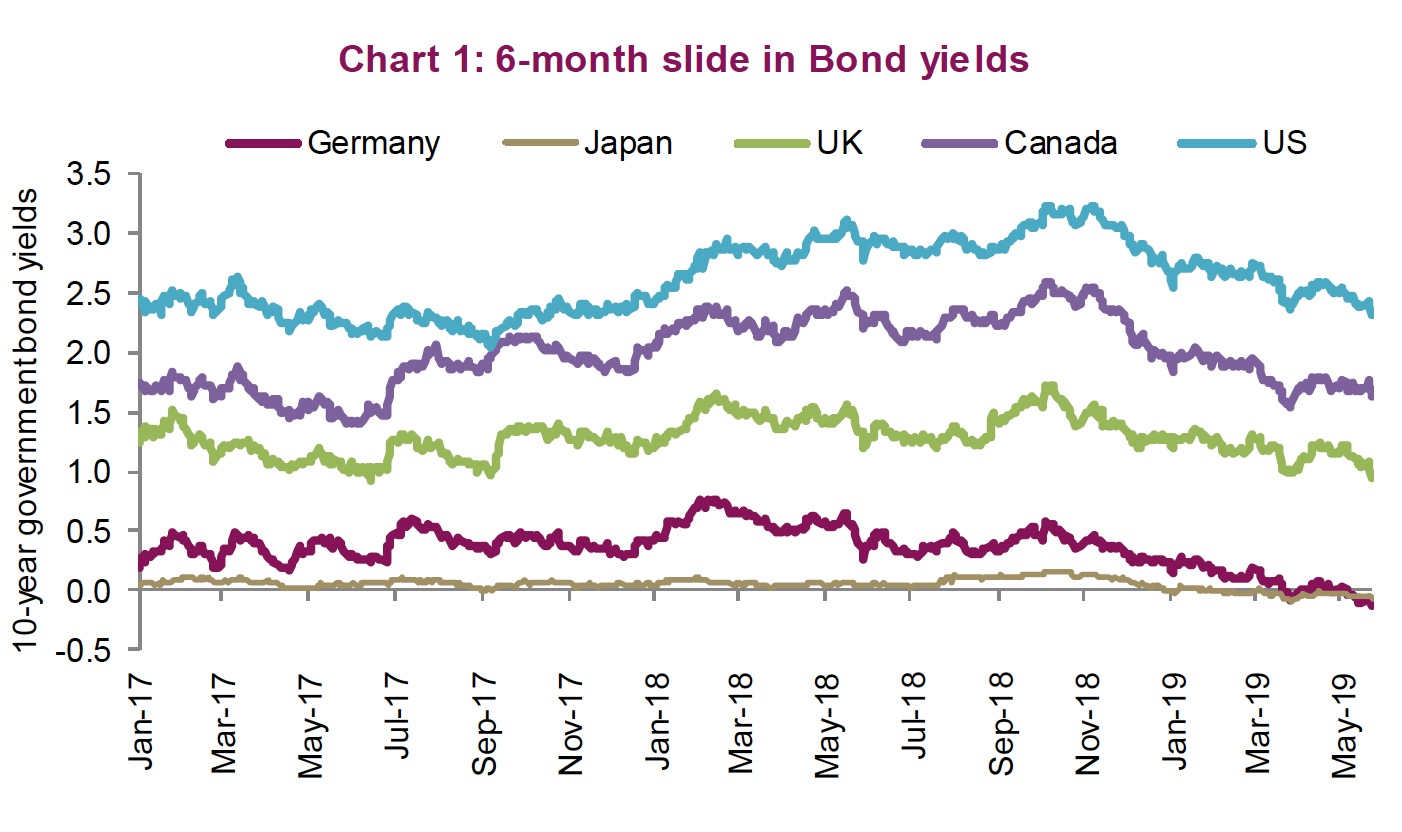

In other words, yields – which started falling during the fourth-quarter equity market correction, have continued to do so. In early October 2018, the U.S. 10-year Treasury yielded 3.2%. Today the same bond fetches a yield of only 2.33%.

Bond yields around the globe have moved materially lower over the past few months.Ten- year German bonds are now yielding -0.11% and French bond yields are positive, but not by much at 0.3%. (Chart 1).

So here we sit, uncomfortably, with the bond market implying global economic growth may be decelerating faster and an optimistic equity market signalling things have improved materially since the year began. It is likely in the coming months that one of these markets will be proven right and one will be proven wrong.

Let’s put the 2019 equity rally into better context. The year started coming out of a very oversold market and there have since been three key equity-friendly developments:

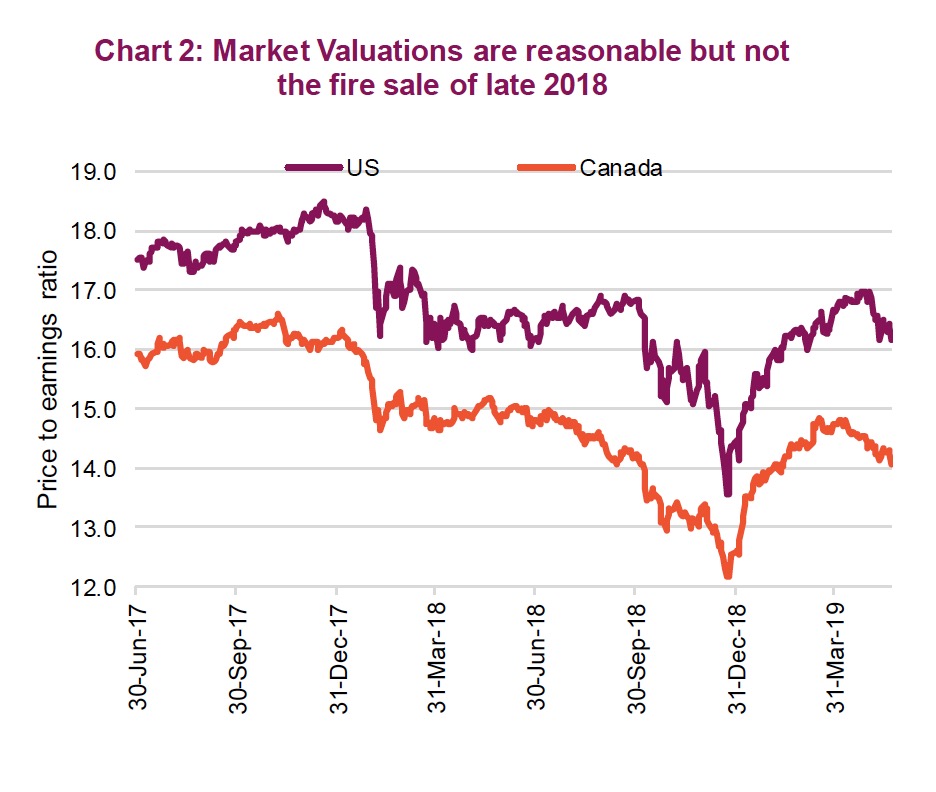

1. Valuations. The market was cheap after the Q4 sell off with the S&P trading below 14x. This was a tailwind.

2. U.S. Federal Reserve. The Fed backed off its rate-hiking path, which provided another boost.

3. Lower bond yields. This helped fuel higher stock prices through multiple expansion.

The issue now may be these tailwinds are pretty much played out. Valuations for the S&P 500 are now above 16x, so no great bargain there.

We would be hard pressed to see the Fed become more dovish given very low unemployment. And while bond yields can always fall further, in doing so equity markets would likely pivot from welcoming lower yields to being overly concerned about slowing economic growth.

It is all up to the data now

With the previously mentioned market tailwinds largely exhausted, it may be up to the economic data going forward.

Of course, the one big exception would be a rapid resolution to the U.S.-China trade conflict, but that is more of a guessing game than anything else.

If the economic data continues to decelerate, bond yields would continue to fall. While falling bond yields provided a positive influence on the equity markets initially, at this point the markets would likley view this as a negative due to growth concerns and the risk of slower earnings growth.

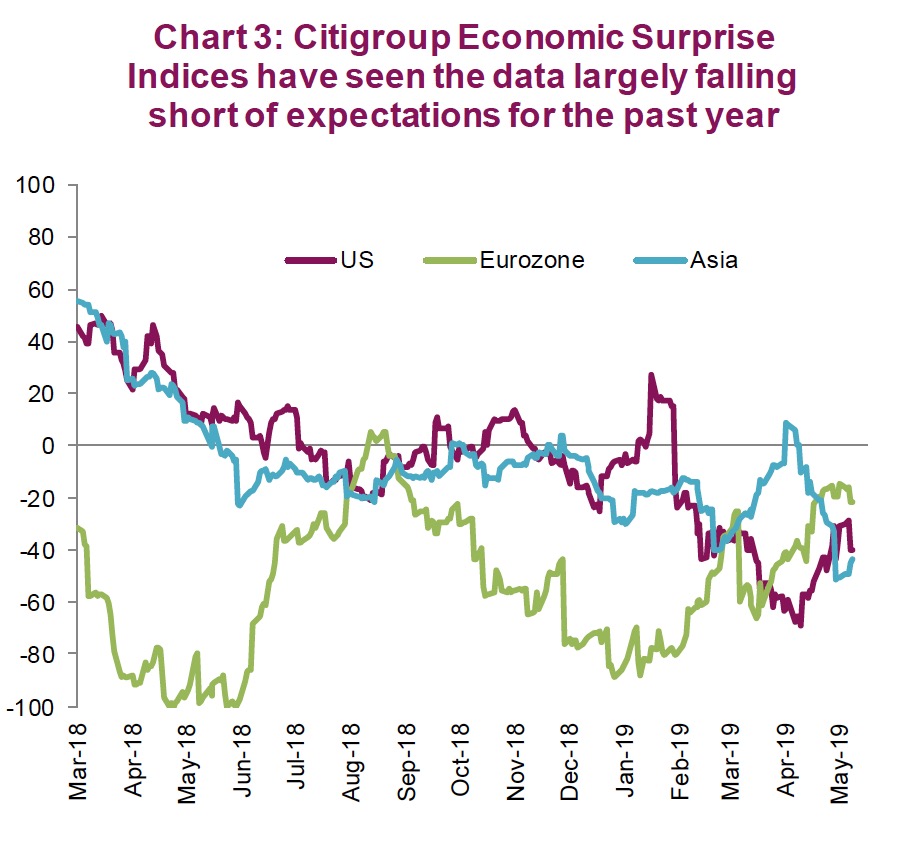

Indices have seen the data largely falling short of expectations for the past yearUSEurozoneAsia If the economic data improves, bond yields would likely grind higher. This would create a very strong tailwind for equities given still- reasonable valuations, yields rising from a low base and improving optimism for earnings growth.

Recent economic data has continued to disappoint (Chart 3). The Citigroup Economic Surprise indices for the U.S., Eurozone and Asia have been consistently below zero for much of the past year. And the data of the past few months has been generally worse.

Conclusion

The equity markets can likely hang in there for some time, weathering poor economic data. But it will weigh on confidence – an attribute not as plentiful today given the recent escalation of trade tensions. The next few weeks will be crucial with global manufacturing data releases, consumer confidence and labour reports. Sometimes economic data matters more than other times – this is one of those times. Long live all economists.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP.

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness. The opinions, estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor. Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them.

Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trademark of James Richardson & Sons, Limited. GMP is a registered trademark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

©Copyright May 27, 2019. All rights reserved.